If you have been trying to become a Abu Dhabi resident, you know how important it is to have health insurance for Abu Dhabi residence visa applicants. Unlike Dubai, Abu Dhabi follows its own health insurance system, which is regulated by DoH. This authority links visa status directly to insurance coverage.

In this guide, we will walk you through who must be insured, who is legally responsible for providing coverage, what type of UAE health insurance is accepted, and what happens if you change jobs or transfer your visa.

Too Long; Didn’t Read (TL;DR)

- Health insurance is legally mandatory for issuing or renewing any Abu Dhabi residence visa and is directly linked to visa approval.

- Abu Dhabi follows its own DoH-regulated insurance system, and policies valid in other emirates, including Dubai, are usually not accepted.

- Employers must insure employees, while sponsors are legally responsible for arranging insurance for spouses and children.

- Insurance must be DoH-approved, active, and Abu Dhabi–valid at all times, including during job changes, to avoid visa delays or rejection.

Is Health Insurance Mandatory for an Abu Dhabi Residence Visa?

Health insurance is not optional in Abu Dhabi. It is a legal requirement that applies to anyone applying for or renewing a residence visa, regardless of their job title or visa category.

Legal Framework in Abu Dhabi

The health insurance system in Abu Dhabi is regulated by the Department of Health – Abu Dhabi (DoH).

Immigration authorities check insurance status as part of the visa process. If your insurance is expired, cancelled, or does not meet DoH requirements, your visa application may be delayed or rejected. This applies to both first-time visa applications and renewals.

Note that Abu Dhabi residence visa health insurance rules are separate from those in other emirates. Compliance with Dubai regulations for health insurance does not automatically mean compliance in Abu Dhabi.

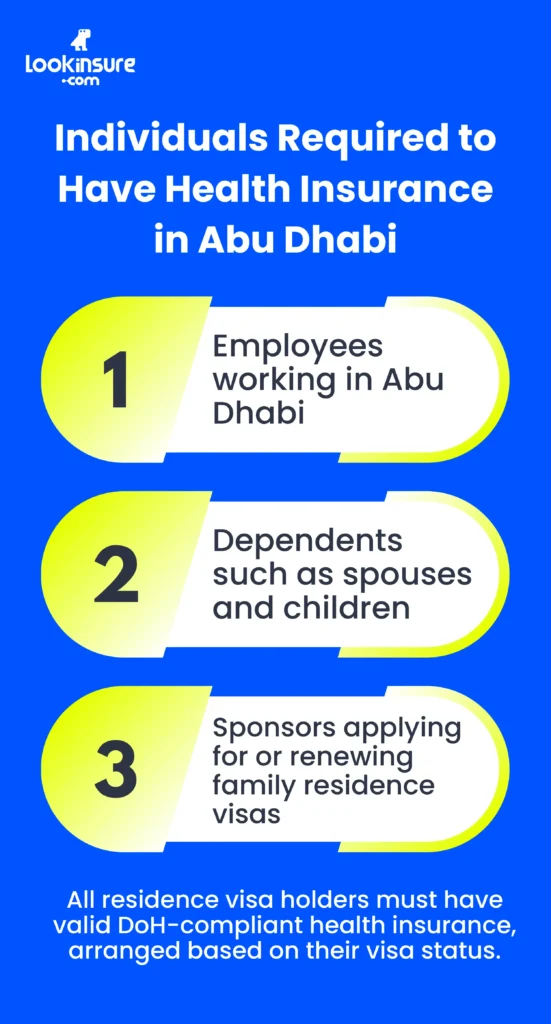

Who Must Be Covered?

Health insurance for Abu Dhabi residence visa is a requirement that applies to everyone, including:

- Employees working in Abu Dhabi

- Dependents such as spouses and children

- Sponsors applying for or renewing family residence visas

Every individual listed on a residence visa must have their own active health insurance policy that meets DoH standards. The responsibility for arranging that insurance depends on whether the person is an employee or a dependent.

Who Is Responsible for Providing Health Insurance in Abu Dhabi?

Responsibility for health insurance in Abu Dhabi is clearly defined by law. However, it differs depending on whether the insured person is an employee or a dependent.

Employer-Sponsored Health Insurance

- Employers in Abu Dhabi are legally required to provide health insurance for their employees. This insurance must meet the minimum coverage requirements set by the Department of Health.

- Employees should not be asked to pay for mandatory health insurance themselves. If an employer fails to provide valid coverage, it can create problems during visa issuance or renewal, affecting both the employer and the employee.

- Some employers offer more comprehensive plans as part of their benefits package, but even the most basic employer-provided plan must still be DoH-approved to be valid for visa purposes.

Health Insurance for Dependents

Failing to insure dependents is one of the most common reasons family visa applications get delayed in Abu Dhabi.

So take note: If you are sponsoring your spouse or children, you are required by law to arrange their health insurance before applying for or renewing their residence visas.

Dependent insurance policies must list each individual by name and remain active throughout the visa period. Many employers do not automatically include dependents in their employee insurance plans, so this should never be assumed!

What Type of Medical Insurance Is Accepted for an Abu Dhabi Visa?

Just like the requirements for visa renewal in Dubai, not every insurance policy qualifies for visa purposes in Abu Dhabi. The policy must meet specific standards and be approved by the local health authority.

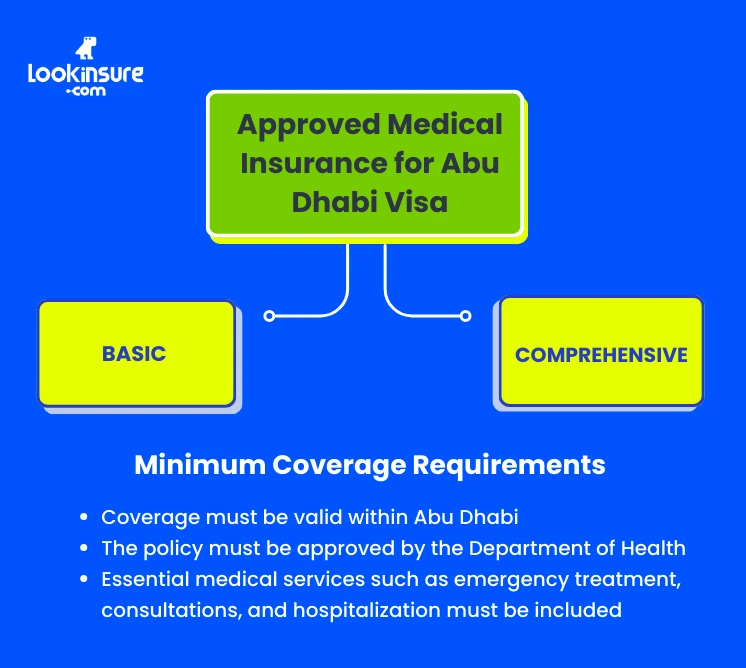

Basic vs Comprehensive Health Insurance Plans

Health insurance plans in Abu Dhabi generally fall into two categories: basic and comprehensive.

Basic plans are designed to meet minimum legal requirements. They usually cover essential medical services within Abu Dhabi and are commonly used to satisfy medical insurance for Abu Dhabi visa requirements. These plans often have limited hospital networks and lower coverage limits.

Comprehensive plans provide broader benefits, such as access to a wider network of hospitals, higher annual limits, and sometimes coverage outside Abu Dhabi. While not legally required, they are often chosen by families or individuals who want more flexibility in their healthcare options.

Basic coverage may be sufficient for visa approval, but it may not always be ideal for long-term healthcare needs.

Minimum Coverage Requirements

To be accepted for an Abu Dhabi residence visa, health insurance must meet the following criteria:

- Coverage must be valid within Abu Dhabi

- The policy must be approved by the Department of Health

- Essential medical services such as emergency treatment, consultations, and hospitalization must be included

NOTE: Policies that only cover other emirates or international travel insurance plans are generally not accepted for visa purposes.

Health Insurance During Job Change or Residence Visa Transfer

Changing jobs in Abu Dhabi can affect your health insurance as an expat, and this is an area where many residents face unexpected issues if they are not careful.

Coverage Gaps and Grace Periods

When an employment contract ends, employer-sponsored health insurance is usually cancelled shortly after the final working day. This can create a gap in coverage if a new policy is not arranged immediately.

While residents may have a grace period to transfer their visa or find new employment, being uninsured during this time can be risky. Insurance lapses can cause complications if a visa renewal or transfer is processed while coverage is inactive.

NOTE: Medical emergencies during uninsured periods can also result in significant personal expenses.

Insurance Continuity and Legal Compliance

Maintaining uninterrupted health insurance coverage is strongly recommended during job transitions. Some residents choose to short term health insurance until their new employer provides coverage.

From a legal standpoint, continuous insurance coverage helps ensure that visa transfers and renewals proceed without delays. Immigration authorities may request proof of active insurance at different stages of the process.

How to Buy Health Insurance for Abu Dhabi Residence Visa

Buying health insurance in Abu Dhabi is easy, but it helps to know what documents are required and what mistakes to avoid.

Required Documents

Most insurers will ask for the following documents when issuing a policy:

- Emirates ID or Emirates ID application receipt

- Residence visa copy

- Employer or sponsor details

For dependent policies, insurers may also request marriage or birth certificates to confirm the relationship.

Common Mistakes to Avoid

Some of the most common mistakes that cause visa delays include:

- Purchasing insurance policies that are not approved in Abu Dhabi: Many insurer short-term plans that are not registered with the Abu Dhabi Department of Health (DoH). When these policies are submitted, the visa system automatically flags them as non-compliant, and the application is put on hold until a valid Abu Dhabi–approved policy is uploaded.

- Assuming Dubai health insurance is valid for Abu Dhabi visas: Dubai and Abu Dhabi follow different health insurance rules, and a policy approved in Dubai may not be accepted for an Abu Dhabi visa.

- Overlooking hospital and clinic network limitations: Policies with limited medical networks or insufficient coverage may fail Abu Dhabi visa requirements even if they appear valid.

So keep that in mind; always confirm that the policy is DoH-compliant and suitable for your specific visa category before purchasing.

Conclusion

Health insurance is a core requirement for obtaining and renewing an Abu Dhabi residence visa. It is closely monitored and directly linked to immigration approvals. Misunderstanding insurance responsibilities can easily lead to delays or rejected applications.

By planning ahead, confirming who is responsible for coverage, and ensuring your policy meets Abu Dhabi regulations, you can stay compliant. When it comes to health insurance for Abu Dhabi residence visa applications, preparation makes all the difference.

Frequently Asked Questions

Is health insurance mandatory for obtaining or renewing an Abu Dhabi residence visa?

Yes. Valid health insurance is a legal requirement for both issuing and renewing an Abu Dhabi residence visa.

Can my residence visa application be rejected without valid health insurance?

Yes. Visa applications can be delayed or rejected if health insurance is missing, expired, or non-compliant.

Who is legally responsible for providing health insurance in Abu Dhabi?

Employers are responsible for insuring employees. Sponsors are responsible for arranging insurance for dependents.

What happens to my health insurance if I change jobs in Abu Dhabi?

Employer-sponsored insurance usually ends when employment ends. You may need temporary coverage until your new employer provides insurance.

Can a Dubai health insurance policy be used for an Abu Dhabi residence visa?

In most cases, no. Abu Dhabi has a separate regulatory system, and Dubai-only policies are usually not accepted.

Is medical insurance required for dependents under an Abu Dhabi residence visa?

Yes. Each dependent must have active, compliant health insurance before their visa can be issued or renewed.