Whether you’re checking health insurance cost Dubai individual plans or trying to figure out an insurance premium that won’t shock you at renewal time, the numbers can feel unpredictable. But they don’t have to stay that way.

This guide breaks everything down into plain, friendly language. Clear look at what shapes the average health insurance premium Dubai and how much individuals and families usually pay. By the end, you’ll know exactly what’s going on behind the scenes and what kind of plan actually fits your life.

Too Long; Didn’t Read (TL;DR)

- Health insurance costs in Dubai depend mainly on your age, medical history, plan type, and how many people you want to cover. Individuals pay less with basic plans, while the cost of medical insurance for families gets higher as they add spouses, kids, or parents.

- Basic plans are the cheapest, standard plans offer more comfort, and comprehensive plans give the widest coverage. Pre-existing conditions usually raise the price.

- Family floater plans can be cheaper than separate policies, and comparing insurers helps you find the best value.

- You can cut costs by choosing the right deductible, paying yearly, and checking prices online. Tools like Lookinsure make it easier to compare plans and get DHA-approved coverage you can rely on.

Factors Affecting Health Insurance Cost in Dubai

Health insurance prices in Dubai can vary a lot from one person to another. There isn’t a single number that fits everyone, because insurers look at a few key details before deciding how much your average health insurance premium Dubai should be. Once you understand these factors, the pricing starts to make a lot more sense.

Age and medical history

Your age is one of the biggest reasons premiums go up or down. Younger adults usually pay less because they need fewer medical treatments.

Medical history also plays a strong role. If you already have certain health conditions or if you need regular medication or follow-ups, the insurer considers you a higher-risk customer and the premium becomes higher.

Type of plan (basic, standard, comprehensive)

The kind of plan you choose changes the price immediately.

A basic plan gives you essential coverage and is usually the cheapest option.

A standard plan adds more hospitals, more treatments, and sometimes maternity.

A comprehensive plan covers the widest range of hospitals, specialists, and extra benefits, so it naturally costs more.

The rule is simple: the more coverage you want, the higher Dubai health insurance prices will be.

Employer-sponsored vs self-purchased insurance

If your employer provides your health insurance, you usually pay much less (sometimes nothing at all) because companies pay most of the cost.

But if you buy a plan yourself, the price can be higher since you’re paying the full premium.

Coverage for dependents and family members

Covering a spouse, children, or even parents increases the premium and total cost of medical insurance for families because the insurer is covering more people and more possible medical needs.

Children often cost less to insure, while older parents usually cost more.

For more accurate pricing you can try our online comparison tool which will give you access to personalized quotes from multiple providers all at once:

Average Health Insurance Premiums for Individuals

If you’re buying health insurance just for yourself, the prices in Dubai follow a pattern that’s actually pretty easy to understand once you see how the plans are divided.

Basic coverage costs for a single adult

These plans are designed to meet DHA requirements and cover the essential things such as general doctor visits, emergency care, and basic treatments. It is also considered as a plan with the lowest health insurance cost Dubai individual.

For many people, especially young adults with no major health issues, this is usually enough. Also this plan is considered as a vital expat health insurance Dubai residents usually buy.

Standard and comprehensive individual plans

A standard plan adds a little breathing room. You get access to more hospitals, more specialists, and sometimes extras like maternity or dental. It costs more than a basic plan.

A comprehensive plan is the “no worries” choice. It covers a wide network of hospitals, more advanced treatments, and better benefits overall and of course, comes at the highest price!

How chronic conditions and pre-existing illnesses affect premiums

If you have a long-term condition like diabetes, asthma, or heart-related issues, the insurer expects more check-ups and treatments ahead and pushes the premium higher.

Pre-existing illnesses work the same way. They don’t stop you from getting a plan, but they do change the price of health insurance cost Dubai individual.

Family Health Insurance Premiums in Dubai

The moment more people enter the picture, family health insurance premium Dubai UAE shifts. Sometimes a little. Sometimes a lot. Let’s see how insurers calculate it:

Average costs for couples and children

The average health insurance premium Dubai usually pays is more than two single adults. Not because insurers want to make life hard, but because joint plans come with better coverage and shared benefits.

Kids, on the other hand, often cost less. They need fewer long-term treatments, so their premiums stay lower.

Family floater plans vs individual family plans

Family floater means one pool of coverage. If someone gets sick, the coverage comes from the same shared limit. It also reduces family health insurance premium Dubai UAE in comparison to insure family members separately.

But individual plans give each person their own space. Their own limit. Their own coverage rules. This costs more, but it protects you from situations where one person’s big medical bill affects everyone else.

Adding parents or extended family to the plan

Adding parents changes the price quickly. Older adults have more medical needs, and insurers adjust the premiums to match that reality.

Extended family members (brothers, sisters, in-laws) follow the same rule. The older they are, or the more medical history they bring with them, the higher the premium climbs.

Many families use special plans for parent health insurance in Dubai so their costs don’t inflate the rest of the family’s premiums.

Comparing Premiums Across Major Insurance Providers

To lower the average health insurance premium Dubai residents must be patient when choosing their provider. Going with the first option you come across means not finding out about cheaper deals that other providers might have been offering. So make sure you spend some time researching in order to make the best choice.

Here is a little guide to help you start on your research journey:

Top insurers for individual plans

For individuals, a few names appear again and again.

- Daman offers strong basic plans that meet DHA rules and stay affordable for most people.

- AXA has wider hospital networks and more flexible coverage options.

- ADNIC is popular for expats health insurance because of its reliable service and easy claim process.

Best insurers for family plans

Families often lean toward insurers with strong networks and fast claim approvals.

- Daman’s family plans are popular because they keep costs under control and include essential benefits for children.

- Cigna and Allianz sit on the higher end, but they offer very broad networks, including international coverage that helps families who travel often.

- Orient Insurance also has good mid-range plans that work well for families living long-term in the UAE.

Cost comparison table

| Provider | Typical Individual Premium (Annual) | Typical Family Premium (Annual) | Network Strength | Notes |

| Daman | AED 900–2,000 | AED 4,000–7,500 | Strong (UAE-wide) | Good for basic plans and DHA-compliant options. |

| AXA | AED 1,500–4,500 | AED 6,000–12,000 | Very strong | Good mix of standard and comprehensive plans. |

| ADNIC | AED 1,200–3,800 | AED 5,000–10,000 | Strong | Popular with expats; easy claims. |

| Orient Insurance | AED 1,000–3,200 | AED 4,800–9,500 | Medium–Strong | Good mid-range plans with balanced coverage. |

| Cigna | AED 6,000–18,000 | AED 18,000–45,000 | Premium-tier | Global coverage for frequent travelers. |

| Allianz | AED 8,000–22,000 | AED 20,000–50,000 | Premium-tier | Very wide international network |

Note: These prices are estimated, for more information get a quote from Lookinsure.

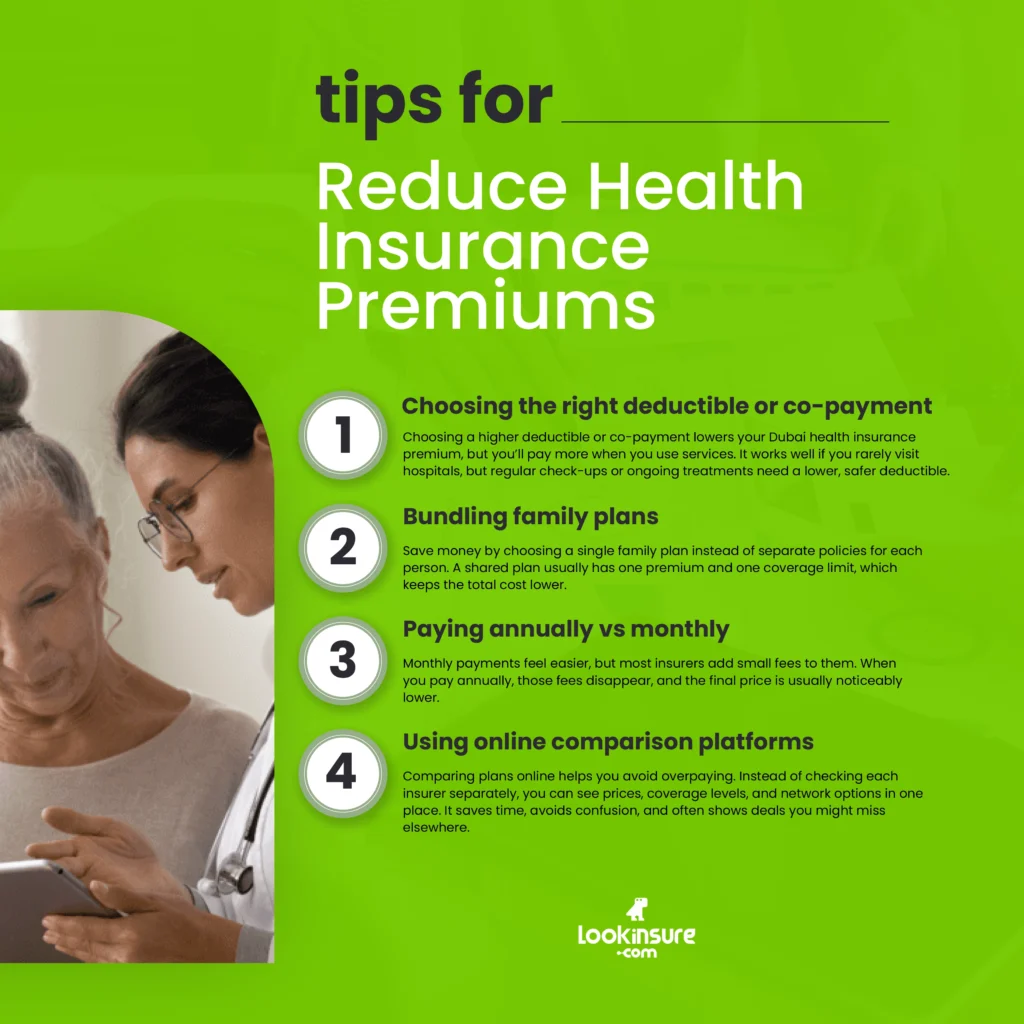

Tips to Reduce Health Insurance Premiums

Health insurance can get expensive fast. But there are a few practical ways to bring the price down without cutting the coverage:

Choosing the right deductible or co-payment

One of the easiest ways to lower Dubai health insurance prices is choosing a higher deductible or co-payment. This means you agree to pay a bit more when you actually use medical services, but your monthly or yearly premium becomes much cheaper.

For people who rarely visit hospitals, this trade-off can save a lot of money. But if you have regular check-ups or ongoing treatments, a lower deductible is usually the safer and more comfortable choice.

Bundling family plans

Save money by choosing a single family plan instead of separate policies for each person. A shared plan usually has one premium and one coverage limit, which keeps the total cost lower.

Paying annually vs monthly

Monthly payments feel easier, but most insurers add small fees to them. When you pay annually, those fees disappear, and the final price is usually noticeably lower.

Using online comparison platforms

Comparing plans online helps you avoid overpaying. Instead of checking each insurer separately, you can see prices, coverage levels, and network options in one place. It saves time, avoids confusion, and often shows deals you might miss elsewhere.

Buying Health Insurance in Dubai

It is a bit like walking into a busy market: there are plenty of options, plenty of voices, and plenty of shiny promises for a health insurance plan. Read below tips to avoid confusion.

How to select the right plan based on budget and coverage

Ask yourself two simple questions:

“How much can I spend comfortably?” and “What kind of care do I actually need?”

These two answers shape everything.

A young adult with no major health issues might do perfectly fine with a basic or mid-range plan. A family with kids will likely want a wider network and stronger coverage for emergencies.

Think of it like choosing a phone plan: the cheapest one works only if it actually covers the things you use every day. The right insurance plan works the same way.

Required documentation for individuals and families

Easiest part. You’ll need a passport copy, a visa or Emirates ID copy, and sometimes a recent photo. Families simply repeat the same for each person, plus marriage or birth certificates if the insurer asks for proof.

Online vs offline purchase options

Online platforms make the process fast. You check Dubai health insurance prices, networks, and benefits side by side, then buy the policy in minutes. It’s practical and saves time.

Offline works too. Some people like speaking to a real person, especially when they’re buying insurance for the whole family or dealing with special medical needs.

Both paths lead to the same result. The difference is just choosing the style that makes you feel more comfortable.

Why Lookinsure Is a Smart Choice

Lookinsure is for people who don’t want to waste time trying to understand insurance. The goal is simple: make the whole process faster, clearer, and a lot less stressful.

Compare premiums instantly

Instead of clicking through ten different websites, Lookinsure puts the numbers in one place. You see plans, prices, and networks side by side,Just clear comparisons in a few seconds.

Check DHA-approved plans

Every plan you see on Lookinsure is DHA approved health insurance in Dubai. That means no outdated policies, no missing benefits, and no surprises later.

Support for individuals and families during claims

The day you need help and suddenly everything feels a bit overwhelming, we step in. Instead of leaving you to figure out claim forms on your own, we walk you through all.

Conclusion

Health insurance costs in Dubai depend on many factors such as age, medical history, plan type, and family size.

Comparing providers, checking coverage levels, and using comparison websites can save you both time and money. Whether you’re buying your first plan or looking for less family health insurance premium Dubai UAE, taking a few minutes to compare options ensures you get solid coverage, DHA-compliant protection, and support when you need it most.

Frequently Answered Questions

1. How much does individual health insurance cost in Dubai?

Dubai individual health insurance can range from roughly AED 1,200 to AED 6,000 per year, depending on age, coverage, and provider.

2. What is the average family health insurance premium in Dubai?

Average family health insurance premiums in Dubai are typically between AED 10,000 and AED 40,000 per year for a family of 3–4.

3. Do premiums increase with age?

Yes. Older adults usually pay more because insurers expect more medical care as age increases.

4. Can pre-existing conditions affect health insurance cost?

They can. Long-term illnesses or regular treatments often lead to higher premiums because the insurer expects more medical expenses.

5. Is there a difference in cost between employer-provided and self-purchased plans?

Usually yes. Employer plans are often cheaper because the company pays part of the cost. Self-purchased plans require you to pay the full premium.

6. Are there cheaper alternatives for families in Dubai?

Family floater plans often cost less than buying separate plans for each person.