Ferrari Car Insurance – Exclusive Coverage for High-Performance Cars

Flexible installments to pay later with

And

Regulated by the Government of Dubai

Ferrari continues to dominate the ultra-luxury car segment in the UAE, with sales reaching unprecedented levels in 2023. The iconic Italian brand saw a remarkable 35% increase in deliveries, with the Ferrari Roma and F8 Tributo leading the charge.

At Lookinsure, we recognize the unique requirements of Ferrari owners and offer specialized Ferrari car insurance solutions designed to protect these exceptional vehicles. To help you secure the best insurance solution for your prized possession, we have compiled this comprehensive guide covering everything from Ferrari insurance quote options to detailed coverage information for various models.

Tailored Insurance Solutions for Ferrari car insurance

Getting the perfect insurance is all about picking the right policy, which won’t be possible until you know all the available options. Here is a little guide to help you get started:

Comprehensive Ferrari Car Insurance

For vehicles of this caliber, insurance comprehensive coverage is the only sane option. These packages usually include the following coverage:

| 1 | Complete protection against accidents and theft |

| 2 | Natural disaster and vandalism coverage |

| 3 | Personal accident and passenger liability protection |

| 4 | Specialized roadside assistance for high-performance vehicles |

| 5 | Access to Ferrari-certified repair facilities |

| 6 | Genuine parts guarantee |

| 7 | International coverage options |

Third-Party Ferrari Auto Insurance

Insurance experts do not recommend a third-party liability insurance policy for Ferrari cars. It offers the bare minimum of coverage, but such a policy is still available. The coverage of a TPL includes:

- Mandatory third-party damage protection

- Essential medical expense coverage

- Option to add supplementary features

Ferrari Gap Insurance

Gap insurance is an essential safeguard for those financing their vehicles. Short for Guaranteed Asset Protection, this type of coverage acts as an add-on to standard auto insurance or loan agreements. It bridges the gap between the car’s market value and the remaining balance on your loan if your vehicle is stolen or declared a total loss.

If your car loan is already paid off, gap insurance is likely unnecessary. However, for anyone who has recently financed a vehicle—say, a sleek new Ferrari—this coverage could offer valuable peace of mind.

Add-ons for Ferrari Cars

Enhance your Ferrari insurance with premium add-ons:

Zero Depreciation Coverage | Covers the full cost of replacing or repairing car parts without determining depreciation, ensuring maximum reimbursement. |

Engine and Transmission Protection | Safeguards against repair costs for damage to the engine or transmission caused by unforeseen events such as flooding or oil leakage. |

Track Day Coverage Options | Provides insurance for damages incurred while driving your car on a racetrack during track day events. |

Carbon Fiber Component Protection | Covers the repair or replacement costs for expensive carbon fiber parts often used in high-performance vehicles. |

Extended Territorial Coverage | Expand your car insurance coverage to include specific countries or regions outside your home territory. |

Key Replacement Coverage | Covers the cost of replacing lost or stolen car keys, including reprogramming electronic keys. |

Tire and Rim Protection | Pays for repairs or replacements of damaged tires and rims caused by road hazards like potholes or debris. |

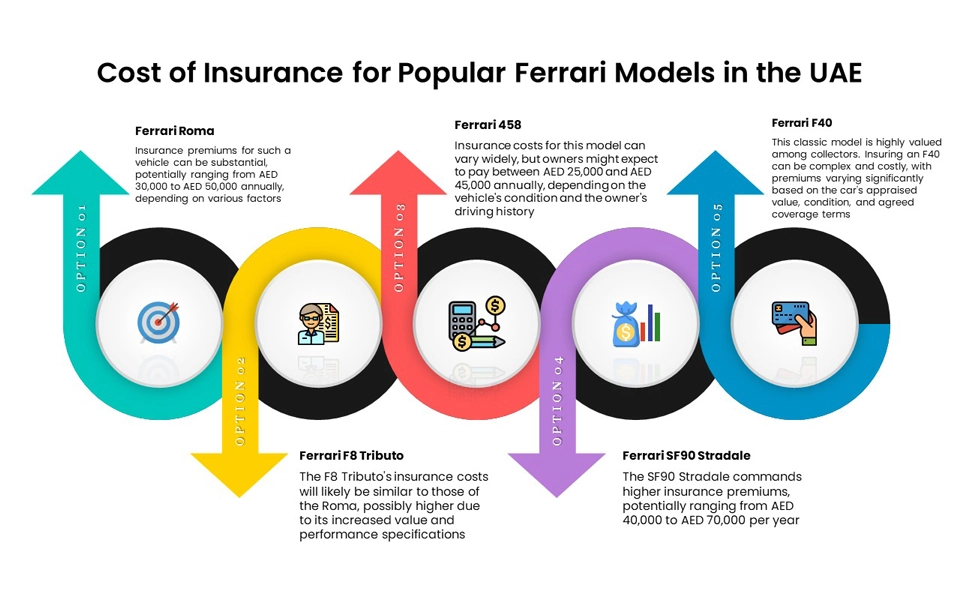

Cost of Insurance for Popular Ferrari Models in the UAE

Ferrari auto insurance costs can even be more expensive than a whole car, so if you own one and are looking for insurance, be ready to be quoted astronomical figures! While specific insurance costs can vary based on factors such as the driver's profile, coverage options, and the insurer, here are some general insights:

- Ferrari Roma: One of Ferrari's more recent models, the Roma, starts at approximately AED 955,500. Insurance premiums for such a vehicle can be substantial, potentially ranging from AED 30,000 to AED 50,000 annually, depending on various factors.

- Ferrari F8 Tributo: With a starting price of around AED 1,272,600, The F8 Tributo's insurance costs will likely be similar to those of the Roma, possibly higher due to its increased value and performance specifications.

- Ferrari 458: Although no longer in production, the 458 remains a popular model in the used car market. Insurance costs for this model can vary widely, but owners might expect to pay between AED 25,000 and AED 45,000 annually, depending on the vehicle's condition and the owner's driving history.

- Ferrari SF90 Stradale: As a high-performance hybrid model with a starting price of approximately AED 2,000,500. The SF90 Stradale commands higher insurance premiums, potentially ranging from AED 40,000 to AED 70,000 per year.

- Ferrari F40: This classic model is highly valued among collectors. Insuring an F40 can be complex and costly, with premiums varying significantly based on the car's appraised value, condition, and agreed coverage terms.

Buy and Renew Ferrari Auto Insurance Plans with Lookinsure

Whether you want to buy a new or just renew an existing Ferrari car insurance policy, Lookinsure’s website offers a pretty convenient platform where you can do both in just a few minutes.

Buying a Policy

Here is how to buy a new policy from Lookinsure:

- Go to Lookinsure's website and click "Get Instant Quotes."

- Enter your car's plate number and verify your identity.

- Provide driving history details and compare quotes.

- Create an account, customize your policy, and add extras.

- Enter your contact details, choose a payment method, and complete the purchase.

Renewal Process

- Log into your Lookinsure account

- Enter policy number

- Review and update coverage

- Process payment

- Download renewed documentation

Top Ferrari Car Insurance Providers in the UAE

Here are some of the most reputable car insurance providers that we recommend as some of the best options when it comes to buying a Ferrari auto insurance policy:

.webp)

Documents Required for Ferrari Car Insurance

To buy insurance for your Ferrari for the first time, you will need to submit the below documents:

- Valid UAE driving license

- Emirates ID

- Vehicle registration (Mulkiya)

- No-claims certificate (if applicable)

- Service history from authorized dealers

- Security system documentation

How to claim a Ferrari Car insurance policy?

Filing an insurance claim on a Ferrari is a big deal as a lot of money is involved. The only way you can make sure the process moves along smoothly is by submitting a flawless claim by carefully following the instructions below:

- Document all damage immediately

- Obtain a police report if required

- Contact your insurance provider

- Submit required documentation

- Schedule inspection at authorized Ferrari center

- Track claim status online

- Proceed with approved repairs

Securing appropriate Ferrari car insurance is crucial for protecting your prestigious investment. Through Lookinsure, you can access competitive coverage options while ensuring your Ferrari receives the protection it deserves. Whether seeking comprehensive coverage or specialized classic car insurance, our platform helps you find the perfect solution.

Frequently Asked Questions

No-claims bonus

Security system discounts

Multi-policy discounts

Garage parking discounts

Advanced driver training certificates

Insurance provider's mobile app or any other online customer portal

Lookinsure's customer service

Logging into your Lookinsure account

Reviewing policy details

Updating coverage if needed

Selecting payment method

Receiving renewed documentation electronically