Lexus Car Insurance

Flexible installments to pay later with

And

Regulated by the Government of Dubai

In the realm of luxury vehicles, Lexus stands out as a perfect blend of Japanese reliability and premium craftsmanship. Known for their exceptional build quality and innovative technology, these cars represent a significant investment that deserves proper protection using every means possible, including the right insurance policy.

In this comprehensive guide, we'll explore everything you need to know about Lexus car insurance in the UAE, helping you make an informed decision about protecting your premium vehicle.

Lexus Car Insurance in UAE

Lexus cars are usually the best choice for people who want everything Toyota has to offer plus a little additional razzle-dazzle, a certain element of luxury. This means that not only do they cost considerably more, but also are more expensive to insure as well.

So if it is your first time upgrading to one of these paragons of craftsmanship, better be ready to be quoted a fair amount of money when asking around for Lexus car insurance.

Types of Lexus Car Insurance Plans in UAE

Depending on the type of usage and the value of the car, every vehicle has its own specific insurance needs, so there are different policy types offering various degrees of coverage. Here is what you need to know about what each kind of policy covers so you can decide and judge which one best fits your taste andwhat you want from your Lexus motor insurance.

Comprehensive Lexus Car Insurance

If you drive a brand-new car, you know that comprehensive auto insurance policies offering complete protection for your vehicle are the best options. This type of insurance typically covers:

| 1 | Accidental damage to your vehicle |

| 2 | Fire and natural disasters |

| 3 | Theft and vandalism |

| 4 | Third-party liability |

| 5 | Personal accident coverage |

Third-Party Lexus Motor Insurance

Considering how expensive these cars are, third party car insurance, which only covers the cost of damages done to third-party vehicles, individuals, or properties, is not a good option. However, third-party Lexus insurance policies are also available for those seeking basic coverage to fulfill their legal obligations.

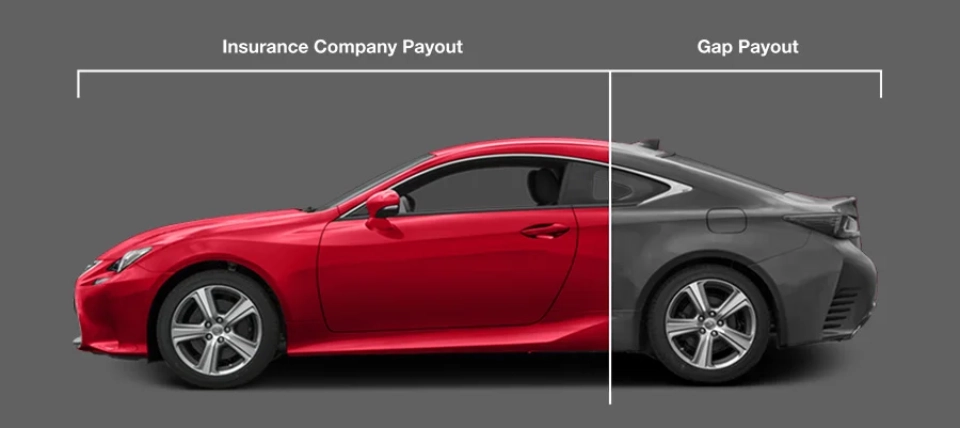

Lexus Gap Insurance

If your car is financed, Gap insurance or Guaranteed Asset Protection insurance is an add-on that covers the "gap" between what you owe on your car loan or lease and the car's current market value if it's totaled or stolen. This option can give you the peace of mind to enjoy driving your Lexus.

Add-ons for Lexus Cars

If you are still not satisfied with the level of protection a comprehensive policy offers, you can still enhance your Lexus car insurance with valuable add-ons such as:

| Zero depreciation cover | Covers the full cost of part replacements without accounting for depreciation |

| Agency repair warranty | Allows repairs at authorized service centers with genuine parts |

| Roadside assistance coverage | Offers help for breakdowns, like towing or jump-starts |

| Replacement car service | Provides a temporary car while yours is being repaired |

| Personal accident coverage for passengers | Covers passengers for injuries, disability, or death from an accident |

What are Covered and Not Covered Under Lexus Car Insurance?

When buying Lexus motor insurance, it’s essential to understand exactly what protection you get. While details vary by provider, most policies include some common coverages and exclusions.

What’s Covered:

- Accidental damage to your Lexus

- Third-party liability for injury or property damage

- Theft or total loss of the vehicle

- Fire, flood, and natural disasters

- Personal accident cover for the driver

What’s Not Covered:

- Driving under the influence of alcohol or drugs

- Fraudulent or intentional damage

- Driving without a valid license

- Wear and tear or mechanical breakdowns

- Use of the vehicle outside allowed geographical limits

Factors Affecting Lexus Car Insurance Premiums

The premium you pay for Lexus motor insurance depends on several factors, which help insurers determine the risk they will be getting themselves into by insuring a car with you as the driver.

- Driver Profile: Age, driving history, and claim record

- Vehicle Model: Premiums differ; an RX may cost more to insure than an ES

- Coverage Type: Comprehensive coverage is more expensive than third-party liability

- Usage Patterns: Frequent commuting raises premiums compared to occasional use

- Location: Areas with higher risks of accidents or theft increase costs

- Car Insurance Lexus Renewal: Timely renewals help keep your premium lower

Lexus Car Insurance Price in UAE

Here, some popular Lexus models are listed and their estimated insurance cost gives you a general insight. Remember, these are only ballpark figures which are highly likely to change depending on the factors listed above and any fluctuations in the market:

Lexus Model | Insurance Cost Range (AED) |

Lexus IS | AED 1,100 - AED 4,000 |

Lexus LX | AED 2,000 - AED 5,000 or more |

Lexus NX | AED 1,500 - AED 4,500 |

Lexus UX | AED 1,200 - AED 4,000 |

Lexus LS | AED 2,500 - AED 6,000 or more |

For a more accurate quote for car insurance Lexus owners can visit our website and get prices from multiple providers all at once.

Cheap Lexus Car Insurance – How to Save More

It is true that these cars are rather expensive to own and maintain, but owning one can be affordable if you manage your Lexus auto insurance wisely. Here are a few ways to save on premiums:

- No-Claim Bonus (NCB): A clean record gives you discounts at the time of car insurance Lexus renewal.

- Compare Policies Online: Use platforms like Lookinsure to find the most competitive Lexus motor insurance rates.

- Higher Deductible: A great option for drivers who use their cars mainly for leisure or weekend drives.

- Third-Party Liability (TPL): For low-usage vehicles, TPL policies are a cost-effective way to meet legal requirements.

How to Buy Lexus Car Insurance Online with Lookinsure

For buying car insurance Lexus owners can use our website in a relatively straightforward process that won’t take more than a few minutes. Here is how you do it:

| 1 | Visit Lookinsure |

| 2 | Enter the car plate number |

| 3 | Verify using UAE Pass or Emirates ID |

| 4 | Provide driving history information |

| 5 | Review multiple quotes |

| 6 | Select preferred policy |

| 7 | Log in to your account |

| 8 | Customize with desired add-ons |

| 9 | Enter phone number |

| 10 | Choose a payment method and complete the transaction |

Lexus Car Insurance Renewal Online

Renewing your Lexus motor insurance in the UAE is equally straightforward. It invloves a few easy steps that can be completed online in a matter of minutes. Here is what you'll need to do:

- Log in to your Lookinsure account

- Select your existing policy

- Review and update details if needed

- Choose additional coverage options

- Complete payment

To help our costumers with managing the financial burden of mandatory renewals, you can now pay for your Lexus auto insurance policy in instalments.

Documents Required for Lexus Car Insurance

Whether you drive a Lexus or any other car, the documents required for buying car insurance are the same. These include:

- Valid Emirates ID (Original and copy)

- Driver's License

- Vehicle Registration (Mulkiya)

Additional Requirements

- Bank loan letter (if applicable)

- Company documents (for corporate vehicles)

- Passport copy (for new residents)

Top Lexus Car Insurance Providers in the UAE

Here are some of the most reputable insurance providers in the UAE who can get you the coverage you need for your beloved Lexus:

Provides specialized motor insurance plans designed to meet the needs of Lexus owners. They offer competitive premiums and a strong claim settlement record. | |

Known for offering comprehensive coverage explicitly tailored for Lexus models, combining attractive premium rates with flexible coverage options for new and pre-owned Lexus vehicles. | |

Offers Sharia-compliant insurance solutions, providing extensive coverage for Lexus cars while ensuring compliance with Islamic principles. | |

With a strong reputation in the market, they offer reliable and robust insurance packages for Lexus owners, including specialized options for high-end vehicles. | |

Provides Islamic insurance (Takaful) solutions with comprehensive coverage for Lexus vehicles, including benefits like agency repairs and roadside assistance. | |

Delivers premium insurance solutions with specialized packages tailored for Lexus car owners, often including additional benefits like replacement car services and personal accident coverage. |

How to Make a Lexus Car Insurance Claim?

Filing a Lexus car insurance claim must be done systematically to ensure smooth processing. Here's a detailed breakdown of the process:

Immediate Steps After an Incident

- Ensure safety and contact police if necessary

- Document the scene with photographs

- Collect information from all parties involved

- Contact your insurance provider immediately

Digital Claim Filing Process

Most Lexus motor insurance providers now offer digital claim filing through:

- Mobile apps

- Online portals

- WhatsApp services

After following the instructions above and procuring the required documents, you must file an official claim online or by personally visiting your insurer’s offices, submitting the documents, and waiting for your claim to get processed.

Required Documentation

To process your claim efficiently, prepare:

- Police report

- Photos of damage

- Registration documents

- Valid driver's license

- Emirates ID

- Insurance policy details

Selecting the right Lexus insurance provider requires careful consideration of coverage options, cost, and service quality. With Lookinsure's comprehensive comparison platform, you can find the best car insurance for Lexus vehicles that matches your needs. Whether insuring a brand-new car or renewing coverage for an existing model, our platform ensures optimal protection at competitive rates.