If your basic health insurance plan feels like it’s missing a few pieces, you’re not alone. Many residents find their standard policy doesn’t cover common needs like dental check-ups, new glasses, or having a baby. That’s where health insurance add-ons Dubai providers offer come in. These optional extras let you build coverage that actually matches your specific needs.

Whether you’re looking at maternity cover health insurance UAE families rely on, or everyday dental vision cover health insurance Dubai residents use, these add-ons fill the gaps in your protection. Let’s break down what’s available and how these optional health insurance benefits can work for you.

Too Long; Didn’t Read (TL;DR)

- What Are Add-ons: Add-ons are extra bits of coverage you can buy on top of your basic health insurance to cover things like dental work, eye care, and having a baby.

- Main Add-ons for Health Insurance: The most popular health insurance add-ons Dubai offers are for dental care (check-ups, fillings), vision (eye tests, glasses), and maternity (prenatal care, delivery).

- Not Standard: Don’t assume your basic plan includes these. You often have to add them separately for an additional cost.

- Maternity Rules: Maternity cover health insurance UAE policies often have a waiting period (like 6-12 months) before you can claim, so you need to plan ahead.

- How to Choose: Look at your family’s health history and needs. If you wear glasses, a vision add-on is a smart move. If you’re planning for a family, maternity cover is pretty essential.

What Are Health Insurance Add-Ons in Dubai?

Let’s break down what health insurance add-ons Dubai provider offer:

Definition and purpose of add-ons or riders

Add-ons are additional benefits you can attach to your main plan. People usually consider, health insurance add-ons Dubai, when they want protection that goes beyond the legally required baseline. Many families also explore, maternity cover health insurance UAE, if they are planning to have children soon, or they look into a stronger, dental vision cover health insurance Dubai, when they know they will need frequent dental or eye care.

How add-ons differ from standard coverage

Basic insurance plans in Dubai can sometimes feel limited. They usually cover emergencies and essential treatments, but they rarely include items that fall under optional insurance benefits Dubai or long-term needs. When you add riders, you get more control over what your policy can do for you. For example, upgrading to, dental vision cover health insurance Dubai, means you can actually go for proper check-ups without paying everything out of pocket.

Why residents consider add-ons for better protection

People who want UAE health insurance extras often choose them because they feel more relaxed knowing that they won’t be surprised by sudden medical bills. Couples who are planning a family rely heavily on, maternity cover health insurance UAE, while professionals who spend long hours on screens often add vision coverage. If you’re an expat, learn more about How to Choose the Right Health Insurance in UAE that offers the best add-ons.

Dental Cover Add-Ons

A bright, healthy smile is important, and dental care in Dubai can be expensive without insurance.

Types of dental coverage (basic check-ups, fillings, major procedures)

Dental add-ons can include:

- Routine cleanings and polishing

- X-rays and diagnostic tests

- Fillings, root canals, and simple extractions

- Crowns, dentures, and gum treatments

Anyone who cares about long-term dental health usually finds, dental vision cover health insurance Dubai, very helpful, especially since major dental procedures can get rather expensive.

Typical costs and coverage limits

Many insurers offer dental limits ranging from AED 1,500 to AED 10,000 per year. Plans with higher limits obviously cost a bit more, but they also provide broader protection. Because dental work is often unavoidable, people often include dental riders when selecting private medical insurance add-ons for their families.

| Type of Dental Benefit | Typical Annual Limit (AED) |

| Routine Check-Ups | 500–1,000 |

| Fillings & Extractions | 1,000–3,000 |

| Major Procedures | 3,000–10,000 |

Best plans offering dental add-ons in Dubai

Some insurers tailor dental packages for families, young adults, and frequent clinic visitors. Many people who choose, health insurance add-ons Dubai, also request dental add-ons first, simply because dental bills can stack up faster than expected.

Vision Cover Add-Ons

If you wear glasses or contacts, you know how quickly the costs can add up. A vision add-on takes care of that.

Coverage for eye exams, glasses, and contact lenses

Vision add-ons often include:

- Annual or biannual eye tests

- Prescription glasses

- Contact lenses

- Special lenses for screen use

Plans that include vision care pair especially well with, dental vision cover health insurance Dubai, giving policyholders two major benefits at once.

Who benefits most from vision add-ons

Anyone who works in front of screens all day, drivers who need regular eye checks, or children with changing prescriptions find these benefits very practical. Many families exploring UAE health insurance extras end up adding vision riders simply because they offer peace of mind at a reasonable price.

Cost considerations for vision coverage

Costs depend on how frequently you need to update your prescription and how expensive your lenses are. When comparing optional insurance benefits Dubai, vision coverage usually falls on the more affordable side.

Maternity Cover Add-Ons

Starting or growing your family is a beautiful experience, and having the right financial support is necessary. Learn more about family health insurance in Dubai in addition to maternity covers.

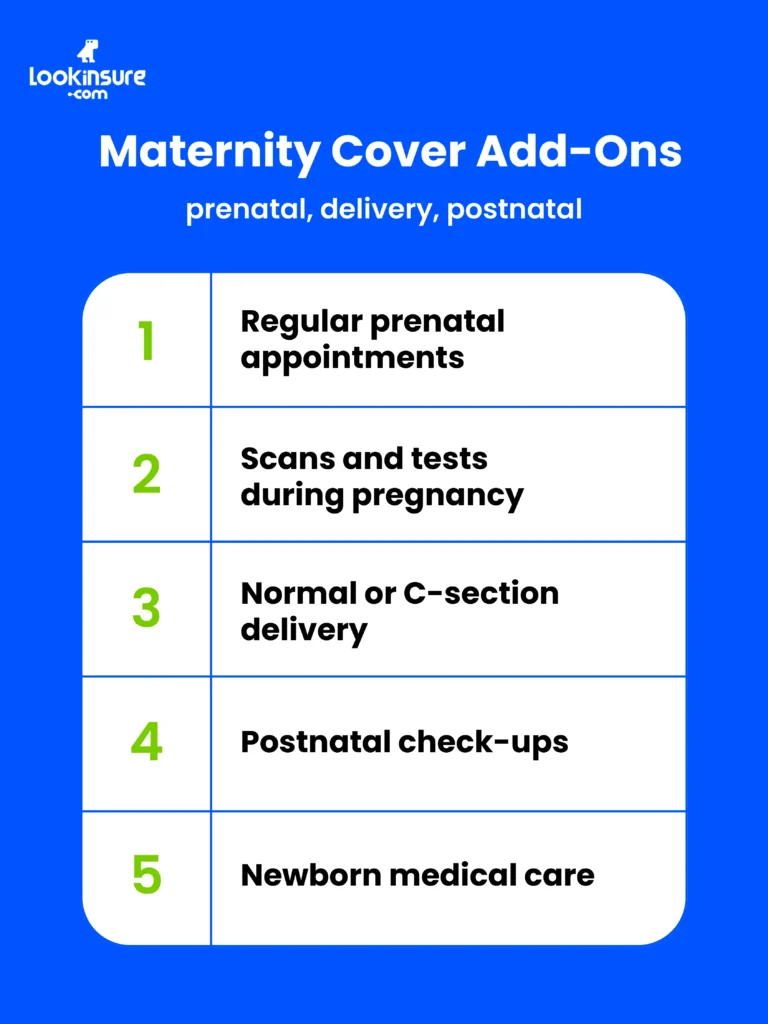

What maternity insurance usually includes (prenatal, delivery, postnatal)

A good maternity add-on normally includes:

- Regular prenatal appointments

- Scans and tests during pregnancy

- Normal or C-section delivery

- Postnatal check-ups

- Newborn medical care

Because giving birth in Dubai can be costly, many families rely heavily on, maternity cover health insurance UAE, to manage their expenses.

Waiting periods and eligibility rules in UAE

Almost all maternity add-ons come with waiting periods ranging from 6 to 12 months. This means you need to add maternity benefits well before planning a pregnancy. For many families,health insurance add-ons Dubai, become essential at this stage because maternity benefits are rarely included in basic plans.

Tips for choosing maternity add-ons

When comparing maternity & childcare coverage UAE, look at:

- The delivery limit

- The hospital network

- Whether newborn cover is included

- Waiting period rules

- Emergency neonatal care benefits

Couples often say that selecting, maternity cover health insurance UAE, gives them a sense of comfort because it removes the fear of sudden medical bills.

Other Popular Health Insurance Add-Ons

Besides the big three, there are other UAE health insurance extras that can be well worth the investment.

Outpatient benefits

These add-ons cover consultations, lab tests, and medicines. Many people pair them with, health insurance add-ons Dubai, if they visit clinics regularly.

Alternative therapies (physiotherapy, chiropractic)

Physiotherapy and chiropractic treatment are becoming more popular. They also fit within the range of private medical insurance add-ons many residents appreciate.

Therapy sessions, psychiatric consultations

Mental health has become more openly discussed in 2025. Many insurers now include psychiatric sessions as part of their growing list of UAE health insurance extras.

How to Choose the Right Add-Ons for Your Health Insurance

With all these options, how do you pick what’s right for you?

Assess your family’s medical needs

Think of what you need most—maternity, dental, vision, or more regular outpatient care. Families often prioritize, dental vision cover health insurance Dubai, or, maternity cover health insurance UAE, depending on their stage of life.

Compare costs vs. benefits

Not all add-ons offer the same value. Always balance the cost with how often you expect to use the benefit, especially when selecting, health insurance add-ons Dubai, .

Consider plan flexibility and network coverage

Wide networks are especially important for maternity and dental coverage. This is why many people prefer flexible plans that support strong optional insurance benefits Dubai.

Buying Health Insurance with Add-Ons in Dubai

Getting a plan with these extras is a pretty simple process.

Available platforms for purchase

You can purchase policies through insurers, brokers, comparison websites, and platforms like Lookinsure, which helps people compare private health insurance in UAE and health insurance add-ons Dubai providers offer.

Required documentation

Common documents include:

- Emirates ID

- Passport copy

- Visa page

- Previous insurance details

Tips for upgrading or adding benefits mid-term

Some insurers allow upgrades mid-policy, while others only allow changes during renewal. If you plan to add, maternity cover health insurance UAE, it is always better to add it early due to waiting periods.

Why Choose Lookinsure for Health Insurance Add-Ons

When you’re trying to figure out the best health insurance add-ons Dubai has to offer, it can be a lot to take in. That’s where a platform like Lookinsure can make a real difference.

Compare add-ons across multiple insurers

Lookinsure gives you a clear breakdown of options, especially for, dental vision cover health insurance Dubai, and, health insurance add-ons Dubai, making the whole process much easier. We offer the selections from the best health insurance companies in Dubai.

Transparent pricing and coverage details

Everything is clearly explained, including maternity limits, dental caps, and vision allowances, so you can select the right private medical insurance add-ons without stress.

Customer support for claims and plan upgrades

Their team assists with claims and helps you choose the best, maternity cover health insurance UAE, or dental and vision add-ons when upgrading your plan.

Conclusion

Choosing the right, health insurance add-ons Dubai, can make a world of difference in how confident you feel about your healthcare. Whether you need stronger, dental vision cover health insurance Dubai, or you want reliable, maternity cover health insurance UAE, before starting a family, these add-ons help protect your health and manage costs in a more predictable way. They give residents, expats, and families a more complete approach to medical care.

If you’re looking for a simple way to compare options and find the best mix of benefits, Lookinsure is a great place to start because it makes reviewing and choosing add-ons very straightforward.

Frequently Answered Questions

1. What are the most common health insurance add-ons in Dubai?

The most common are, health insurance add-ons Dubai, such as dental, vision, maternity, and outpatient benefits.

2. Does maternity cover include delivery and postnatal care?

Yes, most, maternity cover health insurance UAE, policies include prenatal visits, delivery, and postnatal check-ups.

3. Are dental and vision add-ons included in standard plans?

Most standard plans do not include them, which is why many residents purchase, dental vision cover health insurance Dubai, .

4. How much do health insurance add-ons cost in Dubai?

Prices vary depending on age, insurer, and the, health insurance add-ons Dubai, you select.

5. Can I add dental or vision coverage after buying a plan?

Some insurers allow mid-term upgrades, letting you add, dental vision cover health insurance Dubai, even after purchase.

6. Are alternative therapies like physiotherapy covered under add-ons?

Yes, several private medical insurance add-ons include physiotherapy and chiropractic services.