Find the Right HSBC Insurance Plan for Your Needs

Flexible installments to pay later with

And

Regulated by the Government of Dubai

If you are looking for a trusted and well-established insurance provider in the UAE, HSBC Insurance would be the right choice. This company helps manage risks and protects you from financial losses if something terrible happens to you or your belongings. HSBC Insurance in the UAE offers a wide range of support and the highest quality services.

We can never emphasize enough the importance of having a reliable insurance provider. When we talk about insurance, we are talking about managing risks. HSBC Insurance Company understands this need and ensures you get the most comprehensive yet flexible coverage options tailored to your needs.

About HSBC Insurance Company

HSBC Insurance is a subordinate of the globally famous HSBC Group. It delivers insurance solutions that perfectly match its clients’ financial goals. It has branches in more than 60 countries, including the UAE, and has a worldwide reputation for customer-centric approaches. HSBC values each client's needs and appreciates their diversity and differences.

That’s why it guarantees that each client will receive a personalized insurance plan according to their requirements, nothing more or less. The company provides various types of insurance, including HSBC life insurance, HSBC vehicle insurance, HSBC home insurance, and HSBC health insurance.

Benefits of HSBC Auto Insurance

As mentioned, HSBC vehicle insurance is a well-recognized choice for car owners. There are many advantages to choosing HSBC Insurance Company for your car.

Comprehensive Coverage Options

HSBC will ensure that it supports you with the most inclusive and comprehensive coverage options that protect you against various risks. Whether it's a car accident, theft, or natural disaster, HSBC auto insurance ensures you are financially safe and covered.

24/7 Customer Support

As we said before, accidents and emergencies are always unpredictable. HSBC Insurance Company makes sure to be available for you at any moment with its dedicated support team. HSBC prioritizes availability to ensure its clients can always access support. That’s why you can always have access to someone who will answer your questions and support you when you are in need.

Flexible Options

Each individual has different demands regarding their ideal policy, and that’s very respectable at HSBC. While some people need comprehensive and inclusive auto insurance, others might want minimum coverage. HSBC Insurance Company is big on flexibility. Everything can be personalized and tailored based on the client’s needs, from the type of coverage to its pricing. This helps customers find the most suitable and economical coverage for their vehicles.

Effortless Claim Process

Making a claim can be long and frustrating. Well, not with HSBC. Your comfort and convenience are a priority for HSBC. Filing a claim with HSBC Insurance Company is straightforward and hassle-free, and the company ensures that claims are processed quickly and efficiently.

HSBC Insurance Company Services

HSBC Insurance Company offers a wide range of services. We will discuss some of them here.

HSBC Travel Insurance | HSBC travel insurance provides coverage for a wide range of events during travel, ensuring a worry-free experience. Offers annual policies for frequent travelers. |

Covers risks from natural disasters and accidents. Mandatory third-party cover is required by law, while fully comprehensive coverage protects both third-party liabilities and damages to your vehicle. | |

Health Insurance | Offers private health policies for quicker access to treatment. It is essential to check for exclusions, especially regarding pre-existing conditions. |

Life Insurance | Life Cover: Lump sum payment upon death. Critical Illness: One-time payment for serious illness/injury. Income Protection: Regular payments if unable to work due to illness or disability |

Compare HSBC Insurance Quotes on Lookinsure

Lookinsure is a convenient platform for checking and comparing HSBC Insurance quotes. It provides detailed information about different HSBC insurance policies and allows you to compare coverage options, benefits, and prices. This transparency helps you make an informed decision and choose the best insurance policy for your vehicle, house, pet, etc.

Types of HSBC Car Insurance in Dubai

HSBC car insurance services are divided into three main categories:

Comprehensive Car Insurance

This is the most inclusive type of coverage you can imagine when you have HSBC car insurance in the UAE. The comprehensive type will cover car accidents, theft, fire, and natural disasters. It will support the damages done to your vehicle and caused by your car to another individual or property. If you want to drive on the road with peace of mind, HSBC motor insurance in the UAE is the best possible option.

Third-Party Insurance

Third party liability insurance UAE is mandatory by the law of the UAE. It covers the damages done by your auto to other individuals or property. However, it does not financially support you if your car gets damaged or stolen. It’s a very economical option, especially for people who rarely use their vehicles.

Specialized Insurance

HSBC also offers specialized insurance options to fill any gaps in your policy. These additional items (add-ons) provide unique coverage tailored to each individual's specific needs.

How to Buy Online HSBC Insurance in the UAE

Buying HSBC insurance online is a simple process. Here are the steps you need to follow:

- Sign Up: Sign up on Lookinsure's website to create an account for yourself.

- Choose Your Plan: The HSBC insurance plan fully suits your needs.

- Read the exclusions for each type of coverage carefully.

- Compare Different Aspects: Review and compare quotes, prices, and benefits.

- Complete the Process: Fill out the application form with your details.

- Pay Online: Complete the online payment process. Your policy documents will be emailed to you immediately after payment.

How to Renew HSBC Auto Insurance Plan?

HSBC auto insurance renewal is not a demanding process. On the contrary, it’s swift when it’s done on a platform like Lookinsure. These steps need to be followed for your renewal:

- Log In: Log into your Lookinsure account.

- Select Policy: Choose the policy that requires renewal.

- Update Necessary Details: Review and update your details if applicable.

- Confirm and Pay Online: Confirm the renewal and finish the process by making the payment online. After that, you will receive the confirmation and documents related to your policy via your email.

How to File HSBC Motor Insurance Claim

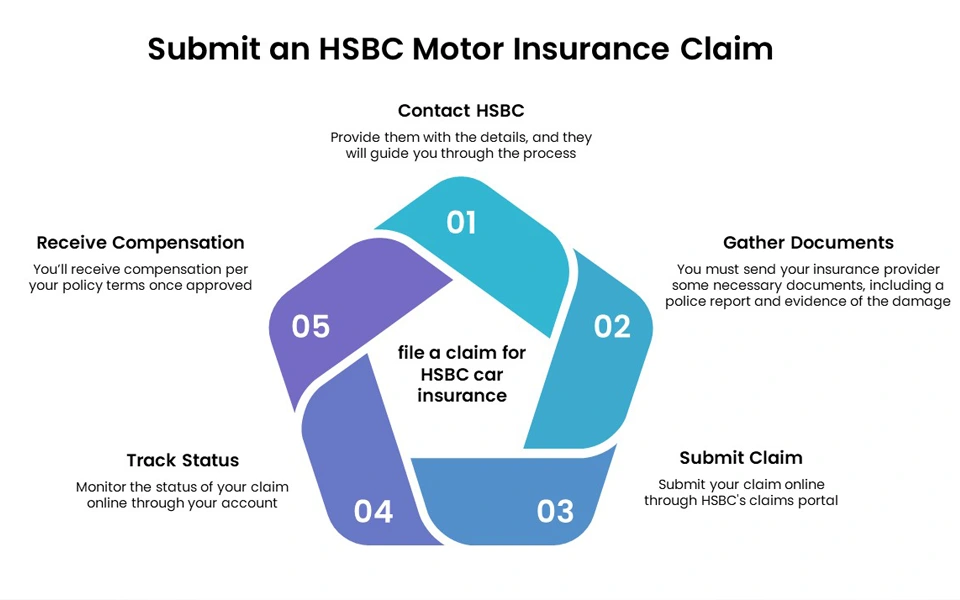

Here's how you can file a claim for HSBC car insurance:

- Contact HSBC: Reach out to the HSBC motor insurance hotline immediately after the incident. Provide them with the details, and they will guide you through the process.

- Gather Documents: You must send your insurance provider some necessary documents, including a police report and evidence of the damage (photos or videos).

- Submit Claim: Submit your claim online through HSBC's claims portal.

- Track Status: Monitor the status of your claim online through your account.

- Receive Compensation: You’ll receive compensation per your policy terms once approved.

Documents Required for HSBC Car Insurance

To get HSBC auto insurance, you will need the following documents:

- Personal Identification Documents

- Vehicle Registration Documents

- Driving License

- Policy Number (Your HSBC policy number)

- Incident Proof (such as photos, videos, and a police report)

Finding a trustworthy insurance company like HSBC can be challenging these days. HSBC offers extensive and dependable insurance solutions to meet the diverse needs of its customers in the UAE.

With a strong reputation for quality and customer-centric services, HSBC Insurance is a preferred choice for many UAE residents. Whether you need coverage for your car, home, pet, health, travel, or life, HSBC Insurance has a broad range of budget-friendly options tailored to your requirements.

Overall, HSBC Insurance, accompanied by the perks of using Lookinsure, provides a unique insurance experience in the UAE. Secure your financial future, protect yourself, your family, and your valuable belongings with HSBC Insurance, and enjoy peace of mind.