If you live and work in Dubai, renewing your visa comes with a few non-negotiables and one of them is health insurance for visa renewal in Dubai. Whether you’re an employee, a sponsor, or a dependent, you can’t renew your residence visa without valid coverage.

In this guide, we’ll break down everything you need to know. From the legal framework, costs, required documents and more.

Too Long; Didn’t Read (TL;DR)

You cannot renew your Dubai residence visa without valid health insurance. It’s a mandatory legal requirement.

- The Rule: Your insurance must be from a DHA-approved provider and meet the minimum Essential Benefits Plan (EBP) standard. The policy’s validity period must match your visa’s term.

- The Cost: Prices vary based on age and coverage.

- Basic plans start around AED 700 – 1,000 per year.

- Comprehensive family coverage can cost AED 4,000+.

- The Process: Gather your documents (Emirates ID, passport, visa copy), buy or renew a DHA-approved plan, and submit the insurance certificate with your visa application.

- Key Pitfall to Avoid: Do not let your insurance expire before renewing it. Even a short gap can cause your visa renewal to be delayed or rejected. Renew your policy at least 2-3 weeks before it expires.

Why Health Insurance is Mandatory for Dubai Visa Renewal

Dubai doesn’t take healthcare lightly and that’s a good thing. Here’s why that rule exists and what happens if you try to skip it.

Legal & Regulatory Framework in Dubai

According to the Dubai Health Authority (DHA), having valid health insurance for Dubai visa renewal is a legal must. The DHA introduced this rule to make sure everyone in the city, from long-term expats to new arrivals, has access to reliable healthcare. Whether you’re getting a new visa or renewing an old one, proof of health insurance for visa renewal in Dubai must be submitted as part of your application.

Consequences of Non-Compliance for Visa Renewal

Ignoring the Dubai visa health insurance requirement can create more problems than you think. Without valid coverage, your visa renewal can be delayed or outright rejected. In some cases, fines are added, and your residence visa stamp might even be blocked in the system. In short, skipping or forgetting to renew your policy can stop your visa process in its tracks and no one wants to deal with that kind of last-minute chaos.

How Health Insurance Protects Sponsors, Employees & Dependents

Beyond rules and paperwork, health insurance mandatory for Dubai visa renewal also protects people, sponsors, employees, and dependents alike. It ensures that families can access hospitals and clinics when needed, employers avoid financial liability in medical emergencies, and everyone has peace of mind knowing they’re covered.

What Are the Requirements for Health Insurance at Visa Renewal in Dubai?

Before your visa renewal gets the green light, your health insurance needs to meet a few key conditions. Let’s see what are they:

Minimum Coverage & Approved Insurer Criteria

Your insurance must come from a DHA-approved provider and meet the minimum standard known as the Essential Benefits Plan (EBP). This is the baseline for all health insurance for visa renewal in Dubai. If your current plan doesn’t meet the Dubai visa health insurance requirement, you’ll need to upgrade before renewal.

Validity Period & Alignment with Visa Term

To be accepted for health insurance for Dubai visa renewal, your policy has to cover the full duration of your visa. For example, if your residence visa is valid for two years, your insurance must also remain active for the same period. If your plan expires before your visa term, it can delay processing. Keeping your policy dates aligned avoids gaps in coverage and renewal goes smoothly.

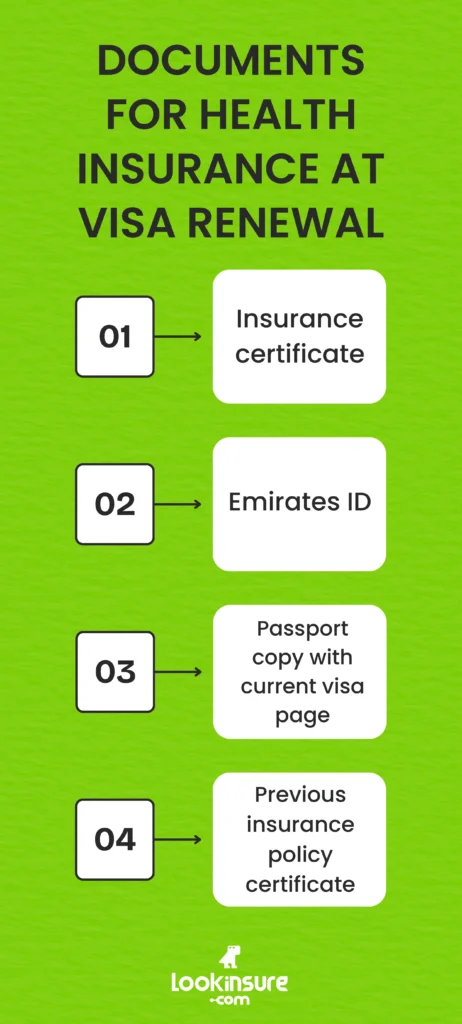

Documents & Proof to Submit During Renewal

Health insurance for visa renewal in Dubai is mandatory because when you go through the process you will be asked to submit the proper documentation confirming that you do indeed have valid medical insurance. Other important documents include:

- Insurance certificate or e-card showing active policy details

- Emirates ID (or application receipt if new)

- Passport copy with current visa page

- Previous insurance policy (if renewing or upgrading)

Cost of Health Insurance for Visa Renewal in Dubai

Let’s be honest, one of the first questions people ask about is, “How much does visa renewal health insurance Dubai cost?” The good news is, Dubai offers options for every budget, from essential plans for employees to premium coverage for families and sponsors.

Typical Premium Ranges by Visa Type or Age

The cost of health insurance for Dubai visa renewal depends on who you’re covering and what level of benefits you need. Here’s a rough breakdown:

| Visa Holder Type | Typical Annual Premium (AED) | Coverage Type |

| Low-income workers (Essential Benefits Plan) | 700 – 1,000 | Basic emergency and hospital care |

| Individual employees or freelancers | 1,000 – 2,000 | Broader coverage with outpatient benefits |

| Family dependents | 2,000 – 4,000 | Maternity, child healthcare, specialist visits |

| Sponsors or senior residents | 4,000 – 6,000+ | Comprehensive plans with wider hospital access |

As we said, these are just estimates, but if you are looking for personalized quotes you can head over to our online calculator:

Factors That Influence Cost (Age, Coverage, Dependents, Network)

Several things can affect how much you pay for Dubai health insurance for residents:

- Age: Older applicants typically pay higher premiums because of increased health risks.

- Pre-existing conditions: Chronic illnesses can raise premiums or add waiting periods.

- Dependents: Adding family members or domestic staff increases total cost.

- Coverage type: Plans with maternity, dental, or worldwide coverage cost more.

- Hospital network: Policies that include top-tier private hospitals are priced higher than those limited to basic networks.

Ways to Get Competitive Pricing for Renewal Policies

Since health insurance for visa renewal in Dubai is mandatory, you could end up in a position where you have to renew your insurance policy at a time when you might not be as financially able as you’d like, and this is why it is important to try and find the best deal possible. A few smart moves can help you get the best deal:

- Compare multiple providers before renewing – online platforms like Lookinsure make this easy.

- Look for digital discounts – many insurers offer lower prices for online purchases.

- Match your hospital network to your needs – if you visit specific clinics regularly, choose a plan that covers them.

- Renew early – avoid last-minute purchases when rates are higher or plans are limited.

How to Prepare the Documents & Complete Insurance for Visa Renewal

Look, your health insurance for visa renewal in Dubai is not a paperwork marathon. If you plan ahead and know what to expect, the whole thing can be done in just a few simple steps.

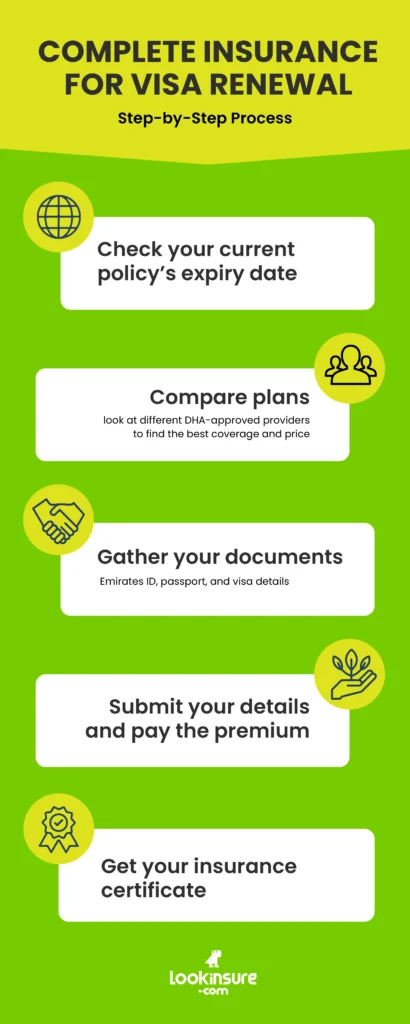

Step-by-Step Renewal Process for Insurance & Visa

Here’s how to make the process smooth and stress-free:

- Check your current policy’s expiry date – make sure your health insurance for Dubai visa renewal will stay valid through your visa term.

- Compare plans – look at different DHA-approved providers to find the best coverage and price.

- Gather your documents – keep your Emirates ID, passport, and visa details ready.

- Submit your details and pay the premium – most insurers let you do this online in minutes.

- Get your insurance certificate – once issued, upload it along with your Dubai visa renewal insurance documents to the visa portal or hand it to your PRO for processing.

And just like that, you’re covered and ready for your renewal appointment

Documents You Need to Submit for Insurance

Before you buy or renew your policy, prepare these files:

- Passport copy (with visa page)

- Emirates ID copy or registration receipt

- Personal photo (for new applications)

- Previous insurance certificate (if renewing or upgrading a plan)

Additional documents (case-specific):

- Employment or sponsorship letter – if your coverage is provided through your employer or sponsor

- Residency visa application or renewal receipt – to show your visa is under renewal

- Medical test report – sometimes requested for older applicants or specific visa categories

- Dependent documents – marriage certificate (for spouse) or birth certificate (for children), if you’re adding family members

- Trade license copy – if you’re self-employed or under a company sponsorship

Tips to Avoid Delays in the Renewal Cycle

A few simple habits can save you from last-minute stress:

- Don’t wait until your visa renewal week. Renew your policy at least 2–3 weeks before expiry.

- Avoid any coverage gap. A few inactive days between policies can delay your visa approval.

- Upload your certificate early. The DHA system sometimes takes a day or two to update your health insurance for Dubai visa renewal record.

- Verify your insurer is DHA-approved. Non-approved providers may cause your application to bounce back.

Common Pitfalls & Mistakes to Avoid at Visa Renewal Time

Even with all the right intentions, many people still run into hiccups when renewing their visa because of small oversights in their renewal process. We’ve made a list out of mistakes and how to avoid them. Take a deep look at it:

| Common Mistake | What Happens | How to Avoid It |

| Insurance policy expired or not aligned with visa dates | Visa renewal gets delayed or rejected because your insurance doesn’t cover the full residence period. | Renew your health insurance for Dubai visa renewal at least two weeks before expiry and make sure it covers your full visa duration. |

| Using a non-approved insurer or low coverage plan | The DHA may reject your insurance certificate if it doesn’t meet the Essential Benefits Plan standard. | Always check that your insurer is DHA-approved and that your plan meets the requirements. |

| Missing or incorrect documentation | Incomplete or mismatched information (like a wrong Emirates ID number) can put your renewal on hold. | Double-check all your visa renewal insurance documents before submission, especially ID numbers and policy details. |

| Not updating dependent information | If a dependent’s visa or ID has changed, their insurance may not link correctly in the system. | Update your insurer with any changes in dependent details before renewal. |

| Gaps between old and new policies | A few uninsured days can cause the system to show “inactive coverage,” blocking your renewal temporarily. | Purchase your new policy before the old one expires to maintain continuous Dubai health insurance for residents. |

Why Choose Lookinsure for Health Insurance in Dubai

At Lookinsure, we’ve built tools that help users quickly find health insurance coverage across trusted insurers in Dubai and the wider UAE. No confusing portals, no waiting! just fast, accurate results and clear policy details in one place.

Here’s why people rely on our platform:

Compare Leading Insurers

Easily view plans from the most reputable insurance companies offering health insurance for expats side by side and choose a policy that matches your real healthcare needs.

Transparent Prices

No hidden charges, no fine-print surprises. Every plan listed on Lookinsure includes clear pricing and detailed coverage information.

Fast Online Purchase

Got your documents ready? Great. You can complete your application and payment online in just a few clicks. Your policy certificate is issued instantly!

Options for Individuals, Families, and Employees

Whether you’re renewing your own visa, sponsoring family members, or managing staff renewals, our platform has a plan that fits.

Conclusion

Having valid health insurance for Dubai visa renewal is essential for keeping your residency active and avoiding delays. Make sure your plan meets the minimum Dubai visa health insurance requirement, and renew your policy before it expires.

Frequently Answered Questions

1. Is health insurance mandatory for every Dubai visa renewal?

Yes. Health insurance for Dubai visa renewal is required by law. Without valid coverage, your visa renewal can be delayed or rejected.

2. What is the minimum coverage required for health insurance when renewing a Dubai residence visa?

Your plan must meet the Dubai visa health insurance requirement, which means at least the Essential Benefits Plan (EBP) approved by the DHA

3. What happens if I let my health insurance policy expire before visa renewal?

Your visa renewal may be put on hold until you reactivate or renew your health insurance for visa renewal in Dubai. You might also face fines or a renewal delay.

4. Can I use international health insurance to renew a Dubai visa?

Usually not. The DHA accepts only policies from approved local providers that comply with Dubai health insurance for residents standards.

5. How much does health insurance for visa renewal typically cost in Dubai?

The visa renewal health insurance Dubai cost depends on the plan and age group. Basic plans start around AED 700–1,000 per year, while family or premium coverage can go above AED 4,000.

6. Which documents do I need to submit to prove health insurance coverage during my visa renewal?

You’ll need your insurance certificate or e-card, Emirates ID, passport copy, and visa page.

7. How can I switch or upgrade my health insurance plan before visa renewal to get better benefits?

Compare plans online, cancel your old policy after confirming coverage dates, and purchase a new health insurance that offers the benefits you need.