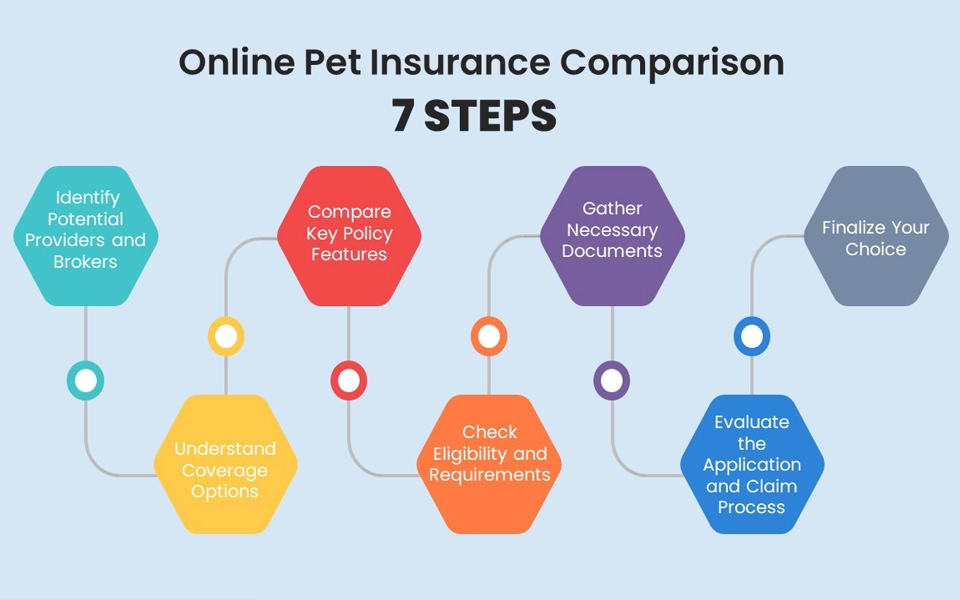

Veterinary costs continue to rise alongside growing pet ownership in the country. This makes pet insurance in the UAE a must-have to cover the routine expenses of your furry companion. The expansion of digital platforms for brokers and providers makes it easier to compare pet insurance online, which has become an essential responsibility for pet parents.

With varying pet insurance UAE coverage options, policy features, and provider networks, selecting the right plan requires a thorough comparison of pet insurance providers. This comprehensive guide provides a step-by-step pet insurance comparison checklist designed for UAE residents, helping you make an informed decision that balances cost, coverage, and convenience for your furry family member.

Step 1: Identify Potential Providers and Brokers

The first thing you’ll need to know is try to familiarize yourself with some of the most known pet insurance companies in the UAE, especially those in your own city.

Research Local Providers

Begin your pet insurance comparison by identifying reputable providers operating in the UAE market. Well-established insurers such as MetLife Gulf offer specialized pet insurance products that cover medical exams, diagnostics, unexpected accidents, and illnesses. When evaluating providers, always verify that they are licensed by the UAE Insurance Authority to ensure regulatory compliance and consumer protection.

Use Comparison Platforms for Wider Options

Online pet insurance comparison platforms can significantly expand your options when you compare pet insurance online. Modern comparison of pet insurance tools allows you to evaluate multiple providers simultaneously, saving time and ensuring you consider a comprehensive range of available policies.

Platforms like Lookinsure provide added-value services such as expert guidance that can help you navigate the complexities of different policies and find the best coverage for your needs. They also offer installment payment options through services such as Tabby and Tamara, so you can get the best insurance providers offer.

Step 2: Understand Coverage Options

Before you compare pet insurance online, you should figure out what kind of pet insurance coverage is offered and which fits your needs best. Here is a rudimentary guide for you:

Accident-Only Plans

Accident-only plans offer basic coverage, protecting injuries such as fractures, bites, or swallowed objects. These policies are typically the most affordable option and are ideal for pet owners primarily concerned about emergencies rather than comprehensive medical coverage. While these plans provide limited protection, they can serve as a valuable safety net for unexpected accidents that might otherwise result in significant veterinary expenses.

Basic/Accident & Illness Plans

Accident & illness plans offer more balanced coverage by including both injuries and common medical conditions. These policies typically cover treatments for issues ranging from allergies and arthritis to cancer and hip dysplasia. These plans are particularly valuable for pet owners who want robust coverage without paying for routine care benefits they may not need, offering a middle ground between basic accident-only coverage and comprehensive wellness plans.

Comprehensive or Wellness Plans

Comprehensive or wellness plans provide the most extensive coverage, including accidents and illnesses, routine care, vaccinations, and sometimes dental coverage. These policies offer broader protection but come with higher premiums to match the expanded coverage. While these plans have higher upfront costs, they can provide significant value for pet owners who want peace of mind and predictable budgeting for their pet’s healthcare needs.

Step 3: Compare Key Policy Features

The next step is to read the details of each policy to get a better understanding of the specifics of your pet insurance plan. Here are what you should be paying attention to:

Veterinary Fees and Annual Limits

When you compare pet insurance online, carefully examine the maximum annual payout for veterinary costs, as this represents the total amount the insurer will pay per policy year. Consider your pet’s breed-specific health concerns and potential treatment costs when evaluating whether a policy’s annual limit will provide sufficient protection. Some policies may have sub-limits for treatment types, so review them to ensure they align with your pet’s potential needs.

Deductibles/Excess

The deductible or excess is the amount you must pay out-of-pocket before your insurance coverage applies. When conducting your comparison of pet insurance, remember that policies with higher deductibles generally have lower premiums, while lower deductibles result in higher premium costs. Choose a deductible amount that represents a balance between affordable premiums and manageable out-of-pocket expenses in the event of a claim.

Premiums

Premium costs vary significantly based on factors such as your pet’s age, breed, coverage type, and deductible selection. When you compare pet insurance online, note whether policies require monthly or annual payments, as some insurers offer discounts for annual payment in full. Use online pet insurance comparison tools to obtain multiple quotes based on your pet’s characteristics to accurately compare premium costs across providers.

Payout Limits

In addition to annual limits, examine any per-condition or per-incident limits that may apply to your policy. Some policies have caps on reimbursements for treatments or conditions, which could affect your coverage in certain situations. Understanding these limits helps avoid surprises when submitting claims and ensures your chosen policy provides adequate protection for your pet’s needs.

Exclusions

Carefully compare pet insurance online for policy exclusions. They specify which conditions or treatments are not covered. Common exclusions in UAE pet insurance policies include pre-existing conditions, behavioral therapy, elective procedures, cosmetic procedures, and vaccinations, which are rarely available with regular policies. Careful comparison of pet insurance exclusions helps you avoid unexpected claim denials and make sure your selected policy meets your pet’s needs.

| Feature | What to Look For | Common Range in the UAE | Considerations |

| Annual Limit | Maximum payout per policy year | AED 5,000 – AED 30,000+ | Higher limits offer more protection but cost more |

| Deductible | The amount you pay before coverage begins | AED 0 – AED 9,000 | Higher deductibles, lower premiums |

| Reimbursement Percentage | Portion of vet bills covered after deductible | 50% – 100% | A higher percentage means less out-of-pocket |

| Premium | Cost of policy | Varies by pet and coverage | Compare similar coverage levels across providers |

Step 4: Check Eligibility and Requirements

You should make sure about certain things regarding your pet which are:

Age Limits

Most pet insurance policies in the UAE have age restrictions that exclude very young and senior pets. During your comparison of pet insurance, review age eligibility requirements, especially if you have a senior pet or a new puppy or kitten, as options may be more limited for animals outside the standard age ranges.

Pre-existing Conditions

Pre-existing conditions are generally excluded from coverage by most pet insurance policies in the UAE. When you compare pet insurance online in terms of coverage, honesty is crucial regarding your pet’s medical history, as failure to disclose pre-existing conditions may result in claim denials or policy cancellation. Some insurers may offer coverage for pre-existing conditions that have been cured and symptom-free for a specific period, so inquire about such options if applicable to your pet.

Microchipping & Vaccinations

Microchipping and vaccination requirements are standard across most UAE pet insurance policies. Ensure your pet’s records are updated before applying for insurance, as failure to meet these requirements could result in coverage denial or claim rejection. These requirements help insurers manage risk and promote responsible pet ownership.

Step 5: Gather Necessary Documents

Here are some of the most important documents for pet insurance you will need to buy pet insurance in the UAE:

Proof of Ownership

When applying for pet insurance comparison, you will typically need to provide proof of ownership documents. These may include adoption certificates, breeder receipts, or registration papers that establish your ownership of the pet. Having these documents ready before starting your application process can streamline the process and prevent delays.

Microchip & Vaccination Records

Microchip and vaccination records are essential documents for most pet insurance applications in the UAE. Keep these records organized and easily accessible, as you may need to submit them when you compare pet insurance online,during the application process and when filing claims.

Step 6: Evaluate the Application and Claim Process

Making pet insurance claim is a very important procedure, so make sure you know the way your selected provider handles claims.

Application Process

The application process for pet insurance in the UAE is mostly online through insurer websites or comparison of pet insurance platforms. When you compare pet insurance online, you’ll need to provide information about your pet (age, breed, medical history) and select your desired coverage options. The efficiency and user-friendliness of the application platform can indicate the overall customer experience you can expect from the provider.

Claim Procedure

Understanding the claim procedure is for pet insurance comparison. Most UAE insurers operate on a reimbursement model, meaning you pay the veterinary costs initially and then submit a claim to recover eligible expenses from the insurer. Evaluate the claim submission process, required documentation, and typical processing times when comparing providers, as a difficult claims process can add stress when your pet needs medical care.

| Step in Process | What to Expect | Tips for Success |

| Veterinary Visit | Pay for services rendered | Obtain detailed invoices and medical records |

| Document Collection | Gather required documents: claim form, vet report, invoices | Ensure all documents contain the pet’s microchip ID |

| Claim Submission | Submit claim online or via app | Double-check that all required fields are completed |

| Processing | Insurer reviews claim | Respond promptly to any requests for additional information |

| Reimbursement | Payment issued for covered amounts | Typically takes 7-14 business days after approval |

Step 7: Finalize Your Choice

If everything in order you can then go ahead and finalize the process. Just make sure you do these before signing the final papers:

Read Policy Documents Carefully

Before making your final decision, read policy documents to fully understand the terms, conditions, coverage details, exclusions, and limitations. Pay special attention to waiting periods, which are common in pet insurance policies. If any aspect of the policy is unclear, contact the insurer for clarification before purchasing to ensure there are no surprises when you need to use the coverage.

Seek Expert Guidance if Needed

If you find policy documents complex or confusing, seek expert guidance from insurance advisors who can help interpret terms and conditions. These professionals can provide valuable insights into how to compare pet insurance online and which policy might best suit your needs and budget.

Extra Tips for a Successful Pet Insurance Comparison

Compare Multiple Options

Always compare pet insurance online from multiple providers before making a decision. This allows you to evaluate a range of options across different premium points, coverage levels, and policy features. Use online pet insurance comparison tools to streamline this process and view multiple options side-by-side. Don’t make your decision based solely on the comparison of pet insurance premium cost; consider the overall value, including coverage breadth, customer service reputation, and claims process efficiency.

You can do all that by using our online calculator:

Check for Multi-Pet Discounts

If you own more than one pet, check for multi-pet discounts that could make comprehensive coverage more affordable. Some insurers offer discounts when insuring multiple pets under the same policy or with the same provider. Inquire about these discounts during your research process when you compare pet insurance online, as they can significantly reduce your overall insurance costs while ensuring all your pets have adequate protection.

Consider Your Pet’s Specific Needs

Consider your pet’s breed, age, and lifestyle when selecting a coverage level. Certain breeds are predisposed to health conditions that may require more comprehensive coverage. Similarly, older pets may need more extensive coverage than younger, healthier animals. Tailoring your coverage selection to your pet’s characteristics and needs ensures you get appropriate protection without paying for unnecessary coverage.

Conclusion

Conducting a thorough pet insurance comparison using this step-by-step checklist empowers UAE pet owners to make informed decisions that balance cost, coverage, and convenience. The process to compare pet insurance online might seem daunting initially, but taking a systematic approach ensures you find a policy that provides adequate protection for your pet while remaining affordable for your budget.

Frequently Answered Questions

1. How do I pick the right pet insurance?

Choosing the right pet insurance involves evaluating your pet’s needs (age, breed, health history), your budget, and comparison of pet insurance from multiple policies based on coverage, exclusions, limits, and premiums.

2. Is pet insurance mandatory in the UAE?

Pet insurance is not currently mandatory in the UAE, but it is highly recommended given the high costs of veterinary care in the region. Some emirates may have requirements regarding pet registration and health certification, but comprehensive insurance coverage remains optional.

3. What’s the best pet insurance for multiple pets?

The best pet insurance for multiple pets typically comes from providers that offer multi-pet discounts. Compare pet insurance online policies that cover all your pets under a single plan or provider to maximize savings.

4. What limit should I choose for pet insurance?

The appropriate limit for pet insurance depends on your pet’s potential healthcare needs and your risk tolerance. Pet insurance comparison rates range from AED 5,000 to AED 30,000+, with higher limits providing more protection but at higher premium costs.

5. How can online comparison tools help me find the best pet insurance?

When you compare pet insurance online, you can evaluate multiple coverage options, premiums, and features side-by-side. These tools save time and ensure you make an informed decision based on comprehensive market analysis.