Engine Protection in Car Insurance

Flexible installments to pay later with

And

Regulated by the Government of Dubai

Engine protection cover, also known as engine protection insurance, is an add-on coverage to a standard car insurance policy that provides financial coverage for repairs regarding engine damage and engine-related mechanical issues. These damages and repairs aren’t usually included in a standard policy, and most drivers have to pay out of pocket for such incidents. However, with this add-on engine insurance, you can ensure that your repairs aren’t all on you.

In this Lookinsure, we aim to provide detailed information on how engine protection insurance works, including the best options available, the benefits of owning this coverage, and all the necessary tips for selecting the right policy regarding your personal needs and priorities.

Best Engine Protection Cover In Car Insurance

Here are what you should be looking for in the best engine insurance add-on:

Characteristic | Description |

Covers Specific Components | Protects specific engine parts such as the engine, gearbox, and differential assembly |

Fits with Your Budget | Offers competitive pricing and fits within your financial plan |

Low Deductible Amount | Has a low deductible, minimizing out-of-pocket expenses in case of a claim |

Provider Reputation | It comes from a reputable insurance provider with good customer reviews and ratings. |

Proper Length of Coverage | Provides adequate coverage duration to ensure long-term protection |

Why Choose Lookinsure For an Engine Protection Cover?

Lookinsure’s collection of car insurance add-ons includes some of the industry’s best options. Here’s why:

Comprehensive Access to Top UAE Insurers

Here at Lookinsure, we have gathered UAE’s most reliable and well-known insurance providers in one place. You can access all these insurers by visiting our website.

Simplified Insurance Comparison

Finding an insurance policy today is difficult because numerous insurers offer the same standard policies and unique plans and quotes. Looking through all these different web pages can be overwhelming.

Tailored Options for Your Needs

With Lookinsure, you can mention your necessities and priorities, and we will provide you with all the suitable options. This way, you can compare quotes simply through one webpage instead of a dozen (if not more).

Specialized Coverage for Engine Protection

By mentioning your add-on necessities, such as engine protection cover in car insurance, we will select the most suitable plans and policies for you. Many other significant factors put us ahead of our rivals, so check our website for more information.

What is an Engine Protection in Car Insurance?

Engine protection cover is an add-on coverage to standard car insurance policies focusing on a vehicle's engine.

This coverage provides financial assistance for engine issues and damages, such as engine failure, oil leakage, overheating, and more.

This category also includes all incidents that require engine repairs, as well as damage to engine parts such as the gearbox, crankshaft, cylinder, and pistons.

Does Car Insurance Cover Engine Protection?

Standard car insurance policies like third-party insurance and comprehensive policies do not cover repairs or engine protection. They only cover standard accidents.

Comprehensive car insurance only covers the engine if damaged directly in a road accident. None of these policies include engine protection.

Therefore, you will need engine protection insurance, which is an add-on to your policy to protect your engine.

Why Opt for Car Insurance with Engine Protection in UAE

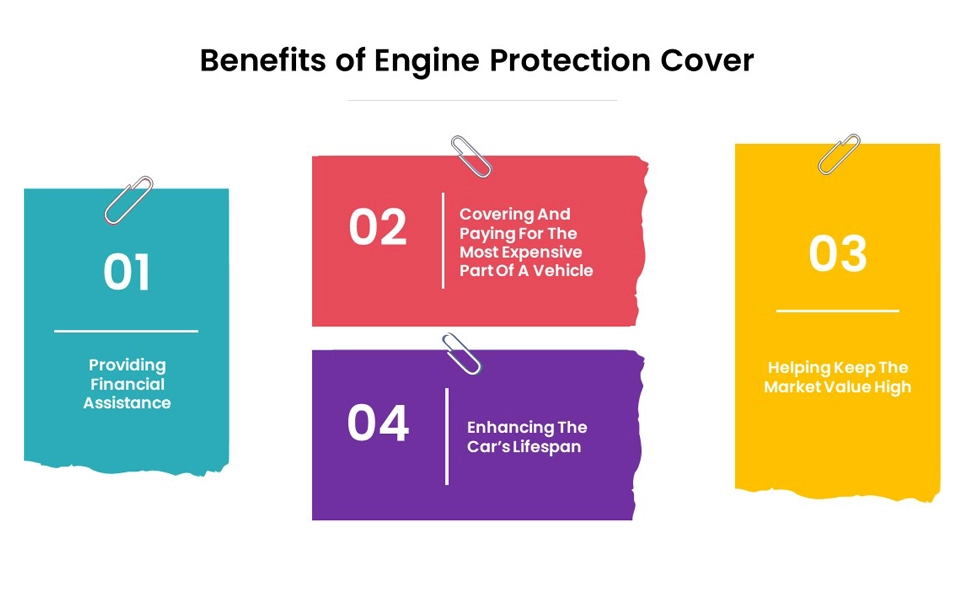

Engine cover in car insurance is arguably the most essential and practical add-on coverage available for your car. Let’s explore a few of its benefits:

Providing Financial Assistance

For drivers with low protection insurance policies, any minor damage, even during a car accident, might lead to engine damage. No one will help, so you must handle the issue yourself.

However, engine protection insurance covers the costs of repairs, so you don’t have to worry about your engine parts failing.

Covering and Paying for the Most Expensive Part of a Vehicle

As you may know, the engine is the most expensive part of a vehicle. Therefore, replacing or repairing it is usually very costly. However, with engine protection insurance, your insurer will cover these costs.

Enhancing the Car’s Lifespan

The engine plays a significant role in a car’s lifespan. As the heart of a car, proper engine repairs are necessary to keep your vehicle safe and maintain its market value.

This is also necessary to enhance your car’s longevity. Engine failure can directly affect your car’s function and cause permanent issues if not fixed immediately.

Helping Keep the Market Value High

If you sell your car later in life, you can ensure that you sell it for a price closer to what you paid.

This is because all necessary repairs have been made, and nothing threatens the longevity and safety of your car. Therefore, the car’s resale value is still the highest it can be.

Services Typically Covered under Engine Protection

Engine cover in car insurance protects you from expenses regarding the following issues:

Type of Coverage | Description | Insurance Coverage |

Damage To The Car’s Engine | Covers the repairs or replacement of the insured car's engine or parts. | Covered by the insurance policy. |

Damage To The Gearbox | Provides coverage for the repair or replacement of the gearbox. | Covered by the insurance policy. |

Water Ingression | Covers loss and damage to the engine caused by water entering it. | Covered by the insurance policy. |

Oil Leakage | It covers repair costs due to the leakage of lubricant oil, a common issue for drivers. | Covered by the insurance policy. |

Labor Costs | It covers labor costs for repairing, replacing, and carrying the car and its parts. | Covered by the insurance policy. |

Exclusions & Limitations of Engine Protection

Let’s take a look at a few things car engine insurance add-on does not take care of:

Type of Damage | Description | Insurance Coverage |

Consequential Damage | Damage resulting from continuing to drive a car with an existing issue. | Not covered if further damage occurs due to ignoring problems. |

Regular Wear-and-Tear | Problems that develop in the engine due to normal daily usage over time. | Not covered by the insurance policy. |

Things Covered By The Manufacturer | Any repairs or damages are covered under the car's warranty. | Not included in the engine protection insurance policy. |

No Water Inundation | Damage from water inundation that isn't proven to be covered under a water ingress policy. | Not covered by engine protection insurance. |

Force Starting A Submerged Car | Damage that occurs when a submerged car is forced to start despite being underwater. | Not covered by this insurance policy. |

Do I Need An Engine Protection Cover?

As mentioned earlier, a car’s engine is one of its most expensive parts. Therefore, repairing or replacing it is a huge inconvenience to most drivers.

Standard insurance policies do not include the cost of repairs, so most people opt for add-ons. A car engine insurance or engine protection cover add-on helps you save plenty of money on engine repairs.

If you own an expensive car, we highly recommend getting a car engine insurance to ensure nothing threatens it. This especially applies to luxury cars.

Costs & Premium Impact of Engine Protection Cover in UAE

Engine protection cover is one of those add-ons that feels optional until you actually need it. In the UAE’s extreme heat, engines are under constant stress, and even a single incident of water damage, oil leakage, or overheating can cost thousands to repair. Adding engine protection cover to your policy slightly increases your premium, but the added peace of mind is worth it.

Typically, this add-on adds a small percentage to your base premium, depending on your car’s make, model, and age. However, it saves you from paying out-of-pocket for internal engine repairs, which are often excluded from standard comprehensive policies. In short, it’s a smart investment for anyone driving in UAE’s harsh climate or dealing with frequent city traffic.

How to Add Engine Protection Cover to Your Policy via Lookinsure

Adding engine insurance through Lookinsure is quick and straightforward. Whether you’re buying a new policy or upgrading an existing one, you can complete the process online in just a few minutes. Here’s how to do it:

- Visit the Lookinsure website – Go to the Lookinsure platform and click on the car insurance section.

- Get a quote – Enter your car details, driver information, and insurance preferences to generate a personalized quote OR enter your policy number if you want to add engine protection cover to your current policy.

- Select add-ons – When prompted, scroll through the list of available add-ons and select engine protection cover to include it in your policy.

- Review your premium – The system will automatically update your premium to reflect the added coverage. You can review the cost before finalizing.

- Confirm your policy – Once you’re satisfied, proceed to checkout and make your payment securely online.

- Receive your updated policy – You’ll get an instant digital copy of your policy with the engine protection add-on clearly listed.

If you already have an active Lookinsure policy, you can still add the cover by logging into your account, selecting your existing plan, and requesting to include the engine protection option. The updated premium and terms will appear immediately once approved.

Things To Consider When Buying Engine Protection Cover In UAE

Like other policies, engine cover in car insurance has several conditions you should consider before purchasing. Here are a few things that you better pay attention to:

- This insurance add-on is only available for vehicles younger than 5 years old.

- This insurance coverage is not available for third-party insurance owners.

- This insurance coverage requires increased premiums; therefore, you must pay more to get this add-on coverage.

- Most insurance providers only allow drivers to make up to two claims under this coverage in a year. Therefore, check your insurer’s terms and conditions and double-check your premium before committing.

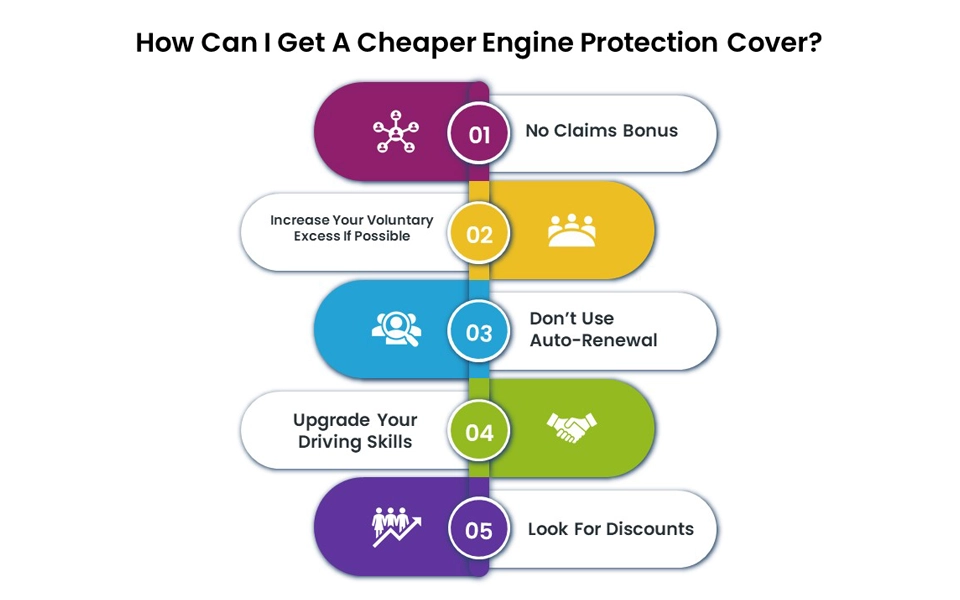

How to Get Cheap Engine Protection as Add-On

Here are some things to pay attention to to decrease your insurance premiums when adding car engine insurance to your policy:

No Claims Bonus

Most insurers provide a no-claims bonus or no-claims discount. Here at Lookinsure, we reward safe drivers and want to ensure your safety is your top priority. Therefore, we reward drivers who make little to no claims per insurance year. You can get offers on your insurance plans and premiums by making fewer claims.

Increase Your Voluntary Excess If Possible

By increasing your excess, you will pay less for your premiums. However, remember that you should only do so if you can pay your excess when the time comes.

Don’t Use Auto-Renewal

Most insurance providers automatically renew your policy at the end of the term. This sometimes leads to paying for unwanted policies.

Upgrade Your Driving Skills

The safer and more professional you drive, the fewer accidents you cause. Therefore, fewer claims lead to lower premiums.

Look For Discounts

Most insurers offer discounts to many drivers, and there is usually something for everyone. Make sure to look for discounts that apply to you.

How Do You File a Claim for Engine Protection Coverage

Filing an insurance claim for engine car protection is just like any other insurance coverage. Let’s take a look at the steps:

- In case of an accident, contact the police

- Gather proof

- Contact your insurer

- Submit your proof and police reports if available

- Include required documents (car registration card, driver’s license, Emirates ID, passport)

- Wait for your insurer’s notice

Engine protection cover, or car engine insurance, is a valuable add-on to insurance premiums to protect your car engine or its parts. This add-on is highly recommended since the engine is the most expensive part of a vehicle, and repairing or replacing it is very costly. Here at Lookinsure, we have gathered all the UAE’s best insurance providers to simplify the process. By comparing quotes on our website, you can easily find the most suitable policy for yourself.