If you’ve ever renewed your car insurance early, switched providers in the middle of the policy year, or bought a new plan just because the deal looked amazing, there’s a small chance you’ve experienced car insurance overlap without realizing it.

In this article, we’ll break down everything you need to know about car insurance overlap from what it actually means to the different types of overlap, what happens if insurance overlaps, and how it affects your claims and costs. We’ll also look into the legal and regulatory side, sharing some practical tips to help you avoid car insurance coverage overlap. So, keep reading!

Understanding Car Insurance Overlap

Before we dive into the legal or financial details, it helps to first understand what car insurance overlap really means and how it can happen in everyday situations.

An overlap doesn’t always mean you’ve done something wrong. Sometimes, it’s just a mix-up between renewal dates or a delay in cancellation. But knowing how it happens is the first step to avoiding unnecessary costs or complications later on.

What Is Car Insurance Overlap?

Car insurance overlap happens when a vehicle is covered by more than one active policy at the same time. This usually occurs when a driver buys a new policy before the previous one expires or forgets to cancel the old one altogether.

For example, let’s say your policy ends in May, but you decide to buy a new one in April because the offer looks better. If the first insurer doesn’t deactivate your policy, you now have car insurance coverage overlap. Now two policies covering the same car, and both potentially responsible for paying out if an accident happens.

While it may sound like a safety net, the reality is more complicated. You might end up confused about what happens if insurance overlaps, or worse, dealing with delays as insurers debate who should handle the claim. In the UAE, this confusion can turn into financial stress if not sorted out quickly if you know about different types of overlap.

Types of Overlap

Car insurance overlap can happen in several ways, depending on your policy type or renewal timing. Here are the most common cases:

- Overlap with comprehensive insurance policies: When you hold two active comprehensive plans. Both cover the same risks, so instead of extra protection, you might face confusion about what happens if insurance overlaps.

- Overlap with third-party liability insurance: Sometimes drivers unknowingly buy a second mandatory policy. This kind of Car Insurance coverage overlap doesn’t add value and can cause compliance issues in the UAE.

- Overlap caused by policy renewals or extensions: A short overlap happens when a new policy starts before the old one ends. Even if brief, it can delay claims or refunds if not fixed.

What Happens if Insurance Overlaps?

Having two active policies might sound harmless, but car insurance overlap can easily create confusion and delay when you need help the most. In the UAE, insurers must decide which company is responsible for paying your claim and that process isn’t always quick or simple.

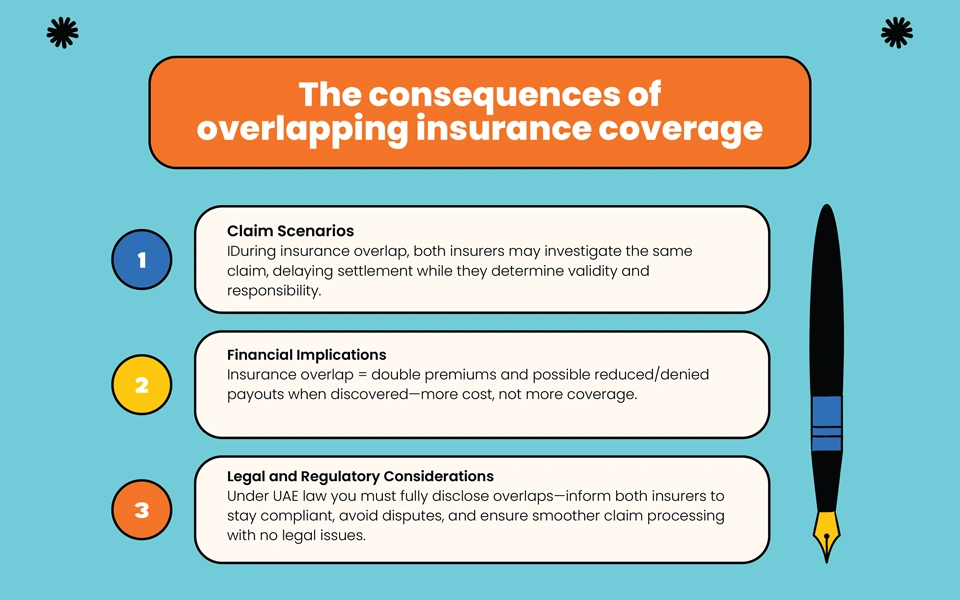

Claim Scenarios

When multiple policies exist, both insurers may review and investigate the same incident. This can delay settlement, as each company checks the claim’s validity and their level of responsibility. For example, if an accident occurs during car insurance coverage overlap, both insurers might launch their own investigations before deciding who pays which means extra waiting time for you.

Financial Implications

Overlapping policies mean you’re paying two premiums for the same period money that could easily be saved. In addition, some insurers may reduce or deny part of the payout once they discover more than one active policy. So what happens if insurance overlaps isn’t more coverage, it’s often just more cost.

Legal and Regulatory Considerations

UAE insurance laws require honesty and full disclosure when filing claims. If you have car insurance overlap, you must inform both insurers to stay compliant and avoid disputes. Being transparent from the start ensures your claims are processed smoothly and protects you from potential legal issues.

How to Avoid Car Insurance Coverage Overlap

Avoiding car insurance overlap is easier than fixing it later. With a little attention to timing and communication, you can keep your coverage clear and hassle-free.

Keep Track of Policy Dates

The simplest way to prevent car insurance coverage overlap is to monitor the start and end dates of every policy you hold. Before buying a new plan, double-check when your current one expires. Even a few overlapping days can cause confusion during a claim.

Notify Your Insurance Company

If you already have an active policy, always tell your insurer before signing up for another. Letting them know about existing coverage helps them coordinate start dates and avoid duplicate protection. This quick step can save you a lot of time later if what happens if insurance overlaps becomes an issue.

Cancel or Adjust Policies Correctly

When switching insurers, make sure the old policy is officially canceled, not just ignored. Ask your provider for written confirmation or an email stating the cancellation date. If you accidentally paid for overlapping days, you may qualify for a partial refund. Keeping your records updated helps prevent unnecessary car insurance overlap and keeps your coverage clean.

Benefits and Drawbacks of Overlapping Insurance

Car insurance overlap isn’t always bad on paper, but in practice, it often creates more confusion than benefit. Still, it helps to understand both sides before deciding whether it’s worth keeping or fixing.

Benefits

- Extra protection: If one insurer delays or denies a claim, the second policy might provide temporary backup coverage. This can offer a bit of peace of mind during uncertain or high-risk periods.

- Backup coverage: In rare cases, Car Insurance coverage overlap can help when one insurer’s limit doesn’t fully cover damages, though this usually depends on how both companies handle claims.

Drawbacks

- Wasted premiums: You’re paying twice for the same coverage without receiving double protection.

- Complicated claims: When what happens if insurance overlaps becomes reality, insurers may take longer to process your claim while deciding who should pay first.

- Conflicts between companies: Two insurers covering the same risk can lead to disagreements, delays, and unnecessary stress for the driver.

Practical Tips for Managing Overlap

Avoiding or fixing car insurance overlap doesn’t have to be stressful. A few simple habits can save you both time and money while keeping your coverage clear and valid.

- Check policy dates: Always review start and end dates before purchasing a new plan to prevent car insurance coverage overlap.

- Keep your records: Store both digital and printed copies of all insurance documents so you can easily verify your active policies.

- Ask the right questions: Before switching, ask insurers directly if any part of the coverage will overlap and what happens if insurance overlaps in their system.

- Consult a professional: If you’re unsure, an insurance broker in the UAE can help you review your options and make sure there’s no duplication in your coverage.

Conclusion

Let’s be honest : car insurance overlap isn’t the kind of thing most people think about until it causes trouble. But here’s the thing: a small mix-up, like forgetting to cancel your old plan, can quietly turn into double payments and messy claims.

The good news? It’s totally avoidable. Keep an eye on your renewal dates, ask your insurer if any coverage overlaps, and don’t be shy about calling customer service when something feels off. A quick chat can save you a lot of paperwork later.

The smart move? Stay one step ahead. Mark your renewal dates, talk to your insurer before switching, and always double-check what’s active. It takes just a few minutes and can save you from paying extra for coverage you’ll never use.

Think of it this way: your insurance should protect your car, not confuse you about who’s protecting it. A little attention now means fewer headaches later, and that’s a trade worth making.

Frequently Answered Question

1. What is car insurance overlap?

Car insurance overlap happens when two or more active insurance policies cover the same vehicle at the same time. It often occurs if you buy a new policy before canceling the old one.

2. What happens if my insurance overlaps?

If your insurance overlaps, you’ll pay double premiums without extra benefits. It can also cause delays in claims, as insurers need to decide who’s responsible for paying.

3. Can I have two car insurance policies at the same time?

Technically yes, but it’s not recommended. Having two active policies can lead to confusion, wasted money, and complications when filing a claim.

4. How do insurance companies handle overlapping claims?

When car insurance coverage overlap occurs, both insurers usually investigate. They decide who should pay and how much, which can slow down the process.

5. How can I avoid car insurance coverage overlap in UAE?

Keep track of your policy dates, inform your insurer before switching, and make sure the old policy is officially canceled before you go about buying a new one.