Health insurance in the UAE comes in two main forms: long term and short term health insurance UAE. The type you need depends heavily on your visa status, how long you plan to stay, and what kind of medical care you might need. Visitors often rely on temporary or visitor health insurance Dubai vs resident plans, while residents must follow DHA rules that require full-year coverage. Understanding the difference between these two categories helps you avoid gaps in protection and pick a plan that actually fits your situation.

Too Long; Didn’t Read (TL;DR)

- Short-term plans are meant for visitors and short stays (7–90 days), offering basic emergency care but no chronic, maternity, or long-term benefits.

- Long-term plans are mandatory for all residents and provide full 12-month coverage, including outpatient care, tests, maternity, and chronic illness treatment.

- Visitors only need temporary insurance for the duration of their trip, while residents must maintain annual DHA-approved coverage to keep their visa valid.

- Your choice should be based on visa status, length of stay, and medical needs, short-term for travel or transitions, long-term for full residency and ongoing care.

Overview of Health Insurance Requirements in the UAE

Health insurance rules in the UAE are tied closely to a person’s visa type and how long they plan to stay. Residents must follow yearly DHA requirements, while visitors only need short-term coverage that lasts for their trip. This is why understanding short term health insurance UAE and long term health insurance Dubai is essential before choosing any plan.

Mandatory insurance laws for residents

Anyone holding a UAE residency visa must have a full-year policy. Employers usually provide it, but dependents, freelancers, and some workers must buy their own resident medical insurance UAE to keep their visa valid.

Insurance requirements for visitors

Tourists and short-term guests only need a temporary policy that covers them for the length of their stay. This is where visitor health insurance Dubai vs resident rules come in, since visitors don’t need annual plans unless they switch to residency.

Why coverage duration matters

Your insurance must match your stay. Short trips require temporary medical insurance UAE, while residents need 12-month policies to meet DHA requirements and avoid fines. Choosing the wrong duration can lead to gaps in coverage or delays in visa processing.

What Is Short-Term Health Insurance in the UAE?

Short-term plans are designed for people who only need medical cover for a brief period. They’re simple, quick to buy, and ideal for anyone who isn’t staying in the country long enough to commit to a year-long policy. This is where short term health insurance UAE and temporary medical insurance UAE become useful.

Typical coverage duration (7–90 days)

Most short-term plans last anywhere from one week to about three months. They are meant to cover the exact length of a visit or a temporary stay, not a full residency period, which makes them ideal as health insurance for expats.

Who needs short-term insurance?

Short-term insurance is usually a good fit for:

- Tourists and visitors

- Freelancers waiting for visa approvals

- People between jobs

- Expats who need coverage for a transition period before getting long term health insurance Dubai

What short-term plans usually cover

Short-term policies normally include emergency treatment, basic hospital care, and urgent medical support during the stay. They don’t offer all the benefits found in annual resident medical insurance UAE, but they work well for short visits or temporary stays.

What Is Long-Term Health Insurance in UAE?

Long-term plans are full-year policies designed for anyone living in the country. They follow DHA rules and provide the level of cover residents need for visas, employment, and day-to-day healthcare. This is the standard form of long term health insurance Dubai used by most expats and citizens.

Annual coverage and renewability

These plans run for 12 months and must be renewed every year. Renewal keeps your residency status valid and ensures you stay protected without gaps in coverage.

Ideal for residents, expats, and employees

Anyone holding a residency visa needs a long-term plan. Employers often provide it, but families, freelancers, and dependents must arrange their own resident medical insurance UAE if no employer policy is available.

Coverage benefits offered by long-term plans

Long-term plans usually include outpatient visits, specialist care, tests, maternity benefits, medication, and emergency treatment. Some plans also offer better hospital networks and higher limits than any short-term or travel health insurance Dubai option.

Key Differences Between Short-Term & Long-Term Health Insurance

Short-term and long-term plans serve completely different needs in the UAE. Short-term policies are simple, quick, and meant for brief stays, while long-term plans offer full benefits required for visas, employment, and everyday healthcare. Understanding the differences helps you choose between short term health insurance UAE and long term health insurance Dubai without confusion. Here is a clear comparison:

| Feature | Short-Term Health Insurance | Long-Term Health Insurance |

| Coverage Duration | 7–90 days (temporary medical insurance UAE) | 12 months, renewable (UAE health insurance duration) |

| Who It’s For | Visitors, freelancers in transition, people between jobs | Residents, expats, employees (resident medical insurance UAE) |

| Coverage Level | Basic emergency care, limited benefits | Full outpatient, inpatient, maternity, chronic care |

| Pre-Existing Conditions | Usually not covered | Often covered after waiting periods |

| Hospital Network | Smaller network; basic access | Wider network and specialist access |

| Price | Lower cost | Higher premiums |

| Visa Requirement | Not required for tourists | Mandatory for residency visas |

Short-Term vs Long-Term Health Insurance — Advantages & Limitations

Now let’s compare the benefits and limitations of short term and long term insurance in Dubai:

| Category | Short-Term Health Insurance (UAE) | Long-Term Health Insurance (Dubai) |

| Pros | – Low cost- Easy and quick to issue- Ideal for temporary stays or visa waiting periods | – Full benefits (outpatient, inpatient, maternity, chronic care)- Mandatory for residency visas- Suitable for long-term medical needs |

| Cons | – Limited coverage- No chronic illness or pre-existing condition cover- No maternity benefits | – Higher premiums- Medical underwriting may apply |

| Best For | – Visitors- Short business trips- Freelancers or expats in transition- Anyone who needs temporary medical insurance UAE | – Residents and expats- Employees and dependents- Families needing stable, year-round care- Anyone needing long term health insurance Dubai |

Visitor Health Insurance Dubai vs Resident Health Insurance

Health insurance rules in the UAE treat visitors and residents very differently. Visitors only need short-term protection for the length of their stay, while residents must follow DHA regulations and hold a full-year policy. Understanding this helps you choose between visitor health insurance Dubai vs resident plans without any confusion.

Who qualifies for visitor insurance?

Visitor insurance is meant for tourists, short-term guests, and anyone entering Dubai without a residency visa. It’s usually tied to the trip duration and works as short term health insurance UAE for people who don’t need long-term benefits.

Coverage expectations for tourists

Tourists should expect basic emergency care, urgent treatment, and hospital support during their stay. It’s similar to travel health insurance Dubai, covering sudden medical issues but not long-term care, maternity, or chronic conditions.

Why residents must have annual health insurance

Anyone holding a residency visa must have a 12-month policy that meets DHA rules. This ensures full access to clinics, hospitals, medication, and specialist care through proper resident medical insurance UAE. Without annual coverage, visas can’t be renewed and fines may apply.

Cost Comparison

Let’s take a quick look at the difference between the prices of long term and short term health insurance in UAE:

| Type of Plan | Typical Cost Range | What the Price Usually Includes |

| Visitor / Short-Term Insurance | AED 40–AED 300 for basic 7–30 day plansAED 100–AED 600 for 30–90 day plans | Emergency care, basic hospital treatment, limited cover tied to the trip duration |

| Resident / Long-Term Insurance | AED 600–AED 1,200 for basic EBP plansAED 2,000–AED 7,000+ for mid-range and premium plans | Outpatient visits, tests, specialist care, maternity (depending on plan), chronic illness treatment |

NOTE: these prices are only estimates. For more personalized quotes click below:

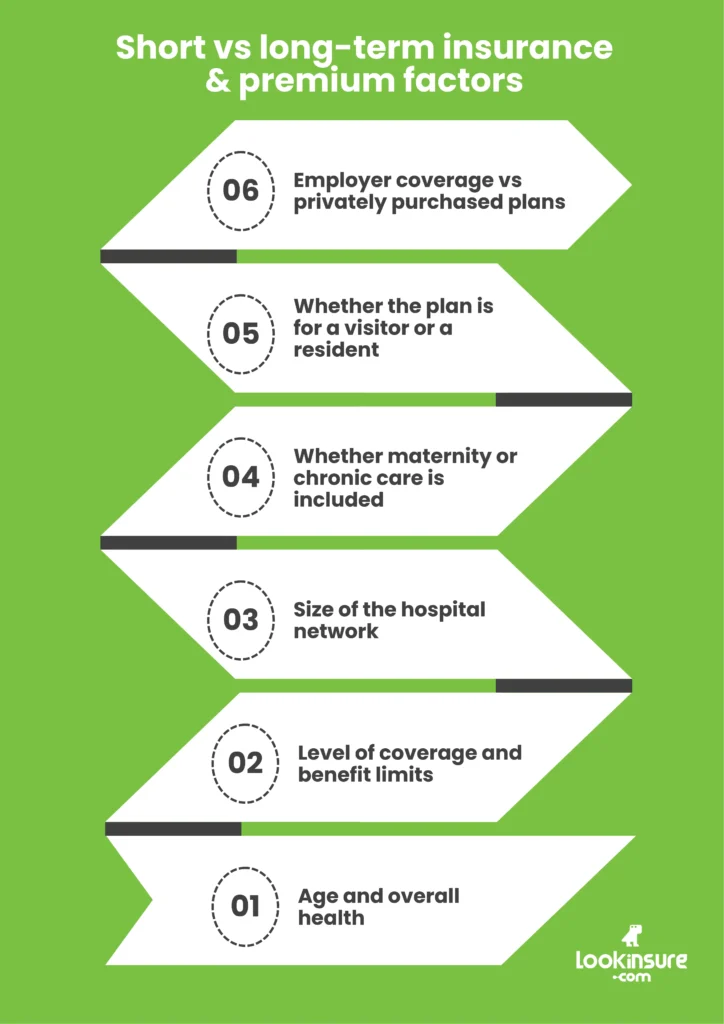

Factors that influence premium differences

Several things can cause prices to go up or down, including:

- Age and overall health

- Level of coverage and benefit limits

- Size of the hospital network

- Whether maternity or chronic care is included

- Whether the plan is for a visitor or a resident

- Employer coverage vs privately purchased plans

How to Choose the Right Option

Picking between short term and long term health insurance Dubai depends on a few factors:

Choosing based on length of stay

If you’re staying for a short visit or waiting for your visa, a temporary plan is usually enough. Anyone living in the UAE long-term must choose a full-year policy that meets DHA rules.

Choosing based on medical needs

People with ongoing health issues, medication needs, or maternity requirements should always go for long-term insurance. Short-term plans won’t cover chronic care or pre-existing conditions, so they’re only suitable if you expect minimal medical needs.

Choosing based on budget & visa requirements

Short-term plans cost less and work well for tourists or short stays. Long-term plans cost more but are mandatory for residency visas. If your visa requires proof of full-year coverage, you must choose a long-term plan regardless of budget.

How to Buy Short-Term or Long-Term Health Insurance

Getting the right plan in the UAE is straightforward once you know where to buy it and what documents you’ll need. Whether you want short term health insurance UAE for a brief stay or long term health insurance Dubai as a resident, the process is quick when done through approved channels.

Buying online through licensed platforms

The easiest way is to purchase your plan through licensed comparison platforms or directly from DHA-approved insurers. This helps you compare prices, benefits, and networks without dealing with unclear or outdated information.

Required documents

Most insurers only need a few basic documents:

- Passport copy

- Visa or Emirates ID (if applying for resident plans)

- Contact details

- Simple medical questionnaire for long-term plans

Tourists usually don’t need any medical history unless they choose higher-tier visitor coverage.

Approval & policy issuance timelines

Short-term policies are issued almost instantly, often within minutes. Long-term plans take a little longer because insurers review documents and basic medical details, but most are approved within a few hours to one business day.

Why Choose Lookinsure

Whether you’re searching for short term health insurance UAE or comparing options for long term health insurance Dubai, Lookisnure can help keep everything clear and simple. Here’s what we offer:

Compare short-term & long-term plans easily

You can instantly compare prices, benefits, coverage duration, and network options. This is especially helpful when deciding between visitor plans and annual resident medical insurance UAE.

DHA-approved insurers & transparent pricing

All listed plans come directly from DHA-approved insurers, so you know the policies follow official rules. Prices and benefits are laid out clearly, with no hidden fees or confusing fine print.

Support team to guide residents & visitors

If you’re unsure which plan fits your situation, Lookinsure’s support team can help you choose. They guide both tourists and residents, making it easier to pick a plan that matches your stay, budget, and visa needs.

Conclusion

Choosing between short-term and long-term health insurance in the UAE really depends on how long you’ll be in the country and what your visa requires. Short-term plans are great for visitors or anyone staying briefly, while long-term plans are essential for residents and offer the full benefits you need for everyday healthcare. If you want an easy way to compare both options, Lookinsure helps you check prices, coverage, and insurer networks in minutes so you can pick the plan that fits your stay and your budget.

Frequently Answered Questions

1. What is the difference between short-term and long-term health insurance in UAE?

Short-term plans cover you for a brief stay and offer basic emergency care, while long-term plans provide full benefits for 12 months and are mandatory for residents.

2. How long does short-term insurance last in Dubai?

Most short-term plans last between 7 and 90 days, depending on the insurer and the purpose of your visit.

3. Is visitor health insurance enough for a 30–90 day stay?

Yes. Visitor insurance is designed for short trips and is usually enough for tourists who only need emergency or basic medical cover.

4. Do short-term plans cover pre-existing or chronic conditions?

No. Short-term policies do not cover long-term, pre-existing, or chronic illnesses.

5. Can I upgrade from short-term to long-term insurance?

Yes. You can switch to a long-term plan at any time, especially once your residency visa is approved.

6. Which option is better for new expats waiting for visa approval?

A short-term plan works best while waiting for your visa. Once the visa is issued, you must switch to a full-year long-term plan.