Understanding the Dubai mandatory health insurance law is your first step to a safer life in the emirate. The Dubai Health Authority (DHA) is the body that enforces this system, setting the crucial DHA health insurance requirements Dubai relies on. This law requires most residents to have valid coverage, a rule that employers must follow for staff and sponsors for their families.

Getting to know these rules ensures your access to healthcare and keeping your visa in good standing. For any expat or resident, securing proper DHA health insurance for residents is the key to peace of mind.

Too Long; Didn’t Read (TL;DR)

- The Rule: Pretty much every resident in Dubai is required by the Dubai mandatory health insurance law to have coverage. It’s not optional.

- Who Pays: Your employer must provide it for you. If you sponsor family members, you must get it for them.

- The Basic Plan: For lower-salaried employees, there’s a basic, low-cost plan called the DHA Essential Benefits Plan (EBP) that meets the minimum DHA health insurance requirements Dubai expects.

- Visa Link: As part of UAE residency visa insurance rules, ou cannot get or renew your residency visa without showing proof of valid DHA health insurance for residents.

- The Enforcer: The Dubai Health Authority (DHA) makes the rules, approves the insurance companies, and ensures compliance.

- The Risk: No insurance means fines and an blocked visa. Employers face heavy penalties for not covering staff.

Overview of DHA’s Role in Dubai’s Health Insurance System

Think of the Dubai Health Authority as the head of the city’s healthcare system. They don’t just run hospitals; they set the rules for the entire health insurance in Dubai to make sure everything runs smoothly and fairly for everyone involved.

What DHA supervises and regulates

The Dubai Health Authority is the architect of the DHA health insurance requirements Dubai mandates. They define minimum coverage, license DHA-approved insurance companies, and monitor healthcare providers to uphold quality standards. They also serve as the final arbiter for consumer complaints.

Protecting residents through standardized rules

Before the DHA’s intervention, insurance plans could be unreliable. The Dubai mandatory health insurance law changed this by standardizing core benefits. Now, every plan must cover essentials, preventing inadequate policies and creating a safer system for all residents.

DHA-approved insurers and compliance

For your visa to be processed, your policy must be from a DHA-approved insurance company. These vetted providers guarantee your plan meets all legal DHA health insurance requirements Dubai has established, ensuring seamless visa stamping. Discover DHA-approved health insurance companies in Dubai.

Dubai Mandatory Health Insurance Law What It Means

This UAE residency visa insurance rules is the foundation of the system. It officially made health insurance a compulsory requirement for obtaining and renewing a residency visa in Dubai, transforming healthcare from a personal expense into a structured, insured system.

Who must have health insurance under Dubai law

The reach of the Dubai mandatory health insurance law is very broad. It covers:

- All expatriate employees in the private and public sectors.

- All expatriate residents, including dependents (spouses, children) and domestic helpers sponsored by a resident.

- While UAE nationals have a separate government scheme, the law is designed to cover the entire expatriate population. Check out our detailed guide on choosing the right health insurance for expats.

Employer obligations for employees

For businesses in Dubai, the law is clear. You must provide a health insurance plan for every employee. The required coverage level is tied to the employee’s salary. For lower-wage workers, the DHA Essential Benefits Plan (EBP) or DHA health insurance for residents is enough. For higher-earning staff, a better plan is required. This is a legal duty, not a voluntary benefit.

Sponsor responsibilities for dependents

If you sponsor your family’s visas, the responsibility for their health insurance is yours. Your company’s insurance does not typically cover them. You must purchase a separate policy for each dependent. This is a very common point of confusion, so it’s best to know from the start. Proof of their insurance is mandatory for their visa applications and renewals.

DHA Health Insurance Requirements for Residents

So, what are the DHA health insurance requirements Dubai enforces?

Minimum mandatory benefits in Dubai

Every DHA-compliant plan, even the most basic, must cover a specific set of services. This includes:

- General practitioner and specialist visits.

- Emergency room treatment and ambulance services.

- Coverage for surgery and hospital stays.

- Basic maternity care (usually with limits).

- A wide range of common medications.

- Emergency dental care (e.g., for a severe toothache).

Yearly renewal requirements

Your health insurance is typically valid for one year and must be renewed annually to maintain both your coverage and your visa status. Your employer or insurer will usually remind you, but it’s wise to keep track of the expiry date yourself.

Validity of health insurance for visa stamping

Your health insurance MUST be active when your residency visa is issued or renewed. Government processing centers will not accept your application without a valid insurance certificate. An expired policy leads to an automatic visa rejection. To avoid such issues, learn how to check health insurance is active online.

Understanding the Essential Benefits Plan (EBP)

The Essential Benefits Plan is the DHA health insurance for residents that covers the lowest-income workers have basic health coverage.

What the EBP covers (basic benefits)

The EBP is a safety net. It’s not fancy, but it covers the essentials DHA health insurance requirements Dubai residents are expected to have.

| Benefit Category | Coverage Details (General Overview) |

| Hospitalization | Covers room, board, and nursing care for a specified number of days per year. |

| Surgery | Includes surgeon fees, operating theatre, and anesthesia. |

| Doctor Visits | Covers in-patient visits and a limited number of out-patient visits. |

| Emergency Care | Coverage for emergency treatment inside and outside of hospitals. |

| Medicines | Covers a wide range of essential drugs from a approved list. |

| Maternity | Covers prenatal care, delivery, and post-natal care, often with a co-payment. |

| Diagnostic Tests | Includes basic blood tests, X-rays, and scans as prescribed by a doctor. |

Who qualifies for this plan

The DHA Essential Benefits Plan (EBP) is for employees earning a monthly salary of 4,000 AED or less. It is the minimum legal coverage an employer can provide for these employees. Those earning more must be provided a better ‘Standard’ or ‘Comprehensive’ plan.

Cost limits mandated by DHA

The DHA caps the price for the EBP to keep it affordable. The premium is generally between AED 500 and AED 700 per person per year, making it feasible for companies to cover all their staff.

DHA Rules for Pre-Existing & Chronic Conditions

This is a major concern for many. A pre-existing condition is any illness you had before starting your new insurance policy.

Waiting periods

Many basic plans impose a waiting period for pre-existing conditions, typically six months to a year. During this time, treatment for that condition is not covered. After the waiting period, coverage usually begins.

When insurers must cover chronic illness

For chronic conditions like diabetes or asthma, the rules are firmer. While basic plans may have exclusions, the Dubai health insurance regulation mandates that after any waiting period is completed, the insurer must cover the ongoing management of these conditions, especially in non-EBP plans.

Exclusion rules and medical declarations

When applying, you must complete a medical declaration honestly. Failure to disclose a pre-existing condition can lead to denied claims or policy cancellation. Some conditions may be permanently excluded, but the insurer must state this clearly upfront.

Network Requirements Under DHA Regulations

An insurance “network” is the list of hospitals, clinics, and doctors your insurance company has agreements with for cashless treatment.

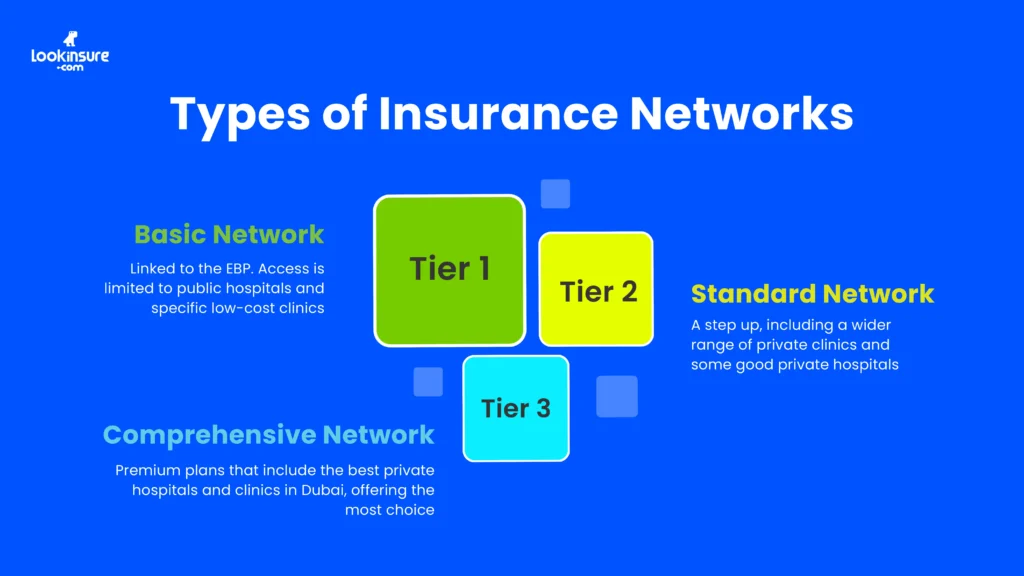

Types of networks (Basic, Standard, Comprehensive)

- Basic Network (Tier 1): Linked to the EBP. Access is limited to public hospitals and specific low-cost clinics.

- Standard Network (Tier 2): A step up, including a wider range of private clinics and some good private hospitals.

- Comprehensive Network (Tier 3): Premium plans that include the best private hospitals and clinics in Dubai, offering the most choice.

Access to hospitals, clinics, and pharmacies

Your insurance card lists where you can go. Using a provider outside your network may result in no coverage or a very small reimbursement, leaving you with a large bill. The same applies to pharmacies.

Cashless treatment availability

The main benefit of using a network provider is “cashless” treatment. You show your card, and the hospital bills the insurer directly. Going outside the network usually means paying upfront and filing for reimbursement later.

Penalties & Fines for Violating DHA Insurance Laws

The DHA enforces its rules with a system of fines to ensure compliance.

Fines for sponsors who fail to insure dependents

If you sponsor family and let their insurance lapse, you will be fined AED 500 per month, for every uninsured dependent. This accumulates quickly, making it far more expensive than just buying the insurance.

Consequences for expired or invalid insurance

If your insurance expires, your visa renewal stops. You typically have a 30-day grace period to get a new policy. After that, monthly fines begin, and your legal status is at risk.

Penalties for companies violating employee coverage rules

For companies, penalties are severe. An employer can be fined AED 500,000 for failing to provide health insurance. The company can also be blocked from obtaining new work permits, halting business operations.

How to Buy DHA-Compliant Health Insurance

Getting the right insurance is more simple than ever.

Documents required

You typically need the following for DHA health insurance for residents and other compliant plans:

- A copy of your passport.

- A copy of your residence visa (if you have one).

- Your Emirates ID.

- A completed application form.

Buying online through licensed platforms

The easiest method is to use an online insurance marketplace or a DHA-approved insurance company website. You can compare plans, get quotes, and purchase a policy entirely online, with the certificate emailed to you.

Approval time & issuance process

After payment, the insurance certificate is often generated and emailed within hours, sometimes instantly. This speed is essential for visa processing.

Why Lookinsure Helps You Stay DHA-Compliant

With all these rules, choosing the right plan can be overwhelming. A service like Lookinsure simplifies the process.

Compare DHA-approved plans easily

Lookinsure aggregates plans from dozens of DHA-approved insurance companies in one place. You can see all your options and prices side-by-side, saving time and effort.

Guidance for expats, families, and employers

The platform helps everyone single expats, families, and businesses filter plans to find the right fit. They provide clear information on coverage, helping you avoid surprises.

Transparent pricing and instant quotes

You see the final price for each plan immediately with no hidden fees. This transparency makes budgeting easy and reduces the stress of finding compliant DHA health insurance for residents.

Conclusion

Getting to grips with the Dubai health insurance regulation might seem like a lot initially, but it’s a system built for your protection. It ensures a medical emergency doesn’t become a financial disaster and that everyone has access to a basic standard of care.

By understanding and following the DHA health insurance requirements Dubai has established, you’re not just complying with the law you’re securing your health and your legal standing in the city. With straightforward tools like Lookinsure, finding the right DHA-compliant plan for your life and budget is easier than ever, a simple step that brings a great deal of comfort and security.

Frequently Answered Questions

1. Is health insurance mandatory for all Dubai residents?

Yes, the Dubai mandatory health insurance law requires all expatriate residents, including employees, dependents, and domestic helpers, to have valid coverage.

2. What does the DHA Essential Benefits Plan include?

It covers basic medical needs like doctor visits, emergency care, hospital stays, surgery, basic maternity care, and essential medicines, fulfilling the minimum DHA health insurance requirements Dubai sets.

3. Does DHA insurance cover chronic illnesses and pre-existing conditions?

Yes, after any applicable waiting periods (often 6 months). It’s crucial to declare all conditions when applying.

4. What happens if my insurance expires during visa renewal?

Your renewal will be put on hold until you provide proof of a new, active policy. Lapsing for too long leads to monthly fines.

5. What fines apply for not having valid health insurance in Dubai?

For individuals, it’s AED 500 per month per uninsured person. For companies, fines can reach AED 500,000.

6. Do employers have to provide health insurance for all staff?

Yes, every employer must provide a DHA-compliant health insurance plan for every employee, as per law.