One of the most important decisions when selecting a policy is choosing the coverage limit, which determines how much your insurer will pay toward medical expenses each year. While basic plans may provide only minimal protection, higher coverage limits allow access to better hospitals, broader treatment options, and more peace of mind. Among the popular mid-range choices in the UAE is AED 3 million health insurance, which offers a strong balance between affordability and comprehensive medical protection.

In this guide, we take a closer look at what AED 3 million health insurance in UAE really means, who should consider it, what it covers, what it does not, and how to choose the right plan for your needs in the UAE.

Too Long’ Didn’t Read (TL;DR)

What is it?

AED 3 million health insurance refers to any medical insurance policy in the UAE that provides an annual coverage limit of up to AED 3 million, offering strong financial protection for both routine and major healthcare needs.

Who is it for?

AED 3 million health insurance cover suits professionals, families, business owners, frequent travelers, and anyone seeking reliable coverage without paying premium-level prices.

What does it cover?

Most types of AED 3 million health insurance include inpatient and outpatient treatment, surgeries, diagnostics, maternity benefits (depending on the plan), prescription medication, chronic disease management, and emergency care.

What’s excluded?

Cosmetic procedures, experimental treatments, non-medical services, and some pre-existing conditions during waiting periods are usually excluded.

Is it worth it?

For many UAE residents, AED 3 million health insurance offers a practical balance between cost and comprehensive protection.

What is AED 3 Million Health Insurance?

AED 3 million health insurance refers to any medical insurance policy that provides coverage of up to AED 3 million per year. This amount represents the maximum total cost of medical services that your insurer will pay for within a policy year.

To put this in perspective, basic health insurance plans in the UAE often come with coverage limits ranging between AED 150,000 and AED 500,000, which can be quickly exhausted if hospitalization, surgery, or specialist care is required. In contrast, AED 3 million health insurance offers a significantly higher safety net, helping policyholders manage both expected medical expenses and unforeseen emergencies.

In simple terms, AED 3 million health insurance gives you room to focus on recovery rather than worrying about medical bills.

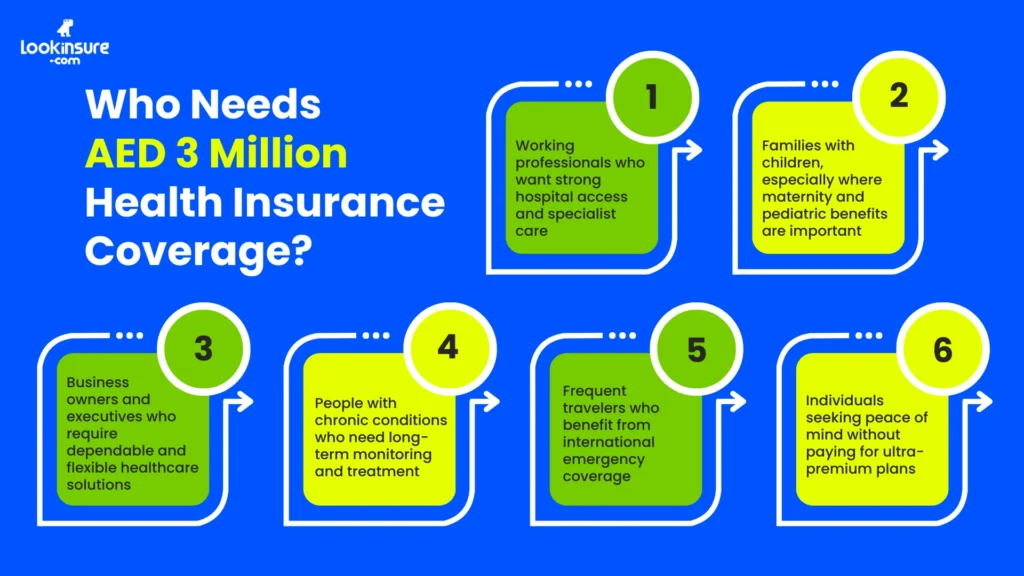

Who Should Get AED 3 Million Health Insurance?

The AED 3 million health insurance is particularly suitable for individuals and families who want dependable, mid-to-high level medical coverage.

This level of coverage is ideal for:

- Working professionals who want strong hospital access and specialist care

- Families with children, especially where maternity and pediatric benefits are important

- Business owners and executives who require dependable and flexible healthcare solutions

- People with chronic conditions who need long-term monitoring and treatment

- Frequent travelers who benefit from international emergency coverage

- Individuals seeking peace of mind without paying for ultra-premium plans

For many residents, AED 3 million health insurance provides a solid middle ground far more comprehensive than the basic health insurance requirements in the UAE, yet still more affordable than ultra-high-limit policies.

Types of AED 3 Million Health Insurance Plans

Many insurance providers in the UAE offer policies that come with this coverage limit. These plans differ mainly in geographical coverage, hospital access, benefit structure, and optional add-ons, rather than in the limit itself.

Here are the most common types of AED 3 million health insurance you will come across:

| Plan Tier | Key Features |

| Entry-level 3M plans | Basic inpatient + limited outpatient, restricted hospital network |

| Mid-tier 3M plans | Balanced inpatient & outpatient, specialist access, maternity options |

| High-tier 3M plans | Premium hospital networks, international emergency cover, strong outpatient benefits |

What Does AED 3 Million Health Insurance Cover?

In most cases, AED 3 million health insurance cover includes a broad range of medical services rather than simply offering a higher financial ceiling. While benefits vary across insurers, most policies at this level offer enhanced access, wider hospital networks, and better outpatient benefits.

Here is what you can typically expect from AED 3 million health insurance cover:

Typical Coverage Table

| Coverage Category | What is Usually Included |

| Inpatient treatment | Hospital accommodation, surgical procedures, ICU charges, anesthesia, operating theatre costs, nursing care |

| Outpatient services | GP visits, specialist consultations, diagnostic imaging (MRI, CT scans, X-rays, ultrasound), lab tests |

| Prescription medications | Prescribed drugs, chronic condition medications, post-hospitalization prescriptions |

| Maternity & newborn care | Antenatal visits, delivery, postnatal care, newborn coverage (subject to waiting periods) |

| Chronic disease management | Long-term monitoring, specialist follow-ups, continuous medication |

| Emergency & international care | Emergency treatment, medical evacuation, repatriation (depending on plan) |

While AED 3 million health insurance cover does not always mean broader benefits automatically, many insurers bundle enhanced features into plans at this level, making them more comprehensive than basic policies.

What’s Not Covered Under AED 3 Million Health Insurance?

Even the best AED 3 million health insurance plans come with exclusions. Understanding these limitations helps avoid unpleasant surprises later.

Common exclusions include:

- Cosmetic and aesthetic treatments (unless medically necessary, like dermatology cover)

- Experimental and unproven procedures

- Fertility treatments (unless explicitly included)

- Non-medical services such as spa therapy and wellness retreats

- Injuries caused by high-risk activities, unless covered by add-ons

- Pre-existing conditions during waiting periods

- Treatment received outside the approved hospital network

Always review the policy wording carefully, as exclusions can vary widely between different providers and types of AED 3 million health insurance.

Best AED 3 Million Health Insurance Plans

There is no single “best” policy for everyone, but the best AED 3 million health insurance plans usually share a few key characteristics:

- Wide hospital networks

- Strong outpatient benefits

- Low co-payment requirements

- Maternity and chronic disease coverage

- Optional international benefits

Here are the best types of AED 3 million health insurance from the top health insurance companies in the UAE:

| Insurer | Plan Name | Approx. Annual Limit | Coverage Highlights |

| Cigna | Healthguard International | ~AED 5M–7M | Worldwide cover, inpatient & outpatient, mental health |

| Sukoon Insurance | HealthPlus | ~AED 5M–6M | Comprehensive maternity, outpatient & wellness |

| GIG Gulf | Premier / Global Plan | ~AED 5M–7M | Broad hospital network, optional dental & optical |

| Allianz (via local partners) | Executive Care | ~AED 5M+ | Global hospital access, medical evacuation |

| Bupa Global | Elite (Lower Tier) | ~AED 5M+ | Premium international healthcare access |

When comparing the best AED 3 million health insurance plans, focus not only on price but also on hospital access, claims processing speed, and benefit limits.

Why Choose AED 3 Million Health Insurance?

There are many reasons why residents in the UAE opt for AED 3 million health insurance rather than basic coverage or ultra-premium plans.

Key advantages include:

- Strong financial protection during major medical events

- Access to high-quality hospitals and specialists

- Balanced premium cost, offering value for money

- Better outpatient and diagnostic coverage

- International emergency benefits in many plans

For most individuals and families, AED 3 million health insurance delivers dependable protection without excessive premiums, making it a practical and popular choice.

How to Choose the Right AED 3 Million Health Insurance in the UAE?

Choosing a policy involves more than selecting a price point. The fine print matters just as much as the coverage limit.

Here are key factors to consider:

- Hospital network coverage – Ensure your preferred hospitals are included

- Outpatient benefits – Important for regular check-ups and diagnostics

- Co-payments and deductibles – Lower out-of-pocket costs improve affordability

- Waiting periods – Especially for maternity and chronic conditions

- Geographical coverage – UAE-only vs international protection

- Claims process – Speed and ease of reimbursement

This is where platforms like Lookinsure add significant value. Lookinsure allows you to compare multiple insurers, understand policy details, and receive professional guidance so you can choose the right coverage without confusion. Their advisors help simplify technical policy language and ensure you find a plan that truly suits your medical needs and budget.

Conclusion

Choosing the right health insurance policy is one of the most important financial decisions you can make in the UAE. While basic coverage may seem appealing due to lower premiums, it often falls short during serious medical situations.

AED 3 million health insurance offers enough coverage to handle major healthcare needs, but remains affordable enough for individuals, families, and professionals. With strong inpatient and outpatient benefits, access to quality hospitals, and optional international coverage, this level of protection meets the needs of most UAE residents.

Frequently Answered Questions

1. Is AED 3 million medical insurance enough for you?

For most individuals and families in the UAE, AED 3 million health insurance provides more than enough coverage for both routine care and major medical treatments.

2. Can I visit any hospital with AED 3 Million health insurance plan?

It depends on your policy. Network-based plans restrict you to approved hospitals, while reimbursement-based plans offer greater flexibility.

3. What is the coverage limit of basic health insurance plans in UAE?

Basic plans usually range between AED 150,000 and AED 500,000, significantly lower than AED 3 million health insurance.

4. Does it cover pre-existing conditions?

Most plans cover pre-existing conditions after a waiting period, typically between 6 and 12 months.

5. Are international treatments included?

Some best AED 3 million health insurance plans include international emergency treatment, while others offer optional global coverage.

6. Can I upgrade my AED 3 Million health insurance plan with extra benefits?

Yes, many insurers allow add-ons such as dental care, optical benefits, maternity upgrades, and international coverage.