Maybe you are switching jobs, planning to leave the country, or simply found a better medical plan that suits your family a bit more. At that point, a very common question comes up: can I actually cancel my health insurance?

Making sense of health insurance cancellation UAE rules can be pretty confusing at first. Health insurance is mandatory across most of the country, yet there are situations where cancelling a policy is allowed and completely legal. The trick is knowing when you can cancel health insurance policy UAE laws require you to have, how to do it properly, and what mistakes to avoid so you do not end up with fines, visa issues, or gaps in coverage.

Too Long; Didn’t Read (TL;DR)

Cancellation is allowed in specific cases, including job changes, visa cancellation, relocation, or switching to a new health insurance plan.

Who handles cancellation depends on the policy: employers usually cancel employee coverage, while individuals must request cancellation directly from the insurer.

A formal request and documents are required, such as Emirates ID, policy details, and proof of visa or employment change.

Refunds are conditional, with pro-rata refunds (refund calculated for unused coverage) possible in some cases, but early cancellation fees or past claims may reduce or cancel any refund.

Timing matters, as cancelling too early can cause coverage gaps or visa compliance issues.

When Can You Cancel Health Insurance in the UAE?

Before doing anything, it is important to understand that cancelling a health insurance in UAE is not something you can do freely at any time just because you feel like it. In most cases, cancellation is allowed only under specific conditions that are recognized by insurers and local regulations.

Employer-Provided Insurance

If your health insurance is provided by your employer, the rules are fairly straightforward.

In Dubai and other emirates, employers are legally required to provide health insurance for their employees. This means:

- The policy is usually tied directly to your employment contract

- The employer is responsible for paying the premium

- The coverage normally ends when your employment ends

So, if you leave your job, your employer will typically initiate the process to cancel health insurance policy UAE on your behalf. As an employee, you usually do not need to submit the cancellation yourself, but you do need to stay aware of timing.

Key points to keep in mind:

- Coverage often ends on your last working day or shortly after

- You should confirm the exact cancellation date in writing

- If you are staying in the UAE, you will need new coverage immediately

A short gap without insurance can cause issues, especially if you are transferring to a new visa.

Individual or Family Plans

If you bought your own insurance policy for yourself or your family, the situation is a bit different.

Private policies can usually be cancelled under conditions such as:

- Visa cancellation or permanent departure from the UAE

- Switching to another insurer or employer-sponsored plan

- Policy upgrades or restructuring

Most insurers require:

- A minimum coverage period (often three to six months)

- Written notice before cancellation

- Supporting documents

This is where medical insurance cancellation UAE rules can vary from one provider to another, so reading your policy wording is always a smart move. Since every plan has its own rules and benefits, it’s worth reading more about common health insurance plans in the UAE, including how different coverage levels, costs, and policy structures can affect cancellation terms.

How to Cancel a Health Insurance Policy

Once you know that you are eligible, the next step is knowing how the process works in practice. Make sure you do this right to avoid no health insurance fines in UAE.

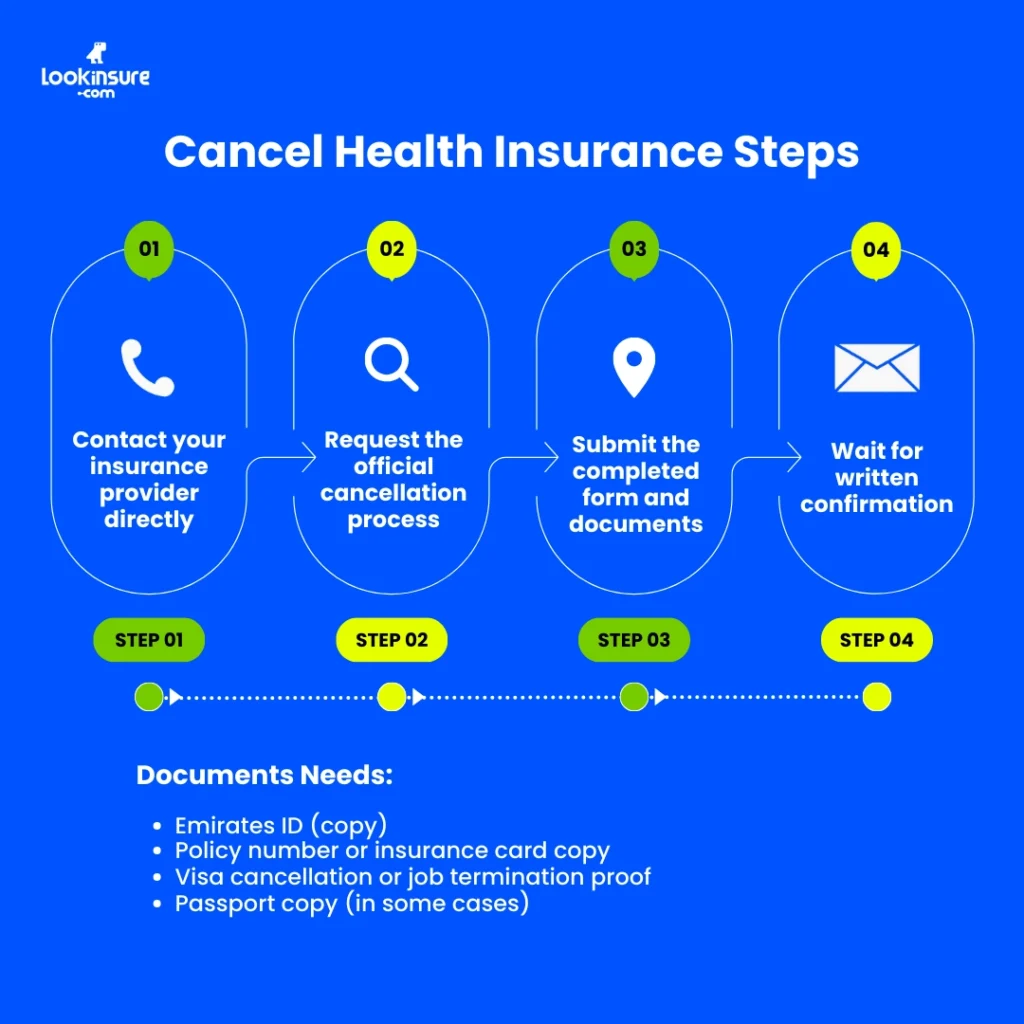

Step-by-Step Cancellation Process

Although each insurer has its own forms and procedures, the general steps for health insurance cancellation UAE look very similar across the board.

Here is a simple breakdown:

- Contact your insurance provider directly

- Request the official cancellation form or written procedure

- Submit the completed form along with required documents

- Follow up until you receive written confirmation

Commonly required documents include:

- Emirates ID (copy)

- Policy number or insurance card copy

- Visa cancellation or job termination proof

- Passport copy (in some cases)

When dealing with medical insurance cancellation UAE, insurers usually prefer email submissions so there is a clear paper trail.

Processing Time and Confirmation

Cancellation is not instant. In most cases:

- Processing takes between 7 and 14 working days

- Some insurers may take slightly longer during busy periods

- Coverage may remain active until cancellation is approved

Always ask for a confirmation email or letter. This written proof is extremely important, especially if you later need to show that you followed the correct cancel health insurance policy UAE procedure.

Fees, Refunds, and Penalties

Money is often the biggest concern when cancelling a policy, so let’s break this part down carefully.

Pro-Rata Refunds

If you cancel early, you may be eligible for a partial refund. This is usually calculated on a pro-rata basis, meaning the insurer refunds the unused portion of your premium.

Here is a simple example table to make things clearer:

| Policy Duration | Time Used | Possible Refund |

| 12 months | 4 months | Partial refund for 8 months |

| 12 months | 9 months | Very small or no refund |

| 6 months | 3 months | Partial refund, minus fees |

Refunds under health insurance cancellation UAE often depend on:

- How long the policy has been active

- Whether any claims were made

- Administrative or cancellation fees

Penalties for Early Cancellation

In some cases, there may be penalties or no refund at all.

Situations where penalties apply include:

- Claims already used during the policy period

- Minimum coverage period not completed

- Special discounted or promotional plans

That said, exceptions do exist. Visa cancellation and permanent relocation often allow cancel health insurance policy UAE requests without heavy penalties, provided documents are submitted correctly.

Cancelling Short-Term vs Long-Term Health Insurance Plans

Not all health insurance policies work the same when it comes to cancellation. One key factor is the length of your plan:

Short-Term Health Insurance Plans (3–6 months)

- short-term health insurance plans in the UAE designed for temporary situations like short stays or visa transitions

- Refunds are often limited or unavailable once the policy is active

- Usually stricter cancellation rules because these plans are lower-cost and short-term

Long-Term Health Insurance Plans (12 months)

- Standard yearly policies with more structured rules

- Often offer pro-rata refunds if cancelled early, depending on usage and claims

- Administrative fees may apply, but procedures are generally predictable

- Best suited for residents needing consistent, long-term coverage

Important Considerations Before Cancelling

Cancelling insurance is not just a paperwork exercise. It can have real consequences if not handled properly.

Visa and Residency Implications

Health insurance is closely linked to residency status, especially in Dubai.

If you cancel your policy too early:

- Your visa renewal could be delayed or rejected

- You might face fines for being uninsured

- Medical expenses become fully out-of-pocket

Maintaining coverage until your visa status officially changes is a key part of responsible medical insurance cancellation UAE planning.

Continuous Coverage for Future Policies

Another point that many people overlook is continuity.

When applying for a new policy, insurers often ask for proof of previous coverage. Gaps can lead to:

- Higher premiums

- Waiting periods for certain treatments

- Exclusions for pre-existing conditions

An insurance continuity certificate helps show that your health insurance cancellation UAE was handled correctly and that coverage remained consistent. Because valid coverage is tied to residency visas, it’s also useful to explore how health insurance for visa renewal in Dubai works, including the documentation, minimum requirements, and timing that most residents face.

Conclusion

Cancelling health insurance in the UAE is possible, but it needs to be done the right way. Whether your policy is linked to your job or purchased privately, understanding the rules around cancel health insurance policy UAE requests can save you from fines, stress, and unexpected costs.

Always review your policy terms, prepare the correct documents, and coordinate closely with your insurer before making any moves. A careful approach to medical insurance cancellation UAE ensures that your residency status stays intact and your future coverage remains smooth and affordable.

Frequently Answered Questions

1. Can I cancel my health insurance in UAE?

Yes, you can, but only under certain conditions such as job termination, visa cancellation, or switching to a new plan. Following official health insurance cancellation UAE procedures is essential.

2. Are there penalties for cancelling a private health insurance policy early?

Sometimes, yes. Penalties depend on how long the policy has been active and whether claims were used. Each insurer applies medical insurance cancellation UAE rules differently.

3. Can I cancel my employer-provided health insurance if I leave my job in the UAE?

In most cases, your employer handles the process once your employment ends. This is a standard cancel health insurance policy UAE situation tied to labor contracts.

4. Will I get a refund if I cancel my medical insurance in the UAE?

You may receive a partial refund if the policy is cancelled early and no major claims were made. Refunds under health insurance cancellation UAE are usually calculated on a pro-rata basis.

5. What documents do I need to cancel my health insurance policy?

Typically, you will need your Emirates ID, policy details, and proof of visa or job cancellation. These documents support medical insurance cancellation UAE requests.

6. Can cancelling my health insurance affect my UAE residence visa renewal?

Yes, it can. Lack of valid coverage may delay or prevent visa renewal, which is why cancel health insurance policy UAE decisions should always be timed carefully.