TATA AIG Insurance in UAE – Reliable Coverage for Your Needs

Flexible installments to pay later with

And

Regulated by the Government of Dubai

Choosing a trusted insurance provider ensures peace of mind and financial security. The insurance market is quite competitive, so selecting a company that offers comprehensive coverage, excellent customer support, and an easy claim process is essential. TATA AIG Insurance Company stands out, making it a reliable name in the UAE insurance industry.

TATA AIG has become a reliable choice for many UAE residents seeking high-quality insurance solutions. The company offers various types of insurance for individuals and businesses. Although all types of TATA AIG insurance are well-recognized in the UAE, specific policies, such as TATA AIG auto insurance, are particularly well-known and more popular in large, crowded cities.

About TATA AIG Insurance Company

The American International Group (AIG) and the Tata Group have partnered to form TATA AIG Insurance Company. This is an excellent partnership because it combines the local knowledge that Tata Group has and the experience of AIG’s global insurance to offer the best insurance products for diverse needs. The business is well-known in the UAE and beyond because of its vast network and creative solutions. This company ensures extensive coverage for all aspects of life. It offers a range of general insurance products, including vehicle, home, travel, etc. TATA AIG General Insurance Company started its operation in India on January 22, 2001, and since then, it’s been a trusted insurance provider worldwide, including the United Arab Emirates.

Benefits of TATA AIG Car Insurance

Purchasing TATA AIG general car insurance plans has many advantages. This section will mention some of them.

24/7 Customer Support

Nothing is more important than having a satisfied customer, and to that end, TATA AIG always considers customers' needs. As a policyholder, you can access customer support when needed. Accidents and emergencies can happen anytime, and TATA AIG’s support team is always available.

Extensive Coverage Options

TATA AIG car insurance offers comprehensive and full coverage insurance options that protect you against various risks. Many potential risks threaten your safety or that of your vehicle, including car accidents, theft, fire, or natural disasters. TATA AIG auto insurance ensures you are financially covered if any of these incidents happen. Some of these incidents might never even occur, but it’s better to be safe than sorry. It’s wise to take action to avoid possible unpleasant consequences later, even though they might seem unnecessary.

Easy Claims Process

Customer convenience is a top priority for TATA AIG. The process of filing a claim can be an annoying and time-consuming experience. TATA AIG is doing its best to make it as effortless as possible. After the claim is submitted, the company ensures that claims are processed quickly so you can get your approval as soon as possible. This focus on customer satisfaction makes TATA AIG car insurance the number one choice for many vehicle owners.

Budget-Friendly and Flexible Options

Another characteristic of TATA AIG car insurance plans is flexibility. Each individual is looking for something different, and it’s the insurer's responsibility to offer the most suitable options. Many car owners are not looking for something comprehensive; they might just want economical insurance with minimum coverage.

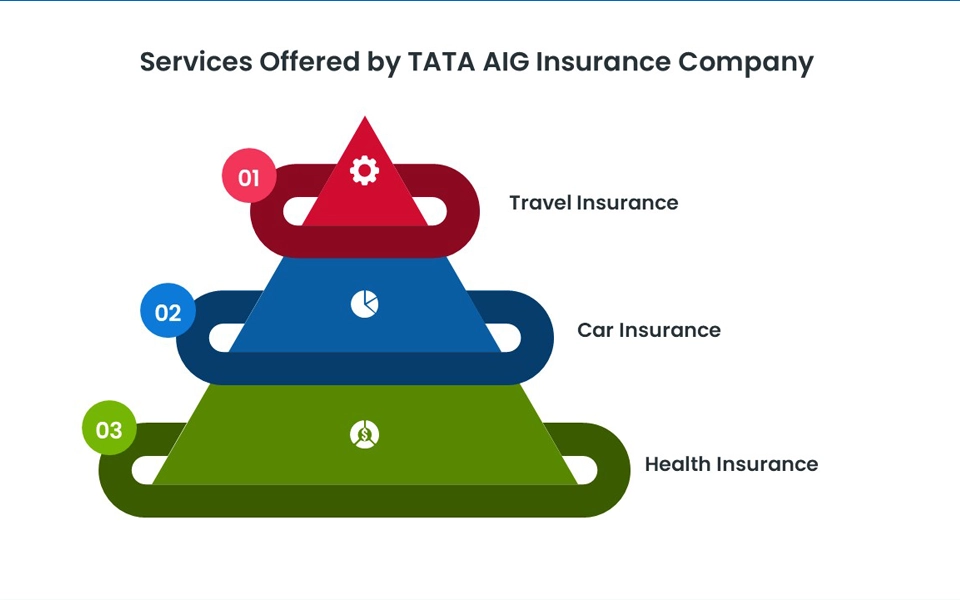

TATA AIG Insurance Company Services

Let’s delve into the different kinds of services and products that you can get from TATA AIG.

Travel Insurance

When you travel, incidents might catch you off guard. Nobody embarks on a vacation expecting danger. But if we are realistic, incidents can occur anywhere and are unpredictable. Bad things can happen to us no matter where on earth we are. One of the worst things that can occur during a pleasant trip is to get involved in an incident without financial support. Imagine going to a foreign city and experiencing lost luggage, a minor accident, or a medical emergency without the proper financial coverage.

Car Insurance

TATA AIG car insurance is popular for its expansive coverage and excellent customer service. Whether looking for basic third-party liability or full coverage, TATA AIG car insurance is the right insurer. It protects against floods, storms, earthquakes, fire, theft, and road accidents. Two other advantages come with choosing TATA AIG auto insurance: cashless garages and a no-claim bonus. You can access more than 5400 cashless garages to take care of your vehicle in case of damage. The other perk is that you can get discounts on your TATA AIG car insurance renewal OD premium after having claim-free years. You can get a 20% discount after one claim-free year, and if you keep it up to five years, you will get a 50% discount.

Health Insurance

It’s quite unavoidable to face a health emergency in one’s life. Illnesses and health emergencies might show up when you are not financially ready for them, and that’s why you should be prepared before they get too late. TATA AIG Insurance Company aims to remove the mental and financial pressure a medical emergency will put on an individual. Whether routine check-ups or major medical treatments, TATA AIG health insurance provides the financial support you need to cover your healthcare costs. TATA AIG respects the individual needs of all of its customers, so it offers three different types of coverage for its health insurance: TATA AIG MediCare, TATA AIG Medicare Premier, and TATA AIG MediCare LITE.

Compare TATA AIG Insurance Quotes on Lookinsure

As mentioned before, Lookinsure is a platform that makes it easy to compare different information. Comparing insurance quotes is a serious step in deciding your insurance plan. The Lookinsure platform gives detailed information about different TATA AIG insurance policies, allowing you to compare coverage options and prices. You won’t be able to find the most suitable policy unless you have access to transparent details, and Lookinsure’s responsibility is to provide you with that.

Types of TATA AIG Car Insurance in Dubai

Comprehensive Car Insurance Policy

Comprehensive car insurance offers extensive coverage for your vehicle. This policy protects against third-party liabilities, damage from road accidents, theft, floods, earthquakes, man-made disasters, etc. However, it’s important to note that this coverage has specific exclusions. If you drive under the influence of substances and get into an accident, you will not be supported by the Comprehensive car insurance plan.

Stand Alone Own Damage Car Insurance Policy

This policy applies only to cars bought after September 2018. If your vehicle is involved in an accident and suffers financial loss, TATA AIG's damage cover covers the damages caused only to the insured car.

Stand Alone Third Party Car Insurance Policy

Third-party car insurance is mandatory by law and can be considered the most basic type of coverage you can get. TATA AIG car insurance third-party supports you if your vehicle injures someone or damages a property.

How to Buy Online TATA AIG Insurance in the UAE

Here are the steps you need to follow for purchasing TATA AIG car insurance online:

- Sign Up: To make an account, register on the Lookinsure website.

- Choose Your Plan: Decide which TATA AIG insurance plan best meets your requirements.

- Compare Quotes: Take a look and compare quotes, advantages, and prices of different plans.

- Complete the Application: Provide personal information and fill out the application form.

- Pay Online: Finish the online payment procedure. When the payment is made, you will receive confirmation via email.

How to Renew the TATA AIG Insurance Plan?

Here are the steps for processing your TATA AIG car insurance renewal online:

- Log In: Log into your Lookinsure account.

- Select Policy: Choose the policy for which you need renewal.

- Review and Update Information: Review and update your information if necessary.

- Confirm and Pay Online: Confirm the renewal and make the payment online.

- Receive Confirmation: Receive confirmation and policy documents via your email.

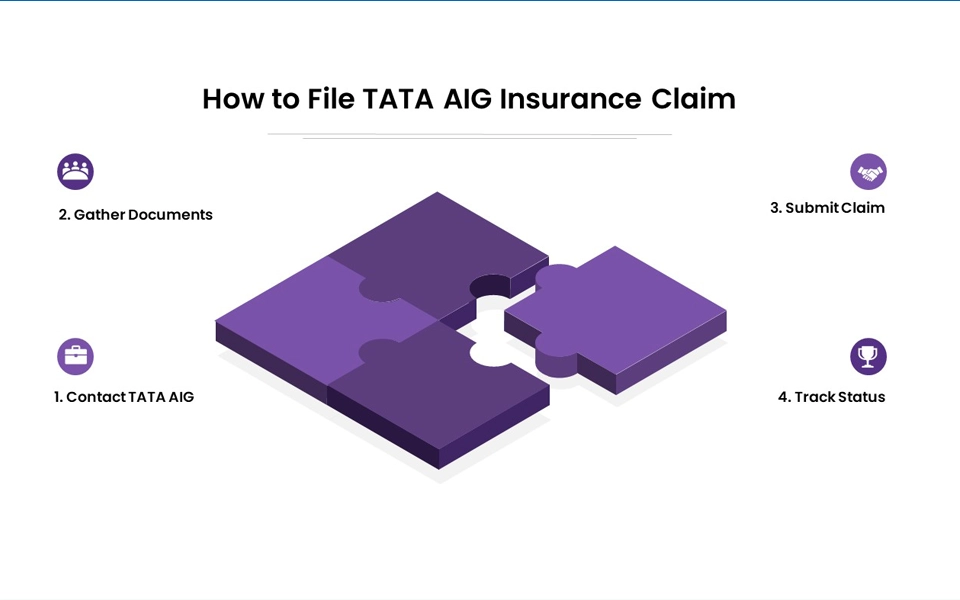

How to File TATA AIG Insurance Claim

Filing a claim is very straightforward, and having access to 24/7 customer service makes it relatively easy. These are the steps you need to follow:

- Contact TATA AIG: Contact your insurance provider as soon as possible. Tell them what happened, and they will provide support and guidance.

- Gather Documents: Collect and send necessary documents, including a police report or other evidence of the damage.

- Submit Claim: Submit your claim online through TATA AIG's claims portal.

- Track Status: Monitor the status of your claim online.

Documents Required for TATA AIG Insurance

To get TATA AIG insurance, you will need the following documents:

- Valid Identification Documents

- Vehicle Registration Number

- Driver’s License

- Policy Number (Your TATA AIG policy number)

- Evidence of the Incident (such as photos, videos, and a police report)

TATA AIG Insurance Company provides comprehensive insurance solutions to satisfy the diverse needs of its clients in the United Arab Emirates. Many citizens of the United Arab Emirates choose TATA AIG Insurance because of its quality service. The company's unparalleled products and services cannot be found elsewhere. TATA AIG promises to protect your vehicle and your health and will provide financial support if anything goes wrong during a trip. Lookinsure also provides a platform that makes all those services and products easily accessible.

Frequently Asked Questions

Find quick answers to common questions about TATA AIG Insurance and how to manage your policies effectively.