Among the many providers in the country, health insurance by Orient stands out for its flexible coverage options, wide hospital network, and strong customer support. Whether you are an individual looking for basic medical cover or a business owner searching for group insurance solutions, Orient offers plans that fit different needs and budgets.

In this guide, we explore the features and benefits of Orient health insurance in UAE, highlight the best plans available in the UAE, and explain how to get Orient health insurance with ease.

Overview of Orient Health Insurance

Orient Insurance PJSC is one of the most established insurance providers in the UAE, with decades of experience in delivering reliable and customer-focused insurance solutions. The company offers a broad portfolio that includes motor, travel, home, and medical insurance, with health insurance being one of its strongest segments.

Health Insurance by Orient is designed to meet the healthcare needs of individuals, families, and corporate employees. Their medical plans comply fully with UAE regulations while offering flexible options, wide hospital access, and efficient claims management. Most Orient health policies are administered through trusted third-party administrators (TPAs), ensuring smooth approvals and cashless treatment across a large healthcare network.

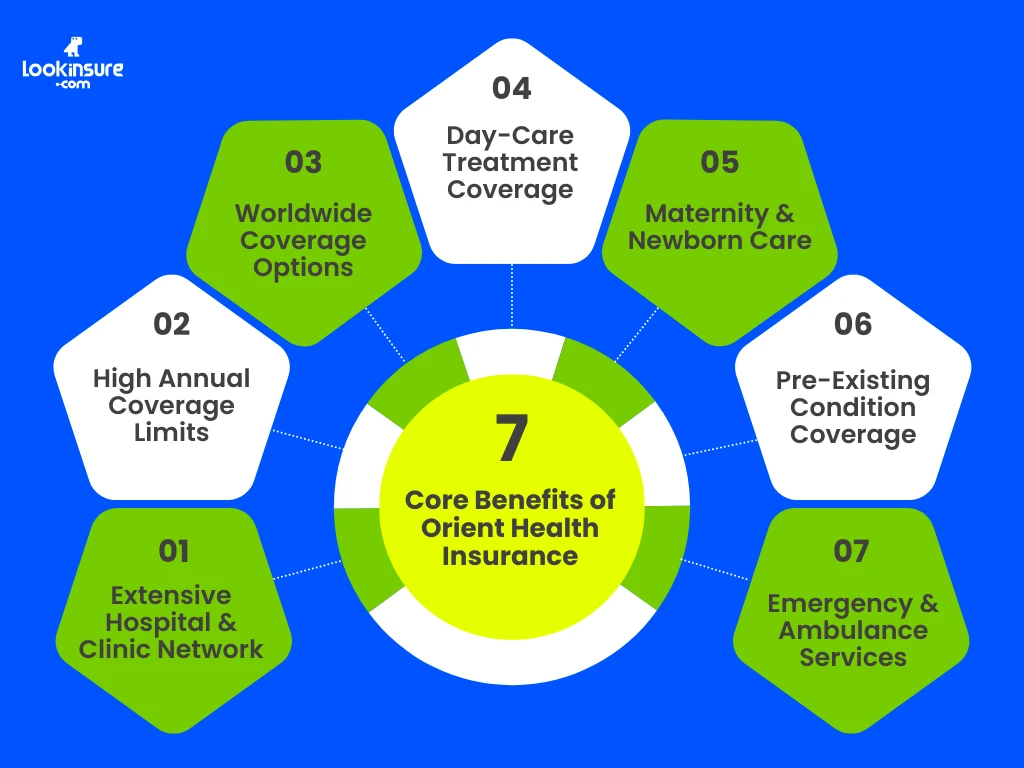

Key Features and Benefits of Orient Health Insurance

Before diving into specific health plans provided by Orient Insurance, it is helpful to understand what sets the company apart. The features and benefits of Orient health insurance go beyond basic coverage, offering a balanced mix of affordability, accessibility, and practical healthcare support.

Below are the standout advantages that make Orient a preferred choice in the UAE.

Extensive Hospital & Clinic Network

Orient provides access to a large network of hospitals, clinics, pharmacies, and diagnostic centers across Dubai, Abu Dhabi, Sharjah, and the Northern Emirates. This allows policyholders to receive treatment without worrying about upfront payments, thanks to direct billing facilities.

High Annual Coverage Limits

Most plans come with annual coverage limits reaching up to AED 1 million, ensuring financial protection against major medical expenses, including surgeries, hospitalization, and long-term treatments.

Worldwide Coverage Options

One of the most attractive features and benefits of Orient health insurance is worldwide coverage. This makes it an ideal health insurance for expats in UAE for frequent travelers or those who prefer access to international medical facilities.

Day-Care Treatment Coverage

Medical procedures that do not require overnight hospitalization, such as endoscopies and minor surgeries, are covered as day-care treatments. This allows faster recovery and lower treatment disruption.

Maternity & Newborn Care

Selected policies include maternity benefits, covering prenatal visits, delivery costs, postnatal care, and newborn treatment, which makes these plans particularly suitable for families.

Pre-Existing Condition Coverage

Pre-existing medical conditions are covered subject to medical underwriting and defined waiting periods. This ensures long-term medical security for individuals managing chronic health conditions.

Emergency & Ambulance Services

Emergency treatment and registered road ambulance services are covered across all plans, offering peace of mind during unexpected medical emergencies.

Best Orient Health Insurance Plans in the UAE

Orient offers individual health insurance and corporate plans. Below is a clear breakdown of the health plans provided by Orient Insurance, based on the official Health Plus policy structure.

Individual Health Insurance Plans

These plans are suitable for:

- Salaried professionals

- Freelancers

- Self-employed individuals

- Families

- Dependents

The Health Plus series offers five individual plans with different coverage levels, hospital networks, and benefits.

Health Plus Individual Plans – Key Comparison

| Plan | Annual Limit | Network | Key Benefits |

| Plan 1 | AED 1 Million | NextCare GN+ | Private room, maternity up to AED 20,000, dental & optical options, worldwide coverage |

| Plan 2 | AED 1 Million | NextCare GN | Private room, maternity up to AED 20,000, pharmacy & diagnostics, outpatient cover |

| Plan 3 | AED 1 Million | NextCare RN | Private room, maternity up to AED 12,500, outpatient consultations, pharmacy cover |

| Plan 4 | AED 1 Million | NextCare RN2 | Private room, maternity up to AED 12,500, limited outpatient benefits |

| Plan 5 | AED 1 Million | NextCare RN3 | Semi-private room, maternity up to AED 10,000, essential coverage |

Key Individual Plan Benefits Include:

- Inpatient hospital treatment

- Emergency services

- Diagnostics including MRI, CT scans, and X-rays

- Prescribed medicines

- Physiotherapy sessions

- Maternity services

- Vaccination for children

- Optional dental and optical benefits

- Psychiatric treatment (on selected plans)

These health insurance by Orient plans offer flexibility, allowing residents to choose coverage based on budget, hospital preference, and family healthcare needs.

Group Health Insurance Plans

Group health insurance plans are designed for:

- Small businesses

- Medium enterprises

- Large corporations

- Employee benefit programs

Group policies allow companies to offer structured healthcare coverage to employees while staying compliant with UAE labor laws.

Key Features of Group Health Insurance Plans

| Feature | Benefit |

| Custom Plan Design | Employers can tailor benefits based on staff needs |

| Flexible Premiums | Cost-effective pricing for bulk coverage |

| Large Hospital Network | Extensive provider access across the UAE |

| Comprehensive Benefits | Inpatient, outpatient, maternity, pharmacy, diagnostics |

| Corporate Discounts | Reduced premiums for large employee groups |

| Fast Claim Settlement | Direct billing through TPA systems |

Features and benefits of Orient health insurance include wellness programs, annual medical check-ups, and expanded outpatient services, helping employers support workforce health and productivity.

How to Get Orient Health Insurance?

Applying for Orient health insurance is simple. Whether you apply directly or through an insurance platform, the steps remain quick and efficient.

Steps to Apply

- Select your desired health insurance based on coverage needs and budget

- Submit personal or company details

- Share Emirates ID and visa copies

- Complete the medical declaration form

- Review premium quotes

- Confirm policy issuance after payment

Required Documents

| Individual Applicants | Corporate Applicants |

| Emirates ID | Trade license |

| Visa copy | Employee visa list |

| Passport copy | Emirates IDs of employees |

| Medical declaration | Staff details & census |

Buying Through Brokers vs Direct Channels

Buying health insurance by Orient directly is more direct, but insurance brokers help compare multiple options, explain benefits clearly, and negotiate better pricing. Brokers also assist with claims handling and how to get orient health insurance policy upgrades.

Role of Platforms Like Lookinsure

Digital insurance platforms such as Lookinsure make buying health insurance easier by allowing users to compare policies, review coverage features, understand exclusions, and purchase plans online. This ensures transparency, speed, and informed decision-making.

Important Notes Before Buying

Before purchasing any health insurance policy, reviewing certain factors carefully can prevent unpleasant surprises later.

Benefits Vary by Policy

Each Orient plan offers different benefit limits, hospital access, and outpatient coverage. Always compare plan details before finalizing your choice.

Waiting Periods

Some benefits, such as maternity and pre-existing condition coverage, are subject to waiting periods. These periods vary depending on underwriting and plan selection.

Exclusions and Limitations

Common exclusions include:

- Cosmetic procedures

- Fertility treatments (IVF)

- Weight-loss surgeries

- Non-medically necessary treatments

- Alternative therapies (unless specifically covered)

- Experimental treatments

Reading policy exclusions helps avoid claim rejections.

Importance of Reviewing Policy Wording Carefully

Policy wording defines coverage scope, limitations, and claim conditions. Reviewing it thoroughly ensures you understand exactly what your insurance covers. Contact Lookinsure support for more information on how to get orient health insurance.

Conclusion

Orient Health Insurance offers a balanced combination of affordability, coverage depth, and healthcare accessibility. With flexible plans for individuals and businesses, strong hospital networks, and efficient claims processing, health Insurance by Orient remains a dependable choice in the UAE medical insurance market.

Whether you are looking for basic medical protection or comprehensive family coverage, the health plans provided by Orient Insurance offer solutions that can adapt to diverse healthcare needs, making Orient a reliable partner for long-term medical security.

Frequently Answered Questions

1. Why should I choose Orient health insurance in UAE?

Orient Health Insurance offers wide hospital access, flexible plan choices, competitive pricing, and reliable claims service. Their plans suit individuals, families, and companies, making them one of the most dependable insurers in the UAE.

2. How much do Orient health insurance policies cost?

Premiums depend on age, medical history, coverage level, and hospital network. Basic health insurance by Orient starts from affordable rates, while premium policies offer higher limits and expanded benefits at higher costs.

3. Which hospital accepts Orient insurance in Dubai?

Orient policies are accepted at a wide range of hospitals and clinics across Dubai, including facilities within the NextCare GN, GN+, RN, RN2, and RN3 networks.

4. Orient health insurance UAE contact number?

For direct assistance, customers can contact Orient Insurance through their official customer service number 800 674368 (ORIENT) or through their website, consult licensed brokers and insurance platforms for policy inquiries and support.

5. What types of insurance does Orient offer?

Orient Insurance offers a wide range of insurance solutions, including health insurance for individuals and families, property insurance to protect assets, corporate medical insurance for businesses, energy and engineering insurance for specialized industries, marine insurance for shipping and transport, miscellaneous insurance for unique risks, and motor insurance for vehicles.