Bringing a newborn home is a beautiful and life-changing experience. Along the joy and new routines is a task that every parent in the UAE must address: getting health insurance for their newest family member. With legal requirements to fulfill and the potential for high medical costs for things like vaccinations and check-ups, arranging coverage is not something you can put off. If you have been asking yourself, “Can you buy health insurance for a new born baby in UAE?” the answer is a definite yes.

This guide will walk you through the entire how to buy health insurance for new born online, from your options and what to look for in a health insurance for newborn, to a step-by-step guide on how to buy a policy online.

Too Long; Didn’t Read (TL;DR)

Yes, you can and must buy health insurance for your newborn in the UAE. It’s a legal requirement for their residency visa.

- The Grace Period: Your newborn is automatically covered under the mother’s policy for the first 30 days. You must get them their own separate policy before this period ends to avoid a coverage lapse and potential fines.

- How to Get It: The easiest way is to add them to your existing family health insurance plan. If that’s not possible, you can buy a standalone policy online.

- Key Coverage to Look For: Ensure the plan comprehensively covers vaccinations, well-baby check-ups, newborn screening tests, and potential NICU costs.

- Cost: Premiums vary, but a good standard plan typically costs between AED 3,000 to AED 7,000 per year.

- The Process: You can buy it online by comparing plans, selecting one, and uploading the required documents (baby’s birth certificate, passport, and Emirates ID application, plus parents’ IDs and visas).

Bottom Line: Don’t delay. Securing health insurance within the 30-day grace period is crucial for your baby’s health and legal status, giving you peace of mind from the start.

Why Health Insurance for a Newborn Baby in the UAE Matters

Before diving into the specifics of how to get health insurance for new born baby in UAE, it’s important to understand exactly why it is necessary. It’s about building a foundation of health and security for your child from their very first day.

Legal & Regulatory Requirements for Dependents

In the UAE, newborn baby health insurance UAE is mandatory for all residents, including infants. For expat parents, providing health insurance for your newborn is part of the visa process. You usually have 30 days to add your baby to a plan and 120 days to complete all documents. Missing the deadline can lead to fines of AED 100 per day.

Medical Cost Risks for Newborns

Newborns require frequent medical attention, and the costs can add up quickly. Without health insurance for newborn babies, you are looking at paying out-of-pocket for everything. Consider all the routine care a baby needs:

- Vaccinations as per the official UAE schedule

- Newborn screening tests

- Regular check-ups with a pediatrician

- Potential emergencies or unplanned hospital stays

A simple visit to a private clinic can cost between AED 150 and AED 500. More serious issues, like a stay in the Neonatal Intensive Care Unit (NICU), can run into tens of thousands of dirhams. Having health insurance for new born baby in UAE from day one protects you from these unexpected bills.

Peace of Mind for Parents from Day One

Knowing that your baby’s health is covered provides incredible peace of mind. It allows you to focus on bonding with your baby rather than worrying about how to pay for a doctor’s visit or what might happen in a medical emergency.

Can You Buy Health Insurance for a Newborn Baby in UAE?

The process of obtaining health insurance for a new born baby in UAE is actually quite simple, and you have a few clear methods available to you, depending on your current situation.

Automatic Coverage via Mother’s Policy for Initial Period

The good news is that for a short time, your newborn is already covered. Most health insurance policies in the UAE automatically cover a newborn baby under the mother’s policy for the first 30 days after birth. This is a temporary safety net. You must take active steps to get a separate health insurance for newborn before this period ends.

Adding Newborn as Dependent to Existing Family Plan

This is the most common path to get health insurance for new born baby in UAE. If you have a family health insurance plan or an employer-sponsored policy, you can typically add your newborn as a dependent. The process usually involves notifying your insurer or HR department and submitting the required documents. Adding a newborn to an existing family plan often only increases the premium by about 15-25%.

Buying a Standalone Newborn Health Insurance Plan Online

If your current plan doesn’t allow dependents or you’re looking for better coverage, you can purchase a separate policy just for your baby. Thanks to digital insurance platforms, you can buy health insurance for new born online. These platforms let you compare different plans from various insurers and often complete the purchase instantly.

What to Look For When Buying Newborn Health Insurance Online

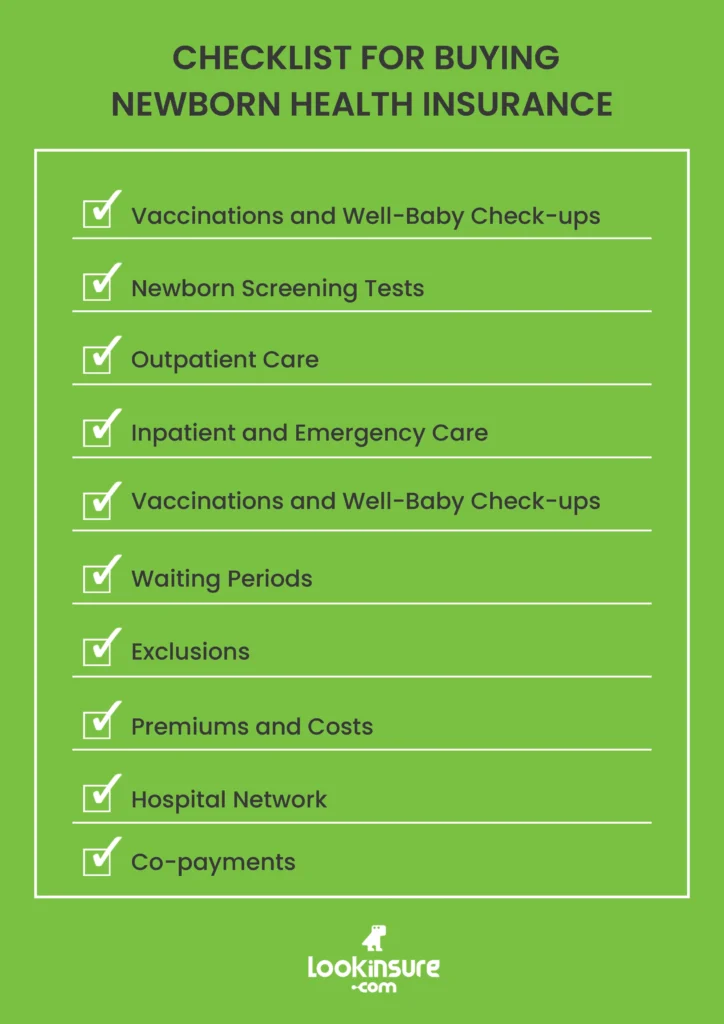

Once you know you need to get health insurance for newborn, the next step is figuring out what to look for. Not all policies offer the same benefits, and knowing the key features to compare will make your decision much easier when you buy health insurance for a new born online.

Let’s break down the essential benefits, costs, and fine print about newborn baby health insurance UAE providers offer:

Key Benefits & Inclusions (Vaccinations, NICU, Outpatient Visits)

When comparing health insurance for new born baby in UAE , ensure it covers the services your newborn will need most:

- Vaccinations and Well-Baby Check-ups: The plan should fully cover routine immunizations and regular doctor’s visits.

- Newborn Screening Tests: Coverage for essential tests after birth is crucial.

- Outpatient Care: This includes visits to pediatricians and specialists.

- Inpatient and Emergency Care: The plan should have a good annual limit to cover the cost of a hospital stay.

Exclusions, Waiting Periods & Pre-existing Conditions

Understanding what health insurance for newborn does not cover is just as important:

- Waiting Periods: This is the time after the policy starts during which you cannot claim for specific conditions. For newborns, a key area is congenital conditions (health issues present at birth).

- Exclusions: Most policies will not cover cosmetic procedures or experimental treatments.

Comparing Premiums, Networks & Online Platforms

To find the best value health insurance for new born baby in UAE, look at more than just the price:

- Premiums and Costs: The table below gives a rough idea of UAE newborn baby insurance cost ranges.

- Hospital Network: Check that your preferred pediatricians and hospitals are included.

- Co-payments: This is the percentage of the medical bill you pay out-of-pocket.

| Plan Tier | Estimated Annual Cost (AED) | Typical Coverage Features |

| Basic | 150 – 3,000 | Essential care, limited network, higher co-payments. |

| Standard | 3,000 – 7,000 | Wider network, includes specialist consultations, some dental/optical. |

| Comprehensive | 7,000 – 15,000+ | Extensive network, low co-pays, international coverage options. |

How to Buy Health Insurance for a Newborn Baby Online in the UAE

You’ve compared health insurance for newborn plans and know what you’re looking for, great! Now, let’s walk through the actual process. The good news is that the steps to buy health insurance for new born online are designed to be user-friendly and efficient, allowing you to get online health insurance for baby UAE government has mandated from the comfort of your home in just a few clicks.

Step-by-Step Online Application

You can easily buy health insurance for new born online:

- Research and Compare: Use a reputable online insurance comparison platform.

- Select a Plan: Review the coverage details, network, and premium.

- Fill Out the Application: Complete the online form with your baby’s information.

- Upload Documents: Provide digital copies of the required documents.

- Make Payment: Pay the premium securely online.

- Receive Policy Documents: You’ll get the policy and digital insurance card via email.

Documents You’ll Need

You should have these documents ready in a digital format to get health insurance for new born baby in UAE:

- Baby’s birth certificate

- Baby’s passport (if available)

- Baby’s Emirates ID application number

- Parents’ passports and Emirates IDs

- Parents’ residency visas

Common Pitfalls & How to Avoid Them

Even with the best intentions, it’s easy for new parents to make simple mistakes in the busy postpartum period. Being aware of these common missteps can save you from future headaches and ensure your health insurance for newborn provides the seamless, comprehensive protection you expect.

Delayed Enrolment Leading to Coverage Gaps

Missing the 30-day enrolment window is the biggest mistake that interferes with health insurance for new born baby in UAE. After this period, your baby loses automatic coverage. If you then need to see a doctor, you will have to pay all costs yourself. Set a calendar reminder to start the insurance process within the first couple of weeks.

Choosing a Plan with Limited Network or High Co-pays

A plan with a very low premium can be tempting, but it often comes with trade-offs. A restricted network might not include the best pediatric hospitals near you, and high co-payments mean you are still paying a significant amount for every visit.

Ignoring the Fine Print (Exclusions, Age Limits, Dependent Terms)

Never assume that everything is covered. Take the time to read the policy document, especially the sections on “exclusions” and “limitations.” Pay special attention to how the policy handles congenital conditions.

Tips for Ensuring Seamless Coverage for Your Newborn

- Set a reminder to enroll within the grace period: make sure you don’t forget by setting reminders for before the 30-day automatic coverage ends.

- Review your plan annually: Your baby’s health needs will change. Check if your plan still offers the best network and coverage at renewal time.

- Keep copies of policy documents: Save a digital copy of the insurance card on your phone and keep a physical copy in your baby’s bag.

Why Choose Lookinsure for Health Insurance in Dubai

Finding the right health insurance for newborn is easier with a trusted partner. Our platform helps you compare prices from some of the best health insurance companies in Dubai an other cities in the region all in one place, with transparent prices and no hidden fees. The fast online purchase process means you can get comprehensive coverage for your baby quickly. We provide options for individuals, families, and employees, giving you the tools to make an informed decision.

- Instant plan comparisons

- Transparent pricing for UAE newborn baby insurance cost

- Quick application processing

- Multiple insurer options in one place

Conclusion

So, can you buy health insurance for a new born baby in the UAE? Absolutely, and it is a critical step for any responsible parent. By acting promptly within the 30-day grace period, you can ensure your baby is covered without any gaps.

The key is to choose a plan that offers comprehensive coverage for vaccinations, check-ups, and emergencies. With the right health health insurance for new born baby in UAE, you can enjoy this precious time with your new baby, content in the knowledge that their health is protected.

Frequently Answered Questions

1. When should a newborn baby be added to a health insurance plan in the UAE?

You have a maximum of 30 days from the date of birth to add your newborn to a health insurance plan to avoid a lapse in coverage after the initial automatic coverage ends.

2. Can a newborn baby be covered under my existing health insurance plan?

Yes, most parents add their newborn as a dependent to an existing family or employer-sponsored health insurance plan. This is often the most cost-effective method for online health insurance for baby UAE laws require.

3. What documents are required to buy health insurance for a newborn online in the UAE?

You will typically need the baby’s birth certificate, passport, and Emirates ID (or application number), as well as the parents’ passports, Emirates IDs, and residency visas.

4. Are there waiting periods or exclusions for newborn health insurance in the UAE?

While standard waiting periods for infant insurance have been removed in Dubai, coverage for congenital conditions can be limited and is often initially handled under the mother’s maternity plan. Always check the policy exclusions carefully.

5. What happens if my newborn is not insured within the grace period?

If you miss the 30-day window, the baby loses coverage and you will be liable for all medical costs. Additionally, you may face difficulties with visa processing and could incur fines if all documents are not finalized within 120 days of birth.

6. How much does health insurance for a newborn baby in the UAE typically cost?

Health insurance for newborn costs can vary widely, from around AED 150 for a very basic plan to over AED 15,000 per year for a comprehensive premium plan. A common range for a good standard plan is between AED 3,000 and AED 7,000 annually.

7. Can I switch my newborn from a dependent plan to a standalone plan later?

Yes, you can switch your newborn to a standalone plan later, for example during the annual renewal period. Be sure to check for any new waiting periods that might apply when taking out a brand new policy.