Across all Emirates, holding valid health insurance is a legal requirement. When this obligation is ignored or delayed, health insurance fines in UAE come into play. These penalties are not symbolic. They can affect your finances, your visa status, and even your ability to access healthcare services.

This article explains how fines work within the UAE health insurance system, who can be fined, how much penalties can reach in different Emirates, and what practical steps you can take to stay compliant and avoid unnecessary costs.

Too Long; Didn’t Read (TL;DR)

- Health insurance is required in the UAE. If your policy is missing, expired, or not valid, you can face fines linked to your visa.

- Fines may apply to employers or individuals, depending on who is responsible for the coverage.

- Penalties differ by emirate. Some charge monthly fines for each uninsured person, while others apply fines during visa renewal or cancellation.

- Not having insurance can also lead to visa delays, rejections, and limited access to medical care.

- Most fines can be avoided by keeping insurance active, checking expiry dates, and arranging coverage quickly when changing jobs or visas.

How Health Insurance Fines Work in the UAE

Health insurance enforcement in the UAE is handled at the emirate level, but the principle is the same everywhere: no valid insurance means non-compliance.

Legal Basis for Fines

UAE health insurance laws require residents to be covered at all times. Each emirate has its own regulator and enforcement system. Abu Dhabi follows rules set by the Department of Health (DoH), while Dubai operates under the Dubai Health Authority (DHA) and related insurance bodies. Other Emirates apply similar requirements through local authorities.

Despite these differences, the outcome is the same. If insurance is missing, expired, or does not meet minimum requirements, authorities can impose a UAE health insurance fine. These fines are often linked to immigration systems, which means issues surface quickly during visa issuance or renewal.

Who Can Be Fined?

Both employers and individuals can face penalties, depending on who is responsible for providing coverage.

- Employers can be fined if they fail to arrange valid health insurance for their employees, as required by law. This includes situations where insurance is delayed, cancelled prematurely, or does not meet minimum standards.

- Residents can also be fined if they remain uninsured, especially in cases where they are responsible for their own coverage, such as sponsors of dependents or individuals between jobs. In these cases, the fine for no health insurance UAE is applied directly to the individual.

Fine Amounts and Penalties

The financial impact of non-compliance varies depending on the emirate and how long the violation lasts.

Penalty Range by Emirate

In Abu Dhabi, fines are typically calculated on a monthly basis for each uninsured individual. This means the longer the gap in coverage, the higher the penalty. Employers and sponsors can accumulate significant fines if multiple employees or dependents are uninsured.

In Dubai, penalties are often applied as fixed fines, especially during visa renewal or cancellation processes. While the structure differs, the intent is the same: to enforce continuous insurance coverage.

Other Emirates follow similar models, either applying monthly penalties or fixed fines at specific stages of immigration processing. In many cases, fines are recurring rather than one-time, which makes delays particularly costly.

Additional Consequences

Financial penalties are only part of the problem. Lack of valid insurance can also lead to:

- Visa renewal delays or outright rejection for expats without health insurance in UAE

- Inability to complete visa transfers or sponsorship changes

- Restricted access to government hospitals and services

Here’s a fine table in different emirates in dubai:

| Emirate | Fine Structure | Typical Fine Amount | When Applied | Add-Ons & Extra Penalties |

| Abu Dhabi | Monthly fine per uninsured person | AED 300 per month per individual | Accumulates monthly until insurance is activated | Backdated fines for full uninsured periodMultiple fines if several dependents/employees are uninsuredVisa renewal blocked until fines are paid |

| Dubai | Fixed or monthly fine linked to visa status | AED 500 per month (commonly enforced) | Applied during visa renewal, cancellation, or transfer | Lump-sum fine covering all uninsured monthsVisa processing suspended until settlement Employer penalties if employee insurance lapses |

| Sharjah | Monthly or visa-stage fine | Around AED 300 per month | During visa issuance or renewal | Accumulated penalties for long coverage gapsDelays in residency-related services |

| Ajman | Monthly or fixed fine | Around AED 300 per month | Immigration processing stage | Retroactive fines possibleDependent sponsorship may be frozen |

| Ras Al Khaimah | Monthly or fixed fine | Around AED 300 per month | Visa renewal or issuance | Fines applied per uninsured dependent Administrative holds on visa transactions |

| Fujairah | Monthly or fixed fine | Around AED 300 per month | Visa-related procedures | Accumulating fines if insurance remains inactiveRestricted access to government healthcare |

| Umm Al Quwain | Monthly or fixed fine | Around AED 300 per month | Residency processing | Backdated fines for insurance gapsVisa services blocked until compliance |

How to Avoid Health Insurance Fines

Avoiding penalties is usually easy and predictable, as long as responsibilities are clear and timelines are respected.

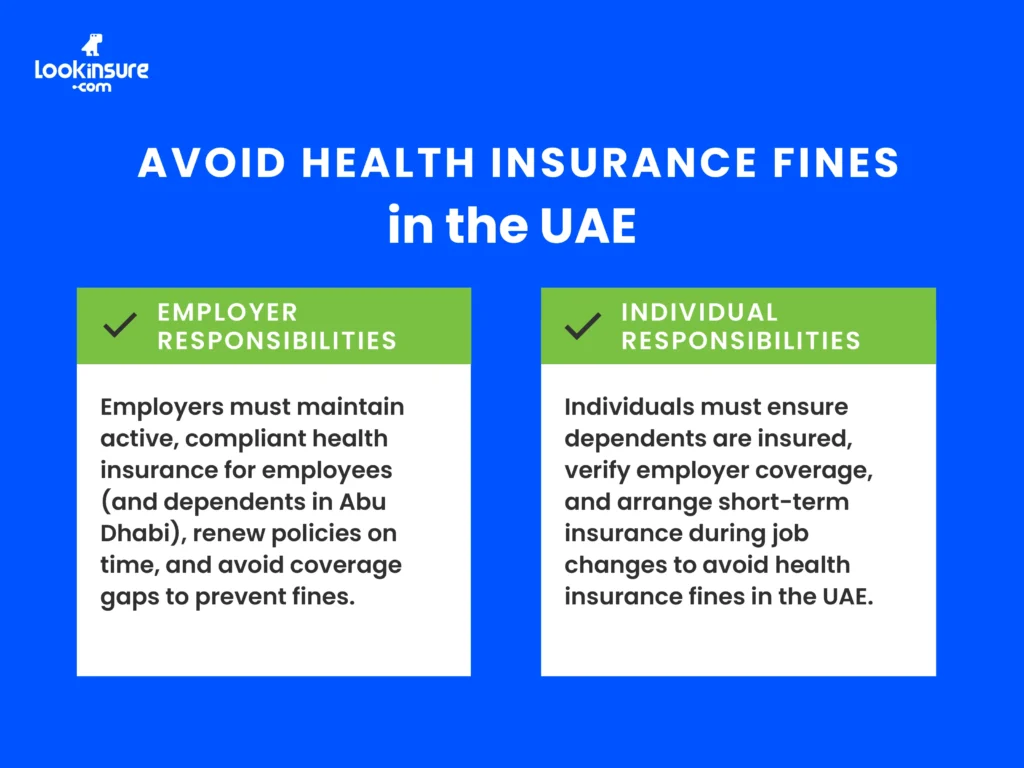

Employer Responsibilities

Employers are legally required to provide health insurance for their employees. This coverage must be active, compliant, and maintained throughout the employment period.

Employers should also monitor policy expiry dates and ensure renewals are processed on time. If coverage lapses even briefly, fines can apply. In some cases, employers assume employees will arrange their own insurance, which is a common and costly mistake.

Important NOTE: In Abu Dhabi, employers should cover both employees and their dependents, whereas in Dubai coverage is required only for employees.

Individual Responsibilities

Individuals also have a role to play. Sponsors must arrange insurance for their dependents, including spouses and children. Employees should confirm that their employer-provided insurance is active and valid.

For those changing jobs, insurance often ends when employment ends. During this transition, arranging short term health insurance is essential. Checking policy status regularly is one of the simplest ways to avoid a fine for no health insurance UAE.

Steps to Resolve or Appeal a Fine

If a fine has already been applied, there are still steps you can take to resolve the situation.

Contacting the Insurer or Authority

The first step is to confirm the reason for the fine. This usually involves checking immigration portals or contacting the relevant health authority. In some cases, fines are triggered by administrative delays or system mismatches rather than actual lack of coverage.

Your insurer can also help verify policy dates and provide documentation if coverage was active but not properly recorded.

Corrective Measures

If the fine is valid, resolving it usually requires purchasing or reinstating health insurance immediately. Some authorities allow retroactive coverage in limited cases, though this depends on the emirate and insurer.

Once insurance is active, fines typically need to be paid before immigration processes can continue. Keeping records updated and ensuring all systems reflect the correct insurance status helps prevent future issues.

Conclusion

Health insurance compliance in the UAE is closely monitored, and penalties are enforced consistently. Health insurance fines in UAE are designed to ensure that residents and employees remain covered at all times, not to create unnecessary hardship.

The good news is that most fines are avoidable. By knowing who is responsible for coverage, keeping policies active, and checking insurance status regularly, residents and employers can stay compliant. A little planning goes a long way when it comes to avoiding fines, visa issues, and last-minute stress.

Frequently Asked Questions

1. How much is the fine for not having health insurance in UAE?

The amount depends on the emirate and how long the person remains uninsured. In some Emirates, fines are calculated monthly per uninsured individual, while in others they are applied as fixed penalties during visa processing.

2. Can employers be fined if they fail to provide insurance to employees?

Yes. Employers are legally responsible for insuring their employees. If they fail to provide valid coverage, they can face fines and administrative penalties.

3. Do fines differ between Abu Dhabi, Dubai, and other Emirates?

Yes. Each emirate has its own enforcement structure and fine calculation method, though the obligation to have insurance applies nationwide.

4. Is there a grace period before health insurance fines are applied?

Grace periods are limited and not guaranteed. In many cases, fines start accumulating as soon as coverage lapses, especially during visa-related processes.

5. Can I appeal a health insurance fine if I already purchased coverage?

In some situations, yes. If you can prove coverage was active or there was an administrative error, authorities may review the case. Outcomes depend on the emirate and circumstances.

6. How can residents ensure they are compliant and avoid fines in the UAE?

Residents should confirm who is responsible for their insurance, track policy expiry dates, and arrange coverage promptly during job or visa changes. Regular checks help prevent a UAE health insurance fine before it happens.