Car modification in the UAE is a tricky road. Major performance mods are prohibited, but there are still many ways to personalize your ride. If you are thinking about joining this community, there is one thing that shouldn’t be ignored: how car modifications effect the car insurance price and coverage.

This complete guide will walk you through everything you need to know about insurance for modified cars, from understanding premium changes to UAE’s specific legal landscape. We are covering all the key aspects of car modifications and their effect on car insurance in the UAE, so you can make smart choices.

Understanding Car Modifications in the UAE

Car modification is a broad term. Let’s look at it in terms of car modifications effect the car insurance company is concerned with.

What Qualifies as a Car Modification?

Put simply, a car modification is any change you make to your vehicle that alters it from the manufacturer’s original specifications. It is a popular way for car owners to enhance their vehicle’s look, speed, or handling. Whether it is a minor change like new seat covers or a major project like an engine swap, it legally counts as a modification.

Common Types of Modifications

Car modifications and their effect on car insurance in the UAE generally fall into three main categories:

- Aesthetic Modifications: These are changes that modify the vehicle’s visual appeal. Think custom paint jobs, vinyl wraps, tinted windows, or installing alloy wheels.

- Performance Enhancements: This category is for modifications that aim to boost the car’s power and driving dynamics. Common examples include engine tuning, upgrading the exhaust system, installing turbochargers, and altering the suspension.

- Safety Enhancements: These modifications are designed to protect you and your vehicle. This includes adding anti-theft devices, rear-view cameras, and GPS trackers, which are positive factors in insurance for modified cars.

Legal vs Illegal Modifications in the UAE

The UAE has clear, strict regulations governing what you can and cannot do to your car.

Legal Modifications (with approval):

Some car modifications effect the car insurance are perfectly legal, but they often require official approval from authorities like the RTA. This includes engine upgrades that stay within emission and noise limits, approved suspension adjustments, and legal window tinting. Changing your car’s color is allowed, but you must get it officially registered.

Illegal Modifications:

Some modifications are strictly prohibited because they compromise safety or environmental standards. These include:

- Window tinting that lets in less than 50% of light on front windows.

- Noisy exhaust systems that exceed 95 decibels.

- Excessive suspension lowering that reduces ground clearance below the legal minimum.

- Unapproved engine swaps performed without proper authorization.

How Car Modifications Affect Car Insurance

As mentioned, car modifications and their effect on car insurance in the UAE depend on the risk factor. Flashy cosmetic mods mainly lead to premium increases. In case of safety mods, you can get discounts based on how it lowers perceived risk.

Impact On Insurance Premiums

The car modifications effect the car insurance have on your premium are mostly increases. Generally, modifications are seen as increasing risk, which leads insurers to adjust their prices upward.

- Performance Modifications: These almost always lead to a higher premium. Insurers see them as increasing the likelihood of high-speed accidents.

- Aesthetic Modifications: The impact here can be mixed. Simple changes might have a minimal effect on insurance for modified cars, but expensive visual upgrades that make your car a target for theft can push your premium up.

- Safety Modifications: Interestingly, these can sometimes work in your favor. Adding an approved anti-theft device can actually lower your premium by reducing the risk of theft.

Risk Factors Insurance Companies Consider

When you apply for insurance for modified cars, the provider will carefully assess several risk factors tied to your customizations. The major car modifications effect the car insurance risk assessment include:

- Increased Theft Appeal: Flashy and expensive modifications can make your vehicle more attractive to thieves, raising the risk of a theft claim.

- Higher Accident Risk: Performance upgrades are statistically linked to riskier driving behavior and a higher potential for accidents.

- Costlier Repairs: Aftermarket parts are often more expensive to repair or replace than standard factory parts, leading to a much larger repair bill for the insurer.

Modifications that May Void Coverage

Almost all car modifications effect the car insurance, but some outright void coverage. Failing to follow the rules can lead to a situation where your insurer refuses to pay a claim. The primary way drivers void their coverage is by not declaring their modifications to their insurer. If you have an accident and the insurance assessor discovers an undeclared performance chip, your claim will likely be denied.

| Modification Type | Insurance Impact | Legal Status in UAE | Typical Premium Change |

| Engine Upgrade | Higher risk of accidents & costly claims | Needs RTA/ESMA approval | 15–25% Increase |

| Body Kit/Exterior | Can increase theft appeal and repair costs | Often allowed with approval | 5–10% Increase |

| Paint/Wraps | Minimal risk if declared and legally compliant | Allowed, but the color change must be registered | Low to No Impact |

| Suspension Change | Changes in handling, perceived as a safety risk | Needs approval; excessive lowering is illegal | 10–30% Increase |

| Safety Devices | Reduces risk of theft and may lead to discounts | Legal and often encouraged | 5–15% Decrease |

Insurance for Modified Cars in the UAE

Now that we covered the basics, let’s get into how to handle policy changes for car modifications and their effect on car insurance in the UAE:

Specialized Insurance Policies For Modified Cars

With the growing popularity of custom vehicles, several insurers now offer specialized insurance for modified cars. A specialized insurance policy will more carefully consider how car modifications effect the car insurance. The main conditions for these policies include:

- Modifications must have been done by authorized dealers.

- They must fully comply with UAE laws.

- You must possess the official ESMA Certificate of Modification.

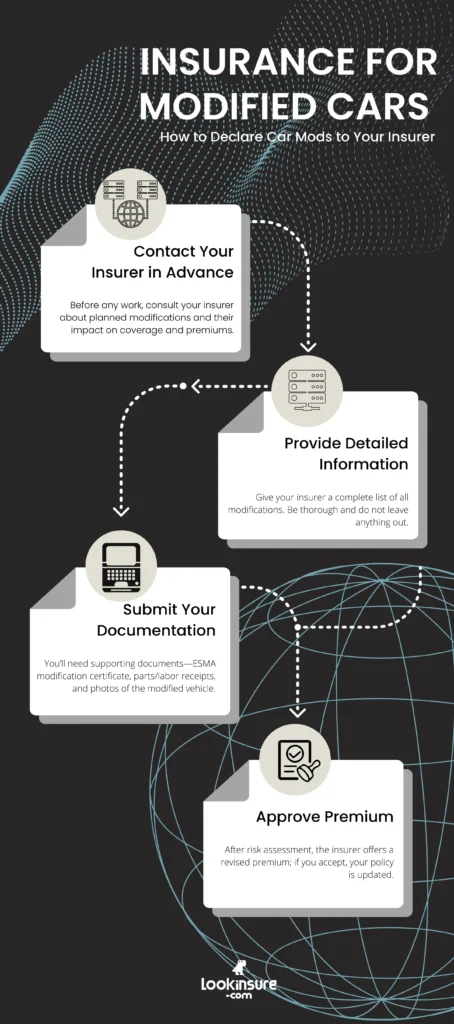

Steps To Declare Modifications To Your Insurer

Transparency is the most important rule when it comes to insurance for modified cars. The process of declaring your changes is pretty straightforward.

- Contact Your Insurer in Advance: Before you start the work, talk to your insurance provider. Discuss the changes you are planning and how such car modifications effect the car insurance

- Provide Detailed Information: Give your insurer a complete list of all modifications. Be thorough and do not leave anything out.

- Submit Your Documentation: You will need to provide supporting documents. This usually includes the ESMA Certificate of Modification, receipts for the parts and labor, and photographs of the modified vehicle.

- Accept the Premium Adjustment: Based on the risk assessment, the insurer will present you with a new premium. If you agree, your policy will be updated.

What Happens If You Don’t Declare Modifications

Choosing not to declare your modifications is a risky gamble. If the inspection finds undeclared modifications during the claims process, they can rightfully refuse the claim entirely. This means you would be personally responsible for all repair costs. In some severe cases, the insurer could even cancel your policy for providing inaccurate information.

Cost Implications and Hidden Risks

Car modifications effect the car insurance base price. From insurance premium increases to the added risk of theft and accidents, let’s see what you’re in for:

Why Modified Cars Usually Cost More To Insure

It is a consistent trend: insurance for modified cars costs more than for standard vehicles. This is a direct reflection of the elevated risks and costs that insurers associate with customized vehicles. The specialized insurance for modified cars is priced higher for a few key reasons.

Safety Concerns and Higher Accident Risks

Beyond the insurance costs, there are genuine safety concerns that come with certain modifications. This is a crucial part of the car modifications and their effect on car insurance in the UAE safety discussion. Altering the factory-tested setup of a vehicle can sometimes unintentionally create hazards.

Impact On Resale Value And Claims

The financial impact of how car modifications effect the car insurance doesn’t end in premiums. It can also affect your car’s resale value and the outcome of insurance claims. While you might pour money into customizations, the broader market for used cars often does not value them as much. Without special insurance for modified cars, you will not recover the significant extra money you invested.

Guidelines for Car Owners

UAE regulations for modified cars are pretty strict. This means you need to stay ahead of policy changes to remain compliant.

How To Stay Compliant With UAE Laws

To get your modifications approved, you should follow these steps:

- Visit an RTA or ESMA-Approved Workshop: Always choose a certified workshop that knows the regulations.

- Share Your Modification Plans: Discuss the changes you want with the experts at the approved workshop.

- Undergo a Vehicle Inspection: The workshop or the RTA will inspect your car to ensure it meets all safety and environmental standards.

- Get Your Approval Certificate: Once everything is approved, you will receive an official Certificate of Modification to update your vehicle’s registration.

Tips To Reduce Insurance Costs For Modified Cars

Even though insurance for modified cars is generally more expensive, there are smart strategies you can use to keep your costs down:

- Focus on Safety Upgrades: Prioritize modifications that improve safety and security, like anti-theft alarms. Some insurers offer discounts for these.

- Maintain a Clean Driving Record: A history free of accidents and traffic violations shows insurers you are a responsible driver.

- Keep Meticulous Records: Hold on to every receipt and photograph related to your modifications. This documentation proves the value of your upgrades.

- Shop Around and Compare: Get quotes from multiple providers, especially those known for offering insurance for modified cars.

Recommended Insurers For Modified Vehicles

While many standard insurers may be hesitant to cover heavily modified vehicles, some companies are more accommodating. Major insurers like ADNIC, for example, explicitly mention that they offer customizable policies for modified and imported vehicles.

Conclusion

The world of car customization in the UAE is exciting and lets you put your personal stamp on your vehicle. However, it is absolutely vital to understand that this personalization comes with serious financial and legal responsibilities. The car modifications effect the car insurance is significant and cannot be an afterthought.

The golden rule in insurance for modified cars is always transparency. Being open and honest with your insurer about the changes you have made, and ensuring every single modification is fully legal and certified, is the only way to drive with true peace of mind.

Frequently Answered Questions

1. Do all car modifications affect insurance in the UAE?

Yes, practically all modifications have the potential to affect your insurance. Performance upgrades almost always increase your premium, while safety features might lower it.

2. What modifications can void my car insurance policy?

The modifications most likely to void your policy are illegal ones, and any changes you fail to declare to your insurance company.

3. Is it mandatory to declare modifications to insurers in the UAE?

Yes, it is absolutely mandatory. Failing to declare modifications is considered non-disclosure and can lead to denied claims and policy cancellation.

4. Which insurers provide coverage for modified cars in the UAE?

Unless you have a Fast-and-Furious level souped up car, almost all providers can accommodate your insurance needs. But several providers offer specialized insurance for modified cars. Companies like ADNIC, for instance, have stated they provide customizable policies for modified vehicles.

5. How much extra does insurance cost for modified vehicles?

The insurance for modified cars cost increase isn’t fixed; it depends on the type and value of the modifications. Basic aesthetic changes might lead to a small 5-10% increase, while major performance work could push premiums up by 25% or more.

6. Are cosmetic changes like wraps and stickers considered modifications?

Yes, cosmetic changes like wraps and stickers are considered car modifications, and their effect on car insurance in the UAE is still considered by the company. While they may have a smaller impact on your premium, they still need to be declared.