Shariah compliant health insurance known as Takaful is a form of medical insurance in UAE coverage based on cooperation and shared responsibility, where members contribute to a common fund that is used to help anyone in the group who needs medical care.

This type of insurance is especially relevant in the UAE, a country with a diverse population and a strong emphasis on ethical finance. Shariah compliant medical insurance answers both concerns by offering medical protection built on cooperation rather than profit-driven risk transfer.

In this article, we’ll cover all aspects of this type of health insurance and answer your questions.

Too Long; Didn’t Read (TL;DR)

- Shariah compliant health insurance (Takaful) is a cooperative system where participants contribute to a shared fund to support one another’s medical costs, rather than transferring risk to a profit-driven insurer.

- Contributions are treated as donations, the fund is owned by participants, and the operator only manages it, which creates greater transparency, shared responsibility, and ethical oversight.

- Takaful avoids interest, excessive uncertainty, and speculative practices, focusing instead on fairness, clear contracts, and mutual support in healthcare coverage.

- In the UAE, shariah compliant medical insurance is legally recognized, open to both Muslims and non-Muslims, and appeals to those who value ethical finance alongside practical medical protection.

Definition of Takaful Health Insurance

The word Takaful comes from an Arabic root that means “to support one another.” In health insurance, it refers to a cooperative arrangement where participants contribute money into a shared pool. This pool is then used to pay for medical expenses when any member falls ill or needs treatment.

What Does Tabarru’ Mean in Shariah Compliant Medical Insurance?

One important concept is Tabarru’, which means donation. The money participants pay is treated as a voluntary contribution rather than a price paid for a service. This distinction matters because it changes the relationship between the participant and the system. You are not purchasing protection from a company; you are contributing to a fund that exists to help everyone in the group.

Because of this structure, the money paid is called a “contribution”, not a premium. A premium suggests a transactional sale, while a contribution reflects shared responsibility.

The Role of Takaful Operators

Participants are the owners of the Takaful fund. The Takaful operator, on the other hand, acts as a manager. Their job is to administer the fund, process claims, and ensure everything runs according to agreed rules.

The operator does not own the fund and cannot treat it as company money. This separation is one of the key differences that makes Takaful easier to trust for people who care about fairness and transparency.

Difference Between Takaful and Conventional Health Insurance

While both systems aim to cover medical costs, the way they work behind the scenes is very different.

| Aspect | Takaful Health Insurance | Conventional Health Insurance |

| Ownership of funds | Owned collectively by participants | Owned by the insurance company |

| Risk model | Risk is shared among participants | Risk is transferred to the insurer |

| Purpose | Mutual support and protection | Profit-driven business model |

| Claims payment | Paid from the shared Takaful fund | Paid from company-controlled funds |

| Governance | Ethical oversight and clear rules | Commercial and regulatory oversight |

In simple terms, conventional insurance is a contract where you transfer risk to a company. Takaful is an agreement where everyone carries the risk together.

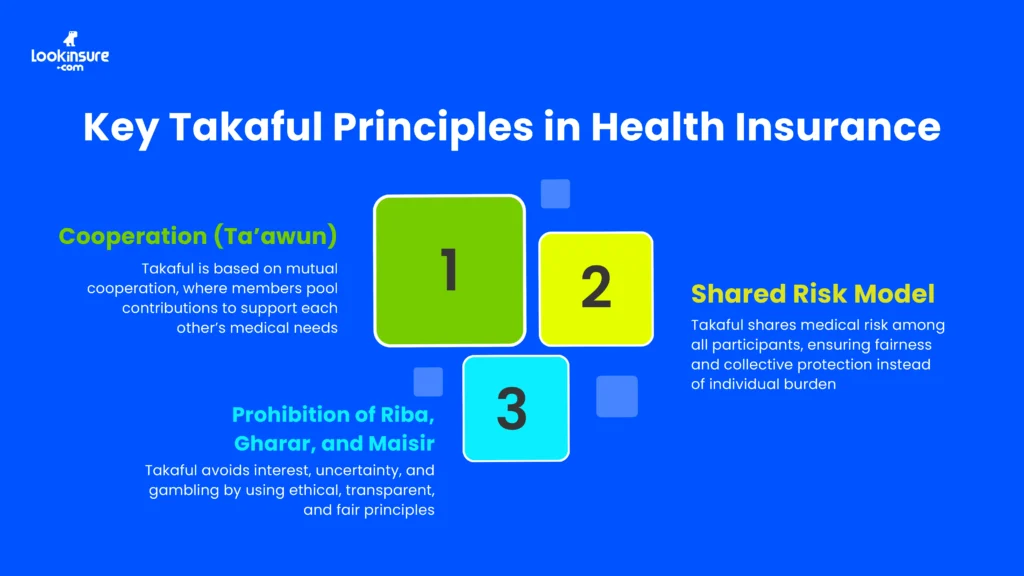

Core Principles of Takaful in Health Insurance

The strength of Takaful lies in a few guiding principles that shape how the system behaves in real life.

Cooperation (Ta’awun)

Cooperation is the heart of Takaful. Every participant contributes with the intention of helping others, not just themselves. When someone needs medical treatment, the cost is covered by the collective contributions of the group.

Shared Risk Model

In Takaful, risk is spread across all participants. No single person carries the full financial burden of unexpected medical expenses. If claims are high one year, the impact is shared rather than falling on one unlucky individual.

This model promotes fairness because everyone contributes according to agreed terms, and everyone benefits from the same protection. It also creates stability, as the system is not designed to profit from someone else’s misfortune.

Prohibition of Riba, Gharar, and Maisir

These three concepts often sound complicated, but their meanings are quite practical.

- Riba refers to interest-based gains. Takaful avoids earning money through interest, focusing instead on ethical investment and fund management.

- Gharar means excessive uncertainty. Takaful contracts aim to be clear and straightforward, so participants know what they are agreeing to.

- Maisir refers to gambling or speculation. Takaful avoids arrangements where one party gains purely by chance while another loses.

By avoiding these elements in Shariah compliant medical insurance, the system stays focused on protection rather than profit or speculation.

How Shariah Compliant Health Insurance Works in the UAE

In the UAE, Takaful health insurance operates within the DHA Health Insurance requirements while staying true to its cooperative roots. Let’s see how exactly:

Contribution to the Takaful Fund

Participants make regular contributions to the Takaful fund. These payments are considered donations meant to support the group as a whole. The operator manages the fund, keeping records, arranging coverage, and ensuring claims are paid correctly.

The fund itself is kept separate from the operator’s own finances, which adds an extra layer of trust and accountability.

Claim Process and Medical Coverage

When a participant needs medical care, the process is usually simple. The individual visits a healthcare provider within the approved medical network. The provider submits the claim, and the Takaful operator reviews it based on the agreed policy terms.

Once approved, the cost is paid from the shared fund. From the participant’s point of view, the experience is similar to conventional insurance, but the underlying financial structure is very different.

Surplus Distribution

Sometimes, the total contributions collected are more than the amount needed to pay claims and cover operating costs. This excess is called a surplus.

In a Takaful system, surplus does not automatically become profit for the operator. Depending on the arrangement, it may be retained in the fund for future stability or distributed back to participants. This approach reinforces the idea that the system exists for the benefit of its members.

Benefits of Shariah Compliant Medical Insurance

There are several reasons why people choose Shariah compliant medical insurance, especially in a multicultural environment like the UAE.

Ethical and Religious Compliance

For individuals who care deeply about ethical finance, Takaful offers peace of mind. The structure aligns with Islamic values while still providing modern healthcare protection.

Transparency and Fairness

Clear rules, defined roles, and transparent fund management help reduce confusion and disputes. Participants know where their money goes and how decisions are made.

Community-Based Protection

Takaful strengthens social bonds by encouraging people to look out for one another. In healthcare, this sense of solidarity can be especially powerful.

Shariah Compliant Health Insurance Companies in the UAE

Several providers operate in this space, offering cooperative health coverage while following ethical guidelines. These following shariah compliant health insurance companies in the UAE play an important role in expanding access to Takaful-based healthcare solutions.

Takaful Emarat

This company focuses on cooperative insurance models and offers health-related Takaful solutions designed around mutual support.

Salama Insurance

Salama has a long-standing presence in the Shariah compliant insurance market in the UAE. The company is known for offering inclusive coverage options while maintaining ethical oversight.

Sukoon Takaful

Formerly known as ASCANA, Sukoon Takaful operates with a focus on ethical finance and cooperative insurance principles.

Methaq Takaful

Methaq is recognized for fair pricing. Its health-related offerings follow Takaful principles and focus on long-term participant benefit rather than short-term gain.

You can get quotes from these providers all at once with just a few clicks:

Who Can Get Shariah Compliant Health Insurance?

One common question is who this type of insurance is actually meant for. Should you be a Muslim to get Shariah compliant health insurance or not?

Is It Only for Muslims?

No. Shariah compliant health insurance is open to everyone. There is no religious requirement to join, and participants are not expected to follow any specific beliefs. The system is ethical in nature, not exclusive.

Why Non-Muslims Choose Takaful

Many non-Muslims are drawn to Takaful because of its transparent structure, shared-risk model, and community-focused approach. For people who value fairness and clarity in financial arrangements, Takaful can be an appealing alternative.

Is Shariah Compliant Health Insurance Right for You?

Choosing the right health insurance depends on both practical needs and personal values. If ethical considerations, transparency, and shared responsibility matter to you, Takaful may be a good fit.

On the other hand, if your priorities are purely cost-based or tied to very specific coverage features, it is worth carefully reviewing how different models align with your expectations. Lifestyle, healthcare usage, and personal beliefs all play a role in this decision.

Conclusion

Shariah compliant health insurance is built on the idea that people are stronger when they support one another. Through shared contributions, transparent management, and ethical oversight, Takaful provides medical protection without relying on profit-driven risk transfer.

Whether chosen for religious, ethical, or practical reasons, Takaful health insurance offers a fair and cooperative approach to healthcare coverage that puts people, not profits, at the center.

Frequently Answered Questions

1. Is Shariah Compliant Health Insurance legally recognized in the UAE?

Yes, it operates within the UAE’s regulatory framework and is officially recognized.

2. What is the main difference between Takaful and conventional health insurance?

Takaful is based on shared risk and participant-owned funds, while conventional insurance transfers risk to a company.

3. Can non-Muslims apply for Shariah Compliant Medical Insurance?

Yes, it is open to everyone regardless of religious background.

4. Are medical claims handled differently under Takaful plans?

The process is similar, but claims are paid from a shared fund rather than company-owned money.

5. Is Shariah Compliant Health Insurance more expensive than traditional insurance?

Not necessarily. Costs depend on coverage and healthcare needs rather than the ethical model itself.

6. What happens if there is a surplus in the Takaful fund?

The surplus may be retained for future stability or distributed among participants, depending on the structure.