As an expat, living in the UAE without a job can be a risk when it comes to medical costs. Maybe you’ve recently left a role, you’re between contracts, you’re freelancing, or you’ve moved to the country on a family-sponsored visa. Whatever the reason, one question usually comes up pretty quickly: what happens to health insurance for expats currently unemployed in the UAE?

Health insurance in UAE is not a luxury but a legal requirement for residents, and it plays a big role in everything from hospital access to visa renewals. The good news is that being unemployed does not automatically mean you are left without options. There are several legal and practical ways for freelancers and self-employed residents to get health insurance without employment UAE.

Too Long; Didn’t Read (TL;DR)

In this guide, we break down what your choices look like, how much they usually cost, and what you should pay attention to so you don’t end up uninsured, fined, or stuck paying medical bills out of pocket. In a glance:

- Health insurance is still mandatory in the UAE even if you do not currently have a job.

- You can legally get covered through private insurance plans designed for residents without employment.

- In some cases, a spouse or family member can sponsor your health insurance under their policy.

- Government or subsidized options exist, but they usually offer limited coverage and access.

- Planning ahead helps you avoid fines, visa issues, and unexpected medical bills while unemployed.

Is Health Insurance Mandatory Without Employment in the UAE?

Yes, health insurance is mandatory for UAE residents, even if you are currently unemployed. This rule applies whether you are:

Legal Requirements for Residents

Health insurance in the UAE is linked to your residency status, not strictly to your employment contract. Once you hold a valid residence visa, you are expected to have active coverage. This is why many people look into health insurance without employment UAE as soon as their job ends.

DHA Health Insurance Requirements are quite clear about the status. While employers are usually responsible for insuring their staff, the responsibility shifts to the individual when there is no employer involved.

Penalties for Non-Coverage

Staying uninsured in the UAE can cause more trouble than most people expect. Some of the common no health insurance fines include:

- Monthly fines for not having valid health insurance

- Limited or denied access to public hospitals

- Delays or issues when renewing or changing your visa

- High out-of-pocket costs in case of a medical emergency

Even a short gap in coverage can create problems later on. This is why sorting out health insurance without job UAE sooner rather than later is strongly recommended.

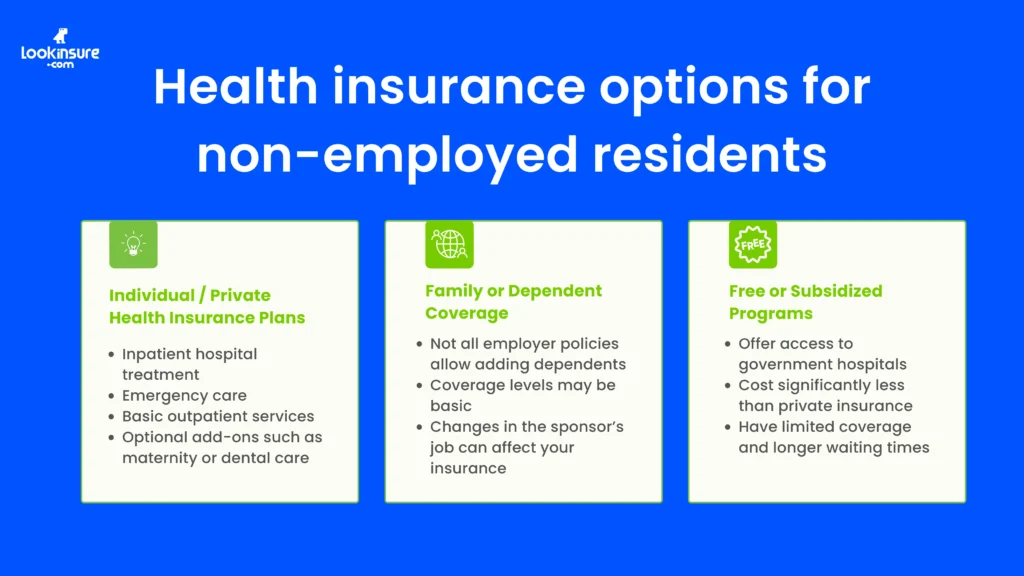

Options for Health Insurance Without a Job

Thankfully, being unemployed does not leave you without options. There are several legal paths to health insurance without job UAE, ranging from private plans you pay for yourself to family-sponsored or partially subsidized alternatives. Each option comes with its own costs, limits, and level of flexibility, which is why understanding the differences really matters.

Individual / Private Health Insurance Plans

Private insurance is the most common route for people looking for medical insurance without job UAE. Top health insurance companies in Abu Dhabi and Dubai offer individual plans specifically designed for residents who are not employed.

These plans usually include:

- Inpatient hospital treatment

- Emergency care

- Basic outpatient services

- Optional add-ons such as maternity or dental care

Here is a simple overview of what private plans often look like:

| Feature | What to Expect |

| Annual cost | Higher than employer plans |

| Coverage | Varies by plan level |

| Payment | Usually paid upfront |

| Flexibility | Can be adjusted to budget |

Private plans give you control, but they do require careful comparison. This option is very popular among freelancers and job seekers needing health insurance without employment UAE.

Family or Dependent Coverage

If your spouse or parent is employed and sponsoring your visa, they may also be able to sponsor your health insurance. This can sometimes be simpler and cheaper than buying a standalone plan.

Things to keep in mind:

- Not all employer policies allow adding dependents

- Coverage levels may be basic

- Changes in the sponsor’s job can affect your insurance

This option works well for families but still requires checking the policy details carefully. It is another common path to health insurance without job UAE, especially for spouses.

Free or Subsidized Programs

In some cases, residents can apply for government-backed or subsidized healthcare options. A well-known example is the Dubai Health Card.

These programs usually:

- Offer access to government hospitals

- Cost significantly less than private insurance

- Have limited coverage and longer waiting times

Eligibility depends on factors like residency status and emirate. While these programs do not fully replace private medical insurance without job UAE, they can help reduce basic healthcare costs.

What to Check Before Buying Insurance Without Employment

When you are paying out of pocket, every detail matters, and small clauses can end up costing you a lot later on. Before committing to any plan, it is important to understand what you are actually getting, especially when looking for health insurance without job UAE or medical insurance without job UAE.

Coverage Details

Before signing anything, take a close look at what the policy actually covers. Important points include:

- Hospital network (private vs government)

- Outpatient visits and medications

- Emergency treatment

- Specialist consultations

Some cheaper plans only cover hospital stays, which may not be ideal if you need regular doctor visits. This step is essential when choosing health insurance without employment UAE.

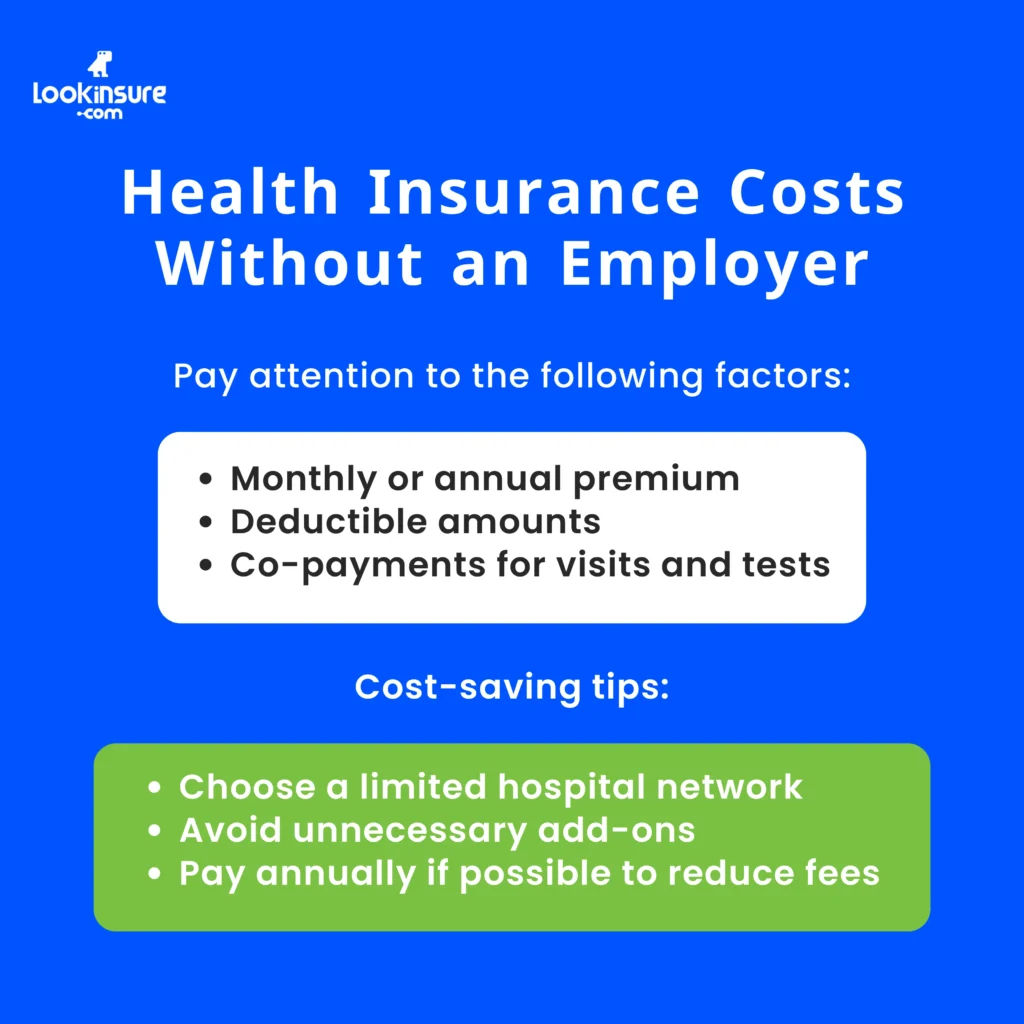

Premiums and Deductibles

Insurance without an employer often costs more, simply because there is no company sharing the expense. You should pay attention to how much health insurance costs in UAE based on:

- Monthly or annual premium

- Deductible amounts

- Co-payments for visits and tests

Cost-saving tips:

- Choose a limited hospital network

- Avoid unnecessary add-ons

- Pay annually if possible to reduce fees

These small decisions can make health insurance without job UAE more manageable financially.

Exclusions and Pre-approval Requirements

Most policies come with exclusions, and it is better to know them upfront than be surprised later. Common exclusions include:

- Certain pre-existing conditions

- Cosmetic procedures

- Alternative therapies

Some treatments also require prior approval from the insurer. Understanding these rules is a key part of selecting medical insurance without job UAE that actually works for you.

Steps to Apply for Health Insurance Without a Job

Applying for health insurance without employment UAE is usually easy, but timing and preparation matter more than people expect. Missing documents, poor plan comparisons, or delayed applications can leave you uninsured for weeks.

Required Documents

While requirements vary by insurer, you will usually need:

- Emirates ID

- Valid residence visa

- Passport copy

- Proof of address

Some insurers may also ask for bank statements or proof of freelance income. Having documents ready speeds up the process of getting health insurance without employment UAE.

Comparing Plans

When comparing options, it helps to line them up side by side:

| Option | Best For | Main Limitation |

| Private insurance | Flexibility | Higher cost |

| Family-sponsored | Dependents | Limited control |

| Government programs | Basic care | Limited coverage |

Taking time to compare is one of the smartest ways to secure health insurance without job UAE that fits your situation. Lookinusre allows you to access quotes from multiple providers all at once, making cost comparison easier than ever.

Avoiding Coverage Gaps

One of the most common mistakes people make is waiting too long to apply. Coverage gaps can lead to:

- Fines

- Higher premiums later

- Problems with visa renewal

Try to arrange your medical insurance without job UAE before your previous policy expires. Continuous coverage makes future applications much smoother.

Conclusion

Yes, it is absolutely possible to get health insurance without having a job in the UAE. While employer-sponsored plans are common, they are not the only option. Private insurance, family sponsorship, and government programs all offer legal ways to stay covered.

Planning ahead is the key. By understanding your options and acting early, you can avoid gaps in coverage, unnecessary penalties, and unexpected medical bills. Whether you are freelancing, job hunting, or between roles, securing health insurance without employment UAE should be a top priority.

With the right approach, finding health insurance without job UAE or medical insurance without job UAE can be straightforward and stress-free.

Frequently Answered Questions

1. Can I get health insurance in the UAE without having a job?

Yes, you can. Having a job is not a requirement to get insured in the UAE. As long as you hold a valid residence visa, you are legally expected to have coverage. Many insurers offer health insurance without employment UAE, including individual plans specifically designed for unemployed residents, freelancers, and people between jobs.

2. Are there government programs for unemployed residents to get medical coverage?

There are limited government or subsidized healthcare options available in some emirates. For example, Dubai residents can apply for a health card that allows access to public hospitals at reduced rates. However, these options do not fully replace private medical insurance without job UAE, as they often come with restricted services, longer waiting times, and limited hospital choices.

3. Can my spouse or family member sponsor my health insurance if I don’t work?

In many cases, yes. If your spouse or parent sponsors your residence visa, they may also be able to include you under their insurance policy. This is a common solution for residents looking for health insurance without job UAE, especially spouses who are not currently employed.

4. How much does private health insurance cost for unemployed residents in the UAE?

Costs vary widely depending on age, coverage level, and insurer. Private plans are usually more expensive than employer-sponsored ones.

5. Are pre-existing conditions covered when applying without employment?

Some medical insurance without job UAE plans exclude them entirely, while others cover them after a waiting period or at an additional cost. Insurers usually require full medical disclosure during the application process, so it is important to be honest. Reviewing this section carefully can help you avoid claim rejections later.

6. What happens if I remain uninsured while unemployed in the UAE?

You may face fines, limited access to healthcare, and issues with visa renewals. Staying insured is strongly advised.