It is common knowledge that third-party car insurance is mandatory in the UAE. So every year, buying car insurance online vs offline is a choice all citizens face. Car insurance is one of the first to become fully digitalized because its paperwork trail is almost fully online thanks to RTA innovations. The InurTech industry is taking the market by storm, so let’s go over how it can change your experience.

This article will walk you through buying car insurance online vs offline, laying out the real pros and cons of buying car insurance online. We will look at everything from cost and convenience to transparency and support. By the end, you’ll have a clear picture of which method fits your life best, helping you make a decision you can feel good about.

Types of Car Insurance Buying Methods in UAE

Before we get into the nitty-gritty, let’s just quickly outline what we’re even talking about when we say “online” and “offline” car insurance in UAE. It’s pretty straightforward, but it helps to see car insurance online vs offline side by side.

Offline Car Insurance

This is how it’s been done for ages. Buying offline means you’re dealing with a person in the real world. You might be walking into a physical insurance office, meeting with a broker who represents several companies, or sitting down with an agent who works for just one.

How it works: You have a conversation, explain what you need, and then fill out paper forms with a pen. A little while later, you receive a physical folder containing your policy documents.

The Pros: There’s a real person to guide you. You can ask questions on the spot and get immediate answers. For some folks, that personal touch builds a lot of trust. You feel like you have a guide, someone who knows your name and your history.

The Cons: The real difference between car insurance online vs offline is all about time. You have to work around their 9-to-5 schedule, which might not fit yours. You might only hear about the plans that one agent sells, which means you could be missing out on better deals. And you have to remember, all that personal service isn’t free, it often ends up in the form of higher premiums.

Online Car Insurance

Everything is becoming online these days and buying insurance is no exception. This is where you use a website or a mobile app to sort everything out yourself, from comparing prices to buying the policy.

How it works: You write a few details about your car and yourself, and boom, you get a list of quotes from different insurers. You can look them over, pick the one you like, pay with a card, and your insurance certificate pops up in your email inbox a few minutes later. It’s all digital.

The Pros: The biggest upside on the list of pros and cons of buying car insurance online is convenience. You can do this at midnight in your pajamas if you want. It’s almost always cheaper because there’s no agent commission to pay for car insurance online vs offline. And the ability to see a dozen different options right in front of you is a game-changer for transparency.

The Cons: The only downside to this method is that you’re on your own. If you get confused by the terms, you might be stuck talking to a chatbot or waiting on hold for a call center. For people who really value that human connection, the online process can feel a little cold and impersonal.

Online vs Offline Car Insurance – What They Really Mean

Okay, so those are the basics of car insurance online vs offline. But what does this mean for your wallet, your schedule, and your peace of mind? Let’s get right into the pros and cons of buying car insurance online:

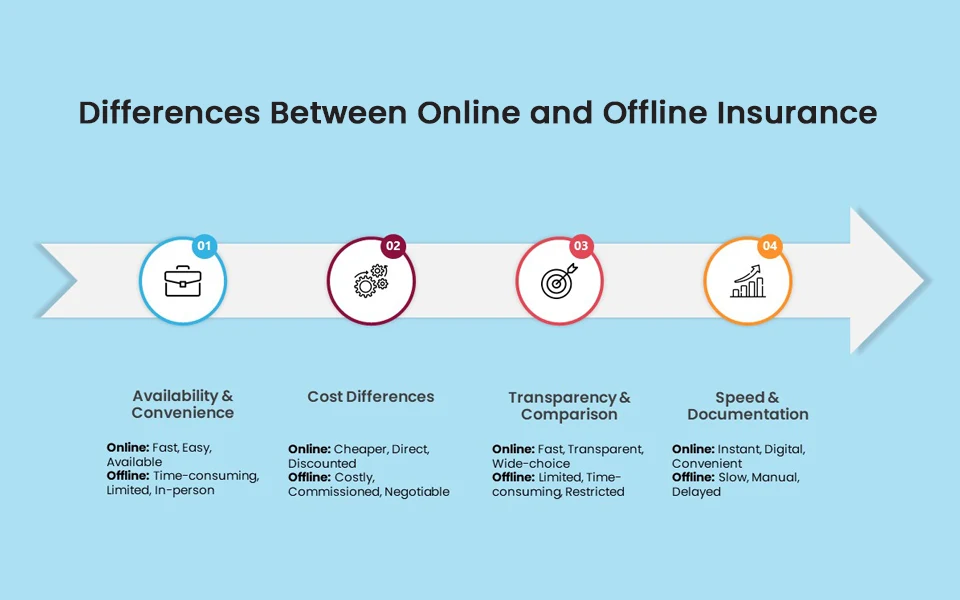

Availability & Convenience

Online: With buying car insurance online vs offline, the insurance agent never sleeps. It’s available 24 hours a day, 7 days a week. Realizing your insurance expires on a Friday evening? Not a problem. You can get it sorted right then and there. There are no trips across town in traffic, no finding parking, just you, your phone, and five minutes of spare time.

Offline: When you choose offline methods, you will have to work around the insurance company’s working hours. If your work schedule is also 9-to-5, getting insurance means taking time off, going in late, or rushing during your lunch break. It turns a simple task into a bit of a logistical puzzle.

Cost Differences

This is a big one for most of us.

Online: Here’s the secret: online policies are cheaper because it costs the insurance company less to sell them to you. No agent commission, less paperwork, lower office overhead; those savings get passed on to you in the form of lower premiums. It’s that simple. You’ll also find online-only promotion codes and special discounts that your local agent just can’t offer.

Offline: That friendly, helpful agent has to get paid. So does the company for renting that nice office space. Those costs are part of doing business, and they get folded into the price of your policy. You might be able to negotiate a little, but you’re almost always starting from a higher base price.

Transparency & Comparison

Online: This is like having a superpower. On a single screen, you can see offers from five, ten, or even fifteen different insurers. You can compare the price, but more importantly, you can compare the coverage details, the excess amounts, and the little extras.

Offline: When you talk to one agent, you’re only seeing the options that one person has to offer. They might be great, but how do you know there aren’t better offers waiting for you at the next company? To get the same view you’d get online in five minutes, you’d have to spend days visiting multiple agents.

Speed & Documentation

Online: We’re talking minutes. You can get a quote, customize your cover, pay for it, and have your policy document in your email inbox all in the time it takes to watch a couple of YouTube videos. Everything is digital, so you can store your insurance certificate on your phone!

Offline: This is a slower process. It can take a day or two just to get a quote. Then you have to sign physical forms and wait for the documents to be printed and delivered to you. If you’re in a hurry to get your car registered, those extra days can feel like forever.

Add-Ons and Benefits in Online Insurance

Buying online isn’t just about the initial purchase. The benefits keep coming long after you’ve clicked that “Buy Now” button.

Renewal and Reminders

Life gets busy. It’s incredibly easy to forget that you’re nearing the end of your policy term. Online systems are fantastic for this. They’ll send you an email or an SMS reminder weeks or even a month before your policy expires. This little alert can save you from a massive headache and some serious fines for driving without valid insurance.

Claim Settlement

If you have an accident, the last thing you want is having to deal with paperwork. Online insurance really is a godsent in these situations. Instead of having to drive to a claims office with a folder full of papers, you can usually start the entire process on your phone. You can upload photos of the damage, fill out a digital form, and submit your garage estimates through the insurer’s app or website. Even better, you can often track the status of your claim online, so you’re not left wondering what’s happening.

Promotions and Discounts

Online is where you find the best bargains. Insurance companies love to run special promotions that are only available on their websites or through partner platforms. We’re talking about everything from “Ramadan Offers” and “UAE National Day discounts” to straightforward promo codes that knock a chunk off your final price.

Key Takeaways

We’ve thrown a lot of information at you here, so let’s simplify it.

Think of it like this:

The Offline Method is like your favorite local bookstore. It’s personal, the service can be wonderful, and there’s a human connection. you may even know your agent by name. But the selection might be limited, and you might pay a little more for that experience.

The Online Method is like a massive digital library. It has almost endless choices, it’s open all the time, it’s often cheaper, and it puts you in complete control. You just don’t get to chat with the librarian.

| Feature | Online | Offline |

| Availability | 24/7 from anywhere | Office hours only |

| Cost | Usually cheaper | Typically more expensive |

| Speed | Fast, digital process | Slower, manual process |

| Choice | Easy to compare many options | Limited to the agent’s offers |

| Support | Digital channels (chat, email) | In-person, face-to-face |

| Renewal | Simple online or auto-renewal | Manual renewal required |

Conclusion

For the vast majority of people living in the UAE, especially if you’re comfortable with technology, value your time, and want to save money, car insurance online vs offline, the innovative method is the clear winner.

Now, does that mean the offline way is totally dead? No, not at all. If you have a really complicated situation, like you’re trying to insure a collection of classic cars or a custom-modified vehicle, then having an expert agent to walk you through it is priceless. And if you just really, really prefer talking to a person you can look in the eye, then that personal service is worth something too.

Frequently Answered Questions

1. Is it safe to buy car insurance online in the UAE?

Yes, it is generally very safe. The reputable websites you use are licensed and regulated, and they use the same kind of strong security that banks do to protect your personal and payment information. Just look for the little padlock symbol in the address bar of your browser which means that the connection is secure.

2. Which is cheaper: car insurance online or offline?

Without a doubt, buying car insurance online vs offline is almost always the cheaper option. The reason is pretty simple: when you buy online, the insurance company doesn’t have to pay an agent a commission or handle as much physical paperwork. Those saved costs are then passed on to you in the form of lower premiums.

3. What are the pros and cons of buying car insurance online?

Well, the pros are pretty compelling. It’s accessible at anytime no matter where you are. Buying car insurance online vs offline is faster, often taking just minutes. It’s more transparent because you can easily compare lots of different policies side-by-side. The main con is that you don’t get that face-to-face chat with an agent. If you’re the kind of person who prefers to sit down with someone, you might find the online process a little less personal.

4. Can I renew my car insurance online in the UAE?

You can absolutely do that, and it’s actually one of the easiest parts of the process. Most companies make it really simple by sending you a reminder email with a direct link to renew. Often, your details are already saved, so it’s just a matter of checking that everything is still correct, clicking a few buttons, and you’re done for another year. It saves you a trip and a lot of time.

5. Do online insurance platforms provide the same coverage as offline?

Yes, they do. The policy itself is the same; it’s a legal contract from the insurance company. Whether you buy it online, offline, or through a carrier pigeon, a comprehensive cover is a comprehensive cover. The only difference is how you bought it. The coverage and the protection you get are identical.

6. How do I compare car insurance online vs offline effectively?

For the online part, use a couple of different websites to get a wide range of quotes. Don’t just look at the price and take a minute to actually read what’s included in each policy. For the offline part, talk to a broker or visit a few insurance offices and see what they offer you.