Personal Accident Cover in Car Insurance UAE

Flexible installments to pay later with

And

Regulated by the Government of Dubai

Insuring a car is not just about ensuring your policy covers the costs of repairs in the event of an accident. You must also consider the possibility of personal injuries. For this purpose, personal accident insurance cover exists: it acts as your financial safety net when the unexpected occurs.

In this page, we will discuss this option in detail to inform our audience about one of the most crucial add-ons that insurance companies offer. Stay with us to learn about the different types of personal accident insurance coverage, how to get it, and, more importantly, why you might need it.

Why choose Lookinsure for Personal Accident Insurance?

Finding the right insurance policy shouldn't be complicated, and with Lookinsure, it isn't. Here's why thousands of UAE residents trust us with their personal accident insurance coverage:

Excellent Customer Care

No matter what your question or issue is, our experts on the customer care team are always prepared to handle them for you in the fastest way possible.

Easy Online Comparison

With Lookinsure, you can finally avoid the hassle of visiting multiple insurance companies. Our platform lets you compare quotes from different providers with just a few clicks, helping you find the best coverage at the best price.

Flexible Payment Options

Managing expenses can be tricky, so we offer convenient payment plans through Tabby and Tamara. These plans allow you to spread your premium payments into manageable installments without extra charges.

Expert Guidance

If you are unsure which coverage to choose or how to perform a particular procedure, our friendly insurance experts are here 24/7 to help. They'll explain everything simply and help you choose the right personal accident coverage for your needs. You can check out our reviews on Google to understand what we mean when discussing dedicated customer service.

What Is Personal Accident Cover in Car Insurance?

In car insurance personal accident cover is an add-on that provides financial protection to you and your passengers in case of injury or, god forbid, death resulting from a road accident. It ensures that, if the unexpected happens, your family or dependents receive compensation to help with medical expenses or loss of income.

This protection goes beyond regular vehicle repairs and is designed to protect you as a person. Whether you’re driving or sitting in the passenger seat, personal accident insurance can make a crucial difference during difficult times.

Here are some of the key features of this type of coverage:

| Broad Coverage | It covers medical bills, rehabilitation expenses, lost wages due to inability to work, and sometimes even funeral costs |

| No-Fault Protection | This coverage pays out regardless of who caused the accident, making it particularly useful in "no-fault" states or for situations where proving fault is complex |

| Passenger Protection | It often extends to cover injuries sustained by passengers in the insured vehicle |

| Additional Living Expenses | If the injury prevents you from performing daily tasks, the policy may cover non-medical costs, such as childcare or housekeeping |

Why Opt for Car Insurance with Personal Accident Cover in the UAE

Road accidents can happen to anyone, no matter how carefully you drive. Medical costs in the UAE can also be significant, especially after serious injuries. Adding car insurance personal accident cover gives you peace of mind knowing that you and your loved ones are financially protected.

Many comprehensive plans include car insurance personal injury cover for the driver, but not always for passengers. Adding personal accident cover car insurance ensures that everyone in your vehicle is protected, not just the person behind the wheel.

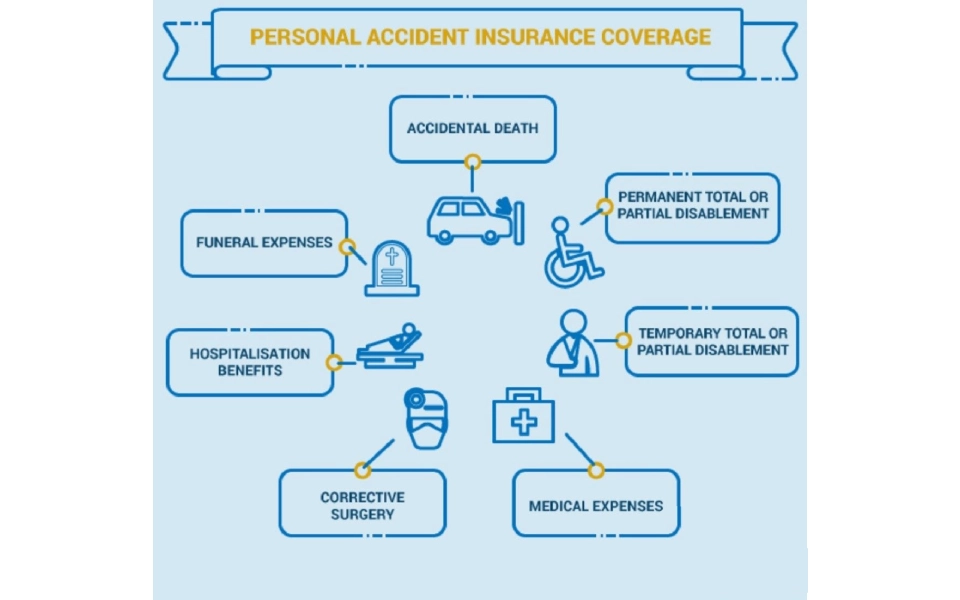

Services Typically Covered under Personal Accident Insurance

What’s included may vary by insurer, but personal accident insurance typically covers:

- Death benefit: A lump-sum payment to the driver or passengers’ family in the event of accidental death.

- Permanent disability: Compensation for total or partial permanent disability caused by a road accident.

- Medical expenses: Reimbursement for treatment and hospitalization following an accident.

- Passenger cover: Optional coverage that protects passengers traveling in the insured vehicle.

Together, these benefits make car insurance personal accident cover a valuable safety net for anyone on the road.

Exclusions & Limitations of Personal Accident Cover

Even though personal accident cover car insurance offers strong protection, there are some exclusions to keep in mind:

- Injuries sustained while driving under the influence of alcohol or drugs.

- Accidents that occur while racing or performing stunts.

- Non-accidental deaths or injuries, such as those from natural causes.

- Driving without a valid license or outside the policy’s geographical area.

- Intentional self-inflicted injuries.

Always read your policy carefully so you understand exactly what your car insurance personal injury cover includes and excludes.

Types of Personal Car Insurance Personal Accident Cover

There are other types of personal accident insurance options than the typical add-on introduced above. These include:

Group Personal Accident Cover Car Insurance

If you run a business with multiple drivers, you can insure them all under one policy using group personal accident cover.

Whether you have a small startup or a large corporation, we can help you find the right coverage to ensure your employees are protected at work and during their commutes.

Stand-Alone Personal Accident Cover

A stand-alone personal accident policy is a type of personal insurance that is not tied to any other policy. Unlike traditional personal accident coverage, which is added to car insurance policies, this coverage is not limited to injuries caused while driving and includes accidents caused in any manner.

Standalone packages offer comprehensive protection that includes:

| 1 | Coverage for accidental death |

| 2 | Permanent disability benefits |

| 3 | Medical expense reimbursement |

| 4 | Daily hospital cash allowance |

| 5 | Emergency medical evacuation |

If you're looking to secure personal accident insurance, consider the flexibility that comes with insurance with Tabby where you can spread your payments and manage your budget more easily, all while protecting yourself with reliable coverage.

Personal Accident Cover for Driver

Personal Accident Cover for Driver is a specialized insurance add-on designed to protect the driver of a vehicle in the event of an accident. It primarily provides financial compensation for death or permanent disability caused by injuries sustained while driving or riding in the insured vehicle.

Here are some of the crucial features of these policies that you might like to know about:

Driver-Specific Coverage:

This coverage applies only to the vehicle's registered driver, ensuring their financial protection in case of an accident.

Compensation for Death or Disability:

This coverage provides financial compensation in the following cases:

- Accidental death

- Permanent total disability (e.g., loss of limbs or eyesight)

- Permanent partial disability (e.g., loss of a finger or hand)

The payout amount is typically pre-determined and outlined in the policy terms.

Medical Expense Reimbursement:

The policy may sometimes cover hospitalization or medical costs incurred up to a specified limit due to the accident.

Affordability:

Personal Accident insurance is generally inexpensive and can be added to an auto insurance policy at a low additional premium.

Documents Required for Personal Accident Cover

Here are the needed documents to get a personal accident insurance:

| 1 | Medical reports |

| 2 | Police report (if applicable) |

| 3 | Identity documents |

| 4 | Any other relevant documentation |

How to Get Cheap Personal Accident Cover as an Add-On

Everyone loves a good deal; we're here to help you save money without compromising protection. Here are some innovative ways to get more affordable personal accident insurance coverage:

| Tip | Description |

|---|---|

| Compare Multiple Quotes | Use our online comparison tool to shop for the best rates from different insurance providers. |

| Bundle Your Coverage | Combining personal accident cover motor insurance with other insurance products often offers attractive discounts. |

| Look for Discounts | Many insurers offer discounts on special days and to specific customers, such as those who choose to pay their premium annually instead of monthly. |

| Review Your Coverage Regularly | Your insurance needs might change over time, so it's worth reviewing your coverage annually to ensure you're not paying for protection you don't need. |

| Adjust Your Deductible | To reduce premium costs, opt for a higher deductible (the amount you pay out of pocket before the insurer pays). Ensure the deductible is affordable if you ever need to make a claim. |

Costs & Premium Impact of Personal Accident Cover in UAE

The cost of car insurance personal accident cover depends on your chosen coverage amount and the number of people insured. On average, it adds only a small amount to your premium, much less than what you’d spend on medical treatment after an accident.

For instance, expanding your car insurance personal injury cover to include passengers or higher compensation limits may slightly increase the premium. Still, most drivers in the UAE find personal accident insurance well worth the extra cost, given the financial security it provides.

How to File a Claim for Personal Accident Cover

Filing an insurance claim is possible online through your insurance provider’s website and in person by visiting one of their offices. All you will need to do in the event of an accident is obtain a police report and document the accident by taking photos.

Moreover, since your claim is for a personal accident, you will also need to get a medical report documenting the injuries. Then, the documents listed below must be submitted to the insurance company:

Personal accident is basically your shield against life's unexpected moments. Whether you're looking for individual coverage, group personal accident coverage for your business, or specialized protection like personal accident car insurance, Lookinsure is here to help you find the perfect solution.

Don't wait for the unexpected to happen. Get your personalized quote today and join thousands of satisfied UAE residents who trust Lookinsure with their protection needs. Remember, with our flexible payment options and expert support, getting the right coverage is easier than ever.