The Dubai Health Authority (DHA) requires every resident to hold a valid policy, and this requirement is tied directly to visa approvals and renewals. Skipping it doesn’t just leave you without medical protection, it also exposes you to no health insurance Dubai fine.

Many newcomers assume they can take care of it “later,” but that delay often leads to trouble. Between penalties for no health insurance UAE and facing big medical bills even after a minor emergency. Penalties for not having health insurance ranges from AED 500 per month to 150,000 AED based on condition.

This guide will walk you through the real risks, how the enforcement works, and the simple steps you can take to avoid all of it.

Too Long; Didn’t Read (TL;DR)

- Dubai requires every resident to have DHA-approved health insurance, and being uninsured can lead to fines, delays in visa renewal, and added paperwork stress.

- A no health insurance Dubai fine is only part of the problem; the bigger issue is high medical bills and the overall risks of uninsured in Dubai UAE, especially during emergencies.

- Fines are enforced through visa applications and DHA’s online system, so gaps in coverage or expired policies are picked up immediately.

- Staying compliant is easy: buy a DHA-approved plan, renew it on time, and make sure dependents are covered to avoid penalties for no health insurance UAE.

Dubai Health Insurance Requirement Overview

The rule is very straightforward: every person living in the emirate must have a valid health insurance plan. This requirement is linked to visa approval and renewal for all residents, which means going with no health insurance Dubai fine can delay residency paperwork. Let’s see more details:

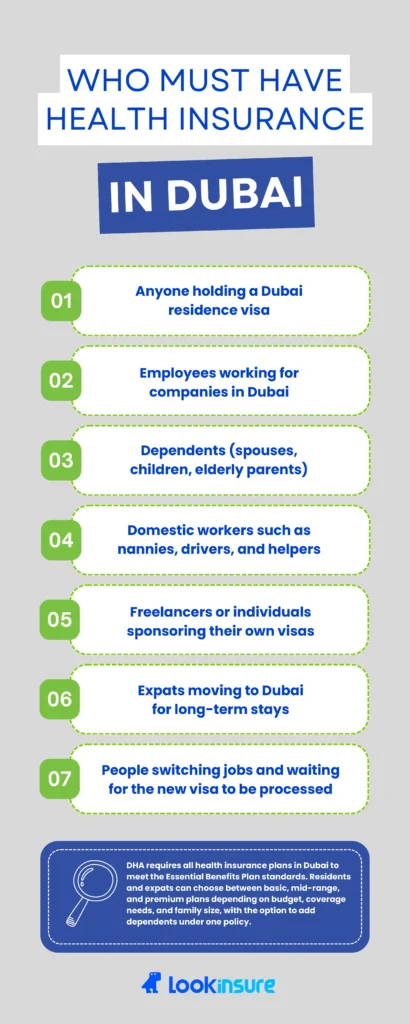

Who must have health insurance

Here’s a simple breakdown of who is expected to be insured under Dubai’s mandatory system:

- Anyone holding a Dubai residence visa

- Employees working for companies in Dubai

- Dependents (spouses, children, elderly parents)

- Domestic workers such as nannies, drivers, and helpers

- Freelancers or individuals sponsoring their own visas

- Expats moving to Dubai for long-term stays

- People switching jobs and waiting for the new visa to be processed

DHA regulations and mandatory coverage

The Dubai Health Authority sets the minimum standard for coverage through the Essential Benefits Plan. No matter if you choose a basic plan or a premium plan, it has to follow the DHA rules to be valid for a visa.

Types of plans available for residents and expats

Many residents choose Essential Benefits Plans because they are affordable and meet DHA requirements. Others prefer mid-range or premium plans that offer wider hospital networks, higher coverage limits, and extra benefits. Expats can select plans based on family size, job status, and personal health needs, and those sponsoring dependents can easily add family members to a single policy.

Fines for Not Having Health Insurance in Dubai

Skipping health insurance in Dubai almost always catches up with people faster than they expect. Because coverage is tied directly to residency rules and the system always checks their insurance status. When there’s no valid policy in place, the result is usually a no health insurance Dubai fine which can start from AED 500 and goes up to AED 500,00 and also a stop in the visa paperwork until the issue is fixed.

Cash penalties for individuals

Residents who don’t have an active health insurance plan can face ongoing fines for each period they remain uninsured. If you are uninsured expect a fine of AED 500/month per person at minimum, and possibly much higher if you’re found to repeatedly breach the law.

Penalties for no health insurance UAE can also appear during visa procedures, which means even if someone manages to go unnoticed for a while, when trying to renew a visa, the DHA system blocks the visa process automatically.

Fines for sponsors and employers

Employers who fail to provide insurance for their staff can face significant fines, and sponsors who don’t insure their dependents (children, spouses, or domestic workers) also risk being penalized.

Additional legal consequences for non-compliance

The financial fines are only one side of the issue. Non-compliance can lead to delays in visa processing, holds on applications, and in some cases complete rejection of renewal requests until the insurance problem is sorted. For families, this can disrupt school registrations, travel plans, or employment paperwork.

For employees, it may create delays in joining a new job or transferring sponsorship. In the worst cases, unresolved fines can turn into legal follow-ups that become far more stressful than simply purchasing a plan on time.

Risks of Being Uninsured in Dubai

Choosing to live in Dubai without health insurance is one of those decisions that feels harmless in the short run but can quickly turn into something overwhelming. The real concern lies in the day-to-day risks of uninsured in Dubai UAE, especially when unexpected health issues appear out of nowhere.

High medical expenses and emergency costs

Without insurance, people end up paying the full amount out of pocket, and that often becomes a financial shock far greater than any penalties for no health insurance UAE they might face.

Limited access to hospitals and clinics

Many clinics and hospitals in Dubai require proof of insurance before offering non-emergency services. Without coverage, residents often have fewer choices, longer waiting times, or limited access to specialists.

Financial impact of chronic or serious illnesses

The biggest risk of being uninsured shows up when someone is diagnosed with a long-term or serious condition. Treatments for chronic illnesses such as diabetes, hypertension, heart problems, or autoimmune disorders can cost thousands of dirhams each year.

How Penalties Are Enforced

Dubai doesn’t leave health insurance enforcement to chance. The system is built so that anyone without coverage eventually faces a no health insurance Dubai fine. These checks exist to reduce the overall risks of uninsured in Dubai UAE and make sure every resident has the minimum required protection.

Checks during visa renewal or new employment

The most common enforcement point is the visa process. When you apply for a new visa or try to renew your current one, the DHA system which is connected to your Emirates ID, checks your insurance status immediately. If there is no active policy, the application stops. Fines may also appear on your file (at least AED 500 per month).

Many residents only realize the impact of penalties for no health insurance UAE when their visa renewal is delayed. That’s why it is important to check your health insurance for visa renewal in UAE.

Online verification by DHA

The Dubai Health Authority has a digital system that updates your insurance status automatically. The moment your policy expires, the system flags you as uninsured. This can trigger fines without any manual review. This online check is part of health insurance compliance Dubai, and it leaves very little room for missed deadlines or forgotten renewals.

Cases of unpaid fines and legal follow-up

Unpaid fines stay linked to your visa file. They show up again during any future application, whether it’s a renewal, a job change, or sponsoring a dependent. If someone keeps ignoring the rules, the issue can escalate into stronger administrative action, or bigger fines up to AED 500,000.

How to Avoid Fines and Stay Compliant

Avoiding mandatory health insurance penalties UAE is much easier than people think. Dubai’s rules are very clear, and following them is easy, especially as an expat. Staying compliant also keeps your visa process smooth and prevents any DHA fines for uninsured residents from being added to your record.

Buying DHA-approved health insurance

The first step is to purchase a DHA-approved policy. Dubai only accepts insurance plans that follow official guidelines, so anything outside this list will not count for visa purposes

Renewing policies on time

Once your plan lapses, the system immediately updates your status and may apply penalties. Renewing your insurance early keeps your coverage gap-free. Even a short break in your policy can cause issues with your visa file.

Choosing the right plan for your visa type

Different visa types come with different responsibilities. Employees are usually covered by their employer, but freelancers, business owners, and self-sponsored residents must buy their own plans. Choose the correct plan for your visa type and ask questions from your insurer before finalizing the plan.

Tips for Individuals and Families

To decrease risks of uninsured in Dubai UAE, Read following tips. These are easier ways for residents to stay compliant and avoid any DHA fines for uninsured residents or issues during visa renewals.

Compare plans online for cost-effective options

Many online platforms such as Looksinure show benefits, networks, and prices side by side, which helps you find a plan that fits your needs without risking mandatory health insurance penalties UAE later.

Include dependents and family members

If you sponsor dependents, you are responsible for their insurance. Children, spouses, elderly parents, and even domestic workers must be covered under Dubai’s system. Take note that leaving a dependent uninsured can result in penalties for no health insurance UAE during sponsorship renewals.

Consider coverage for chronic and pre-existing conditions

Chronic conditions such as diabetes, thyroid disorders, high blood pressure, and heart issues are common among residents. Ask your insurer before buying and then choose a plan that covers these conditions.

Why Lookinsure Helps Avoid Fines

Our mission is to help people understand their options, compare approved plans, and stay compliant without stress. This also reduces the chance of running into penalties for no health insurance UAE during visa renewals or sponsorship updates.

Easy comparison of DHA-approved plans

Lookinsure shows only DHA-approved plans, so you never have to guess whether a policy meets official rules. The comparison tools allow you to check benefits, hospital networks, and prices in one place.

Guidance on choosing compliant coverage

Many residents are not sure which policy works for their visa type or family situation. We offer guidance that helps you pick coverage that fits Dubai’s rules.

Support for renewals and claims

One of the most common reasons people get fined is forgetting to renew their policy. We notify you with reminders and renewal support so your coverage never lapses. Our team also assists with claims, making the entire process easier.

Conclusion

Staying insured in Dubai will protect yourself and your family from the real risks of uninsured in Dubai UAE, like sudden medical bills or delays in visa renewals. A proper, DHA-approved plan keeps your visa process steady and shields you from the real risks of uninsured in Dubai UAE.

Frequently Answered Questions

1. What fines apply if I don’t have health insurance in Dubai?

There are different types of fines depending on your status. For expats without valid health insurance, your visa renewal can be stopped and you may be fined at least AED 500 per month. For general violations under DHA law, penalties range from AED 500 up to AED 150,000, and repeat offences can reach AED 500,000.

2. Can employers be penalized if employees are uninsured?

Yes. Employers can be penalized for their uninsured staff, starting from AED 500 and going up to AED 150,000. If the violation repeats, the fine can be reached as high as AED 500,000.

3. Are there risks besides fines for being uninsured?

Yes. Risks include higher out-of-pocket costs, limited access to services, and potential visa/permit issues.

4. How does DHA verify compliance?

DHA verifies compliance by cross-checking your Emirates ID with insurer databases, reviewing employee insurance enrollments during work-permit and visa renewal and also conducting audits when discrepancies appear. So, if an employee isn’t insured, their system flags it automatically.

5. Can I be denied visa renewal without health insurance?

Potentially, yes. Dubai will not renew your residency visa without health insurance and the DHA system automatically blocks visa renewal if your Emirates ID isn’t linked to an active, approved insurance policy.

6. Is there a grace period for first-time non-compliance?

Some schemes offer a grace period, but specifics vary; confirm with HR or DHA.