Imagine you are changing jobs in the UAE or moving from one health insurance provider to another. Your visa is in progress, your new employer is asking for documents, and suddenly you are told you need proof that your health insurance coverage did not stop in between. This is where an insurance continuity certificate UAE becomes important. It is a formal document that proves you were insured continuously, without gaps, during a specific period.

In this article, you will learn what is insurance continuity certificate, why it is required, how to obtain it, and what to watch out for when using it.

Too Long; Didn’t Read (TL;DR)

- An Insurance Continuity Certificate proves that your health insurance coverage in the UAE stayed active without gaps.

- It’s commonly needed when changing jobs, switching insurers, or renewing a policy to avoid being treated as a new policyholder.

- Having it can protect your existing benefits and help reduce or remove waiting periods under a new plan.

- The certificate is time-sensitive, so request it close to when you need it and double-check all details before submitting.

Understanding an Insurance Continuity Certificate UAE

Before looking at when and why you need this document, it helps to understand exactly what it is and what it does.

What Is a Continuity Certificate?

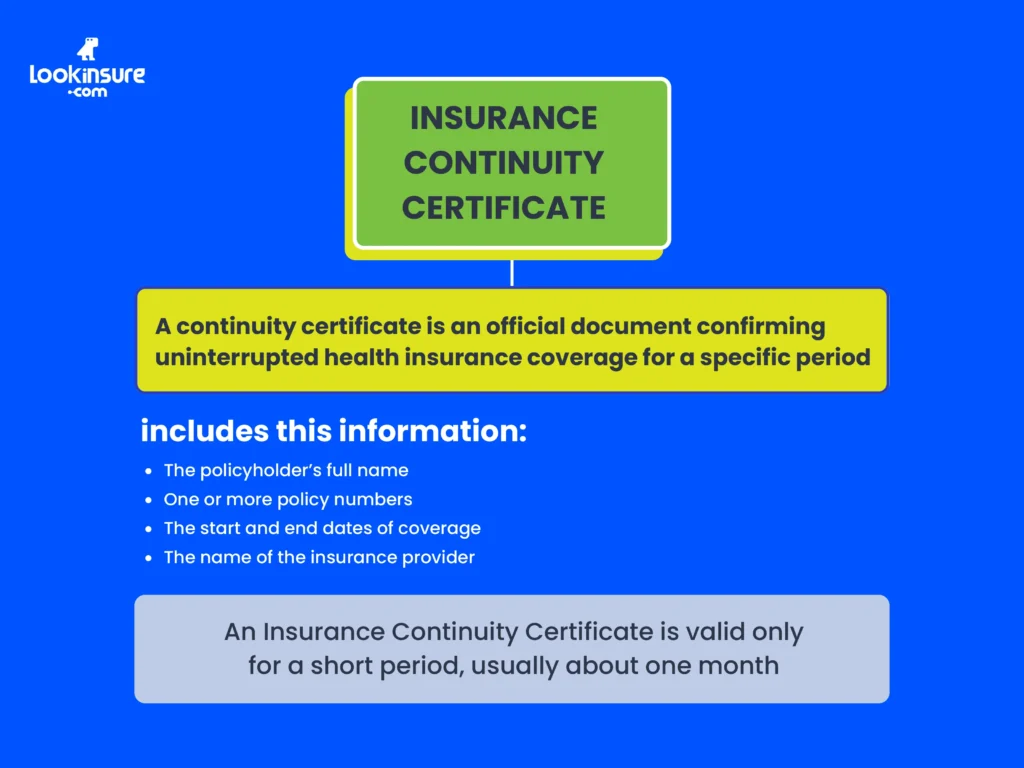

A continuity certificate is an official document issued by an insurance provider. Its main purpose is to confirm that a policyholder had uninterrupted health insurance coverage for a defined period.

In simple terms, it answers one key question: was this person insured continuously, or was there a break in coverage?

The certificate usually includes basic but important information such as:

- The policyholder’s full name

- One or more policy numbers

- The start and end dates of coverage

- The name of the insurance provider

In the context of continuity certificate in health insurance, it acts as evidence that you have already served time under an earlier policy.

Validity Period

An Insurance Continuity Certificate is not valid forever. In most cases, it is accepted only for a limited time, often around one month from the date of issue.

The reason for this limited validity is simple. The certificate reflects your insurance status up to a certain date. If too much time passes, it no longer proves that your coverage remained uninterrupted. Insurance providers and employers need recent confirmation, not historical records from several months ago.

So, keep in mind to request the certificate close to the time you actually need it, especially when changing jobs or finalizing a new policy.

Why You Need an Insurance Continuity Certificate in UAE

Many people only hear about this document when someone asks for it. Understanding why it is required helps avoid delays and confusion.

Changing Employers or Policies

When you move to a new employer in the UAE, your corporate health insurance often changes with your job. New employers or insurers may ask for a continuity certificate to confirm that you were insured until your previous policy ended.

This helps them arrange a smooth transition. Without proof of continuity, the new insurer may treat you as a first-time policyholder, even if you were insured for years before!

Maintaining Benefits

A continuity certificate in health insurance acts like a bridge. It carries your insurance history forward instead of forcing you to start from zero again. Many health insurance plans include waiting periods for certain treatments or conditions.

If you can prove uninterrupted coverage, these waiting periods may be waived or reduced. Without the certificate, you risk losing benefits you already earned under your previous policy.

Compliance with UAE Regulations

In some emirates, especially Abu Dhabi, proof of continuous health insurance coverage is more than just an internal insurance requirement. It is part of regulatory compliance.

Authorities and insurers may request documentation to show that residents remained insured as required by local health insurance rules. It helps demonstrate that you followed these regulations and maintained valid coverage.

How to Obtain an Insurance Continuity Certificate

Getting a continuity certificate is usually straightforward, but it helps to know the correct process.

Request from Current or Previous Insurer

The most common way to obtain a continuity certificate is by requesting it directly from your current or previous health insurance provider. This can usually be done through customer service channels such as phone, email, or an online request form.

Well-known providers in the UAE, such as Daman, Sukoon, Nextcare, and Lumi, typically have established procedures for issuing these certificates. Once requested, the document is often provided within a short processing period.

Using Digital Platforms

Many insurers now offer digital access through mobile apps or online portals. These platforms allow policyholders to download documents, including continuity certificates, without needing to speak to customer support.

Digital access is especially useful when you are short on time. You can download the certificate, check the details, and submit it wherever needed without delays caused by manual processing.

If Your Request Is Denied

In some cases, a request for a continuity certificate may be delayed or denied. This can happen due to system errors, incomplete records, or administrative misunderstandings.

If this happens, the first step is to follow up with the insurer and request clarification. If the issue is related to employment-based insurance, your HR department may be able to assist.

If necessary, you can escalate the issue through formal channels. Policyholders in the UAE have rights, and insurers are generally required to provide proof of coverage history when requested.

Key Considerations When Using a Continuity Certificate in the UAE

Having the certificate is one thing. Using it correctly is just as important.

Accuracy of Coverage Details

Small errors can cause big delays. Always check that your name, policy number, and coverage dates are correct. Even a minor mismatch can lead to rejection by a new insurer or employer.

Common mistakes include missing middle names, incorrect end dates, or outdated policy numbers. These issues are usually easy to fix if caught early.

Timing of Submission

Timing matters more than many people realize. Because continuity certificates have limited validity, submitting them late can create problems.

If there is a gap between when your old policy ended and when the certificate is reviewed, the receiving party may question whether coverage remained uninterrupted. Submitting the certificate promptly helps avoid this situation.

Limitations of a COC

It is important to understand what a continuity certificate does and does not do. It confirms past coverage, not future protection.

The certificate does not act as an insurance policy and does not provide medical coverage by itself. It simply proves that coverage existed during a certain period. You still need an active policy for ongoing protection.

Conclusion

An Insurance Continuity Certificate is a simple document, but it plays a big role in the UAE’s health insurance system. It proves uninterrupted coverage, helps preserve insurance benefits, and supports compliance with local regulations.

Whether you are changing jobs, switching insurers, or renewing coverage, understanding what is insurance continuity certificate? and how to use it can save time and prevent unnecessary complications. By requesting it early and checking the details carefully, you can ensure a smooth transition without gaps in your health insurance history.

Frequently Answered Questions

1. What is an insurance continuity certificate, and why is it needed in the UAE?

It is an official document that proves your health insurance coverage continued without interruption. In the UAE, it is often required when changing employers or insurers to maintain benefits and meet regulatory requirements.

2. How long is an Insurance Continuity Certificate valid?

Most continuity certificates are valid for a short period, usually around one month from the date of issue, as insurers require recent proof of uninterrupted coverage.

3. Can I get a continuity certificate from any UAE health insurance provider?

Yes. Licensed health insurance providers in the UAE can issue a continuity certificate upon request, provided you had active coverage with them.

4. What information is typically included in a continuity certificate?

It usually includes your full name, policy number, insurance provider, and the start and end dates of your coverage.

5. What should I do if my insurer refuses to issue a continuity certificate?

You should first follow up directly with the insurer for clarification. If the policy was employer-sponsored, your HR department can help. If needed, the issue can be formally escalated.

6. Is an Insurance Continuity Certificate mandatory when changing jobs in Abu Dhabi?

In many cases, yes. It is commonly required to confirm compliance with Abu Dhabi’s health insurance regulations and to ensure a smooth transfer of coverage.