Emirates Takaful health insurance works differently from regular insurance companies. Instead of the standard model where the insurer keeps all the profits, Takaful operates on shared responsibility. Everyone pays into a common fund, and when someone needs medical care, the fund covers it. It is based on Islamic principles, which means investments stay away from interest and uncertainty.

This guide explains their plans and what makes them worth considering as one of the best insurance companies in Dubai.

Too Long; Didn’t Read (TL;DR)

- Emirates Takaful health insurance operates on Shariah-compliant principles where participants share risk and surplus gets returned to policyholders, not kept by the company.

- Individual plans start at AED 1,200 per year and family plans from AED 5,000, with options for dental, optical, physiotherapy, and worldwide coverage up to AED 1 million.

- Health insurance by Emirates Takaful is completely transparent with full coverage details, network lists, and exclusions are published online, along with their stock price and financial reports.

- You can buy directly through Emirates Takaful or compare plans to find the best one for your specific needs.

Overview of Emirates Takaful Health Insurance

Emirates Takaful (also known as Takaful Emarat) is a UAE-based insurer that follows the principles of cooperative insurance. Instead of the traditional model where the company keeps all profits, Takaful operates on shared responsibility. Participants pay contributions into a common fund, and when someone faces a medical expense, the fund covers it .

The company is regulated by the Central Bank of the UAE and follows a Shariah complaint set by its own Supervisory Board. This board ensures all investments and operations stay away from interest (Riba) and uncertainty (Gharar).

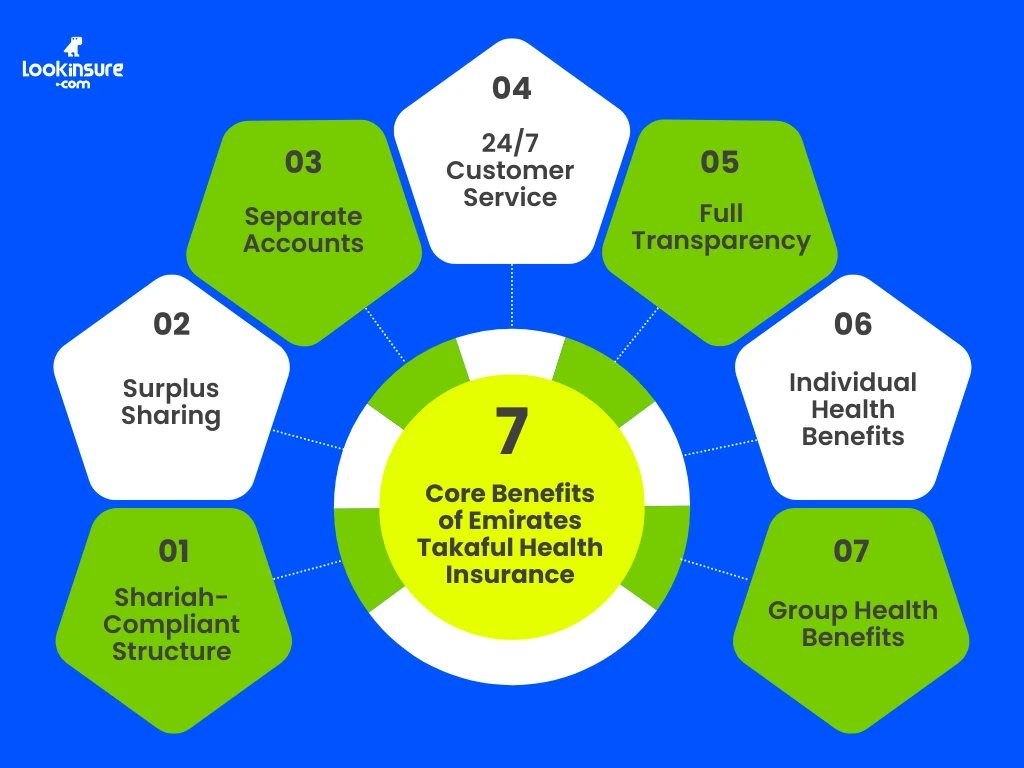

Key Features and Benefits of Emirates Takaful Health Insurance

The features and benefits of Emirates Takaful health insurance go beyond just medical coverage. Because of the Takaful model, policyholders get advantages you will not find with conventional insurers in the UAE.

Shariah-Compliant Structure

Your contributions are invested only in Halal, socially responsible projects. There is no involvement with interest-based transactions or industries prohibited in Islam.

Surplus Sharing

If the Takaful pool performs well and claims are lower than expected, the surplus is distributed back to participants. You might receive this as a renewal discount on your next premium.

Separate Accounts

The company keeps participant funds completely separate from shareholder funds. If there is ever a shortfall in the participant pool, the shareholder fund provides an interest-free loan (Qard Hasan) to cover it. So your claims are never at risk.

24/7 Customer Service

Whether you need help finding a doctor or understanding your coverage, their team is available around the clock.

Full Transparency

All of their plans are listed in Emirates Takaful health insurance page. with complete details about coverage limits, network hospitals, and exclusions. You can also check their stock price and financial reports anytime.

Individual Health Benefits

For individual policyholders, plans like Personal Health+ include extras like prescription drugs up to AED 15,000, physiotherapy sessions, home nursing, and optional dental and optical coverage.

Group Health Benefits

For businesses, Health+ plans allow companies to cover employees and their families under a single contract. These plans offer broad network access and comply fully with UAE insurance regulations .

Health Plans Provided by Emirates Takaful Insurance

The health plans provided by Emirates Takaful insurance are designed for different needs and budgets. They work with Mednet as their TPA (Third Party Administrator) and offer plans with varying copayment levels.

Individual Health Insurance Plans

For individuals and families, Emirates Takaful offers plans under the Personal Health+ umbrella. These plans provide worldwide coverage up to AED 1 million per member per year. Here is a breakdown of what you can expect:

- Prescription Drugs: Up to AED 15,000 coverage for medications

- Dental Benefits: Up to AED 3,000 with direct billing at network providers

- Optical Coverage: Optional add-on up to AED 1,500 for eyewear

- Physiotherapy: Up to 20 sessions covered annually

- Additional Perks: Home nursing services and instant certificate issuance for visa purposes

The plans come in different tiers based on copayment percentages (0%, 10%, or 20%) and network access levels (Gold, Platinum, Rhodium, and Iridium through Mednet). Each tier determines which hospitals and clinics you can visit and how much you pay out-of-pocket.

Group Health Insurance Plans

For companies, the Health+ business plans offer flexible coverage that can be customized for workforce needs. Key features include:

- Multiple payment options (annual, semi-annual, quarterly)

- Available in both AED and USD

- Minimal documentation and quick issuance

- Annual renewal with surplus sharing potential

- Compliance with all UAE health insurance regulations

- Optional add-ons like Permanent Total Disability coverage and life protection benefits

- Group plans allow employers to provide quality healthcare coverage while benefiting from the Takaful model of mutual cooperation.

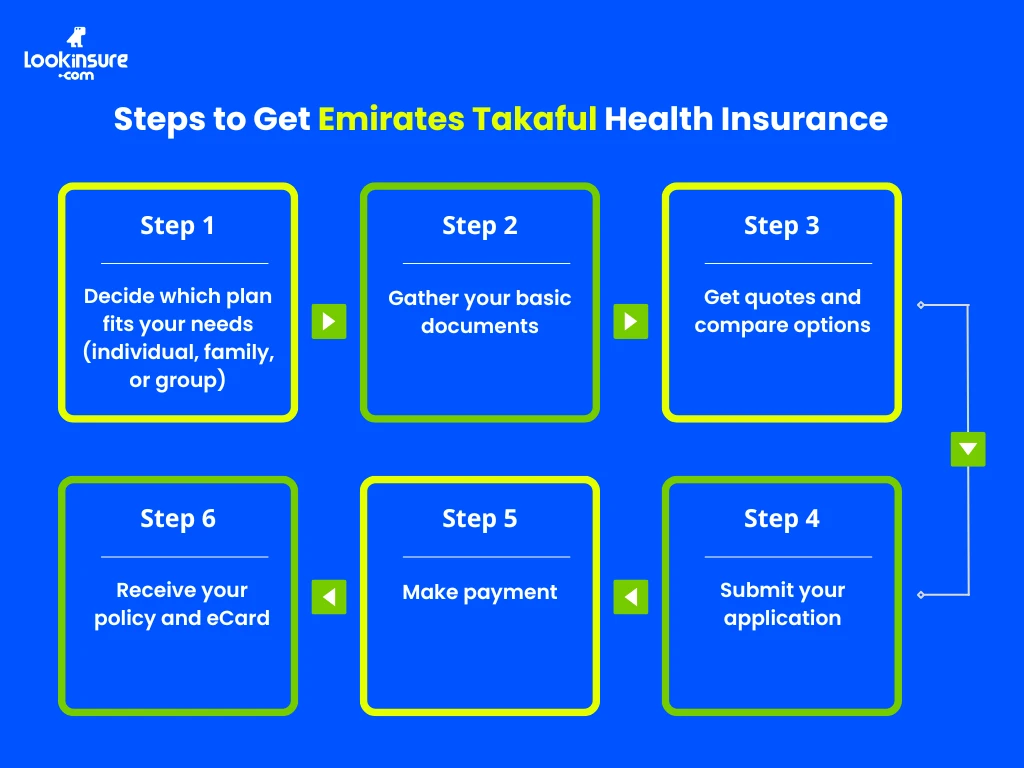

How to Get Emirates Takaful Health Insurance?

The whole health insurance process can be done in under 15 minutes. Here is how the process works.

Steps to apply:

- Decide which plan fits your needs (individual, family, or group)

- Gather your basic documents

- Get quotes and compare options

- Submit your application

- Make payment

- Receive your policy and eCard

Required documents:

- Valid Emirates ID

- Passport copy with current visa page

- Recent photograph

- For dependents: birth certificates and the sponsor’s Emirates ID

- For group policies: company trade license and employee list

Where to buy:

- Directly through Emirates Takaful: Visit their website or contact Emirates Takaful customer service. You can see all the plan details online and apply directly.

- Through Lookinsure: This is where things get easy. Instead of visiting multiple websites or calling around, you can compare health plans provided by Emirates Takaful insurance side by side on Lookinsure. You see the premiums, the coverage limits, the network hospitals, and the fine print,all in one place. No cost to you. No obligation. Just clear information so you can decide without the headache.

- Through your employer: Most companies provide group health coverage via HR. Check with your employer to see if Emirates Takaful is one of their approved providers.

Important Notes Before Buying

Before you commit to any plan, there are a few things you need to understand.

Benefits vary by policy

Not all plans are the same. Some offer worldwide coverage, while others are limited to the UAE. Some include dental and optical, while others focus only on inpatient care. Read the schedule of benefits carefully.

Waiting periods

Most plans have waiting periods for certain benefits:

- Maternity coverage typically requires 6-10 months before you can claim

- Dental and optical may have a 6-month waiting period for major work

- Pre-existing conditions may have waiting periods, depending on the plan

Exclusions and limitations

Every insurance policy has things it does not cover. Common exclusions in Emirates Takaful plans include:

- Cosmetic surgeries (unless reconstructive after an accident)

- Experimental treatments

- Injuries from hazardous sports or activities

- Treatment received outside the network without prior approval

- Pre-existing conditions during the initial waiting period

Network restrictions

Some budget plans limit you to specific hospitals and clinics. Always check if your preferred healthcare providers are in the network before you buy.

Conclusion

Emirates Takaful offers something genuinely different in the UAE market in a system built on mutual support, transparency, and ethical principles. The features and benefits of Emirates Takaful health insurance go beyond standard coverage to include surplus sharing, Shariah compliance, and a genuine commitment to fairness. It combines the security of medical coverage that comes from knowing your contributions help others while protecting yourself.

Frequently Answered Questions

1. Why should I choose Emirates Takaful health insurance in UAE?

You should choose it if you want coverage that aligns with Islamic values. The Takaful model means you are part of a mutual support system where surplus is shared back with participants, not kept as company profit. Plus, the company is transparent about their plans and financial health .

2. How much do Emirates Takaful health insurance policies cost?

Individual plans start from AED 1,200 per year. Family plans start around AED 5,000 per year. The final Takaful Emarat insurance price depends on your age, chosen benefits, and whether you add dental or worldwide coverage.

3. How to run a Takaful Emirates Insurance status check online?

You can check your policy status by logging into the customer portal on the Emirates Takaful website. If you purchased through Lookinsure, their team can also assist you with status checks and any questions about your coverage.

4. What are the benefits of Takaful insurance?

The main benefits include Shariah-compliant investments, surplus sharing when the pool performs well, mutual cooperation among participants, transparency in operations, and ethical fund management. You also get all the standard medical coverage benefits like inpatient care, outpatient services, maternity, and optional dental and optical .

5. What is Emirates takaful health insurance contact number?

You can reach Emirates Takaful at their Dubai office: +97600522550. Their Abu Dhabi office is available at +97600522550. For claims and specific inquiries you can send WhatsApp messages to +97142309300.