Choosing the best health insurance for parents in the UAE can feel pretty difficult, especially when you are trying to balance comprehensive coverage with what you can afford. For many families, especially expatriates, finding the right medical insurance for parents is not just a legal formality but a really important step toward ensuring their well-being.

With healthcare costs consistently rising and a complex insurance market to figure out, properly understanding your options is crucial. This guide is here to walk you through the essentials, from premiums and age limits to the top providers, so you can make a choice that brings you peace of mind.

Too Long; Didn’t Read (TL;DR)

Securing health insurance for your parents is often a visa requirement and is essential due to high medical costs. Here’s what you need to know:

- Cost & Age: Expect to pay AED 4,000 to AED 6,300+ annually for a comprehensive plan. Most insurers set a minimum entry age of 60-65 years, with coverage extendable up to 80 or even 99.

- Key Factors: The premium is heavily influenced by your parents’ age, existing health conditions, and the level of coverage (e.g., outpatient care, medication).

- Top Providers: Leading companies include AXA Gulf (wide network), Orient Insurance (affordable options), and Daman (strong in Abu Dhabi). The best choice depends on your parents’ specific health needs.

- Pro Tip: Always compare plans carefully, paying close attention to the waiting period for pre-existing conditions and the list of covered hospitals.

Why Health Insurance for Parents Is Important in the UAE

The cost of healthcare in the UAE can be surprisingly high, and for medical insurance for senior citizens who often need more frequent medical attention is absolutely necessary. A good health insurance for parents plan acts as a crucial safety net. It is designed specifically to cover things like medical emergencies, hospital stays, and the management of chronic illnesses that can become more common with age.

Beyond just the financial aspect, these plans provide a real sense of emotional and financial security for the whole family. You will know that your parents can access the quality care they need without you having to worry about enormous, unexpected medical bills. This makes medical insurance for parents an essential part of caring for your family in the UAE.

Average Cost and Premiums for Health Insurance for Parents in UAE

Figuring out the cost of health insurance for parents is a key step. Premiums are not fixed and can change based on your parents’ age and health.

- Price Range: Basic plans can start from around AED 1,025 per year. Comprehensive medical insurance for parents typically ranges from AED 3,950 to over AED 6,300 annually.

- Key Cost Factors:

- Age: This is a major factor; older parents usually have higher premiums.

- Coverage Level: Plans with wider hospital networks and outpatient care cost more.

- Health History: Pre-existing conditions can increase the cost of health insurance for parents.

- Emirate: Where you live affects the price due to different regulations.

Sample Annual Premiums for Health Insurance for Parents

| Age of Parent | Plan Type | Premium (AED) | Co-Pay |

| 62 | Gold Classic | 3,950 | 10% |

| 68 | Platinum Plus | 6,300 | 0% |

| 72 | Silver Visitor | 1,350 (90 days) | 20% |

For more accurate and personalized quotes you can head over to our online calculating tool:

Age Limits and Eligibility Criteria

Understanding age limits is crucial when looking for the best health insurance for parents. Here’s a quick breakdown:

- Age Limits: Most providers set a minimum entry age between 60 and 65 years. Coverage often extends to 80 or even 99 years, but this varies.

- Medical Screening: Be prepared to share full medical records. Some insurers require a medical test for medical insurance for parents.

- Residency Status: You will need your parents’ passport, visa, and Emirates ID for resident plans. For visitors, short-term health insurance plans for family members are available.

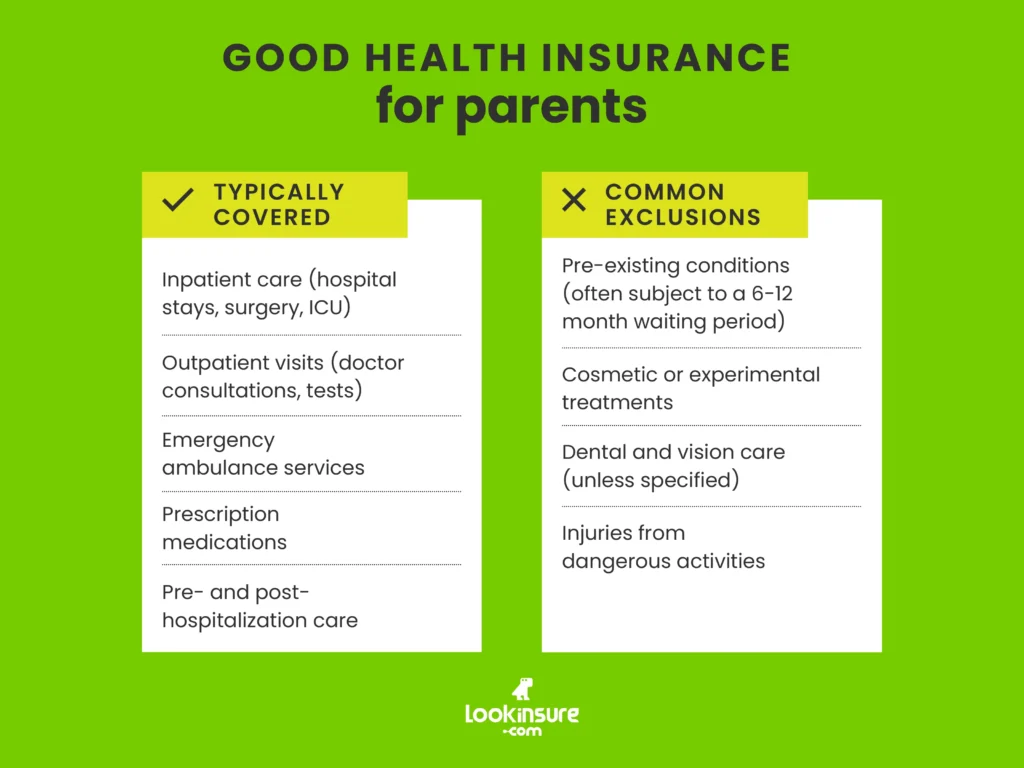

What Is Covered Under Health Insurance for Parents

A good health insurance for parents plan should cover a range of essential medical services. It’s important to know what is included and what is not.

Typically Covered:

- Inpatient care (hospital stays, surgery, ICU)

- Outpatient visits (doctor consultations, tests)

- Emergency ambulance services

- Prescription medications

- Pre- and post-hospitalization care

Common Exclusions:

- Pre-existing conditions (often subject to a 6-12 month waiting period)

- Cosmetic or experimental treatments

- Dental and vision care (unless specified)

- Injuries from dangerous activities

Best Health Insurance Companies for Parents in UAE

Several insurers in the UAE offer dedicated plans, making it easier to find the best health insurance for parents. Here are some of the best health insurance companies in Dubai and other emirates:

- AXA Gulf: Known for flexible and international medical insurance for parents with a wide network.

- Orient Insurance: Offers affordable options with strong benefits for older parents.

- Daman: A leading provider, especially in Abu Dhabi, with special health insurance for parents plans.

- Oman Insurance (Sukoon): Provides comprehensive coverage is an ideal provider of medical insurance for senior citizens.

- MetLife: A strong option for expats seeking medical insurance for parents with critical illness cover.

Top Health Insurance Companies for Parents in the UAE

| Insurance Company | Key Features for Parents | Plan Examples |

| AXA Gulf | Wide network, 24/7 medical support, and flexible plan options. | International coverage plans. |

| Orient Insurance | Affordable options with strong inpatient and outpatient benefits. | I-Med, Orient CareGold. |

| Daman | Government-backed provider in Abu Dhabi with a massive network of providers. | Thiqa programme for UAE nationals. |

| Oman Insurance (Sukoon) | Comprehensive coverage including chronic conditions. | Plans with worldwide coverage. |

| MetLife | Strong global network and options for critical illness coverage. | Plans for expats and non-resident parents. |

| Takaful Emarat | Sharia-compliant plans (Takaful) with options for medical insurance for senior citizens. | E-CARE Blue, Silver, Iridium. |

| Allianz Care | Excellent for worldwide coverage, great for parents who travel. | International health plans. |

How to Choose the Right Health Insurance Plan for Your Parents

Selecting the right medical insurance for parents requires a careful and thoughtful approach. Here is a simple guide to help you choose.

- Assess Health Needs: List any existing conditions, regular medications, and potential future needs.

- Compare Plans: Look at coverage benefits, premium costs, and hospital networks. A broad network is a big plus for parents health insurance Dubai.

- Check the Details: Pay close attention to waiting periods for pre-existing conditions and any sub-limits on treatments.

- Look for Added Value: Consider plans with 24/7 customer support and cashless claim options for the best health insurance for parents experience.

Tips to Lower Health Insurance Premiums for Parents

While good health insurance for parents is important, there are smart ways to make it more affordable.

- Pay Annually: Many companies offer a discount of 5% to 10% if you pay the full premium at once.

- Family Bundles: Inquire about adding your parents to your existing family health insurance UAE policy for a multi-person discount.

- Compare Online: Use insurance aggregators to compare health insurance plans for family coverage side-by-side to find the best value.

- Provide Accurate Records: Maintaining complete and updated medical records helps avoid claim rejections and keeps costs manageable.

Conclusion

Getting the right medical insurance for parents is one of the most valuable steps you can take to protect their health and your own peace of mind while living in the UAE. The process can be pretty difficult to figure out initially, but understanding the premiums, age limits, and coverage details makes the decision much clearer.

The best parents health insurance Dubai plan is one that fits your budget while comprehensively addressing your parents’ specific health needs, ensuring they receive quality care when they need it most. By carefully evaluating different providers and plans, you can find a policy that offers that essential security for your family.

Frequently Answered Questions

1. Is health insurance mandatory for parents in the UAE?

Yes, in emirates like Dubai and Abu Dhabi, sponsors are required to provide health insurance for parents who are resident dependents. It is a legal prerequisite for their residency visa.

2. What is the average cost of parent health insurance in Dubai?

The cost can vary widely, but premiums for parents health insurance Dubai can range from around AED 1,025 for basic clinic-only plans to over AED 6,300 per year for more comprehensive coverage with low or no co-pays.

3. Can I get health insurance for non-resident parents?

Yes, many insurers offer visitor health insurance plans for family members who are non-residents. These plans are designed for short-term stays and can be a great option for parents visiting you in the UAE.

4. Which company offers the best health insurance for parents in UAE?

There is not a single “best” company for everyone. The top insurers like Daman, AXA Gulf, and Orient Insurance all have their strengths. The best health insurance for parents will depend on your parents’ specific age, health profile, and the coverage you need.

5. Can I include my parents under my own health insurance policy?

This depends on your specific employer-provided or personal policy. Some family health insurance UAE plans do allow you to add dependent parents, often for an additional premium. You will need to check the terms of your policy or speak with your provider.