Truck Insurance

Flexible installments to pay later with

And

Regulated by the Government of Dubai

Getting truck insurance here in the UAE is far beyond essential. The most apparent reason is the legal obligation. Driving an uninsured truck is illegal in the UAE, leading to several penalties. However, it’s also a wise financial decision to insure your truck. Trucks are usually expensive investments, and repairing them costs a lot. Plus, they have a higher risk of damage than most other vehicles. Therefore, it is crucial to get insurance that protects your truck.

When getting truck insurance online, consider many factors. Getting a policy aligns with your needs, priorities, and truck conditions. Learning what factors to consider helps you make a better decision.

Truck Insurance in the UAE

Lookinsure partners with the UAE’s top insurance providers to offer clients the most reliable policies. A personalized plan is the best way to get the ideal truck insurance for your business.

Tailored Business truck insurance quotes require a more personal approach. When choosing an insurance solution for your truck business, consider your needs, company risk factors, requirements, and budget.

This feature leads to extensive security due to customized coverage, which helps you avoid as many threats as possible. Whether you own a truck or a personal car, having the right coverage is essential for protection on the road. If you're looking for vehicle insurance Dubai, you can compare quotes and find the best policy that suits your needs. Enter your details now to explore affordable and comprehensive insurance options.

Finding the right coverage for your vehicle is easier when you can explore multiple options in one place. With compare insurance UAE, you can quickly review different policies and choose the best one for your needs. Start comparing now to get the most suitable and cost-effective insurance.

Types of Truck Insurance Plans in UAE

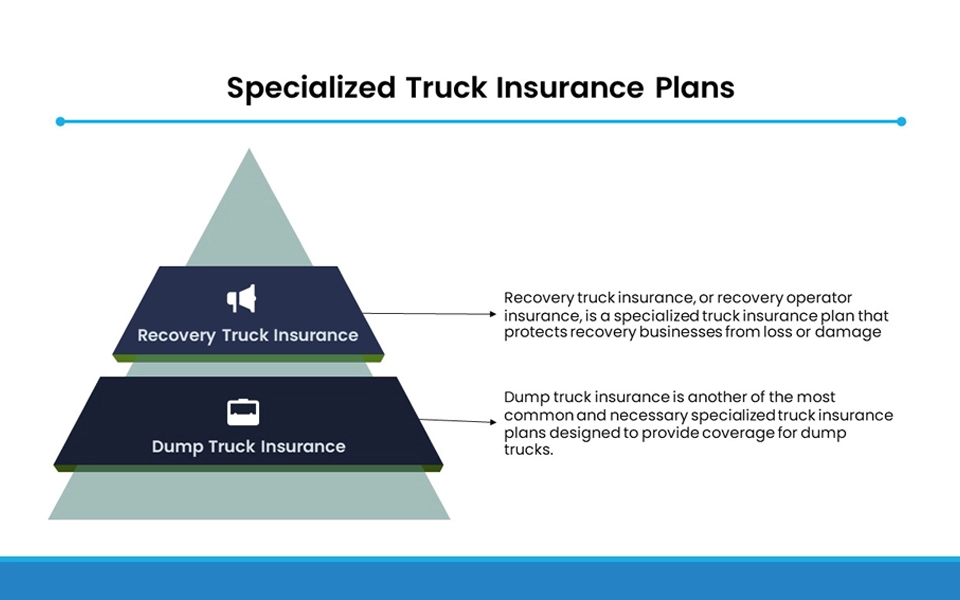

Specialized truck insurance plans include policies designed to protect specific types of commercial vehicle insurance, usually in certain truck operations. These plans include tailored solutions and coverage, considering the risks and needs of different commercial trucks. Below are the most common specialized heavy or commercial truck insurance plans in the UAE:

Recovery Truck Insurance

Recovery truck insurance, or recovery operator insurance, is a specialized truck insurance plan that protects recovery businesses from loss or damage.

Commercial vehicle insurance protects businesses that use vehicles to recover disabled, damaged, or illegally parked vehicles, including tow or breakdown trucks. Recovery trucks always face higher risks than other vehicles, so businesses need to get suitable recovery truck insurance.

Dump Truck Insurance

Dump truck insurance is another of the most common and necessary specialized commercial truck insurance plans designed to provide coverage for dump trucks.

Dump trucks are heavy-duty vehicles transporting and unloading materials like sand and construction debris. Due to their popularity, especially in construction areas, dump trucks always face higher risks and threats than most other vehicle types.

Businesses should always invest in suitable and reliable dump truck insurance, which covers risks that might threaten the driver, the property, and the cargo and lead to financial loss.

Coverage for All Types of Trucks

Lookinsure offers different levels of coverage for all types of trucks. Because trucks differ in operation, usage, and abilities, they are sorted into several categories to help simplify the insurance process.

Insurance Type | Description | Who It's For | Key Features |

High-Risk Truck Insurance | It protects trucking businesses that face higher risks due to driving habits, cargo type, location, etc. | Trucking companies with a history of accidents, newer businesses, or those transporting hazardous materials | Specific coverage tailored for higher risks replaces standard policies, which are less suitable |

Tipper Truck Insurance | Specialized insurance for tipper trucks used in mining, construction, and similar activities. | Owners/operators of tipper trucks involved in the transport of materials | Covers operations using dump trucks tailored to the unique risks associated with this vehicle |

Cheap Semi Truck Insurance | Designed to protect semi-trucks, which haul large loads and transport goods over long distances. | Operators of semi-trucks needing affordable coverage | Provides essential coverage at reasonable rates; suited for long-distance transport risks |

What are Covered and Not Covered Under Truck Insurance?

A commercial or heavy truck insurance policy aims to protect truck owners from the financial risks associated with driving, operating and maintaining large vehicles. Depending on whether you choose comprehensive or liability (TPL) cover, what is covered can vary widely. Below are common coverages and exclusions.

What’s Covered

- Damage to the insured truck in accidents (collision, overturning) under comprehensive policies.

- Loss or damage due to theft, fire, vandalism, natural disasters (e.g. flood, storm) under comprehensive cover.

- Third-party liability: bodily injury or death, and property damage caused to others by the insured truck.

- Personal accident cover for the driver (and sometimes passengers) in case of injury or death.

- Goods in transit (if included as an add-on) – compensation for cargo damage or loss during transport.

- Emergency services: roadside assistance, towing if breakdown or accident occur.

- Agency repairs or approved garage repairs (depending on policy).

What’s Not Covered

- Damage caused by using the truck beyond its stated use (e.g. off-road use if not insured for that, or using it for purposes not declared in policy).

- Overloading beyond the specified weight capacity.

- Wear and tear, mechanical or electrical breakdowns not due to an insured peril.

- Damage due to driver negligence, reckless driving, or driving under influence.

- Damage due to war, nuclear radiation, or similar extreme events unless explicitly included.

- Loss of cargo if goods in transit is not purchased as part of the policy.

- Losses or damage during unauthorized modifications, or use of non-approved parts or repairs.

Truck Insurance Price in UAE

The cost of commercial or heavy truck insurance UAE policies varies depending on the type of truck, coverage, and risk profile. Below are some rough estimates and rules of thumb you can expect in the market:

- Light trucks or vans (up to about 3 tons) with TPL only – around AED 1,550 per year, which is the minimum under UAE tariff rules.

- Heavy trucks (over 3 tons) with TPL only – around AED 2,000 per year as the minimum premium set by the tariff schedule.

- Commercial trucks with comprehensive insurance – usually much higher, often ranging from AED 3,000 to AED 10,000+ per year depending on the truck’s value, its age, driving history, and how and where it’s used.

It's important to remember that these are only estimates. Actual heavy truck insurance premiums can be higher or lower depending on the insurer and the factors listed below, so it’s always best to compare multiple commercial truck insurance UAE quotes online.

Factors Affecting Truck Insurance Premiums

Several factors influence how much you pay for heavy or commercial truck insurance UAE. Key ones include:

- The truck’s weight, size, make & value: heavier or newer trucks cost more to insure. Higher value naturally equals higher replacement and repair costs.

- The type of coverage chosen (comprehensive vs TPL vs add-ons like goods in transit, personal accident).

- The usage & exposure: whether the truck is doing long‐distance haulage, operating in risky terrains, frequent work site exposure, traffic congestion, or mostly idle.

- Driver’s profile: age, driving history, license tenure, accidents or violations record.

- The deductible / excess level you select.

- Location / route risk: areas with high accident rates, theft or vandalism risk cost more.

- Frequency of use & mileage. More use = more risk.

- Safety features & security: alarm systems, tracking devices, proper maintenance, etc.

- Fleet size: larger commercial fleets may benefit from economies of scale.

Cheap Truck Insurance – How to Save More

Here are strategies to reduce the cost commercial and heavy truck insurance in the UAE:

- No-Claims Bonus (NCB): If you have a clean claims history, insurers often offer discounts. Accumulate years without filing claims to lower premiums.

- Compare policies online: Use platforms like LookInsure and others to get multiple quotes. This helps you find lower rates for similar cover.

- Opt for a higher deductible: If you can afford to pay more out-of-pocket when you claim, the insurer will charge lower annual premium. Good for trucks that are used in lower risk settings or seldom driven.

- Choose TPL policies when suitable: If the truck is used in work sites, short distances, or situations where cosmetic damage is less of concern, a third-party liability policy may suffice and be much cheaper than comprehensive.

- Limit optional add-ons: Skip extras unless necessary (for example “new parts only,” “replacement vehicle,” “alloy wheel cover,” “valet parking theft”).

- Maintain good driver records & safety measures: Drivers with clean records, proper licenses, safety training, using certified garages, installing safety and security devices can lower risk in the eyes of insurers.

- Bundle policies: If you have more than one truck, getting a fleet plan can reduce per-truck costs.

How to Buy Truck Insurance Online with Lookinsure

After comparing some of the most popular types of commercial truck insurance UAE policies, it’s time to finalize your decision. To buy your policy using Lookinsure, follow the given steps below:

1. Go to the Lookinsure website

Visit the official Lookinsure website. Navigate to ‘get an instant quote’ to start.

2. Fill in the given sections

Select the options that apply to you and fill in the required information.

3. Sign in

Sign in using your UAE pass or Emirates ID, followed by your EID number.

4. Answer required questions

You will be asked questions regarding your driving license and previous claims. Answer accurately.

5. Review and compare quotes.

After you complete all the necessary sections and provide details, Lookinsure will recommend suitable truck insurance UAE policies based on your information. You can now review quotes from UAE’s best insurers and compare them on one webpage.

6. Choose your policy

After browsing different quotes and comparing them, choosing a policy is time.

7. Choose optional add-ons

You can also select optional add-ons to tailor your policy and enhance the coverage even more.

8. Make the payment

After checking your policy and making necessary alterations, you can pay through one of Lookinsure’s reliable payment options.

9. Wait for confirmation

Afterwards, I will receive your confirmation.

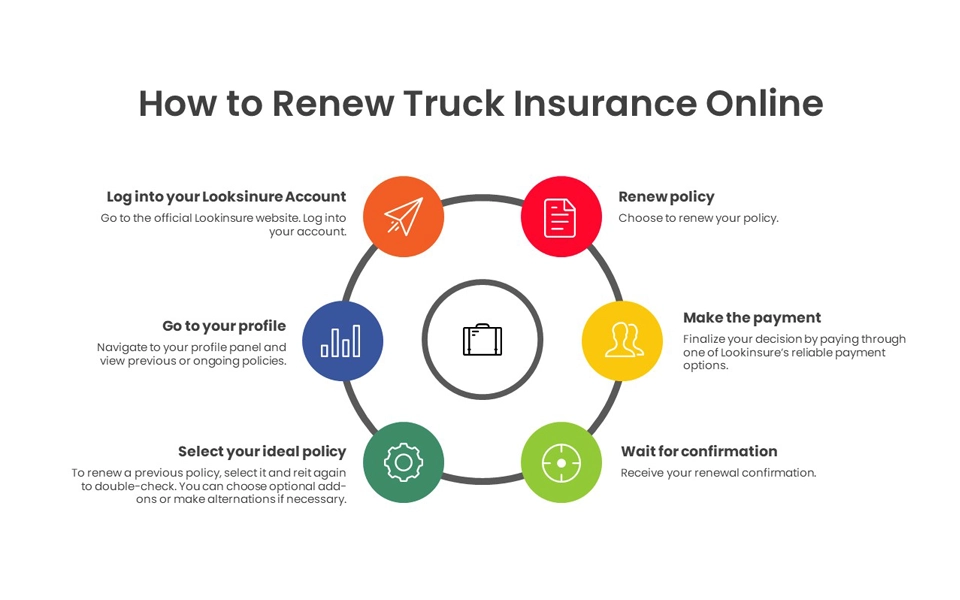

Truck Insurance Renewal Online

How to Make a Truck Insurance Claim

In case of an accident, here is how you can raise an insurance claim on your commercial truck insurance policy using Lookinsure:

1. Report to the police

First and foremost, it’s necessary to report the accident to the police. This is also crucial for receiving a police report, which will be used as evidence later in the process.

2. Inform your insurer

After reporting the accident to the police, you should inform your insurer about the occurrence.

3. Fill out a claim form

You should now fill out the claim form on Lookinsure’s website.

4. Add documents

Attach necessary documents, including evidence such as police reports and photos.

5. Submit the form

After reading your claim form and adding all the required documents, submit it.

6. Track claim status

You will be able to track your claim status on Lookinsure’s website.

Documents Required for Truck Insurance

A truck insurance UAE policy requires certain documents, such as all legal procedures. These documents are as follows:

- Vehicle registration

- Emirates ID

- Passport and Visa (for expatriates)

- Driver’s license

- Commercial license (for commercial vehicles)

- Proof of truck ownership

- Bank statements

- For cargo insurance, you must provide information on the type of goods you transport.

You need to consider several factors when getting a heavy or commercial truck insurance policy. First, you need to determine the type of activity you’re performing using your trucks. Lookinsure has tailored insurance solutions for all commercial trucks and their operations. These specialized plans help you protect your belongings and avoid financial consequences.