Moving to the UAE is exciting: sunshine, career growth, and a metropolitan lifestyle. But once the excitement settles, every newcomer quickly learns one thing: health insurance for expats isn’t optional. It’s mandatory!

You might get your medical coverage through an employer or a personal plan. The right expat medical insurance in UAE keeps you legally covered but also protects you from unexpected medical expenses.

In this guide, we’ll help you find the best expat health insurance for your needs and understand the key differences between emirates.

Too Long; Didn’t Read (TL;DR)

Health insurance is mandatory for all expats in the UAE. It’s a legal requirement for your visa and essential for accessing the country’s high-quality healthcare without facing huge bills.

- The Basics: Most expats get basic coverage through their employer. If you’re self-employed, sponsoring family, or want better coverage, you must buy your own plan.

- What to Look For: A good plan should cover inpatient (hospital stays) and outpatient (doctor visits) care. Also check the hospital network to ensure your preferred clinics are included.

- Cost: Basic plans can start from AED 700-1,000 per year. Comprehensive coverage (including maternity, dental, or international care) typically costs AED 2,000-5,000+.

- Top Providers: Reputable companies include AXA Gulf, Daman, Cigna Global, and Allianz Care.

- Key Tip: Don’t just pick the cheapest plan. Compare coverage details, especially for pre-existing conditions (which often have waiting periods) and renewal deadlines to avoid a coverage lapse.

Bottom Line: Securing the right health insurance is a non-negotiable and crucial part of your move. It provides legal compliance, financial protection, and peace of mind.

Why Expats Need Health Insurance in UAE

Living in a new country can be challenging, especially when you get sick far from home. Without family nearby or knowledge of the local healthcare system, even minor issues can feel overwhelming. So, medical insurance for foreigners in UAE is a safety net.

Legal Requirement

Both Dubai and Abu Dhabi, which have the highest population of expats, have strict laws regarding health insurance, which require every resident, including expatriates, to be covered.

In Dubai, employers must provide expat medical insurance in UAE for their workers, while in Abu Dhabi, the rule extends to employees and their dependents. Other emirates may not have identical laws yet, but having valid health coverage is still necessary for visa renewals and medical treatment.

Access to Quality Healthcare

One of the biggest advantages of living in the UAE is its healthcare system; modern hospitals, skilled doctors, and cutting-edge facilities. With the right expat health cover UAE, you can access these services at affordable rates instead of paying full private fees.

Financial Protection

Even in a place as efficient as the UAE, medical expenses can be surprisingly high. A short hospital stay or surgery can easily cost thousands of dirhams! Having health insurance for expats shields you from those unexpected bills, covering hospital admissions, doctor visits, and sometimes even medication.

Understanding Expat Medical Insurance Plans

When you first start looking at health insurance for expats, the number of choices can feel a bit overwhelming. Some plans are included with your job, while others you have to buy on your own. The key is knowing what each option offers so you can choose the one that actually fits your life in the UAE.

Individual vs. Employer-Sponsored Insurance

Most expats receive expat medical insurance in UAE through their employer. These plans usually cover basic healthcare needs, such as doctor visits, emergencies, and hospital stays.

However, if you’re self-employed, between jobs, or want broader coverage for your family, you can purchase your own plan. Personal policies often allow more flexibility, letting you choose higher coverage limits, extra benefits like dental or maternity, and even international options. It’s the smarter route for those who want more control or plan to stay long-term.

Coverage Types

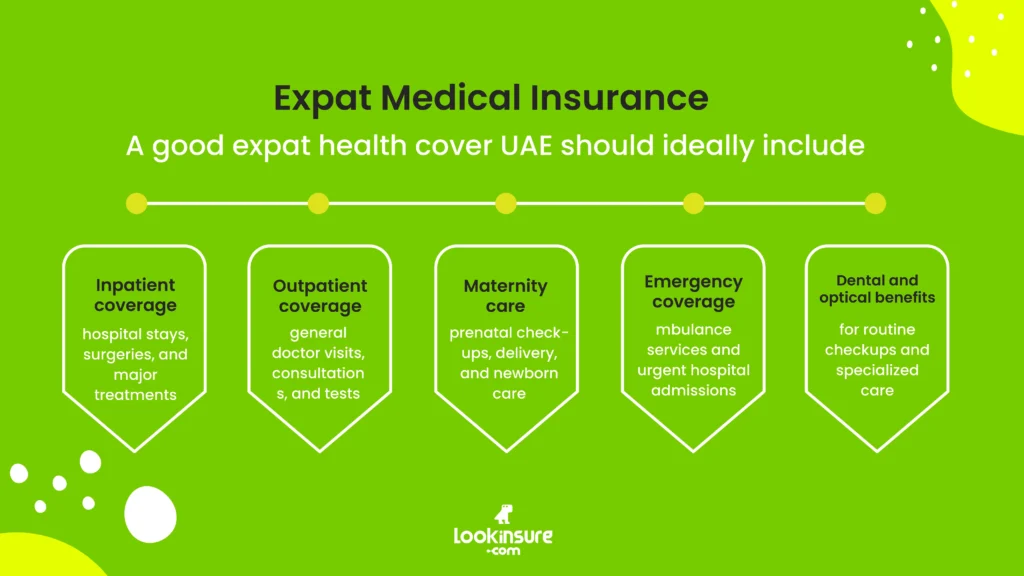

Not all insurance plans are created equal. Some offer just the essentials, while others include almost everything you might need. A good expat health cover UAE should ideally include:

- Inpatient coverage: hospital stays, surgeries, and major treatments.

- Outpatient coverage: general doctor visits, consultations, and tests.

- Maternity care: prenatal check-ups, delivery, and newborn care.

- Emergency coverage: ambulance services and urgent hospital admissions.

- Dental and optical benefits: for routine checkups and specialized care

Network Hospitals

One thing many newcomers overlook when choosing expat health plans is the insurer’s hospital network. The wider the network, the easier it is to find quality care wherever you live or travel within the country.

A strong network means you can walk into approved hospitals, clinics, or pharmacies and receive cashless treatment! So keep looking for a good one!

How to Choose the Right Health Insurance as an Expat

Choosing health insurance for expats in the UAE is about finding what fits your visa (yes your type of visa matters!), budget, and lifestyle, not just the cheapest plan.

Check Eligibility and Residency Requirements

Before anything else, make sure you’re eligible. Some expat medical insurance in UAE plans are designed only for people with valid residence visas, while others also cover dependents or sponsored family members.

If you’re on a freelance or investor visa, you may need a different category of plan. Always confirm eligibility before purchasing so your coverage starts smoothly.

Compare Coverage Levels

Not every plan covers the same medical expenses. When you are looking into expat health cover UAE options, check the limits for hospital stays, maternity benefits, outpatient visits, and specialist consultations. A policy that looks affordable at first might have lower limits or exclude certain services. So dig into the details to make sure it matches your real needs.

Assess Pre-Existing Condition Coverage

If you have an existing medical condition, pay close attention to the fine print. Many medical insurance for foreigners in UAE policies include a waiting period usually six months to a year before covering ongoing conditions. Some may exclude them entirely. It’s better to clarify this upfront than face surprise bills later.

Look for International Coverage

If you travel often for work or visit family abroad, consider international expat medical insurance(nationwide plans) that include global coverage. These let you get treatment overseas or in your home country without losing protection.

Evaluate Premiums and Deductibles

Finally, balance cost and coverage wisely. Lower premiums usually mean higher deductibles or fewer benefits. Compare different affordable expat health plans to find one that fits your budget but still covers emergencies, hospital stays, and more.

Best Expat Health Insurance Providers in UAE

For those new to the country, it can be quite challenging when it comes to choosing the right provider, that’s why we have tried to compile a list of the top health insurance companies in the region to help you with that:

AXA Gulf Insurance

AXA offers flexible expat medical insurance in UAE plans that range from basic to premium coverage. Known for fast claims and wide international reach, it’s a good choice for expats who travel frequently or want global medical support.

Cigna Global Health Insurance

Cigna is popular for its worldwide network and personalized plans. It’s ideal for those seeking expat medical insurance Dubai that includes outpatient care, maternity benefits, and optional international coverage for business or travel.

Orient Insurance (Sukoon)

Orient (now Sukoon) provides affordable and customizable health insurance for expats

(individuals and families). Their DHA-approved policies are widely accepted across clinics in Dubai.

Daman National Health Insurance

Daman is one of the UAE’s largest local insurers and the main provider in Abu Dhabi. It offers comprehensive medical insurance for foreigners in UAE, including emergency coverage, chronic condition management, and strong in-network hospital access.

Allianz Care

Allianz specializes in expat medical insurance Dubai and global health plans. Their coverage extends across the Middle East and Europe, with easy online claims and 24/7 multilingual customer support.

| Provider | Coverage Scope | Network Size | Starting Premium (AED/year) |

| AXA Gulf | Regional + International | Very Wide | ~1,200 |

| Cigna Global | Worldwide | Extensive | ~2,000 |

| Orient (Sukoon) | UAE-based | Large | ~800 |

| Daman | National (UAE) | Very Wide | ~1,000 |

| Allianz Care | Global | Extensive | ~2,500 |

Tips for Expats to Get the Most Out of Their Health Insurance

Once you get your health insurance for expats, a few smart habits can help you use it effectively and avoid surprise costs.

Read the Policy Terms Carefully

Always review your plan’s details. Check exclusions, claim limits, and waiting periods; especially for maternity, dental, or pre-existing conditions. Knowing these terms upfront prevents confusion during emergencies.

Keep Documents Updated

Your coverage is only valid if your paperwork is. Keep your Emirates ID, visa (always check your visa expiration date!), and health card current and linked correctly to your expat health cover UAE. Expired documents can delay claims or hospital approvals.

Use Approved Network Facilities

Whenever needed, visit hospitals or clinics within your insurer’s approved network. So you can use cashless treatment that means you won’t have to pay upfront and wait for reimbursement.

Common Mistakes Expats Should Avoid

Even with the best intentions, expats sometimes make choices that reduce their coverage or create problems later. Here are a few things to watch out for when managing your health insurance for expats.

Choosing Price Over Coverage

Cheap doesn’t always mean smart. Many low-cost affordable expat health plans skip key benefits like maternity care, dental services, or higher hospital limits. Always balance price with protection. Remember that saving a few dirhams upfront can cost much more in an emergency.

Ignoring Renewal Deadlines

Renewing your expat medical insurance on time really matters. Missing the renewal window can leave you without coverage, lead to late fees, or even cause visa issues. Mark the date, renew early, and always keep proof that your insurance is active. Remember health insurance for visa renewal in Dubai is one of the most important documents.

Not Comparing Providers

It doesn’t matter what you are shopping for, everyone agrees that getting quotes from multiple providers is a good choice. Comparing different expat health cover UAE options gives you a clearer view of coverage, networks, and costs. Use platforms like Lookinsure which help you check multiple insurers in the UAE side by side and pick a plan that truly fits your needs.

Conclusion

Settling into life in the UAE means learning how things work, from visas to healthcare. Getting proper health insurance for expats is one of those practical steps that saves you trouble later. It keeps you covered when you need a doctor, protects your wallet when things go wrong, and lets you focus on enjoying your life here instead of worrying about hospital bills.

So take the time to use comparison tools to explore your options, ask questions, and choose expat medical insurance in UAE that fits how you actually live.

Frequently Answered Questions

1. Is health insurance mandatory for expats in UAE?

Yes. Both Dubai and Abu Dhabi require every resident, including foreigners, to have valid health insurance for expats. Employers must provide coverage for their employees, and in Abu Dhabi, dependents must also be insured.

2. How much does expat health insurance cost in Dubai or Abu Dhabi?

Basic expat medical insurance in UAE plans start around AED 700–1,000 per year, while more comprehensive coverage with maternity or international benefits can range from AED 2,000 to AED 5,000 or more, depending on age and health history.

3. What’s the difference between expat and local health insurance plans?

Local plans are designed mainly for UAE citizens and may include government hospital access. Expat health cover UAE, on the other hand, focuses on private and DHA-approved facilities, offering flexible options for foreigners who live and work in the country.

4. Can expats buy individual medical insurance without an employer?

Yes. Freelancers, self-employed professionals, and family sponsors can buy medical insurance for foreigners in UAE directly from insurers or comparison platforms like Lookinsure. These individual plans ensure coverage even if you don’t have an employer.

5. Does expat insurance cover dependents and family members?

Most insurers allow dependents to be added to the main policy. Many affordable expat health plans include family coverage for spouses, children, and sometimes domestic workers, though premiums vary depending on age and benefits.

6. What are the best expat health insurance companies in UAE?

Some of the most trusted providers include AXA Gulf, Cigna Global, Daman, Orient (Sukoon), and Allianz Care, all known for reliable expat medical insurance Dubai and wide hospital networks across the UAE.