Personal Belongings cover in Car Insurance UAE

Flexible installments to pay later with

And

Regulated by the Government of Dubai

No car owner can deny that having good insurance coverage brings peace of mind that is incomparable to anything else. However, some types of coverage, such as the loss of personal belongings in car insurance, might sometimes be overlooked when you buy insurance online. Does your current car insurance policy cover personal belongings? What if your laptop is damaged in a road accident or your backpack is stolen from your vehicle? To cover the loss of personal belongings, some insurance providers offer specific add-ons.

Why Choose Lookinsure for Personal Belongings Insurance?

We claim that Lookinsure is the best choice for your purchase, whether you are shopping for a new policy or an add-on like personal belongings insurance, benefiting you in cost and time. Here's why:

Comprehensive Coverage

Lookinsure offers a valuable car insurance personal belongings add-on designed to enhance the overall protection of your personal items while traveling in your vehicle. This add-on provides more comprehensive coverage by ensuring that your personal belongings, such as electronics, luggage, and other valuable items, are insured against potential loss or damage due to accidents, theft, or vandalism.

Affordability

This affordability is achieved through Lookinsure’s strategic partnerships with various providers and BNPL services, allowing installment payments and a commitment to providing value to policyholders. The competitive quotes offered by Lookinsure partners ensure that customers can access extensive coverage options tailored to their needs while keeping their insurance costs manageable.

Customer-Centric Flexibility

We are highly customer-centric and flexible. It offers a range of customizable add-ons that allow policyholders to tailor their insurance coverage to fit their specific needs. By actively listening to customer feedback and adapting their offerings, Lookinsure ensures that clients feel supported in their insurance choices.

Enhanced Customization

Customization is a key feature of our services, empowering policyholders to select and tailor a coverage plan that best meets their needs. We recognize that each individual has unique requirements for insurance, and nobody understands those needs better than you do.

What is Loss of Personal Belongings Car Insurance Add-On?

Now, let’s delve into the details of this car insurance personal belongings add-on. You can find the necessary information about the coverage of this add-on. If you are a person who always carries personal items with you in the car, you need to know which of those items are qualified to be covered by this add-on when you buy car insurance online.

Services Typically Covered under Personal Belongings Cover

When you have personal belongings insurance as part of your car policy, it generally covers:

- Theft of Items: If your car is broken into, the policy can pay to replace stolen items like electronics, bags, or sunglasses.

- Damage from Theft: It can cover damage to your belongings during a break-in.

- Fire or Accident Damage: If your items are damaged in a car fire or an accident, the cost to replace them may be covered.

- Cover for Specific High-Value Items: Some policies allow you to list and cover specific expensive items like a professional camera.

Note: You should also know that you must secure your car properly to use this add-on. This means you must ensure you are not leaving your vehicle unlocked or with open windows. If you claim theft, you must provide your insurance provider with enough evidence. If there aren’t any signs of forced entry into your vehicle, your insurance provider won’t be able to help you.

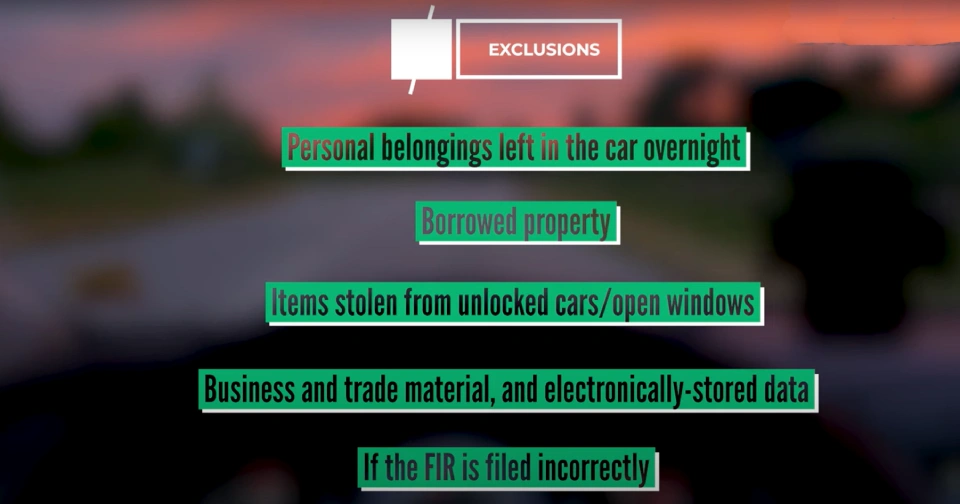

Exclusions & Limitations of Personal Belongings Cover

All insurance policies have limits. For personal belongings cover, common exclusions include:

- Cash and Credit Cards: These are almost never covered.

- Items Left in Plain Sight: Some policies may not cover theft if valuable items were left openly visible on the seats, encouraging the break-in.

- Per-Item and Total Limits: There is usually a maximum amount the insurer will pay for a single item and a maximum total for all items in one claim.

Why Opt for Car Insurance with Personal Belongings Cover in UAE

A lot of people keep valuable items in their cars, whether it's a work laptop, a new shopping purchase, or sports equipment. This makes personal belongings cover a very practical choice.

The main reason to add this cover is the risk of theft from your vehicle. It provides financial protection if someone breaks into your car and steals your things. It also covers damage to your belongings in certain situations, like if a leak in the car ruins a bag. Many people ask, "Does car insurance cover personal belongings?" and are surprised to learn it does not, unless you specifically add this option.

How to Add Roadside Assistance to Your Policy via Lookinsure

In this section, we will cover the steps you must follow to cover the loss of personal belongings in car insurance. The good news is that the process is fast and straightforward, just like everything else with Lookinsure.

- Review Your Current Policy: First, check your current policy to see whether it already covers the loss of your personal items. If not, you need an add-on.

- Choose Add-On: In this step, select the personal belongings add-on that perfectly matches your needs. What you should care about in this step are the details. Make sure you look at all the details provided and related to it. Read the terms and conditions and study the claim limits and exclusions part.

- Get Quotes: Lookinsure makes it easy to get quotes. All you need to do is add details about your vehicle and the coverage you want. This will allow you to compare rates and find the best, most budget-friendly deal.

- Compare with Other Providers: Lookinsure ensures you have enough space and access to compare insurers' offerings. Sometimes, these offerings differ in small details or have huge differences. One might have features like high claim limits or even fewer exclusions.

- Confirm Coverage: Once satisfied with your selection, it’s time for the final step. Add personal belongings coverage to your policy and confirm it in this step. Remember to keep a copy for future reference.

How to Get Cheap Personal Belongings Cover as Add-On

You can find affordable personal belongings insurance with a few simple steps:

- Compare Insurers: Different companies offer different prices for this add-on.

- Adjust the Excess: Choosing a higher excess (the amount you pay in a claim) can lower your premium.

- Only Cover What You Need: If you don't often carry expensive items, you can choose a lower coverage limit to reduce the cost.

- Ask About Bundles: You might get a discount if you buy this add-on together with others, like key replacement.

Costs & Premium Impact of Personal Belongings Cover in UAE

Adding personal belongings insurance to your car policy is generally low-cost. The premium increase is small, especially when you consider the value of the items you regularly carry.

The exact cost depends on the total coverage limit you choose. For example, a cover limit of AED 5,000 will naturally cost less than a limit of AED 10,000. It is a small yearly fee to protect yourself from the significant cost of replacing a stolen laptop or other personal items.

File a Claim for Loss of Personal Belongings

To file a claim under your add-on relating to personal belongings in car insurance, make sure to follow these steps:

- Notify Your Insurance Provider: Immediately after the incident, notify your insurance provider and provide them with the related details.

- Submit a Police Report (if needed): If theft is involved, submit a police report. This will be needed to provide evidence.

- Prove Ownership: You must prove that you own the stolen or damaged items. Complete the claim form and submit all the required documents. Contact your insurer to learn the status of your claim.

Documents Required for Loss of Personal Belonging Add-on in Car Insurance

The last section mentioned that you must submit certain documents to claim personal belongings insurance. This is a list of documents that need to be provided:

- A copy of your vehicle insurance policy

- The police report (if required)

- Proof of ownership or purchase receipts for the stolen or damaged items

- A completed claim form

Note: It’s better to provide your insurance providers with photos or videos of your belongings. Remember that having the right documents ready will speed up the approval of your claim.

Once in a while, we hear stories of people who have had their dear belongings, such as their laptop or golden necklace, stolen from their car. This is not new, and the potential risk is always there. It’s wise to consider good car insurance coverage for the loss of personal belongings. Lookinsure guarantees you will find the most suitable offer with the lowest price and highest quality.