As expats, health insurance in the UAE, particularly in Dubai, can be confusing. The rules are strict and constantly updated. That’s why staying informed about new Dubai health insurance for expats 2026 requirements, coverage rules, and mandatory employer obligations are so important.

This Health insurance Dubai expatriate guide simplifies the available plans, prices, and coverage options to help you choose the right UAE health insurance for expats.

Too Long; Didn’t Read (TL;DR)

Here is the summary of our health insurance Dubai expatriate guide:

- Health insurance is mandatory for all Dubai residents for visa processing and renewal.

- Employers must provide insurance for employees, but expats must cover their dependents (spouse and children).

- A new federal health insurance scheme offers basic coverage for around AED 320 annually for certain residents in the Northern Emirates.

- Plan costs vary significantly: Basic (AED 500-800), Standard (AED 3,000-7,000), Comprehensive (AED 8,000-20,000+).

- Always check policy details for pre-existing condition waiting periods, network hospitals, and common exclusions.

- Use comparison tools to find the best Dubai health insurance for expats 2026 for your needs.

Overview of UAE Health Insurance for Expats (2026 Update)

The framework is built on a simple principle: all residents must have coverage. For expats, this involves employer-provided policies and personal policies for family members under DHA regulations. This Health insurance Dubai expatriate guide helps you find compliant and suitable coverage.

Mandatory health insurance rules for all residents

The mandatory health insurance Dubai means no insurance = no residency. This applies to all expatriates in Dubai, including primary visa holders, spouses, children, and domestic helpers. Employers must provide coverage for employees, while expats must buy insurance for their dependents. If you need more details, check out our guide on how to choose health insurance for expats in UAE.

Who must buy their own private insurance?

Many expats need to arrange their own insurance. This includes:

- Those sponsoring family members

- Freelancers and self-employed individuals

- Investors

- People with insufficient employer-provided coverage

Key changes expected in 2026 for Dubai expats

While specific changes are still subject to change, trends from 2025 predict:

- Wider implementation of the federal basic health insurance scheme

- Continued enhancement of basic coverage standards

- Potential new inclusions in minimum benefits

- Possible premium adjustments due to medical inflation

Why Health Insurance Is Mandatory for Expats in Dubai

The mandatory health insurance Dubai enforces ensures a stable healthcare framework for all residents. It prevents public hospitals from becoming overwhelmed and ensures people can access necessary treatment without financial hardship. These health insurance laws UAE create a sustainable healthcare ecosystem that benefits the entire community.

Legal requirements for visa renewal

Health insurance proof is as crucial as your passport for visa renewal. Government service centers require valid insurance documentation that meets DHA standards before processing any visa application. Without proper Dubai visa health insurance, visa renewal will be rejected.

DHA minimum coverage obligations

The DHA specifies minimum coverage through the Essential Benefits Plan (EBP), which includes:

- Doctor consultations

- Emergency hospital treatment

- Basic medications

- Limited maternity care

However, these basic plans have annual limits and restricted networks.

Fines for not having valid health insurance

What happens if you let your policy lapse? The authorities take it seriously, and so should you. While the exact figures can be updated, failing to maintain valid health insurance can lead to some pretty stiff fines. These fines are typically imposed on a monthly basis for as long as you remain uninsured. In some cases, it can even lead to a block on your visa, preventing you from renewing it or leaving the country until the fines are cleared and a new policy is activated.

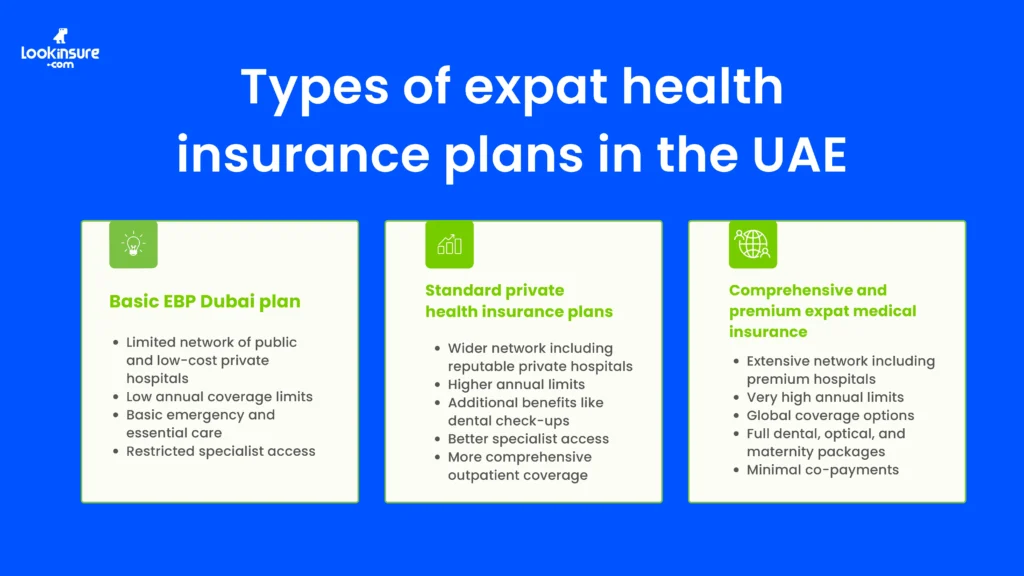

Types of Health Insurance Plans for Expats in UAE

Let’s go over the available options of UAE health insurance for expats:

Basic EBP Dubai plan (Essential Benefits Plan)

This is the Dubai health insurance for expats 2026 laws require. Its features include:

- Limited network of public and low-cost private hospitals

- Low annual coverage limits

- Basic emergency and essential care

- Restricted specialist access

Standard private health insurance plans

These mid-range plans offer:

- Wider network including reputable private hospitals

- Higher annual limits

- Additional benefits like dental check-ups

- Better specialist access

- More comprehensive outpatient coverage

Comprehensive and premium expat medical insurance

If you want the best of the best, this is the category for you. Comprehensive plans are designed for expats who want maximum freedom and the highest standard of care. Top-tier plans provide:

- Extensive network including premium hospitals

- Very high annual limits

- Global coverage options

- Full dental, optical, and maternity packages

- Minimal co-payments

Key Coverage Benefits Expats Should Look For in 2026

When comparing Dubai health insurance for expats 2026 plans, focus on these benefits:

Inpatient & outpatient coverage

- Inpatient: This covers you for when you need to be admitted to a hospital (i.e., you need a bed). This is non-negotiable and should be included in every plan.

- Outpatient: This covers everything else. Doctor’s visits, specialist consultations, and tests done without being admitted. Some cheaper plans try to limit this coverage, so make sure you have a decent outpatient limit.

Pre-existing conditions & waiting periods

Most policies impose 6-12 month waiting periods for pre-existing conditions. Some insurers offer immediate coverage with higher premiums.

Chronic illness and long-term treatments

Coverage for conditions like diabetes, asthma, and hypertension, including:

- Regular medication

- Specialist consultations

- Ongoing monitoring

Emergency and ambulance services

You want to be sure that in a real emergency, you can get to the hospital without worrying about the cost. A solid plan will cover the full cost of an emergency ambulance service. This is one of those things you hope you never need, but you’ll be incredibly grateful it’s there if you do.

Maternity & newborn cover

If you’re planning to start or expand your family, this is essential. Maternity packages vary widely. Some basic plans only cover childbirth complications, while comprehensive plans cover everything from prenatal checks to delivery and postnatal care. Also, check if the policy automatically covers your new baby for the first 30 days, which is a standard requirement under health insurance laws UAE.

Expected Costs of Expat Health Insurance in Dubai (2026)

Understanding cost factors helps budget for your expat medical insurance UAE.

| Plan Type | Annual Cost (Individual) | Key Features |

| Basic EBP | AED 500 – 800 | Minimum coverage, limited network |

| Standard Private | AED 3,000 – 7,000 | Wider network, higher limits |

| Comprehensive | AED 8,000 – 20,000+ | Premium hospitals, extensive benefits |

Factors affecting premiums for expats

- Age: This is a big one. The older you are, the higher the premium, as the risk of health issues increases.

- Medical History: Your personal health background plays a role.

- Lifestyle: Smokers will pay significantly more for their insurance.

- Coverage Level: Higher annual limits and more add-ons (like dental) will increase the price. Health insurance for parents, for example, increases costs significantly.

- Network: Plans that include premium hospitals in their network will cost more.

Expected price changes in 2026

It’s difficult to predict exact numbers, but the general trend in the insurance market is for a slight annual increase. This is due to factors like medical inflation (the cost of treatments and medicines going up) and the DHA potentially expanding the minimum coverage requirements. So, when you’re budgeting for your expat medical insurance UAE policy in 2026, it would be wise to factor in a potential small increase of 5-10% from current prices.

For more accurate prices and quick quotes from multiple providers click below:

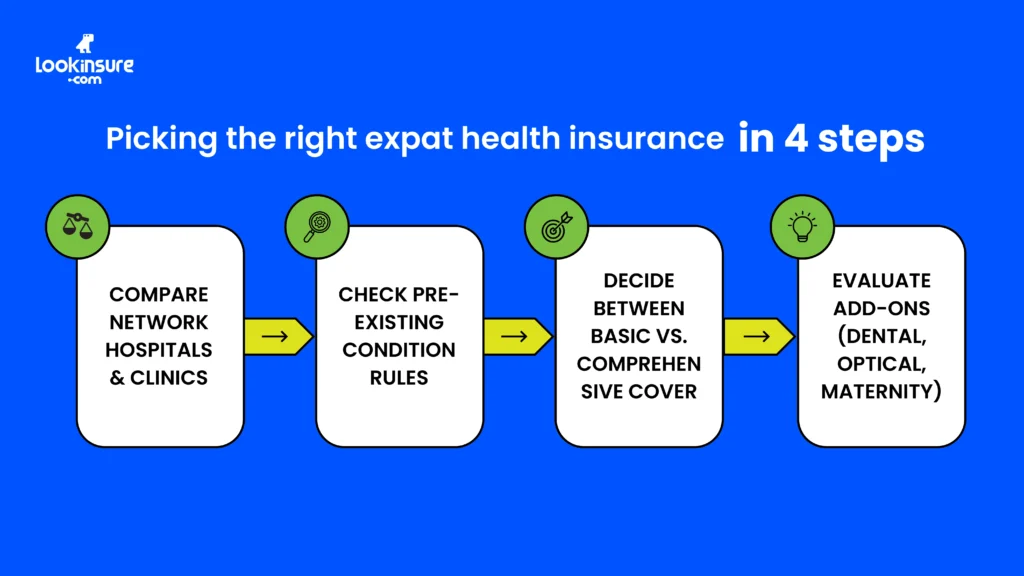

How to Choose the Right Health Insurance as an Expat

Selecting the right UAE health insurance for expats requires careful consideration of several factors.

Compare network hospitals & clinics

- Check if preferred hospitals are in-network

- Verify proximity to home and work

- Assess specialist availability

- Review hospital quality ratings

Check pre-existing condition rules

- Understand waiting period durations

- Check disclosure requirements

- Compare coverage options post-waiting period

- Consider specialized plans if needed

Decide between basic vs. comprehensive cover

- Basic: Minimum legal compliance, lower cost

- Comprehensive: Better access, higher comfort, more expensive

- Consider health status and risk tolerance

Evaluate add-ons (dental, optical, maternity)

- Assess actual need versus cost

- Compare standalone cost versus package inclusion

- Check sub-limits and waiting periods

- Consider family needs

How to Buy Health Insurance in UAE as an Expat

The purchasing process for Dubai health insurance for expats 2026 is straightforward with proper preparation.

Buying through licensed aggregators

- Compare multiple plans simultaneously

- Access expert advice

- Transparent price comparison

- Time-efficient process

Buying directly from insurers

- Direct customer relationship

- Potential loyalty benefits

- Straightforward claims process

- Company-specific promotions

Required documents for expat medical insurance

- Passport copy

- UAE residence visa

- Emirates ID

- Previous insurance details (if any)

Health Insurance Claim Process for Expats in Dubai

Knowing how to actually use your insurance is just as important as having it. There are two main ways claims are handled, and understanding the difference will make your life much easier if you ever need treatment.

Cashless treatment at network hospitals

This is the easiest way. You just go to a hospital or clinic within your network, show them your insurance card and Emirates ID, and they will handle all the billing directly with the insurance company. You won’t have to pay anything upfront (unless for a small co-payment, if your plan has one). It’s a hassle-free experience.

Reimbursement claims

What if you go to a non-network hospital, or have an emergency while traveling? You will have to pay the medical bills yourself first. Then, you gather all the original receipts, doctors’ reports, and discharge summaries and submit them to your insurance company to get your money back. This process can take a few weeks.

Claim rejection reasons & how to avoid them

Claims usually get rejected for a few common reasons:

- Treatment was for an excluded condition (like a pre-existing condition within the waiting period).

- You went to a non-network hospital without authorization (unless it was a genuine emergency).

- The treatment wasn’t medically necessary or was considered elective.

- You didn’t get pre-approval for a planned hospitalization.

The best way to avoid rejection? Always read your policy document and call your insurer’s pre-approval hotline before any planned treatment.

Common Inclusions & Exclusions for Expat Plans in UAE

Understanding the details of UAE health insurance for expats prevents unexpected coverage gaps.

Standard inclusions

Most decent plans will cover the essentials:

- Doctor and specialist consultations

- Hospital room and board

- Surgery and anesthesia

- Diagnostic tests (X-rays, blood tests)

- Emergency accident coverage

- Basic maternity care (varies by plan)

- Medication prescribed by a doctor

Common exclusions

Insurers typically will not cover:

- Cosmetic surgery (unless medically necessary)

- Experimental treatments

- Dental and optical (unless added as an extra)

- Pre-existing conditions during the waiting period

- Injuries from dangerous sports or illegal acts

Waiting periods to expect in 2026

Waiting periods are a standard part of health insurance laws UAE and are unlikely to change. Expect:

- Pre-existing conditions: 6 to 12 months.

- Maternity: Usually 10 to 12 months. This means if you get pregnant soon after buying a plan, the delivery won’t be covered.

- Specific treatments: Some surgeries like for hernias or tonsillitis might have a short 1-2 month waiting period.

Why Choose Lookinsure for Expat Health Insurance

In a market with so many options, having a helping hand can make all the difference. We offer the following features:

Compare plans instantly

- Side-by-side plan comparison

- Transparent pricing display

- Easy benefit comparison

- Time-saving research tool

Support team for expats

- Expert guidance on DHA requirements

- Assistance with document preparation

- Claims support

- Multilingual customer service

Transparent pricing and DHA-approved policies

- No hidden fees

- All plans DHA-compliant

- Clear terms and conditions

- Verified insurer partnerships

Conclusion

As 2026 approaches, having appropriate health insurance remains just as important as last year for expats in the UAE. The right plan ensures following health insurance Dubai regulations while providing access to quality healthcare.

By comparing policies, understanding coverage details, and considering future needs, expats can get coverage for themselves and their families. Using reliable comparison services like Lookinsure makes finding the right Dubai health insurance for expats 2026 coverage straightforward and efficient.

Frequently Asked Questions

1. How much does expat medical insurance cost in Dubai?

UAE health insurance for expats costs from AED 500 for basic plans to AED 20,000+ for comprehensive coverage, depending on age, coverage level, and health status.

2. Is health insurance still mandatory for visa renewal in Dubai?

Yes, valid health insurance remains mandatory for all residency visa applications and renewals in Dubai.

3. What type of health insurance is best for expats with pre-existing conditions?

Comprehensive plans with reasonable waiting periods or specialized plans that cover pre-existing conditions from inception are ideal, though typically more expensive.

4. What are the major exclusions expats should be aware of?

Common exclusions include cosmetic surgery, experimental treatments, dental/vision (unless specified), and pre-existing conditions during waiting periods.

5. Do employers have to provide health insurance for expats in Dubai?

Yes, employers are legally required to provide health insurance for all their employees.

6. Are dependents (wife & kids) covered under employer insurance?

Sometimes, but often expats must buy separate coverage for their dependents. Check your employment contract and with HR for specific company policies.