Facing a totaled vehicle? Understand how total loss car insurance protects UAE drivers. This guide explains the Total loss car insurance claim process, defines cash loss in motor insurance, and reveals negotiation tactics. Discover how to maximize settlements and avoid financial gaps when your car’s repair costs exceed its value.

What Is Total Loss Car Insurance?

Total loss car insurance, also known as total loss insurance, total loss protection, or coverage, is a policy in the United Arab Emirates that gives you financial coverage in case your vehicle is declared a total loss. This means losing your vehicle due to major accidents, fire, theft, or severe natural disasters. The extent of this coverage depends on the nature of your insurer’s policy.

How Does Insurance Total Loss Calculation Work?

When it comes to how insurance total loss calculation works, estimations are made through a comprehensive evaluation of the vehicle, such as:

- Damage assessment: an expert checks the extent of the damage and whether or not it is repairable.

- Market value estimation: experts calculate the market value of the vehicle before the accident considering factors such as age and market demand.

- Repair costs comparison: the costs of repairing the vehicle are compared to the car’s value before the accident. If the repair costs exceed 50% of the car’s value, it is considered a total loss.

When the total loss insurance is being calculated, some other factors are also influential such as

- Deprecation value

- The make and model

- Wear and tear

- Age

- Mileage

- Market demand

What Is Total Loss Car Insurance Value?

To calculate the total loss car insurance value, one needs to calculate the actual cash value (ACV). This is the car’s market value before the incident. Then, repair costs are calculated.

As mentioned earlier, a total loss is declared when the repair costs exceed 50% of the ACV. However, the factors mentioned above also affect the car’s actual cash value, influencing the total loss value as well.

What Is Cash Loss in Motor Insurance?

“Cash loss” refers to the situation where the insurer offers a monetary payout instead of repairing or replacing the vehicle. This is common in total loss cases when the insured prefers to handle the replacement themselves. The payout is usually based on the actual cash value (ACV) minus any deductibles or policy exclusions.

Gap Insurance Total Loss Coverage

GAP insurance, or guaranteed asset protection protects you from owing money after a total loss accident. This is also similar to a total loss insurance. In case you have an accident that leaves your car totaled you can turn to your insurer for financial coverage.

A car accident can result in financial consequences such as owing more than your car’s value. Many insurers will only cover the car’s actual cash value after accidents such as theft. However, the cost of GAP insurance overage depends on several different factors.

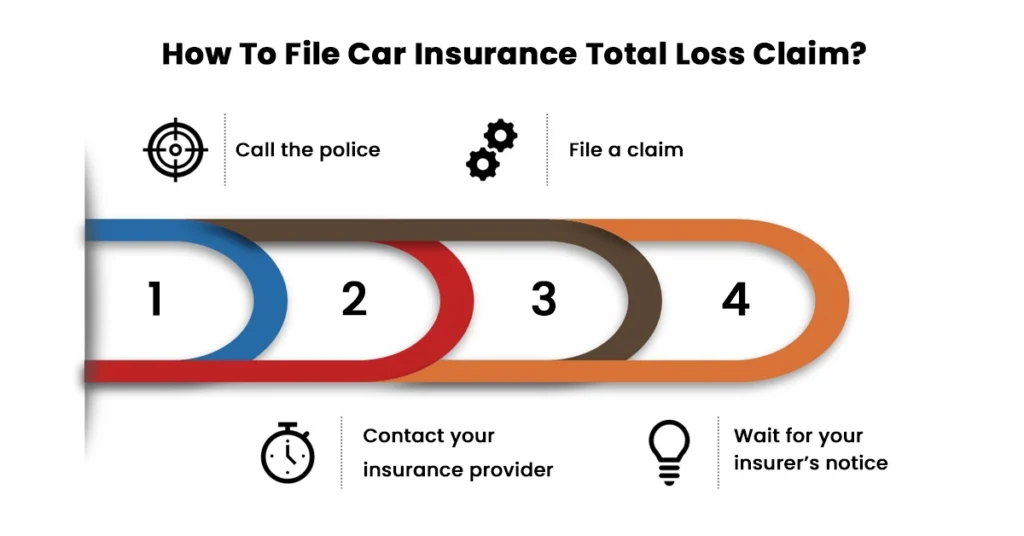

How To File Total Loss Car Insurance Claim?

To file an auto insurance claim regarding total loss in the UAE, you can follow these simple steps:

1. Call the police

First, you should call the police to investigate the accidents as well as give you a police report.

2. Contact your insurance provider

After contacting the police, you should notify your insurer about the accident. They will probably ask for proof and police reports.

3. File a claim

Most insurers have a claim form on their website that you should fill out. Make sure to attach proof such as police reports and other documentation.

4. Wait for your insurer’s notice

Your insurer will contact you to investigate and inspect the accident further.

Total Loss Car Insurance Claim Settlement Process

The total loss car insurance claim settlement process has several steps. Let’s take a look:

1. Initial Claim Report

You will need your initial claim report that you issued to the insurer in the first place. This is usually documented as a form.

2. Assessment of Vehicle Damage

In this step, the damage to your car is precisely calculated through the process we mentioned earlier.

3. Calculation of Vehicle Value

Your vehicle’s actual cash value will be estimated. This is the value before the incident. Then, the damage will be compared to the ACV.

4. Total Loss Notification

In case the repair costs exceed 50% of the ACV, your car is declared a total loss. Therefore, your insurer will notify you about this decision.

5. Settlement Offer

Then, your insurance provider will give you a settlement offer based on the prices they compared earlier in this process for financial coverage.

6. Negotiation Process

You can review the settlement offer. In case you believe that it is not a fair offer, you can negotiate with your insurance provider. You can provide further evidence in case you believe that might be helpful.

7. Settlement Payment

After you agree on the settlement, sign the necessary documents to officially finalize the claim. Your insurer will provide you with the settlement payment through the payment method you agree upon.

8. Recovery of Other Costs (If Applicable)

If you have fully comprehensive car insurance, your insurer will be liable for paying the recovery fees.

9. Tax Considerations

In the UAE, life insurance services are exempt from VAT, meaning no VAT is charged on premiums for life insurance policies. However, general insurance, including vehicle coverage, is subject to a 5 percent VAT on the premiums. This means that when you purchase car insurance in the UAE, you’ll pay the premium plus an additional 5 percent VAT.

When Is a Vehicle Considered Totaled in UAE?

While the 50% rule is a standard guideline, insurers may consider the vehicle a total loss based on repair feasibility, safety concerns, or regulatory guidelines, especially for imported or non-GCC spec vehicles.

Find Total Loss Car Insurance Options Online

Online insurance aggregators have gathered the UAE’s best insurers all in one place. Therefore, they have made the insurance process much easier for you. You can compare your auto insurance total loss options through our website without needing to search the internet to find reliable insurers and compare quotes.

By mentioning your priorities, budget, and some basic information about the vehicle you drive, they will be able to offer you the most suitable plans and policies. Customized auto insurance total loss policies are considered the most reliable policies in the UAE.

Final Verdict on Total Loss Car Insurance in UAE

Whether your car is involved in a major accident or stolen beyond recovery, total loss car insurance ensures you aren’t left with nothing. From understanding how a total loss car insurance claim is processed to avoiding unexpected cash loss in motor insurance, having the right coverage is essential. Compare reliable policies with Lookinsure and choose peace of mind, not panic, when life takes a wrong turn.

Frequently Answered Questions

1: Can I negotiate the total loss settlement amount?

Yes, if you believe the settlement is unfair, you can submit evidence such as recent valuations, market comparisons, or service records to support your counter-offer.

2: How much does insurance pay for a total loss car insurance claim?

The total loss car insurance value depends on several factors, including the car’s make, model, age, condition before the accident, market demand, and market value.

3: How to negotiate with car insurance adjusters about car total loss?

In case you feel like the offer your insurer has given you for total loss is unfair, you can provide more proof and evidence to negotiate with them.

4: How long will insurance pay for the rental car after the total loss?

Most insurance providers and policies cover rental car costs for up to 30 days. However, this depends on your insurance company; you can check this factor in your policy.

5: What are the best total loss options for car insurance in the UAE?

You can look through all the best total loss car insurance providers using Lookinsure. Here are some of the most reliable insurers that provide this service in the UAE: Salama Insurance, Sukoon Insurance, Adamjee Insurance, AL Sagr Insurance, Watania Insurance

6. What does cash loss in motor insurance mean?

Cash loss refers to when the insurer pays you the value of the damaged car rather than arranging repairs. This often applies in total loss situations when the repair isn’t feasible or cost-effective.