NGI Car Insurance

Flexible installments to pay later with

And

Regulated by the Government of Dubai

When it comes to insurance in the UAE, drivers want more than just a legal requirement; they want coverage that actually works when it matters. NGI motor insurance plans are designed to protect against common risks like accidents, theft, or natural damage, giving motorists confidence on the road.

Choosing the right NGI car insurance policy also means having flexibility. From basic liability to more comprehensive options, NGI makes it easier to manage your motor insurance needs while ensuring that drivers stay compliant and covered throughout the year.

NGI Car Insurance Overview

Understanding the history and reach of your insurance provider helps build confidence in your choice. Let's examine what makes NGI car insurance plans one of the UAE's most trusted insurers.

National General Insurance Company PSC began in 1980, establishing itself as a pioneering force in Dubai's insurance sector. Over the years, NGI Insurance has grown from a local provider to one of the UAE's most respected insurance companies, known for its innovative solutions and customer-first approach.

Contact Information

Head Office

National General Insurance Co. (PJSC)

| PO Box | 154 |

| Address | Levels Ground, 2, 3, 5, 6, NGI House, Port Saeed Street, Deira Dubai, Dubai – United Arab Emirates |

| Tel | +9714 – 211 5800 |

| Fax | +9714 – 250 2854 |

| [email protected] | [email protected] | |

| Website | www.NGI.ae |

Abu Dhabi Branch

National General Insurance

| Office | #605, Sky Tower, Jazeerat Al Reem, Abu Dhabi – UAE |

| Tel | +971 622 0223 |

| Fax | +971 622 0037 |

| [email protected] |

Abu Dhabi Traffic Office

National General Insurance

| Office | Abu Dhabi Traffic Office, ADNOC Vehicle Inspection Centre, Muroor Al Mushrif, Abu Dhabi – UAE |

| Tel | +971 449 1277 |

| Fax | +971 622 0037 |

| [email protected] |

Al Ain Traffic Office

National General Insurance

| Office | Al Ain Traffic Office, ADNOC Vehicle Inspection Center, Falaj Hazzaa, Al Ain, United Arab Emirates |

| Tel | +971 3 780 6611 |

| Fax | +971 2 622 0037 |

| [email protected] |

Benefits and Coverage of NGI Insurance

Choosing NGI Insurance Dubai means partnering with a company that meets your needs. Thousands of UAE residents trust National General Insurance for their protection needs.

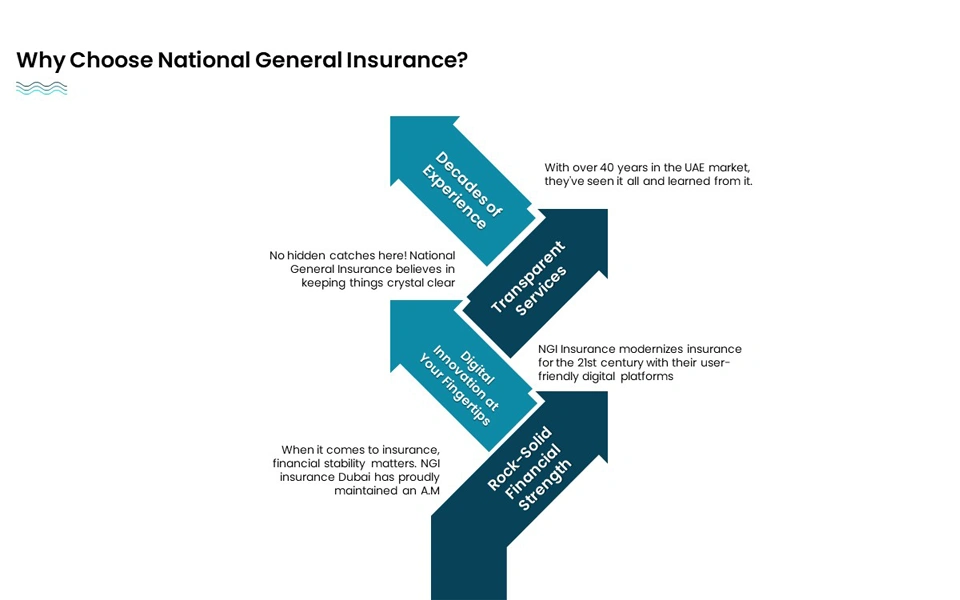

Rock-Solid Financial Strength

When it comes to insurance, financial stability matters. NGI Insurance Dubai has proudly maintained an A.M. Best Financial Strength Rating of "A- Excellent" since 2015. But what does this mean for you? A.M. Best is like the gold standard for rating insurance companies – think of it as a financial health check that tells you your insurer can pay claims when needed.

Digital Innovation at Your Fingertips

NGI Insurance modernizes insurance for the 21st century with its user-friendly digital platforms. From rapid quote generation to effortless claim processing, everything is just a click away.

Transparent Services

There are no hidden catches here! This company believes in keeping things crystal clear so you can rest assured that your NGI car inusrance policy is written in plain language, and their team is always ready to explain any details you might want to know more about.

Decades of Experience

With over 40 years in the UAE market, they've seen and learned from it. This experience translates into better service and more tailored solutions for you.

What Is Covered Under NGI Motor Insurance Plans?

With NGI motor insurance plans, drivers in Dubai and across the UAE benefit from comprehensive protection tailored to everyday use and unforeseen incidents. An NGI Car Insurance Policy is designed to give peace of mind on the road.

Coverage includes:

- Collision damage (fault & no-fault)

- Theft, vandalism, or fire

- Flood and sandstorm damage

- Third-party liability (property damage & bodily injury)

- Personal accident benefits for driver and passengers

Add-ons for NGI Car Insurance Plans

NGI car insurance plans can be customized with a variety of optional add-ons, giving drivers the flexibility to enhance their NGI Motor Insurance Plans for extra peace of mind.

Available add-ons include:

- Roadside Assistance: 24/7 breakdown help

- Zero Depreciation: Higher claim settlement value

- Rental Car Cover: Temporary replacement while your car is under repair

- GCC Coverage: Extended protection across GCC countries

- Natural Calamity Protection: Extra cover for storms or floods

- Personal Belongings Cover: Protection for items inside the vehicle

What Is NOT Covered Under NGI Car Insurance Plans

Even with the most comprehensive NGI Car insurance policy, certain exclusions apply. Being aware of these limitations helps drivers make informed decisions before they buy NGI car insurance online or through an agent.

What’s not covered:

- Normal wear and tear Mechanical or electrical breakdowns

- Racing or reckless driving damages (without add-on)

- Off-road incidents outside coverage terms

- Damage caused by illegal activities or deliberate acts

NGI Insurance Company Services

National General Insurance offers comprehensive solutions for individual and corporate needs. Their extensive portfolio ensures you'll find exactly what you need, whether looking for personal coverage or business protection.

Individual | Description | Corporate | Description |

Medical | Get peace of mind with NGI health insurance that covers everything from routine check-ups to major procedures. Their medical insurance plans are designed to keep you and your family healthy and protected. | Group Medical | Keep your team healthy and productive with comprehensive group medical coverage from NGI medical insurance. |

Motor | Whether you're driving through Dubai or Abu Dhabi, NGI car insurance covers your wheels. Choose from various coverage levels to match your needs and budget. | Motor Fleet | Perfect for businesses with multiple vehicles, offering streamlined management and comprehensive protection. |

Travel | Explore the world worry-free with comprehensive travel insurance that's got your back wherever you go. | Property | Protect your business assets with tailored property insurance solutions. |

Personal Accident | Life is unpredictable – stay protected with coverage that helps you handle unexpected accidents and injuries. | Marine | Specialized coverage for marine-related business operations. |

Home | Your home is your castle – protect it and everything in it with comprehensive home insurance from National General Insurance Dubai. | Engineering | Comprehensive protection for construction projects and engineering operations. |

Life | Secure your family's future with life insurance policies that provide financial protection when it matters most. | Energy | Specialized insurance solutions for the energy sector. |

Yacht | For the seafarers, get specialized coverage for your marine adventures. | Liability | Protect your business from various liability risks. |

General Accident | Broad coverage for various business-related accidents and incidents. | ||

Documents Required to Buy NGI Car Insurance in Dubai, UAE

When you want to buy NGI car insurance online or in person, you will need to provide specific paperwork. These documents ensure smooth processing of your NGI Car Insurance Policy: Emirates ID (for residents) Passport and visa copy (for expatriates) Valid driving license Vehicle registration card (Mulkiya) Bank details or payment proof

Compare NGI Insurance Quotes on Lookinsure

Shopping for insurance shouldn't be complicated or time-consuming. At Lookinsure, we've revolutionized how you can compare and buy NGI car insurance online. Our platform combines multiple insurance providers, allowing you to compare National General Insurance Dubai's coverage and price against other options.

Best Price Guarantee

We work directly with insurers to bring you the most competitive rates. When you compare the price of a NGI car insurance policy through our platform, you can be confident you're getting the best possible deal and even have the option to get insurance installment through Tabby or Tamara.

Transparent Comparison

See coverage details, prices, and benefits side by side. There are no hidden fees or surprises – just straightforward, honest comparisons that help you make an informed decision.

Types of Car Insurance Plans Offered by National General Insurance

Understanding your insurance options is crucial for making the right choice. NGI motor insurance plans come in two main types, each designed to meet different needs and budgets. Let's explore what each option brings to the table.

Third-Party Liability Insurance

This basic level of coverage meets the UAE's mandatory insurance requirements. Third-party liability insurance protects you financially if your vehicle causes damage to other people's property or injuries to third parties. While it's the most affordable option, remember it doesn't cover damage to your vehicle.

Comprehensive Insurance

NGI comprehensive insurance provides complete protection for those seeking peace of mind. This covers not just third-party damages but also:

- Your own vehicle damage from accidents

- Fire and natural disaster damage

- Theft protection

- Personal accident coverage

- Emergency roadside assistance

NGI Gold: Premium Protection

Take your coverage to the next level with the company's exclusive Gold policy. This premium offering which is truely the best NGI car insurance policy money can buy includes:

- 3 Years agency repair

- Personal Accident Benefit for Driver

- Personal Accident Benefits for Passengers

- Loss or Damage of Vehicle

- Loss of Use Allowance

- 24×7 Roadside Assistance

- Ambulance Cover

How to buy NGI Car Insurance Online in the UAE

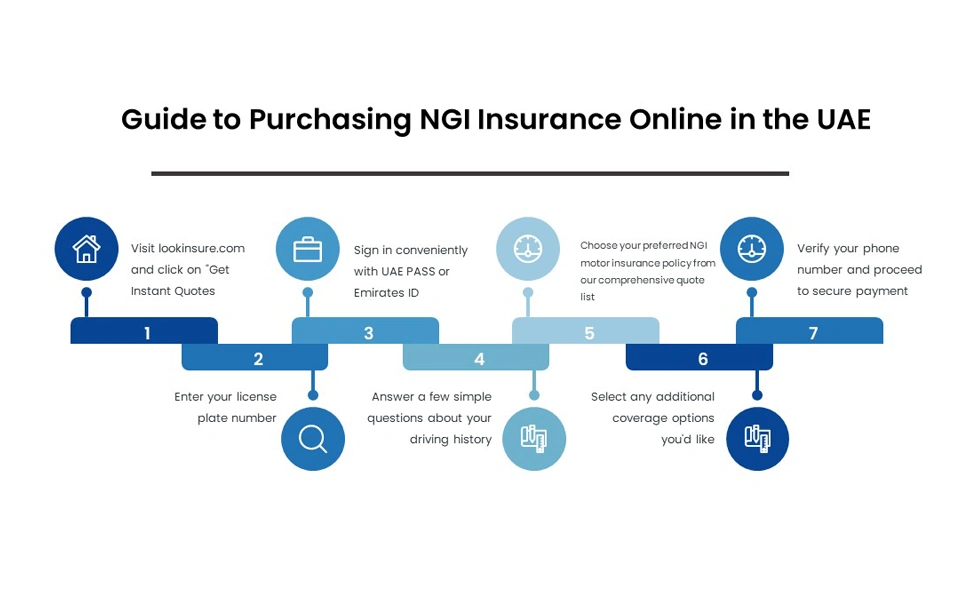

It has never been easier to buy NGI car insurance online and secure your Dubai coverage. While you can purchase directly through National General Insurance's website, using Lookinsure offers additional advantages, such as instant comparisons and often better rates. Here's how to get started with our streamlined process.

- Visit lookinsure.com and click on "Get Instant Quotes"

- Enter your license plate number

- Sign in conveniently with UAE PASS or Emirates ID

- Answer a few simple questions about your driving history

- Choose your preferred NGI motor insurance policy from our comprehensive quote list

- Select any additional coverage options you'd like

- Verify your phone number and proceed to secure payment

How to Renew Car Insurance Online with NGI Insurance in Dubai?

Keeping your coverage up to date is vital for continuous protection, and renewing your NGI car insurance plans is simple and convenient through multiple channels, whether online or in person.

Choose from three easy renewal methods:

- Online through NGI's website

- Via the Lookinsure platform (often with better rates)

- By visiting any NGI branch

Regardless of your chosen method, the process remains the same: all you need to do in order to renew your NGI car insurance policy is enter your policy number, make the necessary changes, and pay.

How to Report Claims for NGI Car Insurance?

When accidents happen, you need a smooth claims process to get back on track quickly. NGI car insurance plans provide multiple ways to file a claim, ensuring you can choose the most convenient option.

Filing Options:

- Through NGI's website

- Via the Lookinsure platform

- By visiting NGI offices in person

Simple Claims Process:

- Report the incident within 24 hours

- Provide necessary documentation

- Choose your preferred workshop

- Track your claim status online

- Get regular updates until the resolution

Documents Required to Claim NGI Car Insurance in UAE

Before applying for an NGI car insurance policy, make sure you have these essential documents ready:

- Valid Emirates ID

- UAE driving license

- Vehicle registration card

- Previous insurance policy (for renewals)

- No claims certificate (if applicable)

- Vehicle inspection report (for cars older than 3 years)

National General Insurance is a reliable choice in the UAE insurance market if you prioritize protecting what matters most. Whether you're looking for an NGI car insurance policy or any other coverage, their combination of experience, digital convenience, and comprehensive protection makes them a wise choice. Remember, getting your NGI insurance through Lookinsure simplifies the process and often saves you money!

Frequently Asked Questions

Find quick answers to common questions about National General Insurance (NGI) and how to manage your policies effectively.