The United Arab Emirates has introduced some important updates to health insurance Golden Visa UAE applicants and holders must know. For those who are planning for long-term residency, understanding these changes is necessary for compliance and ensuring proper medical coverage. The new regulations affect everything from premium structures to minimum coverage requirements, creating both challenges and opportunities for expatriates.

This guide will walk you through exactly what’s different, who is affected, and how to select the right health insurance for Golden Residency UAE that meets both your needs and legal obligations without unnecessary complications.

Too Long; Didn’t Read (TL;DR)

Here are the essential points about the changing landscape of investor visa health insurance UAE requirements:

- Mandatory Coverage: Health insurance is now mandatory for all Golden Visa and Investor Visa holders and their dependents nationwide.

- Basic Plan Introduction: A new, more affordable basic policy of health insurance golden visa UAE holders can buy is available, but it comes with co-payments and a limited network of healthcare providers.

- Pre-existing Conditions: A significant shift is that chronic and pre-existing conditions must now be covered from the start of a policy, with no waiting periods allowed.

- Family Inclusion: You must get coverage for every family member sponsored under your visa.

- Renewal Compliance: Your visa renewal is directly tied to having continuous, valid health insurance, with stricter verification in place.

Overview of Golden Visa & Investor Visa Health Insurance Requirements

Understanding the specific health insurance for Golden Residency UAE requirements is the first step for any long-term visa holder. The DHA health insurance rules for investors and golden visa holders, set these plans apart from standard expat health insurance UAE policies, with distinct minimums that must be met.

DHA Health Insurance Compliance for Long-Term Visas

Making sense of the DHA health insurance rules for investors and Golden Visa holders is the first step. The Dubai Health Authority requires every long-term visa application to include proof of a compliant health insurance policy right from the start. It’s not something you can sort out after your visa is approved. Your application will be rejected if you don’t provide this documentation upfront. The policy must be valid for at least one full year and be renewable to ensure there’s no gap in your coverage.

Differences from Standard Expat Insurance

The health insurance for Golden Residency UAE requirements are a bit different from standard expat plans. While a typical yearly plan might focus just on the individual, long-term visa insurance has to account for the extended duration and often includes broader family coverage obligations. The policy also needs to be robust enough to cover you for the entire length of your visa, which is why short-term or travel insurance policies won’t be accepted.

Minimum Coverage Requirements

For health insurance golden visa UAE government has set clear minimums for what your health insurance must cover. While these can vary a little between emirates, there are common threads:

- A minimum of AED 150,000 annual coverage in Dubai.

- Comprehensive benefits including hospital stays, emergency care, and specialist visits.

- Coverage that is valid across the UAE.

Health Insurance for Golden Visa Holders

There are new options for those seeking a health insurance golden visa UAE plan. It’s important to look beyond just the premium changes for long-term visa holders and consider how well the coverage protects you and your family, both now and in the future.

Eligibility and Coverage Expectations

Golden via holders are required to have health insurance. It doesn’t matter if you are employed, retired, or a student. The good news is you now have more options, from the new basic plan to comprehensive private policies. Your choice should reflect your actual health needs and not just aim for the cheapest way to check the compliance box.

Premium Differences for Golden Visa Holders

The cost of health insurance for Golden Residency UAE is variable. The new basic scheme starts at a lower price point, which is helpful for those on a budget. More comprehensive plans, which offer better coverage and access to a wider range of hospitals, will understandably cost more.

Optional Add-Ons for Families and Dependents

Since your visa likely includes family members, you should look into optional add-ons to make sure everyone is properly covered. Common add-ons include:

- Dental and optical care

- Maternity benefits

- Worldwide coverage for travel outside the UAE

- Mental health services

Health Insurance for Investor Visa Holders

Arranging the right investor visa health insurance UAE policy involves unique considerations for business owners. Beyond personal coverage, you must also understand the UAE Golden Residency insurance requirements for any employees you sponsor under your visa.

Requirements for Business Owners and Investors

For those with an investor visa health insurance UAE requirement, the responsibility falls entirely on you to arrange and pay for coverage for yourself and your family. The process involves a straightforward document submission, but be prepared for a verification check that looks into your business and investment status in the country.

Coverage for Employees under Investor Sponsorship

A key part of the investor visa health insurance UAE rules that sometimes gets missed is the requirement to also cover your employees. If you sponsor employees, you are now responsible for providing them with health insurance that meets the new national standards. There is an affordable basic plan designed specifically to help business owners meet this new obligation without a huge financial strain.

Comparison with Regular Resident Plans

How does investor visa health insurance UAE differ from a standard plan? It often comes down to flexibility and the scope of coverage. Investors and business owners tend to prefer plans that include international coverage, given their frequent travel, and they often select policies with access to premium private hospitals and clinics.

Key Changes in 2025–2026

The recent updates to DHA health insurance rules for investors and Golden Visa holders are significant. These shifts, which include new premium changes for long-term visa holders and coverage mandates, affect everyone from new applicants to those renewing their existing visas.

Updated DHA Regulations for Long-Term Visa Holders

The DHA health insurance rules for investors and Golden Visa holders have been tightened. There’s now a centralized electronic system that checks your insurance status directly against your visa and Emirates ID records. This makes it impossible to bypass the requirement.

Changes in Plan Premiums and Coverage Limits

The introduction of the new basic insurance tier is the most notable change affecting premium changes for long-term visa holders. While it provides a low-cost entry point, it’s important to know that it has co-payments for services and lower annual limits than you’ll find with comprehensive plans.

How These Changes Affect Renewal and Claims

When it’s time to renew your visa, you’ll need to show that you’ve had continuous health insurance with no gaps. The renewal process is more strict than it was before. For claims, the procedures have been standardized to some degree, which should make the process smoother, whether you’re on the basic scheme or a private plan.

Basic vs. Comprehensive Health Insurance Plans

| Feature | Basic Health Insurance Scheme | Comprehensive Plans |

| Annual Cost | Starts from AED 320+ | AED 3,500+ |

| Inpatient Coverage | AED 50,000 max with co-payments | Often AED 250,000+ |

| Network of Providers | Limited | Extensive, including premium hospitals |

| Chronic Conditions | Covered immediately | Covered immediately |

| Maternity Care | Not included | Often included as standard |

Choosing the Right Plan

To find the best health insurance for Golden Residency UAE plan means comparing the top 10 health insurance companies in Dubai, UAE. The best choice balances the UAE Golden Residency insurance requirements with your personal needs, such as family coverage and managing any chronic health conditions.

Comparing Golden Visa and Investor Visa health insurance options

Your first big decision is usually between the basic scheme and a comprehensive plan. The basic plan meets the legal requirement cheaply, but the co-pays and limited network can be a drawback. A comprehensive plan costs more but provides much better access and coverage, which is often a worthwhile investment for your family’s health.

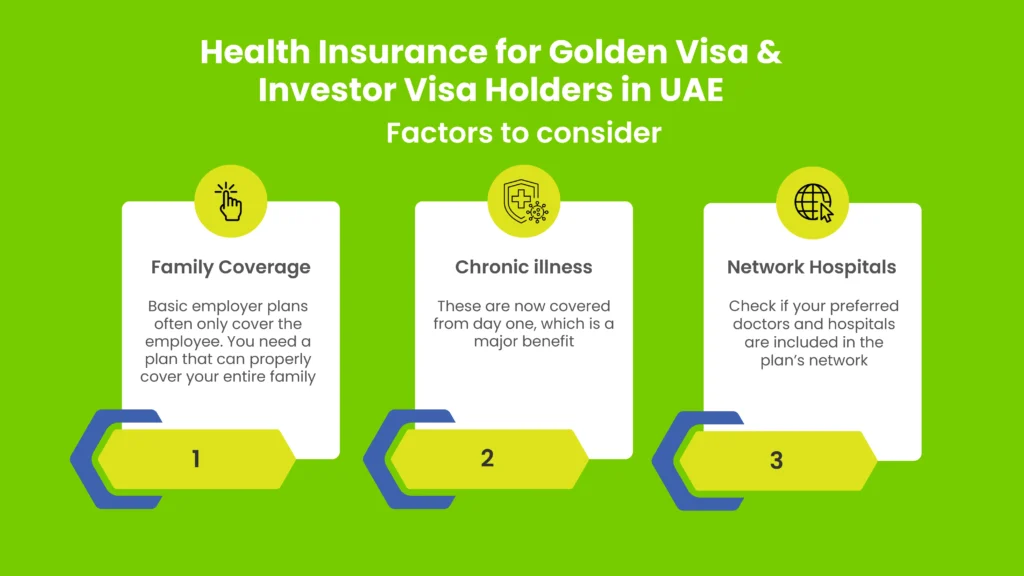

Factors to consider: Family Coverage, Chronic illness, Network Hospitals

A few key things should guide your decision:

- Family Needs: Basic employer plans often only cover the employee. You need a plan that can properly cover your entire family.

- Pre-existing Conditions: These are now covered from day one, which is a major benefit.

- Hospital Network: Check if your preferred doctors and hospitals are included in the plan’s network.

Using Online Comparison Platforms Like Lookinsure

Using a platform like Lookinsure can make comparing your health insurance for Golden Residency UAE options much simpler. It allows you to see multiple DHA-approved plans from different providers in one place, with clear pricing and coverage details. This makes it easier to find a policy that fits both your visa requirements and your personal budget.

Benefits of DHA-Compliant Health Insurance for Long-Term Visa Holders

The advantages of having a compliant health insurance golden visa UAE policy go beyond just visa approval. From covering pre-existing conditions to ensuring access to top clinics, the right plan is a cornerstone of a secure life in the UAE.

Visa Compliance And Legal Protection

The most immediate benefit is that it keeps your visa valid. Without compliant health insurance, you risk having your application rejected or your residency status becoming problematic. It also protects you from the massive financial burden of paying for healthcare out-of-pocket in the UAE.

Access To Private Hospitals And Clinics

A good DHA-compliant plan gives you access to a wide network of private hospitals and clinics. This means shorter waiting times and often a higher standard of care, which can make a big difference in an emergency or when dealing with a ongoing health issue.

Coverage For Pre-Existing And Chronic Conditions

The new rules mandate immediate coverage for chronic and pre-existing conditions. This is a huge step forward for expat health insurance UAE standards and provides significant peace of mind for those with ongoing health needs.

How to Buy Health Insurance for Golden & Investor Visas

The process of buying investor visa health insurance UAE or a golden visa plan is straightforward when you know what’s needed. Gathering the correct documents is key to a smooth application and ensures your visa renewal process remains on track.

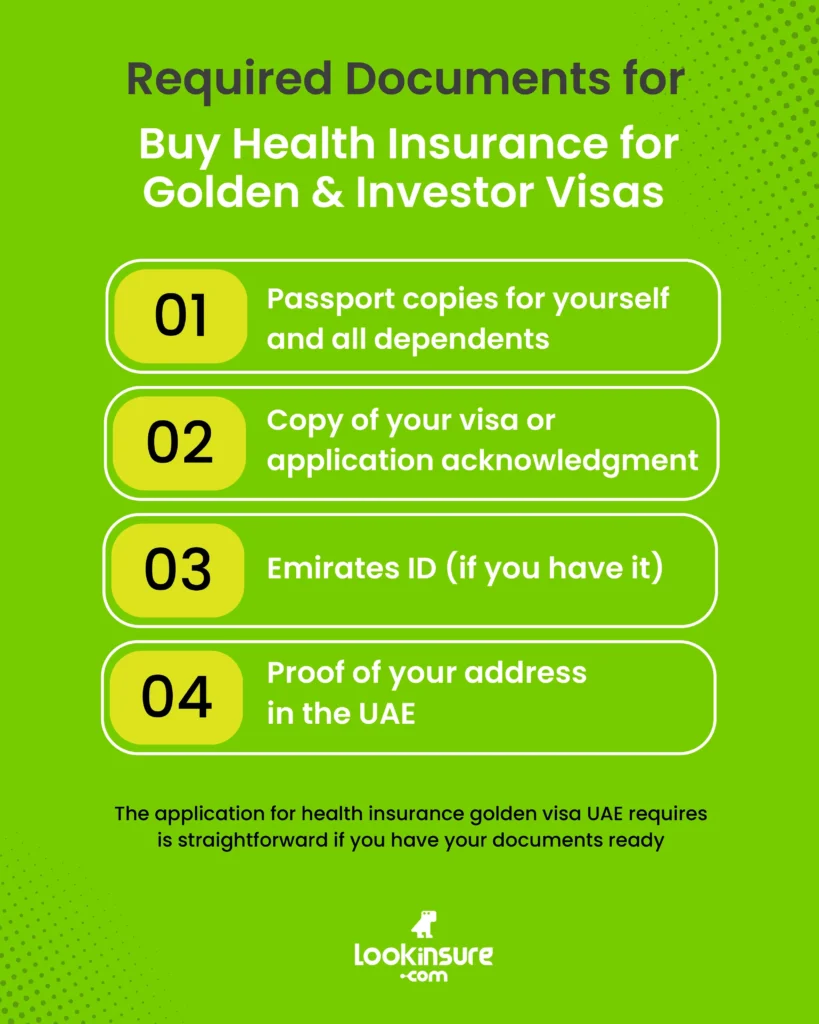

Required Documents

The application for health insurance golden visa UAE requires is straightforward if you have your documents ready. You will typically need:

- Passport copies for yourself and all dependents.

- Copy of your visa or application acknowledgment.

- Emirates ID (if you have it).

- Proof of your address in the UAE.

Online Purchase vs Direct Insurer

You can buy your insurance directly from a company or use an online aggregator. Buying through a platform like Lookinsure lets you compare many plans at once, which can save you time and help you find a better deal, especially if you are new to how health insurance works in the UAE.

Renewals and Policy Updates

Don’t let your coverage lapse. Start the renewal process well before your current policy expires to ensure there’s no gap. Use renewal as a chance to reassess your needs, you might find a better plan has entered the market or that your own health needs have changed.

Conclusion

Staying on top of the changes to health insurance for Golden Residency UAE and investor visa health insurance UAE is essential for a smooth experience as a long-term resident. The right health insurance does more than just fulfill a legal requirement, it protects your health, your finances, and your investment in your life in the UAE.

Taking the time to compare different ealth insurance golden visa UAE plans, perhaps using a service like Lookinsure, is the best way to find coverage that is both compliant and genuinely suited to your needs.

Frequently Answered Questions

1. Is health insurance mandatory for Golden Visa holders in UAE?

Yes, it is absolutely mandatory to get health insurance golden visa UAE government can verify, for the holder and their dependents in every emirate.

2. What is the minimum coverage required for investor visa health insurance?

In Dubai, it is a minimum of AED 150,000 annually. Other emirates have similar requirements.

3. Can families of Golden Visa holders be added to the plan?

Yes, you must provide health insurance coverage for every family member you sponsor under your visa.

4. Do pre-existing conditions affect premiums for long-term visa holders?

Under the new basic scheme, pre-existing conditions are covered without affecting the standard premium. For comprehensive plans, they may lead to a higher premium.

5. Are there optional add-ons like dental or maternity for Golden Visa holders?

Yes, most comprehensive plans offer add-ons like dental, optical, and enhanced maternity coverage for an additional cost.

6. Can investor visa holders insure their employees under the same policy?

Yes, investor visa holders can and should arrange group health insurance policies for their employees, as this is now a legal requirement.