If you live in Dubai, you probably are aware that health insurance is a legal requirement set by the Dubai Health Authority. For many residents and employees, this requirement is met through the essential benefits plan UAE, which is the minimum level of health coverage allowed under local regulations.

Knowing how the Essential Benefits Plan works can keep you compliant with the UAE health insurance regulations, helps cover core medical services, and protects you from fines or visa issues. In this article, we will break down what EBP covers, its main benefits and limitations, and how you can choose the right health insurance in UAE plan or upgrade it if your needs go beyond the basics.

Too Long; Didn’t Read (TL;DR)

Here is everything you need to know about EBP:

What Is EBP?

- The Essential Benefits Plan is mandatory health insurance approved by the Dubai Health Authority

- It provides basic medical coverage at an affordable cost

- It applies to employees, dependents, and most Dubai residents

Why You Need It

- Health insurance is legally required in Dubai

- Not having EBP can lead to fines and visa issues

- Employers usually insure employees, while sponsors insure dependents

What’s Covered

- Hospitalization, surgeries, and emergency treatment

- Doctor visits, diagnostics, and essential medications

- Basic maternity and newborn care

Main Benefits

- Keeps you compliant with DHA regulations

- Helps manage essential healthcare costs

- Access to a network of approved hospitals and clinics

What Is the Essential Benefits Plan (EBP)?

The Essential Benefits Plan, often shortened to EBP, is the minimum level of health insurance required by the Dubai Health Authority. It was introduced to make sure that every resident has access to essential healthcare services, regardless of income level.

At its core, the essential benefits plan UAE is meant to offer affordable health coverage that still meets legal standards. It focuses on basic medical needs such as doctor visits, hospital stays, and emergency care. While it does not offer luxury perks, it ensures that no one is left without medical support.

The EBP health insurance UAE framework is regulated by the DHA, which approves insurers, sets coverage limits, and monitors compliance. Without an active EBP-compliant policy, residents may face fines or issues with visa renewals.

Who Needs EBP

EBP is not optional for most people living in Dubai. It applies to a wide range of residents, including:

- Employees working in the private sector

- Domestic workers

- Dependents sponsored by residents

- Certain categories of visa holders

For many newcomers, especially those moving for work, understanding how EBP fits into broader health insurance for expats in UAE options can make the transition much easier and avoid costly mistakes later on.

Core Coverage Offered by EBP

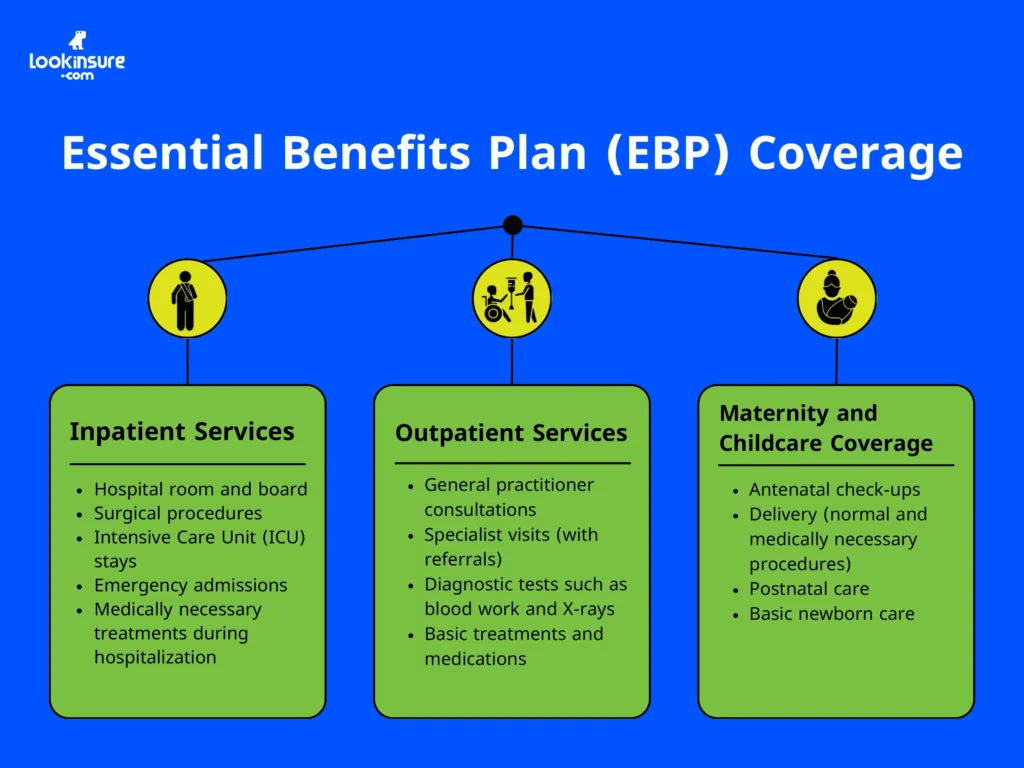

The essential benefits plan UAE focuses on providing core medical services that address everyday health needs and emergencies. Below is a closer look at what is included.

Inpatient Services

Inpatient care is one of the most important parts of EBP health insurance UAE. It covers situations where you need to stay in a hospital for treatment.

Inpatient coverage usually includes:

- Hospital room and board

- Surgical procedures

- Intensive Care Unit (ICU) stays

- Emergency admissions

- Medically necessary treatments during hospitalization

This type of coverage can make a huge difference, as hospital stays in Dubai can be very expensive without insurance.

Outpatient Services

Outpatient care covers medical services where you do not need to stay overnight in a hospital. The essential benefits plan EBP includes a reasonable level of outpatient support.

Common outpatient benefits include:

- General practitioner consultations

- Specialist visits (with referrals)

- Diagnostic tests such as blood work and X-rays

- Basic treatments and medications

Preventive care is also part of the package, helping catch issues early before they turn into bigger problems.

Maternity and Childcare Coverage

One of the most frequently asked questions about the essential benefits plan UAE is whether maternity care is included. The answer is yes, but with limits.

Maternity and childcare benefits typically include:

- Antenatal check-ups

- Delivery (normal and medically necessary procedures)

- Postnatal care

- Basic newborn care

While this level of coverage helps manage major costs, many families choose to upgrade for more flexibility and comfort.

Benefits of Having an EBP

The obvious benefit is legal compliance. However, there’s more to the plan:

Legal Compliance

Perhaps the most obvious benefit of having EBP health insurance UAE is staying on the right side of the law. Dubai authorities take health insurance compliance seriously, so you should consider what happens with no health insurance in Dubai.

Without a valid essential benefits plan EBP, you may face:

- Monthly fines

- Delays or rejection of visa renewals

- Issues sponsoring family members

Simply put, having EBP keeps your residency status safe and stress-free.

Financial Protection

Medical care in Dubai is excellent, but it is not cheap. The essential benefits plan UAE acts as a safety net, covering essential treatments so you are not paying everything out of pocket.

Financial advantages include:

- Reduced hospital bills

- Predictable co-payments

- Coverage for emergency situations

Even basic coverage can prevent serious financial strain during unexpected health issues.

Access to Network Hospitals and Clinics

With EBP health insurance UAE, you gain access to a DHA-approved network of hospitals and clinics. This usually comes with direct billing, which means you do not have to pay upfront and claim later.

Benefits of network access include:

- Faster appointment scheduling

- Cashless treatment at approved facilities

- Clear coverage guidelines

This convenience is especially helpful during emergencies or routine check-ups.

EBP Limitations and Considerations

While the essential benefits plan EBP is helpful, it is important to understand what it does not cover fully.

Coverage Limits

EBP policies come with predefined limits, which can affect certain treatments. These may include:

- Annual coverage caps

- Co-payments for consultations and medications

- Exclusions for cosmetic or elective procedures, such as dermatology coverage in UAE

Here is an overview these limits that helps you avoid surprises later:

| Area | Typical Limitation |

| Outpatient visits | Limited number per year |

| Medications | Co-pay required |

| Specialized care | Referral needed |

| Annual limit | Fixed maximum amount |

Upgrading Your Plan

If you find that EBP does not fully meet your needs, comparing it with private medical insurance in Dubai can help you understand what additional coverage levels and hospital access are available.

Upgrade options may include:

- Higher annual coverage limits

- Access to premium hospitals

- Better maternity benefits

- Coverage for chronic and specialized care

Upgrading does not mean replacing EBP entirely; it simply builds on the base provided by EBP health insurance UAE.

Comparing EBP Plans

Not all EBP policies are identical. Different insurers offer slightly different networks, service levels, and customer support.

When comparing essential benefits plan EBP options, consider:

- Hospital and clinic network

- Claims and approval process

- Customer service reputation

- Clear explanation of exclusions

Conclusion

The essential benefits plan UAE is not just a legal requirement; it is a practical solution that ensures basic healthcare access for residents and employees in Dubai. By meeting DHA standards, the essential benefits plan EBP helps you avoid fines, protects you from high medical costs, and gives you access to approved healthcare providers.

While EBP health insurance UAE has its limits, it serves as a solid foundation. Understanding what it covers, where it falls short, and when to upgrade allows you to make informed decisions that suit your lifestyle and health needs. Take a moment to review your policy details, and if your situation demands more coverage, consider enhancing your plan for added peace of mind.

Frequently Answered Questions

1. What is included in the Essential Benefits Plan in UAE?

The essential benefits plan UAE includes inpatient care, outpatient consultations, emergency treatment, basic maternity services, and newborn care within DHA-defined limits.

2. Who is required to have EBP health insurance?

Most Dubai residents, including employees, dependents, and domestic workers, are required to have EBP health insurance UAE to remain compliant with visa regulations.

3. Can I upgrade my EBP plan for more coverage?

Yes, you can enhance your essential benefits plan EBP with additional benefits such as higher limits, wider hospital networks, and better maternity coverage.

4. How does EBP help with fines and visa compliance?

Having an active essential benefits plan UAE prevents fines and ensures smooth visa issuance and renewal under DHA rules.

5. Are maternity and child healthcare services included in EBP?

Yes, EBP health insurance UAE includes basic maternity and newborn care, though many families choose upgrades for broader benefits.

6. How do I choose the best EBP provider in Dubai?

Compare essential benefits plan EBP providers based on network hospitals, coverage clarity, customer service, and overall value rather than price alone.