BUPA Global, available in the UAE through Sukoon, offers premium international medical coverage designed for individuals, families, and professionals who want dependable, high-quality healthcare. BUPA health insurance features and benefits includes inpatient and outpatient treatment, maternity care, mental health support, and access to a worldwide medical network, all backed by annual coverage limits reaching up to USD 3 million.

Combined with Blua digital health services and direct specialist access, health insurance by BUPA provides a balanced mix of financial security, medical flexibility, and everyday convenience. In the following guide, we take a closer look at the main features, available plans, and how to get BUPA health insurance in the UAE.

TL;DR: Too Long, Didn’t Read

- Wide medical coverage including inpatient, outpatient, maternity, and mental health care

- High annual limits of up to USD 3 million for strong financial protection

- Global hospital network with direct access to specialists

- Blua digital health services for virtual consultations and wellness support

- Flexible health plans provided by BUPA insurance for individuals, families, and professionals

Key Features & Benefits

The BUPA health insurance features & benefits are structured around everyone’s main concerns, long-term health needs, family considerations, financial planning, and lifestyle expectations. Through health insurance by BUPA, policyholders in the UAE gain access to reliable healthcare locally, along with international medical support that extends well beyond national borders.

1. Comprehensive Coverage

BUPA health insurance focuses on complete medical protection that covers routine healthcare and serious medical conditions. This means policyholders do not need to juggle multiple policies or worry about major gaps in coverage.

| Coverage Area | What’s Included | Why It Matters |

| Inpatient Care | Hospital stays, surgeries, intensive care, accommodation | Covers high-cost treatments and major medical events |

| Day-Patient Treatment | Diagnostic procedures, short surgeries, therapies | Allows fast treatment without overnight stays |

| Outpatient Services | GP visits, specialist consultations, lab tests, medication | Supports everyday healthcare needs |

| Chronic Conditions | Diabetes, asthma, hypertension, arthritis care | Ensures continuity for long-term illnesses |

| Cancer Treatment | Chemotherapy, radiotherapy, immunotherapy | Covers advanced and life-saving treatments |

| Rehabilitation | Physiotherapy, post-surgical therapy | Speeds recovery and restores mobility |

This wide coverage structure ensures continuity of care, allowing individuals and families to manage short-term health insurance concerns and long-term medical conditions with confidence.

2. High Coverage Limits

Healthcare costs in private hospitals can rise quickly, especially when specialized procedures, extended treatment plans, or international care are required. One of the most valued BUPA health insurance features & benefits is its generous annual coverage limits.

| Plan Name | Annual Coverage Limit (USD) | Annual Coverage Limit (GBP) | Annual Coverage Limit (EUR) | Best Suited For |

| Select | 1,000,000 | 600,000 | 750,000 | Individuals seeking reliable everyday coverage with strong hospital protection |

| Premier | 1,500,000 | 900,000 | 1,125,000 | Families and professionals wanting broader outpatient, mental health, and dental benefits |

| Elite | 2,000,000 | 1,200,000 | 1,500,000 | Frequent travelers and expatriates requiring extended international healthcare access |

| Ultimate Global Health | 3,000,000 | 1,800,000 | 2,250,000 | Individuals seeking premium, all-inclusive international healthcare coverage |

These high limits play a reassuring role in protecting policyholders from financial strain, especially in emergency situations. Whether treatment is required in the UAE or abroad, health insurance by BUPA ensures that care decisions are guided by medical necessity rather than cost concerns.

3. Blua Digital Health Services

Blua is one of the highlights of the BUPA health insurance features & benefits. Through Blua, BUPA’s digital health platform, policyholders can access medical support anytime and from virtually anywhere.

Key services include:

- Virtual consultations with qualified doctors around the world

- Mental wellness guidance and emotional health support

- Easy appointment booking with clinics and specialists

- Secure digital access to medical records

For professionals with demanding schedules, families managing busy routines, or frequent travelers, Blua offers a level of flexibility that simplifies healthcare without compromising quality.

4. Maternity & Family Benefits

Family health insurance is a central focus of the health plans provided by BUPA insurance. Maternity coverage is especially comprehensive, supporting families throughout pregnancy, childbirth, and postnatal recovery.

Family-focused benefits include:

| Benefit | Coverage Details | Practical Value |

| Prenatal Care | Doctor visits, scans, lab tests | Supports healthy pregnancy monitoring |

| Delivery & Hospital Stay | Normal and caesarean birth coverage | Reduces childbirth financial burden |

| Postnatal Care | Follow-ups and recovery support (up to 18 months) | Ensures mother and baby wellbeing |

| Child Coverage | Up to two children under 16 at no extra cost | Major savings for families |

| Newborn Care | Early-stage pediatric support | Healthy development from birth |

These benefits significantly reduce the financial burden associated with family healthcare and allow parents to focus fully on their growing families, rather than worrying about medical expenses.

5. Dental & Optical Coverage

Oral health and vision care are not overlooked in BUPA health insurance features & benefits. BUPA plans include dental and optical benefits that encourage preventive care and long-term health maintenance.

Health plans provided by bupa insurance typically cover:

- Routine dental check-ups and cleanings

- Dental treatments such as fillings, extractions, and implants

- Eye examinations and diagnostic testing

- Corrective eyewear

By supporting preventive care, these benefits help reduce the likelihood of complex treatments later while promoting daily comfort and confidence.

6. Direct Access to Specialists

A major advantage of health insurance by BUPA is the ability to consult specialists directly, without needing a referral from a general practitioner.

This allows for:

- Faster diagnosis

- Shorter waiting times

- Easier access to expert medical opinions

For individuals managing chronic conditions or seeking advanced medical advice, this direct access simplifies the healthcare journey and removes unnecessary delays.

7. Specialized Care Options

Beyond conventional treatment, BUPA also supports a wide range of specialized healthcare services, including:

- Alternative medicine

- Preventive vaccination programs

- Structured rehabilitation plans

This holistic approach allows policyholders to explore treatment paths that suit their medical needs, personal preferences, and recovery goals.

BUPA Health Insurance Plan Options

BUPA health insurance features & benefits are designed to accommodate a wide range of medical needs, budgets, and lifestyles. Whether someone is looking for dependable everyday coverage or comprehensive global protection, there is a plan to match.

| Feature | Select | Premier | Elite | Ultimate |

| Inpatient Care | ✔ | ✔ | ✔ | ✔ |

| Outpatient Care | ✔ | ✔ | ✔ | ✔ |

| Mental Health | — | ✔ | ✔ | ✔ |

| Dental & Optical | — | ✔ | ✔ | ✔ |

| Global Coverage | Limited | Moderate | Extensive | Worldwide Premium |

| Maternity Benefits | Optional | ✔ | ✔ | ✔ |

| Annual Limit | Up to $1M | Up to $1.5M | Up to $2M | Up to $3M |

1. Select Plan

The Select Plan focuses on essential healthcare coverage, making it suitable for individuals who want dependable protection for everyday medical needs.

Key benefits include:

- Inpatient and outpatient care

- Preventive health screenings

- Basic wellness services

This plan offers solid protection while remaining accessible and practical.

2. Premier Plan

The Premier Plan builds upon the Select Plan by offering enhanced benefits that support physical and emotional wellbeing.

It includes:

- Extended outpatient services

- Mental health treatment

- Routine dental and optical care

This makes it a strong option for families and professionals seeking broader protection.

3. Elite Plan

The Elite Plan offers extensive global coverage, making it one of the best options of health insurance for expats and frequent travelers.

Key advantages include:

- Broad international hospital network

- Access to advanced therapies

- Family-focused benefits

This plan delivers flexibility, reassurance, and strong international medical support.

4. Ultimate Plan

The Ultimate Plan represents the highest level of protection within BUPA health insurance.

Its premium features include:

- Maximum annual coverage limits

- Private hospital accommodation

- Specialized genetic cancer screening

For individuals seeking the highest standard of global healthcare, this plan provides complete peace of mind.

Additional Benefits

Beyond medical treatment, health insurance by BUPA includes a range of valuable health insurance add-ons that enhance patient support and safety.

Emergency Assistance

Policyholders benefit from worldwide emergency services, including:

- Medical evacuation

- Emergency repatriation

These services ensure rapid access to suitable medical facilities during critical situations, regardless of location.

Second Medical Opinion

Complex diagnoses often raise difficult questions. Through second medical opinion services, policyholders can consult independent specialists to confirm diagnoses and treatment plans, providing reassurance and clarity during major health decisions.

Chronic Conditions Coverage

Managing long-term illnesses requires consistent medical care. BUPA health insurance features & benefits provide ongoing treatment support and structured follow-up for chronic conditions, ensuring continuity and stability for patients over time.

How to Get BUPA Health Insurance?

Getting BUPA health insurance in the UAE is straightforward, especially when applying through Lookinsure. The process is designed to be simple, efficient, and user-friendly.

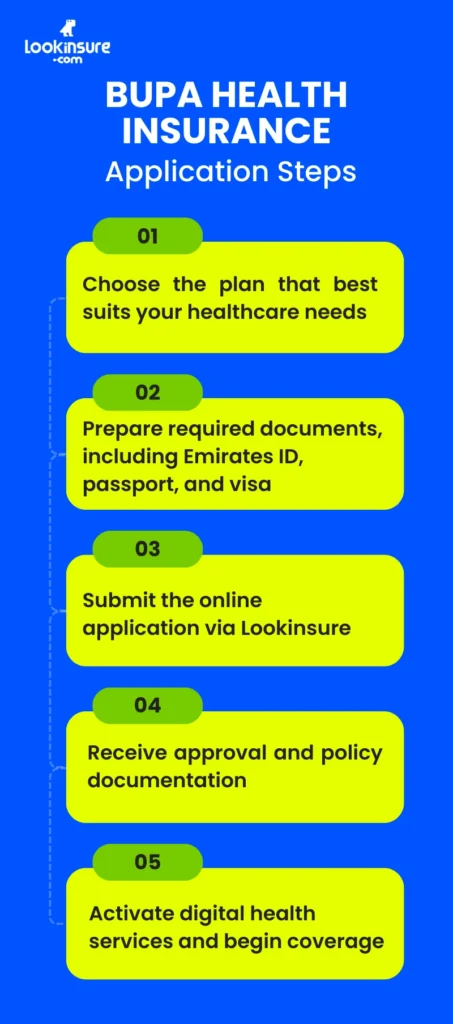

Application Steps

- Choose the plan that best suits your healthcare needs

- Prepare required documents, including Emirates ID, passport, and visa

- Submit the online application via Lookinsure

- Receive approval and policy documentation

- Activate digital health services and begin coverage

Choosing the Right Plan

Figured out how to get BUPA health insurance? Before you finalize your purchase, consider:

- Family size and future planning

- Travel frequency

- Maternity considerations

- Long-term healthcare expectations

These factors allow applicants to choose health plans provided by BUPA insurance that genuinely align with their lifestyle.

Conclusion

The wide-ranging BUPA health insurance features & benefits reflect a thoughtful approach to modern healthcare. With comprehensive medical coverage, high annual limits, family and maternity benefits, digital health services, and worldwide hospital access, health insurance by BUPA offers dependable protection for individuals and families living in the UAE.

Whether you are seeking everyday medical support, international healthcare access, or long-term health security, the health plans provided by BUPA insurance deliver flexible, reliable solutions. Exploring your options through Sukoon and understanding how to get BUPA health insurance allows you to make a confident, informed decision that supports present wellbeing and future peace of mind.

Frequently Answered Questions

1. What is BUPA health insurance and what does it cover?

BUPA health insurance offers comprehensive medical coverage, including inpatient and outpatient care, maternity services, mental health treatment, chronic disease management, and emergency assistance.

2. How can I apply for BUPA health insurance in the UAE?

You can apply online through Lookinsure by selecting a suitable plan, submitting your documents, and completing the digital application process.

3. What are the differences between Select, Premier, Elite, and Ultimate plans?

Each plan offers increasing levels of coverage, from essential medical protection to fully comprehensive international healthcare with premium benefits.

4. Does BUPA cover maternity and postnatal care?

Yes, maternity and postnatal care are included for up to 18 months, along with coverage for children under 16.

5. Can I access specialists directly without a GP referral?

Yes, health insurance by BUPA allows direct access to specialists without referral requirements.

6. Are dental, optical, and chronic conditions included?

Yes, depending on the plan selected, coverage includes dental care, optical services, and chronic condition management.