Car Insurance in UAE

Flexible installments to pay later with

And

Regulated by the Government of Dubai

AIG is a well-known provider of car insurance in the UAE, offering a range of options designed to meet the needs of drivers across the region. With a strong local presence, AIG aims to deliver reliable and tailored solutions for individuals and businesses alike.

Why Choose AIG Car Insurance in UAE

American International Group (AIG) brings 100+ years of global expertise to UAE roads, offering specialized motor coverage since 1976. As a Fortune 500 insurer with AA financial strength ratings, AIG motor insurance provides:

Global Protection: Coverage extends to 80+ countries

EV Specialization: Battery and charging system coverage

High-Risk Driver Solutions: Custom plans for sports/exotic cars

Digital Innovation: AI-powered claims assessment

Regional Highlights:

Dubai DIFC headquarters since 2006

24/7 multilingual claims support (Arabic/English/Hindi)

Partnered with 150+ UAE repair facilities

AIG auto insurance aims for ultimate transparency by enabling its costumer to have access to every detail of their insurance plans on their website, in the section dedicated to car insurance policy wording, available as a PDF file.

Types of AIG Car Insurance in Dubai

AIG motor insurance plans are available in different types, each of which providing drivers with a specific coverage. If you are looking for car insurance in Abu Dhabi, Dubai or other cities in the UAE, here are the three main types of policies available to you.

| Feature | Platinum Comprehensive | Essential Comprehensive | Third-Party Plus |

|---|---|---|---|

| Third-Party Liability Limit | AED 5,000,000 (property damage) + court-determined bodily injury | AED 5,000,000 (property damage) + court-determined bodily injury | AED 1,000,000 (property damage) + court-determined bodily injury |

| Own Vehicle Damage Cover | ✔ Included (loss, accident, fire, theft, malicious damage) | ✔ Included (loss, accident, fire, theft, malicious damage) | ✘ Not included |

| Agency Repairs | ✔ Manufacturer-authorized repairs (up to 1 year standard / up to 5 years optional) | ✘ Not included (non-agency repairs) | ✘ Not included |

| OEM / New Parts | ✔ Yes (subject to depreciation rules; waiver options available) | Limited (subject to depreciation) | ✘ Not applicable |

| Depreciation Waiver | ✔ 6 months included / 12 months optional | Optional | ✘ Not applicable |

| Geographical Coverage | UAE + GCC (up to 60 days per trip) | UAE + GCC (up to 60 days per trip) | UAE only |

| Roadside Assistance | ✔ AAA Gold (UAE + GCC, unlimited call-outs) | ✔ AAA Gold (UAE + GCC, unlimited call-outs) | Limited |

| Personal Accident Cover | Optional (Driver & Passengers up to AED 200,000) | Optional | ✔ Included (basic level) |

| Emergency Medical Expenses | ✔ Up to AED 6,000 per person | ✔ Up to AED 6,000 per person | ✘ Not included |

| Personal Effects Cover | ✔ Up to AED 5,000 | ✔ Up to AED 5,000 | ✘ Not included |

| Off-Road Cover (4x4) | Optional (with additional excess) | Optional | ✘ Not included |

| Natural Perils (Flood, Storm, Hail) | Optional | Optional | ✘ Not included |

| Car Hire / Cash Benefit | Optional (standard or luxury hire) | Optional | ✘ Not included |

| Best For | Luxury & high-value vehicles | Family cars & daily-use SUVs | Budget-conscious drivers needing enhanced liability |

Benefits and Coverage of AIG Car Insurance

Buying an AIG car insurance policy comes with a few advantages:

Comprehensive Coverage Options

AIG automobile insurance provides full coverage to drivers by offering different comprehensive coverage policies. These policies include third-party liabilities, fire and theft coverage, collision and natural disasters coverage, and more.

Customization

AIG car insurance plans are customizable and flexible. This feature enables customers to tailor their policies according to their own needs. Drivers can enhance coverage in certain areas, adjusting their policy to suit their requirements.

Wide Network of Garages

By gaining an excellent reputation worldwide, AIG motor insurance company partners with a vast network of garages across the GCC region to provide immediate repair access to all policyholders.

Global Assistance

Global assistance is one of the most unique features of AIG motor insurance plans. Considering AIG’s international reach, policyholders can access global assistance from the company, even while driving in other countries.

Customer Support

Customer support is one of AIG's key priorities. AIG ensures you get all the necessary protection by keeping its policyholders satisfied.

Additional Coverage Options

By offering plenty of add-ons, you can make alterations to AIG car insurance policy and add coverage.

What is Covered Under AIG Car Insurance?

With AIG Car Insurance plans, drivers in the UAE get wide-ranging protection designed for both daily commutes and unexpected events, ensuring peace of mind on the road.

Collision damage (at-fault & not-at-fault)

Theft, vandalism, fire

Sandstorm/flood damage

Third-party property damage (up to AED 10M)

Personal accident cover (driver: AED 300K)

Add-ons for AIG Car Insurance Plans

AIG Motor Insurance Plans come with optional add-ons, allowing customers to customize their coverage based on lifestyle and driving habits.

Global Drive: 180-day international coverage extension

Zero Depreciation: Full claim settlement for cars <4 years

Track Day Coverage: Circuit racing protection

EV PowerGuard: Battery & charging system warranty

Concierge Assistance: VIP claims handling

Sandstorm Shield: Engine deep-cleaning post-storms

What is NOT Covered Under AIG Motor Insurance Plans?

While AIG Motor Insurance Plans offer broad coverage, certain exclusions apply, making it important for drivers to review policy terms carefully.

What's Excluded:

Wear & tear depreciation

Mechanical breakdowns

Racing accidents (without add-on)

Off-road desert damage

Deliberate acts

Documents Required to Buy AIG Car Insurance in Dubai, UAE

When you want to buy an AIG car insurance online or in person, you will need to To get your AIG insurance, you will need the following documents:

- Emirates ID (for residents)

- Copy of visa and passport (for expatriates)

- Bank statements

- Driving license

- Vehicle registration card

How to Report Claims for AIG Insurance?

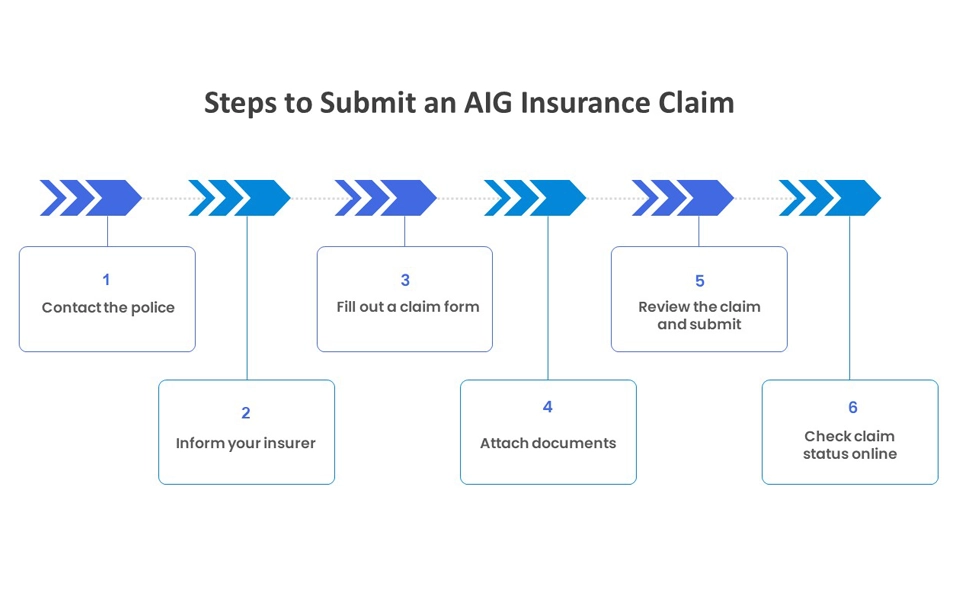

Filing a claim on an AIG car insurance policy is basically the most important part of having an insurance, so it is important to know the ins and outs of this process. Here are the steps involved:

To raise a claim on your AIG car insurance, follow the steps below;

Contact the police

After an accident, call the police immediately. It is also essential to receive police reports as evidence.

Inform your insurer

Let your insurer know about the accident.

Fill out a claim form

Fill out the claim form available on Lookinsure’s website

Attach documents

Attach necessary documents, including a police report.

Review the claim and submit

Review your claim form and submit it.

Check claim status online

You will be able to check your claim status on Lookinsure’s website.

Documents Required to Claim AIG Car Insurance in UAE

Having the proper documentation is very important when filing a claim on your AIG car insurance policy. Missing any of the items listed below can cause delays in the process.

- Police report

- 360° damage video

- Repair estimates

- AIG policy number

How to Renew Car Insurance Online with AIG Insurance?

Just as you can buy AIG car insurance online, AIG car insurance renewal online is also simple and convenient through Lookinsure. To renew your AIG motor insurance with Lookinsure, follow these steps:

Go to Lookinsure’s website

Open your browser and visit the official Lookinsure webpage to start the renewal process.Click on "Get Quote"

On the homepage, select the “Get Quote” option to proceed.Choose "Renew"

From the available options, click on “Renew,” which appears as the first choice.Enter your car information

Provide your car details either by using the chassis number, which is the easiest method, or by manually entering the make and model of your vehicle.Select your preferred policy

Browse the list of available options from multiple providers and choose the policy that best suits your needs.Review and confirm your renewal

Check all details carefully, update any necessary information such as coverage or personal data, and confirm your renewal.Make the payment securely

Complete the renewal by paying through one of Lookinsure’s secure payment methods.Receive confirmation

After payment, you will receive a confirmation of your renewed policy via email or in your Lookinsure account.

Can I Buy AIG Car Insurance in Installments?

Yes. AIG car insurance can be paid in installments through Tabby car insurance and Tamara car insurance, both leading buy-now-pay-later services in UAE.

Both services let you split the premium into 4 interest-free payments, so you don’t have to pay the full amount upfront. The best thing is that your policy will be activated immediately and NOT after all payments are made!

Why Buy AIG Car Insurance Policy in UAE?

Here is why buying an AIG car insurance policy can be a good option for UAE drivers:

Global Leader: $50B+ in assets

Exotic Vehicle Experts: Ferrari/Lamborghini specialists

EV Innovation: Battery degradation coverage

Digital First: AI claims processing

Financial Strength: AA-rated by S&P

AIG Car Insurance Contact Number and Information

For car insurance inquiries only, you can contact AIG through the following channels:

Phone: 0818 244 244

Email:[email protected]

These contact details are dedicated to AIG car insurance support, including quotes, policy questions, and renewals.

American International Group or AIG Reviews

AIG’s car insurance policies receive strong endorsement from many policyholders — more than three in four customers say they would recommend AIG to others, and the provider earns a high overall rating on independent review platforms, reflecting generally positive experiences with pricing, coverage, and service.