For many individuals and families, AED 5 Million Health Insurance strikes a sensible balance between comprehensive protection and affordability. It offers a strong safety net for hospital care, specialist treatment, and long-term medical needs, without pushing premiums into ultra-premium territory.

In this guide, we explain types of AED 5 million health insurance in the UAE, who it is most suitable for, what it covers, and how to choose the right policy in the UAE. Keep in mind, selecting the right limit is not just about cost; it is about making sure that you and your loved ones are fully protected if serious or unexpected medical issues arise

Too Long; Didn’t Read (TL;DR)

- AED 5 million health insurance provides a high annual medical coverage limit suitable for families, professionals, and individuals who want strong financial protection.

- The best AED 5 million health insurance plans usually include inpatient and outpatient care, diagnostics, surgery, maternity, and chronic disease treatment.

- The coverage is higher than standard plans, making it suitable for those who want peace of mind without paying for ultra-premium insurance.

- The right policy depends on the hospital network, benefits, exclusions, and fine print, not just the coverage limit.

What is AED 5 Million Health Insurance?

An AED 5 million health insurance policy is a medical insurance plan that offers up to five million dirhams in annual coverage for eligible healthcare expenses. This amount includes hospital stays, surgeries, outpatient treatments, diagnostics, medications, and sometimes international emergency care, depending on the policy.

To put this into perspective, many basic health insurance plans in the UAE come with annual limits ranging from AED 150,000 to AED 500,000. While those amounts may cover routine medical needs, they can quickly fall short when facing major surgery, long-term illness, or advanced treatments. This is where a higher coverage limit becomes especially important.

With AED 5 million health insurance, policyholders gain access to a wider range of hospitals, advanced treatments, and specialist care without worrying about reaching their financial limit too soon. It is designed for people who want dependable coverage that goes beyond basic requirements while remaining practical and cost-effective.

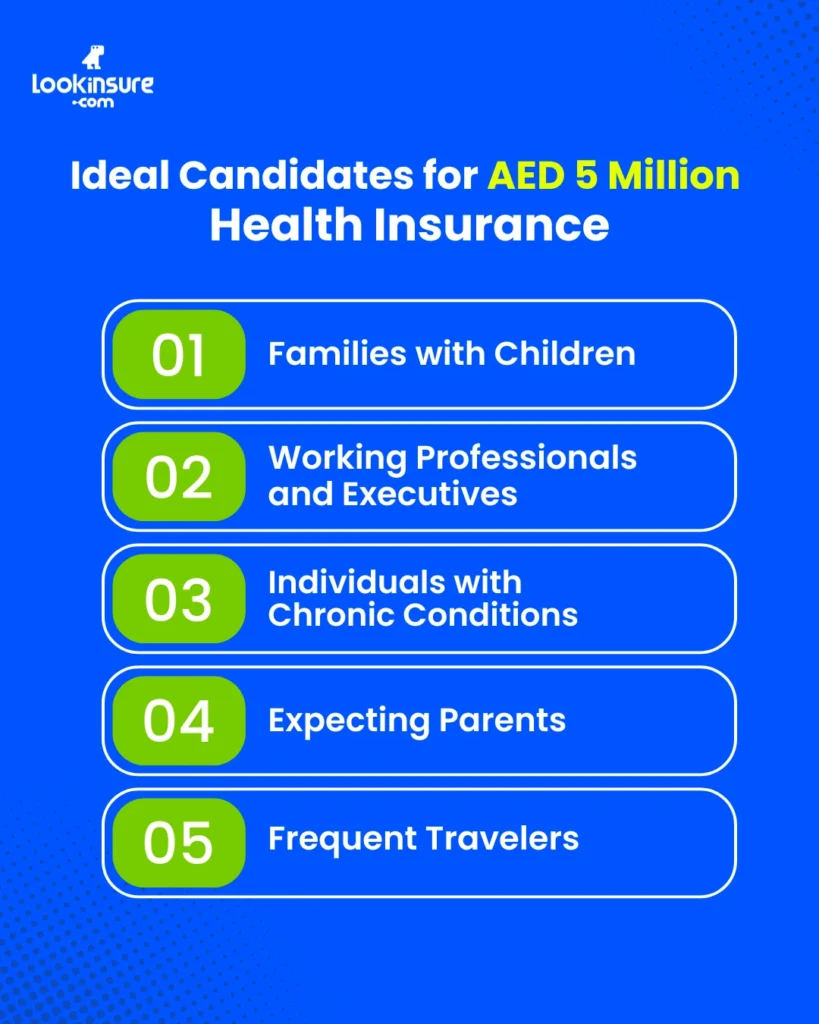

Who Needs AED 5 Million Health Insurance?

This level of coverage is not necessary for everyone, but it is highly suitable for many people living and working in the UAE. Based on market insights and consumer behavior, AED 5 million health insurance is especially beneficial for:

Families with Children

Healthcare expenses can rise quickly when children are involved, especially with regular pediatric visits, vaccinations, and unexpected hospital care. A higher limit ensures continuous access to quality healthcare without financial stress.

Working Professionals and Executives

Professionals who value fast access to specialists, premium hospitals, and advanced diagnostics often prefer higher-limit plans. It allows them to receive timely medical attention without compromising on treatment quality.

Individuals with Chronic Conditions

People managing conditions such as diabetes, asthma, heart disease, or autoimmune disorders often require frequent tests, medications, and specialist care. A larger coverage limit helps prevent financial pressure over the long term.

Expecting Parents

Maternity care, delivery, and newborn coverage can be expensive, particularly at private hospitals. Higher coverage allows families to choose better facilities and doctors without worrying about high out-of-pocket costs.

Frequent Travelers

Many high-limit plans include worldwide emergency coverage, which is particularly useful for people who travel often for work or leisure.

What Does AED 5 Million Health Insurance Cover?

In most cases, AED 5 million health insurance cover does not include entirely new benefits compared to standard plans. Instead, it enhances the depth, limits, and flexibility of existing benefits. This means higher sub-limits, broader hospital networks, and better access to advanced care.

Here is what you can typically expect from AED 5 million health insurance cover:

| Coverage Category | What is Usually Included |

| Inpatient treatment | Hospital accommodation, surgical procedures, ICU charges, anesthesia and operating theatre costs, nursing care |

| Outpatient services | General practitioner visits, specialist consultations, diagnostic imaging (MRI, CT scans, X-rays, ultrasound), blood tests and lab investigations |

| Prescription medications | Coverage for prescribed drugs, chronic condition medications, post-hospitalization prescriptions |

| Maternity and newborn care | Antenatal check-ups, delivery (normal and C-section), postnatal care, newborn coverage (subject to policy terms) |

| Chronic disease management | Long-term disease monitoring, specialist follow-ups, continuous medication coverage |

| Emergency & international coverage | Emergency treatment worldwide, medical evacuation and repatriation (in many plans) |

In short, AED 5 million health insurance cover offers broader financial protection, ensuring that even costly treatments remain affordable and accessible.

Types of AED 5 Million Health Insurance

Although insurers do not officially categorize policies under fixed headings such as “AED 5 million plans,” the market offers several variations that effectively fall under this range. To simplify comparisons, we can group them into the following types of AED 5 million health insurance:

1. Comprehensive Individual Plans

Individual health insurance designed with wide hospital access, advanced diagnostics, and specialist care.

2. Family Medical Insurance Plans

Tailored for families, including maternity, pediatric care, and wellness benefits under one shared limit.

3. Corporate & SME Group Plans

Offered by employers to cover staff, often featuring enhanced benefits and better hospital networks.

4. International Health Insurance Plans

Provide worldwide emergency and planned treatment options, ideal for frequent travelers and senior executives.

Best AED 5 Million Health Insurance Plans

While insurers rarely label plans directly as “AED 5 million,” many of their premium offerings fall within this range. Below are examples of best AED 5 million health insurance plans from the top health insurance providers in UAE:

| Insurer | Plan Name | Approx. Annual Limit | Coverage Highlights |

| Cigna | Healthguard International | ~AED 5M–7M | Worldwide cover, inpatient & outpatient, mental health |

| Sukoon Insurance | HealthPlus Plans | ~AED 5M–6M | Comprehensive maternity, outpatient & wellness |

| GIG Gulf | Premier / Global Plan | ~AED 5M–7M | Broad hospital network, optional dental & optical |

| Allianz (via local partners) | Executive Care | ~AED 5M+ | Global hospital access, medical evacuation |

| Bupa Global | Elite (Lower Tier) | ~AED 5M+ | Premium international healthcare access |

Note: Limits, benefits, and networks may vary. Always review policy documents carefully before purchasing.

What’s Not Covered Under AED 5 Million Health Insurance?

Even the most comprehensive types of AED 5 million health insurance come with exclusions. Common limitations include:

- Cosmetic and elective procedures

- Fertility treatments (IVF, egg freezing, surrogacy)

- Experimental or unlicensed treatments

- Dental and optical care unless added as optional benefits

- Non-emergency treatment outside the hospital network

- Certain pre-existing conditions (depending on underwriting terms)

Understanding these exclusions, such as pre-existing conditions in health insurance, helps prevent unpleasant surprises later on.

How to Choose the Right AED 5 Million Health Insurance in the UAE?

Selecting the right policy goes far beyond simply picking a high coverage limit. The fine print, hospital network, exclusions, and claim procedures matter just as much.

Here is a practical approach:

Assess Your Medical Needs

Consider age, family size, existing health conditions, maternity requirements, and lifestyle factors.

Review Hospital Networks

Make sure your preferred hospitals, clinics, and doctors are included.

Examine Sub-Limits

Check outpatient caps, medication limits, maternity benefits, and diagnostic coverage.

Compare Multiple Insurers

Premiums, benefits, and claim support can vary widely.

Get Professional Guidance

This is where Lookinsure can be extremely helpful, especially with choosing health insurance for expats in the UAE. Our advisors explain policies in clear language, compare multiple providers, and help you select coverage that actually fits your medical and financial priorities, not just the biggest number on paper.

Conclusion

For many residents of the UAE, AED 5 million health insurance offers a strong balance between financial security and affordability. It provides comprehensive coverage for major medical expenses while allowing flexibility in hospital choice and treatment quality.

While the best AED 5 million health insurance plans may not be necessary for everyone, they can be an excellent option for families, professionals, and individuals who want dependable healthcare protection without stepping into ultra-premium pricing. The key is to look beyond the headline limit and focus on benefits, exclusions, hospital networks, and long-term value.

Frequently Answered Questions

1. Is AED 5 million medical insurance enough for you?

For most individuals and families, yes. It comfortably covers major treatments, surgeries, and long-term care needs.

2.Can I visit any hospital with AED 5 Million health insurance plan?

Not necessarily. Coverage depends on the hospital network listed in your policy. Out-of-network visits may require prior approval.

3.What is the coverage limit of basic health insurance plans in UAE?

Basic plans usually range from AED 150,000 to AED 500,000 annually, which is suitable for routine medical needs.

4.Does AED 5 million health insurance cover plastic surgeries?

Only if medically necessary, such as reconstructive surgery after an accident or illness. Cosmetic procedures are generally excluded.

5. Are international treatments included in a AED 5 million policy?

Many types of AED 5 million health insurance include worldwide emergency treatment. Planned international care may require special approval or add-ons.

6. Can I upgrade my AED 5 Million health insurance plan with extra benefits?

Yes. Most insurers offer add-ons for dental, optical, maternity upgrades, wellness benefits, and international coverage.