Key Replacement Cover in Car Insurance UAE

Flexible installments to pay later with

And

Regulated by the Government of Dubai

UAE car owners often focus on major insurance coverage issues, such as accidents and liability. However, many vehicle owners overlook one aspect: car key replacement insurance. With modern car keys becoming increasingly sophisticated and expensive, losing or damaging your car key can lead to significant unexpected costs.

This is why insurance companies offer car key insurance add-ons. By adding this option to your comprehensive or third-party policy, you can ensure no one will take advantage of your predicament by charging you an unreasonable amount. Even if they do, you won’t be the one paying for it! Here is what you need to know about this add-on.

Why Choose Lookinsure for Key Replacement Insurance?

First, let us see why Lookinsure is the best platform for buying car key replacement insurance.

Dedicated Customer Service

One of the things we pride ourselves on is our dedicated customer service. We understand how urgent some insurance-related issues, such as losing your car keys, can be. That's why we provide round-the-clock customer support to assist you with any queries about your car key replacement insurance. Whether you need help choosing the right policy or guidance during the claims process, our dedicated support team is always ready to help.

Easy Online Process

It is time you said goodbye to visiting insurance offices in person to get coverage for your car keys. With Lookinsure, you can easily purchase car key insurance online from the comfort of your home or office. Our user-friendly platform allows you to compare different policies and select the one that best suits your needs, all with just a few clicks.

Installment Payment

We understand that managing expenses in the UAE can be challenging. That's why we've partnered with leading buy-now-pay-later services like Tabby and Tamara to offer flexible payment options for your lost car key insurance cover. You can split your premium into manageable installments, making maintaining comprehensive protection for your vehicle keys easier.

Competitive Prices

As a leading insurance aggregator in the UAE, Lookinsure helps you find the most competitive car key cover insurance rates. We work with multiple insurance providers, allowing you to compare prices and coverage options to ensure you get the best value for your money.

What is Car Key Replacement Insurance?

Car key replacement insurance is a specialized coverage designed to protect you against the costs associated with lost, stolen, or damaged car keys. Modern vehicle keys are no longer simple metal pieces; they're sophisticated electronic devices that can be quite costly to replace. This type of key auto insurance coverage ensures you won't have to pay for these hefty replacements out of your pocket.

Why Opt for Car Insurance with Key Replacement Cover in UAE

Car key replacement insurance cover is often overlooked, but it can cut your losses when least expected. Here are the main reasons why you should get car key insurance add-on:

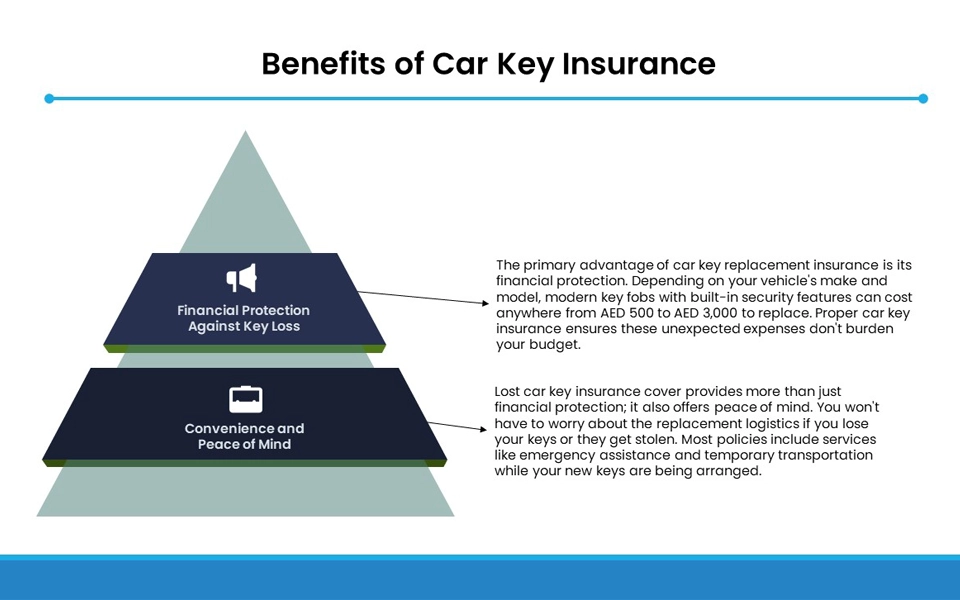

Financial Protection Against Key Loss

The primary advantage of car key replacement insurance is its financial protection. Depending on your vehicle's make and model, modern key fobs with built-in security features can cost anywhere from AED 500 to AED 3,000 to replace. Proper car key insurance ensures these unexpected expenses don't burden your budget.

Convenience and Peace of Mind

Lost car key insurance cover provides more than just financial protection; it also offers peace of mind. You won't have to worry about the replacement logistics if you lose your keys or they get stolen. Most policies include services like emergency assistance and temporary transportation while your new keys are being arranged.

Services Typically Covered under Key Replacement Cover

Like any other insurance add-ons, certain things are covered, and others aren’t. For instance, while car key replacement insurance can be claimed in all the cases below, you can only file a claim a certain number of times in a year. So, being vigilant and always safeguarding your car keys is important.

Here are what is covered under such an add-on:

Coverage for Key Replacement

A comprehensive auto insurance with car key replacement insurance policy typically covers the following:

Service | Description |

Replacement of Lost or Stolen Keys | Quickly replace car keys if lost or stolen, ensuring you regain access to your vehicle promptly. |

Repair of Damaged Key Fobs | Fix broken or malfunctioning key fobs to restore functionality, avoiding the need for a full replacement. |

Reprogramming of Electronic Key Components | Update or reprogram electronic key components to ensure seamless integration with your vehicle’s security system. |

Lock Replacement (if necessary) | Replace car locks for added security, especially in cases of theft or extensive damage. |

Emergency Locksmith Services | Access professional help 24/7 to unlock your vehicle or resolve urgent lock and key issues, anytime and anywhere. |

Additional Services

Many key auto insurance policies also include extra benefits such as:

| 24/7 emergency assistance | Enjoy round-the-clock support to address key-related emergencies, ensuring you're never stranded when you need help |

| Temporary transportation arrangements | While your car key issues are being resolved, you can take advantage of alternative transportation options, helping you stay on the move without interruption |

| Coverage for multiple sets | Protect all keys for your vehicle, ensuring replacements or repairs are covered regardless of which set is lost or damaged |

| Protection against theft and attempted theft | This adds an extra layer of security and protects you against expenses resulting from stolen keys or damages caused by attempted theft |

| Coverage for mechanical key failures | You can get financial protection for repairs or replacements when traditional mechanical keys fail due to wear and tear or other issues |

Exclusions & Limitations of Key Replacement Cover

It is important to know the limits of your car key lost insurance. Common exclusions are:

- General Wear and Tear: The policy does not cover a key that simply stops working due to old age or gradual damage.

- Pre-existing Issues: Damage or loss that happened before you added the cover to your policy is not included.

- Negligence: If you did not take reasonable care of your keys, the claim might be reviewed carefully.

- Claim Limits: Most policies have a limit on the number of claims you can make per year, or a maximum amount they will pay per claim. Check your policy document for these details.

How to Get Cheap Key Replacement Cover as Add-On

You can find affordable car insurance cover key replacement by following these tips:

- Compare Quotes: The cost of this add-on can vary between companies. Always get quotes from several insurers.

- Choose a Higher Deductible: If your policy allows it, agreeing to pay a small amount yourself for the key replacement can lower the add-on cost.

- Bundle with Other Add-ons: Some insurers offer a better price if you buy multiple add-ons together, like key replacement and roadside assistance.

- Maintain a Good Record: A history with no claims can help you get lower premiums on all parts of your policy, including add-ons.

How to Add Roadside Assistance to Your Policy via Lookinsure

Finding the right car key insurance policy is easy with Lookinsure. All you need to do is follow the normal purchase procedure, which includes:

- Visit Lookinsure's website and select "Get Instant Quotes."

- Enter your car’s plate number and verify your identity using UAE Pass or Emirates ID.

- Provide driving history details and compare insurance UAE quotes to choose the best policy.

- Customize your policy, enter contact details, and finalize your purchase with your preferred payment method.

Before making a payment, you’ll be redirected to a page where you can select different add-ons to make your policy more inclusive. You can find car key replacement insurance here and add it to your policy.

Another thing we suggest you compare while looking for car insurance Dubai online is payment plans. On Lookinsure, you have car insurance installment options, which means you can buy your favorite quote and pay in 4 zero-interest installments.

Costs & Premium Impact of Key Replacement Cover in UAE

Adding car key replacement insurance to your policy is one of the most affordable add-ons available. It typically increases your annual premium by a very small amount.

The exact cost depends on your car's make and model, as the price to replace its keys is a major factor. However, for a small yearly fee, you are protected against a single event that could cost you AED 1,000 or more. This makes car key lost insurance excellent value for money.

How to Claim Car Key Replacement Insurance Add-on

Filing a key replacement claim is similar to filing any other insurance claim and involves following the steps outlined below:

- Contact your insurance provider immediately after losing your keys

- File a police report if your keys were stolen

- Provide necessary documentation, including:

- Your policy details

- Vehicle registration information

- Police report (if applicable)

- Personal identification

- Choose an authorized service center or locksmith

- Complete the claims process as directed by your insurer

Remember to keep all receipts and documentation related to your key replacement for claim processing.

Car key replacement insurance is an essential consideration for vehicle owners in the UAE. With the rising costs of modern car keys and their sophisticated technology, having proper coverage can save you from significant financial stress. Through Lookinsure, you can easily find and compare different car key insurance policies to ensure you're protected against unexpected key-related expenses.

Frequently Asked Questions

Basic Key FOB (Non-Transponder): AED 150–400 - Simple key fobs without advanced features.

Transponder Key FOB: AED 400–800 - Includes a chip communicating with the car’s immobilizer system.

Smart Key FOB (Push-to-Start): AED 800–2,500+ - Advanced key fobs with features like keyless entry, push-to-start, and remote start.

Luxury/High-End Car Key FOB: AED 2,500–5,000+ - For premium brands like Mercedes, BMW, Audi, or Tesla, which often require specialized programming.