If you have been searching for health insurance in the UAE, you have almost certainly come across the name of Sukoon. Formerly known as Oman Insurance, this company has been operating for nearly 50 years and has built a strong reputation among both individuals and employers.

But here is the thing: knowing a name is one thing and what actually makes the features and benefits of Sukoon health insurance is another matter.

This guide walks you through the actual coverage details, the different health plans, what is included, what is not, and exactly how to get Sukoon health insurance.

Too Long; Didn’t Read (TL;DR)

- Sukoon is a major UAE health insurer, formerly Oman Insurance, serving over 1.36 million members.

- Plans range from basic DHA-compliant coverage (AED 150k) to unlimited worldwide coverage with Bupa Global.

- Benefits include inpatient and outpatient care, maternity, direct billing at thousands of network hospitals, dental, optical, wellness, and mental health support.

- Pre-existing conditions are covered up to AED 150k, claims settle in 7–10 days, and coverage goes up to age 95.

Overview of Sukoon Health Insurance

The company began as Oman Insurance Company in 1975 and rebranded to Sukoon in 2024. Today, they serve over 1.36 million insured members and process roughly 2 billion dirhams in claims every single year.

Sukoon is fully regulated by the Central Bank of the UAE and complies with all major health authority requirements, including DHA in Dubai and HAAD/DoH in Abu Dhabi. Whether you are looking for personal coverage, family health insurance, or group medical insurance for your company, Sukoon Insurance has a policy for each category.

Key Features and Benefits of Sukoon Health Insurance

Let us get straight to what you actually should know about this company. Here are the real features and benefits of health insurance by Sukoon.

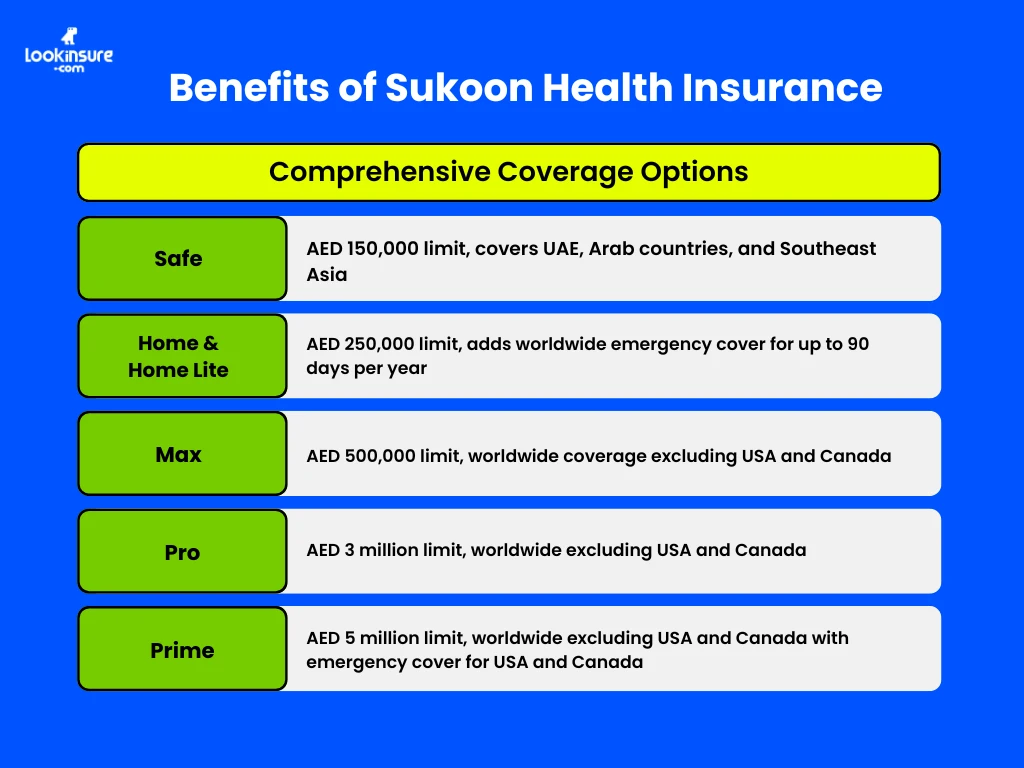

Comprehensive Coverage Options

Suckoon health insurance in the UAE is structured across several tiers. For domestic coverage within the UAE, popular options include Safe, Home, Home Lite, Max, Pro, and Prime. Each plan steps up in annual limits and geographic reach:

- Safe: AED 150,000 limit, covers UAE, Arab countries, and Southeast Asia

- Home & Home Lite: AED 250,000 limit, adds worldwide emergency cover for up to 90 days per year

- Max: AED 500,000 limit, worldwide coverage excluding USA and Canada

- Pro: AED 3 million limit, worldwide excluding USA and Canada

- Prime: AED 5 million limit, worldwide excluding USA and Canada with emergency cover for USA and Canada

For those looking for international coverage, Sukoon partners with Bupa Global to offer four premium plans which range from regional Middle East coverage up to unlimited worldwide coverage including the United States.

Inpatient and Outpatient Coverage

All health plans provided by Sukoon insurance include both inpatient and outpatient benefits.

- Inpatient covers hospital stays, surgeries, operating room costs, medicines administered during admission, and surgical dressings.

- Outpatient covers doctor consultations, diagnostic tests like lab work and X-rays, and prescribed medications.

Higher-tier plans like Pro and Prime offer more generous outpatient limits and lower co-payments. For essential plans like the DHA-compliant EBP, outpatient visits involve a 20% co-pay, which is standard across the industry.

Maternity Benefits

If you are planning a family, maternity coverage matters. This feature includes antenatal care, delivery (both normal and C-section), and postnatal care. The Pro plan, for instance, provides maternity coverage up to AED 20,000.

NOTE: For international plans through Bupa Global, maternity is covered outside the UAE once you have held the policy for 10 months.

Network Access and Direct Billing

One of the strongest advantages of health insurance by Sukoon is their provider network. They have over 14 different hospital networks including Premium, Edge, Signature + Medcare, Signature, Advance, and Vital.

This means you can choose from thousands of hospitals, clinics, and pharmacies across the UAE where you can walk in, show your card, and receive treatment without paying upfront.

Direct billing is also available at all network facilities. The hospital bills Sukoon directly, and you only pay any applicable co-payment or deductible. For international plans, Bupa Global handles direct billing outside the UAE through their worldwide network of over 2 million providers.

Additional Health Benefits

Beyond the basics, the health plans provided by Sukoon insurance include several valuable extras:

- Dental and optical coverage: Available on select plans like Premier, Elite, and Ultimate after six months, covering check-ups, fillings, extractions, and prescribed spectacles or contact lenses

- Vaccinations: Childhood immunizations, flu shots, travel vaccines, and HPV vaccination are covered on most comprehensive plans

- Wellness and preventive care: Annual health screenings are included with limits ranging from USD 420 on Select to USD 8,500 on Ultimate

- 24/7 virtual care: Through partnerships like TruDoc and myAster app, members can access GP consultations online with 0% co-pay on certain plans

- Mental health support: Inpatient and day-patient mental health treatment is covered by health insurance for psychological disorders with the same limits as physical health conditions.

Flexible Plan Options

You are not locked into a rigid box. Sukoon health insurance allows customization through:

- Room type choices: Shared versus private room accommodation

- Coinsurance options: Ranging from 0% to 20% depending on plan and provider network

- Add-on covers: Dental, optical, alternative medicine, and enhanced maternity can be added where not already included

Health Plans Provided by Sukoon Insurance

Knowing different health plans provided by Sukoon insurance helps you to choose suitable coverage based on your needs.

Essential Benefit Plan (EBP – Dubai)

If you are a low-income earner earning AED 4,000 or less, or if you are covering domestic help, the DHA Essential Benefits Plan is your legal starting point. It is starting from AED 560 per year through the ISAHD program.

The plan provides AED 150,000 annual limit, covers inpatient and outpatient care, maternity, emergencies, and includes direct billing at over 500 hospitals and 1,400 pharmacies. There is a 20% co-pay for most services and a six-month waiting period for maternity, unless you were previously insured.

Health Extend Plans (UAE / SEA)

For those wanting more than bare-minimum coverage, the Health Extend plans (Safe, Home, and Home Lite) extend your geographic reach to Arab countries and Southeast Asia. These health plans are ideal if you travel regionally for work or have family in nearby countries.

Premium Global Plans (with Bupa Global)

The Sukoon/ Bupa Global partnership delivers four internationally recognized plans:

- Select: Regional Middle East coverage, £1M limit, essential inpatient and outpatient, basic wellness

- Premier: Worldwide excluding US, £1M limit, adds dental and children’s vaccinations after six months

- Elite: Worldwide including US, £3M limit, covers two children under 10 per parent at no extra cost, extensive maternity, dental, optical, nursing

- Ultimate: Unlimited worldwide coverage, premium benefits including suite accommodation, genetic cancer screening, non-medical evacuation, unlimited scans and specialist visits

All these plans are DHA-compliant and accepted for UAE visa applications.

How to Get Sukoon Health Insurance?

Getting yourself covered is easier than you might think. Here is how it works.

Steps to apply:

- Submit your basic details: age, nationality, visa status, and any pre-existing conditions

- Compare quotes and plan features side by side, using Lookinsure. Instead of visiting multiple websites or calling around, you can compare health plans provided by Sukoon insurance side by side on Lookinsure.

- Select the plan that fits your needs and budget

- Finalize and buy health insurance with payment.

- Receive your policy documents and eCard via email instantly or within 24 hours

Why Choose Sukoon Health Insurance?

There is a reason Sukoon health insurance has won multiple awards including UAE’s Best Health and Life Insurer, UAE Insurer of the Year, and Most Customer-Centric Insurance Company in 2024.

- 50 years in the UAE market reflects stability you can trust.

- Fully compliant with DHA, HAAD/DoH, and Central Bank standards.

- From budget EBP to unlimited global coverage, the health plans provided by Sukoon insurance cover every salary bracket.

- Customers report reimbursement within 7–10 days, sometimes same-day approval for straightforward cases.

- The mySukoon app lets you generate eCards, find network doctors, submit claims, and track progress without visiting a branch.

Important Notes Before Buying

No insurance policy is perfect. Here is what you need to watch for when considering health insurance by Sukoon:

Benefits vary by policy: The AED 20,000 maternity limit applies to Pro. The EBP plan has a much lower limit and a six-month wait. Read your schedule of benefits carefully.

Waiting periods: Maternity typically has 6–10 months waiting period. Dental on some plans requires six months before major work is covered.

Exclusions common to all plans:

- Cosmetic surgeries unless reconstructive after injury

- Dental orthodontics (braces) unless specifically added

- Obesity treatments and weight loss programs

- Experimental treatments

- Injuries from professional sports or hazardous activities

- Hearing aids and vision correction surgery (LASIK)

Co-payments and deductibles: Even on comprehensive plans, you may pay 10–20% for certain services. Know your percentages before you need care.

Network limitations: Some budget plans restrict you to specific networks. Always check if your preferred hospital is in-network.

Conclusion

Sukoon health insurance offers genuine flexibility for a wide range of budgets and medical needs. Their network is wide. The claims reputation, based on customer feedback, is solid. If you need to buy health coverage in the UAE, put Sukoon on your shortlist. Check the premiums, the provider lists, and the fine print. Then decide.

Frequently Asked Questions

1. Does Sukoon cover pre-existing conditions?

Yes, most health plans provided by Sukoon insurance cover pre-existing conditions up to AED 150,000 per year with no waiting period.

2. What is Sukoon’s claim settlement time?

Customers report reimbursement within 7–10 working days. Some receive approval the same day for straightforward claims.

3. Can I use Sukoon health insurance in the USA?

Yes, if you hold Elite or Ultimate plans through Bupa Global. Prime and Pro plans cover USA emergencies only.

4. Is there an age limit for Sukoon health insurance?

Sukoon health insurance offers coverage up to 95 years of age for both expatriates and UAE nationals.

5. How do I find a Sukoon network hospital?

Use the mySukoon app or website provider search tool. Over 14 hospital networks are available across the UAE.