Best Health Insurance For Salary Under AED 5000 In UAE ..If you earn AED 5,000 or less per month in the UAE, you might think good health insurance is out of reach, which is not true! You might Best Health Insurance For Salary Under AED 5000 In UAEthink that you can live without health insurance in the UAE, but it can’t be doable! Health insurance is mandatory for every resident. And having a lower salary does not mean you have to settle for poor coverage. There are actually several affordable plans designed specifically for people in your situation.

The government has made sure that AED 5000 Salary health insurance options exist and are easy to get. Whether your employer provides coverage or you need to buy your own plan, you have choices. This guide walks you through the Best Health Insurance For Salary Under AED 5000 In UAE, what they actually cost, and exactly how to get covered without breaking your monthly budget.

Too Long; Didn’t Read (TL;DR)

- There is no official minimum wage for expats in the UAE, but low-income workers have access to special insurance plans.

- Abu Dhabi offers a Flexible plan for AED 750 per year for people earning above AED 5,000, and there are options for those earning less.

- The cheapest plan in the UAE costs AED 320 per year for employees under the new mandatory scheme.

- Basic plans cover inpatient care, outpatient visits, emergency, and maternity with co-payments.

- You can buy insurance online or through brokers with just your passport, visa, and Emirates ID.

What Is the Minimum Wage in the UAE?

Here is an important fact: the UAE does not have a minimum wage for expatriate workers. The recent minimum wage increase to AED 6,000 applies only to Emirati citizens working in the private sector.

For expats, salaries depend on your job, skills, and employer. Many workers in retail, construction, hospitality, and domestic help earn between AED 1,500 and AED 4,999 per month.

So how much does health insurance cost for someone in this salary range?

| Plan Type | Annual Cost | Who It’s For |

| Basic Employee Plan (Dubai) | AED 320 | Low-income workers (employer-provided) |

| Essential Benefits Plan (Dubai) | Around AED 560 | Domestic staff, workers earning under AED 4,000 |

| Flexible Plan (Abu Dhabi) | AED 750 | People earning above AED 5,000 (not for lower incomes) |

| Private Basic Plans | AED 1,000 – AED 1,500 | Individuals buying their own coverage |

The cheapest option is the AED 320 per year plan for employees under the new mandatory scheme that started in January 2025 . This covers all private sector workers across the UAE.

Best Health Insurance For Salary Under AED 5000 In UAE

If you are looking for the Best Health Insurance For Salary Under AED 5000 in UAE, here are the best options available. Some plans come through your employer. Under the new 2025 rules, all private sector companies must provide basic health insurance to their staff. If you are an employee, your company handles this for you.

But what if you are self-employed, a freelancer, or need to insure your spouse or children? You can buy your own plan. Several insurers offer affordable policies designed for lower incomes or even the possibility to get health insurance without a job. These plans meet all UAE legal requirements while keeping your monthly costs low.

The table below shows the best health insurance options for salary under aed 5000 available right now. Prices are yearly unless stated otherwise. Compare the benefits and networks carefully before choosing.

| Policy Name | Annual Cost | Key Benefits | Network |

| Basic Employee Plan (Government Mandated) | AED 320 | Inpatient, outpatient, chronic conditions, pre-existing conditions, 20% co-pay (capped AED 1,000/year), 25% co-pay for outpatient (max AED 100/visit) | 7 hospitals, 47 clinics, 44 pharmacies |

| DHA Essential Benefits Plan (EBP) | Around AED 560 | AED 150,000 annual limit, inpatient, outpatient, maternity, emergencies, 20% co-pay | Over 500 hospitals, 1,400 pharmacies |

| RAK Essential Medical Insurance | Around AED 499 | AED 50,000 annual limit, inpatient and outpatient, 6 physiotherapy sessions, AED 1,500 pharmacy limit, maternity, vaccinations | RAK network |

| Orient E-Med Insurance | Around AED 560 | AED 150,000 annual limit, dental emergencies, hearing and vision, pre-existing conditions, 6 physiotherapy sessions, AED 1,500 pharmacy limit | Orient’s 14 networks |

| Union Health Insurance EBP | Around AED 525 | AED 150,000 annual limit, inpatient and outpatient, maternity, newborn coverage, chronic diseases | Union network |

| Fidelity United Health First Plan G | AED 1,038 | AED 500,000 cover, good for basic needs | PCP-C Network |

| Takaful Emarat ECARE Blue | AED 1,209 | AED 150,000 cover, basic inpatient and outpatient | E CARE Blue network |

| Dubai Insurance DubaiCare Next N5 | AED 1,239 | AED 1,000,000 cover, higher limit for peace of mind | DubaiCare Next |

| HAYAH Insurance Classic | AED 1,275 | AED 500,000 cover, solid basic coverage | Classic network |

| RAK Insurance Nextcare RN3 | AED 1,390 | AED 1,000,000 cover, comprehensive benefits | NEXTCARE RN3 |

Important notes:

- The Basic Employee Plan at AED 320 is the new government-mandated plan starting January 2025. Your employer must provide this if you are a private sector employee.

- The DHA Essential Benefits Plan (EBP) is specifically for people earning under AED 4,000 in Dubai or for domestic staff. It meets all legal requirements.

- Plans from AED 1,000 to AED 1,400 offer higher annual limits (AED 500,000 to AED 1,000,000). These give you more access to better hospitals.

- Always check which hospitals are in the network before buying. A cheap plan is useless if your preferred hospital is not covered.

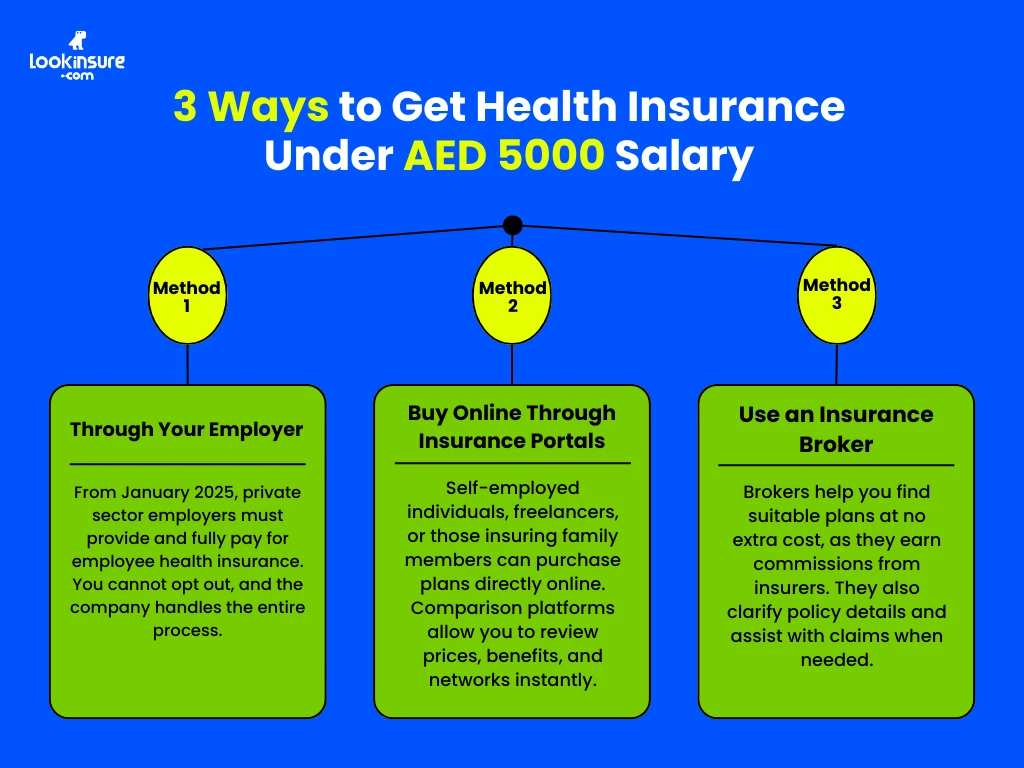

How to Buy Health Insurance Options for Salary Under AED 5000?

You have three ways to get health insurance when your salary is under AED 5,000.

Method 1: Through Your Employer

If you work in the private sector, your employer must provide health insurance starting January 2025 . The employer pays the full cost. You cannot opt out. This is the easiest method because you do nothing, your company handles it.

Method 2: Buy Online Through Insurance Portals

You can buy your own plan if you are self-employed, a freelancer, or need to insure family members. Websites like Lookinsure let you compare plans side by side to buy Online health insurance options for salary under aed 5000 in uae. You can see prices, benefits, and networks instantly.

Method 3: Use an Insurance Broker

Brokers help you find the best deal at no cost to you. Insurance companies pay them commission. They can explain confusing terms and help with claims later.

Documents Required for Buying Health Insurance in UAE

When you apply, you will need these documents :

- Valid Emirates ID copy (mandatory for Dubai residents)

- Valid passport copy (mandatory)

- Valid visa copy (mandatory)

- Previous insurance eCard or Certificate of Coverage (optional, but helps skip waiting periods)

- Birth certificate for newborns under 2 months old

- For Abu Dhabi residents, you may also need your Unified Number (UID) from your residence visa.

Conclusion

Having a salary under AED 5,000 does not mean you cannot get good health insurance in the UAE. The government has made sure low-income workers have access to affordable plans. If you are an employee, your employer must now provide coverage under the new 2025 rules. If you need to buy your own insurance, options start around AED 560 for the DHA Essential Benefits Plan and go up to AED 1,500 for plans with higher annual limits.

Frequently Answered Questions

1. Are there any health insurance options for salary under AED 5000?

Yes. The government-mandated basic plan costs AED 320 per year for employees. The DHA Essential Benefits Plan starts around AED 560 for domestic staff and low-income workers. Several private insurers also offer plans between AED 1,000 and AED 1,500.

2. Do all employers provide their workers with health insurance?

Yes, starting January 2025, all private sector employers in the UAE must provide health insurance to their employees. This is now mandatory across all seven emirates.

3. How much does a good health insurance cost in the UAE?

For basic coverage, plans start at AED 320 per year. For more comprehensive coverage with higher annual limits (AED 500,000 to AED 1,000,000), expect to pay between AED 1,000 and AED 1,500 per year.

4. Is 5000 AED a good salary in the UAE?

AED 5,000 is considered a modest salary in the UAE. It covers basic living expenses, especially if accommodation and transport are provided. Many low-income workers earn between AED 1,500 and AED 4,999 and still access affordable health insurance through employer plans or basic schemes.

5. How much is the cheapest medical insurance in UAE?

The cheapest medical insurance in the UAE is AED 320 per year for the government-mandated basic employee plan. This covers inpatient, outpatient, chronic conditions, and pre-existing conditions with defined co-payments.

6. Is health insurance mandatory in the UAE?

Yes. Health insurance is mandatory for all residents. Also, employers must cover employees.