In Dubai, insurance is something most people know they need, yet many are not entirely sure how different policies actually work. A very common point of confusion is telling apart health insurance and term insurance. At first glance, they can seem similar because both involve paying premiums and dealing with insurers. However, once you look closer, the difference between health insurance and term insurance becomes quite clear.

Health insurance in UAE is there to help you handle medical expenses during your lifetime. Term insurance, on the other hand, is about protecting your family financially if you pass away unexpectedly. When people start comparing health insurance vs term insurance, they often ask which one is more important. In reality, each one solves a different problem.

Too Long; Didn’t Read (TL;DR)

To quickly compare health insurance and term insurance you need to know:

What Health Insurance Is: Covers medical expenses like hospital stays, doctor visits, tests, and emergencies. Used regularly and often mandatory in Dubai for residents.

What Term Insurance Is: Also known as life insurance, it provides financial support to your family if you pass away during the policy term. It focuses on income protection, not medical costs.

Core Difference: The difference between health insurance and term insurance is purpose: one covers healthcare costs, the other protects dependents financially after death.

Costs and Claims: Health insurance premiums may change over time and pay medical bills. Term insurance premiums are usually fixed and pay a lump sum to beneficiaries.

Best Approach: Health insurance vs term insurance is not a one-or-the-other decision. Many people in Dubai combine both for complete, practical financial protection.

Understanding Health Insurance

This is one of the most relevant types of insurancein Dubai. Medical care in the UAE is high quality, but it is also expensive, which makes health insurance for expats essential rather than optional.

What It Covers

Health insurance is designed to cover a wide range of medical expenses. While coverage depends on the plan and insurer, most policies include:

- Inpatient hospitalization and surgeries

- Emergency treatment and ambulance services

- Doctor consultations and specialist visits

- Outpatient care such as physiotherapy or follow-ups

- Diagnostic services including scans, blood tests, and lab work

- Prescription medication

- Preventive services like vaccinations and annual check-ups

- Maternity care and newborn coverage, depending on the plan

When looking at health insurance vs term insurance, this is where health insurance stands out. It focuses on day-to-day health needs and unexpected medical situations that can arise at any stage of life.

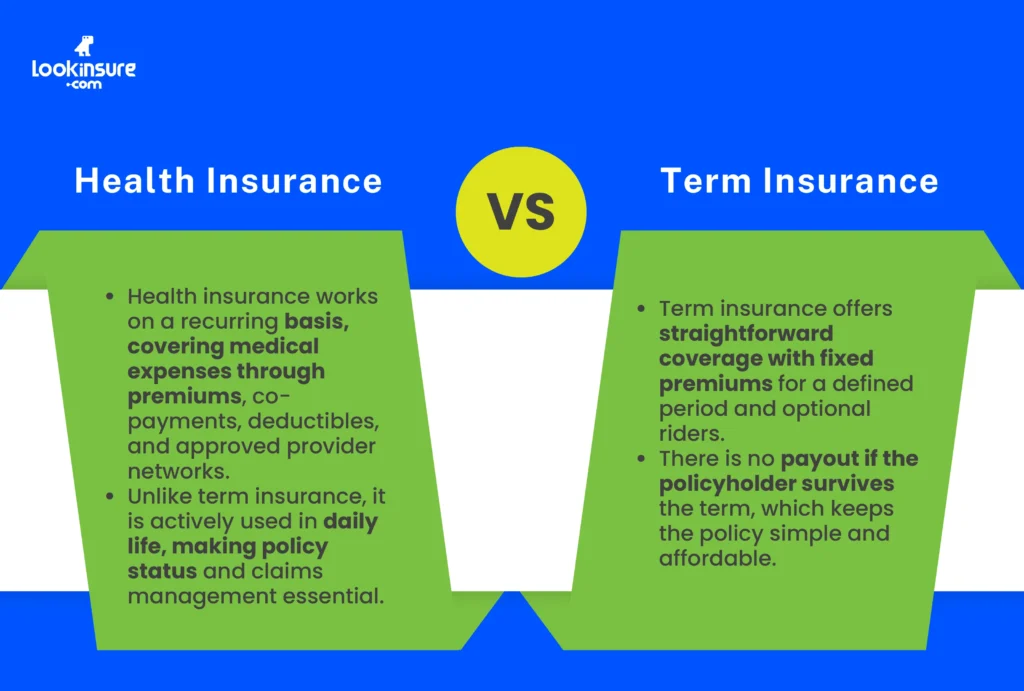

How It Works

Health insurance works on a recurring basis. You pay a premium, usually once a year, and the policy covers eligible medical expenses during that period.

Most plans in Dubai include:

- Co-payments, where you pay a small portion of the bill

- Deductibles, which must be paid before coverage applies

- Approved hospital and clinic networks for cashless treatment

Since claims and policy status matter in everyday use, knowing how to check health insurance online in the UAE helps you avoid surprises at the hospital and keeps your coverage active when you need it most.

This regular interaction with the policy highlights an important difference between health insurance and term insurance, as health insurance is actively used rather than held in the background.

Understanding Term Insurance

Term insurance is a form of life insurance that focuses entirely on financial protection rather than healthcare. It is especially relevant for people who support family members financially.

What It Covers

Term insurance provides life coverage for a fixed period, known as the term. Common terms include 10, 20, or 30 years. If the policyholder passes away during this time, the insurer pays a lump sum to the beneficiaries.

To compare health insurance and term insurance, let’s start with coverage. Term insurance includes:

- A guaranteed death benefit

- Financial support for dependents such as spouses or children

- Optional riders, including critical illness or accidental death

When people compare health insurance vs term insurance, term insurance clearly serves a different role. It does not pay hospital bills or medical costs. Instead, it helps families manage expenses like rent, school fees, and daily living costs after the loss of income.

How It Works

Term insurance is simple by design. You choose:

- The coverage amount

- The length of the policy

- Whether you want additional riders

Premiums are usually fixed for the entire term. If the policyholder survives the policy period, there is no payout. This often raises questions, but it is actually one of the reasons term insurance remains affordable. This simplicity further explains the difference between health insurance and term insurance.

Key Differences Between Health and Term Insurance

To clearly compare health insurance and term insurance, it helps to look at how they differ across key areas.

Compare Health Insurance and Term Insurance

| Aspect | Health Insurance | Term Insurance |

| Primary Purpose | Covers medical expenses | Protects family income |

| Type of Coverage | Healthcare-related costs | Life coverage |

| Premium Structure | May change over time | Usually fixed |

| Claim Type | Medical bills or reimbursement | Lump sum payout |

| Policy Duration | Annual or multi-year | Fixed term |

| Frequency of Claims | Regular or occasional | Rare but significant |

Purpose and Financial Protection

Health insurance protects you from high medical costs, while term insurance protects your family’s financial stability. This core contrast defines the difference between health insurance and term insurance and explains why one cannot replace the other.

Premiums and Costs

Health insurance premiums often increase with age, expanded coverage, or new medical conditions. Term insurance premiums are generally lower and predictable, which helps with long-term planning when weighing health insurance vs term insurance.

Claim Process and Payout

Health insurance claims are frequent and tied to treatment. Term insurance claims are rare but financially substantial. This distinction becomes important when you compare health insurance and term insurance from a risk management perspective.

Policy Duration and Flexibility

Health insurance policies are renewed regularly and adjusted as needs change. Term insurance is locked in for a set period, offering stability rather than flexibility. This again reinforces the difference between health insurance and term insurance.

Choosing the Right Insurance for Your Needs

Choosing between policies depends largely on your personal and financial situation.

Factors to Consider

When evaluating health insurance vs term insurance, consider the following:

- Your age and overall health

- Whether you have dependents

- Your income level and financial obligations

- Long-term plans such as children’s education or property ownership

Someone living alone may prioritize health insurance, while a parent supporting a family may see term insurance as essential.

Combining Policies

In Dubai, many people choose both. Health insurance covers medical expenses, while term insurance ensures financial protection for loved ones. Seeing health insurance vs term insurance as competing options often leads to gaps in coverage.

Using both together allows you to address immediate healthcare needs and long-term financial risks. This combined approach is often the most practical way to compare health insurance and term insurance in real life.

Conclusion

Understanding the difference between health insurance and term insurance helps you make smarter decisions about protection and planning. Health insurance supports your medical needs today, while term insurance protects your family’s future if the unexpected happens.

Rather than choosing one over the other, many people find value in combining both. Take the time to compare health insurance and term insurance carefully, assess your responsibilities, and speak with insurers who understand the UAE market. Once you do, health insurance vs term insurance becomes far less confusing and much more practical.

Frequently Answered Questions

1. What is the main difference between health insurance and term insurance?

The main difference between health insurance and term insurance is purpose: health insurance covers medical expenses, while term insurance provides financial support to your family if you pass away.

2. Can I have both health insurance and term insurance at the same time?

Yes, you can have both at the same time. Many residents choose this approach since health insurance vs term insurance covers very different risks and needs.

3. Which insurance is mandatory or strongly recommended in UAE?

In Dubai, health insurance is mandatory for residents. Term insurance is not required by law but is strongly recommended for anyone with dependents or financial responsibilities.

4. How do premiums differ between health insurance and term insurance?

When you compare health insurance and term insurance, health insurance premiums may increase with age, while term insurance premiums are usually fixed for the chosen policy term.

5. Does term insurance cover medical expenses or just life events?

Term insurance only covers life events, specifically death during the policy term. This is a key difference between health insurance and term insurance many people overlook.

6. How do I decide which insurance is right for me and my family?

To decide between health insurance vs term insurance, review your medical needs, family dependency, income stability, and long-term goals, then choose coverage that matches those priorities.