Renault Car Insurance

Flexible installments to pay later with

And

Regulated by the Government of Dubai

Renault cars are among the most popular choices for drivers in the UAE. Owners love them for their comfort and sometimes unique designs. According to a 2021 report, Renault holds 18.6% of the market share for passenger cars in the United Arab Emirates, which means there'll be a great demand for Renault car insurance quotes in Dubai and other emirates. Specific Renault models, such as the Renault Kwid, are well-liked and stand out due to their SUV-inspired design. Renault cars are known for being reliable and innovative in style and structure.

Renault Car Insurance in the UAE

Renault cars are popular in the UAE thanks to their balance of affordability and European design. Whether you drive a compact Renault Symbol or a family-friendly Koleos, having proper coverage is a legal requirement. You can choose between third-party liability for basic protection or full comprehensive insurance for broader coverage.

Many providers offer tailored Renault auto insurance policies that include roadside help, agency repairs, and optional add-ons. Comparing offers ensures you get the right balance between coverage and price.

Types of Renault Car Insurance Plans in UAE

As mentioned, what makes Lookinsure stand out is the wide range of options available to you as a Renault owner. Some vehicle owners are only satisfied with comprehensive and complete insurance plans, while others may prefer a more basic vehicle insurance policy. Lookinsure has something for everyone.

Comprehensive Renault Insurance

As the name suggests, comprehensive motor insurance is an excellent Renault insurance option that provides complete protection for your car. This option covers you in an accident, theft, or even natural disaster. It's a wise investment for owners, as it provides peace of mind knowing that this comprehensive coverage protects you no matter what potential risks exist for a vehicle.

This type of coverage protects your Renault car and damages to other individuals or their property. If you are thinking of leveling up your protection, you can always change to a comprehensive policy when applying for a Renault car insurance renewal.

Third-Party Renault Insurance

3rd party insurance is an excellent choice for those needing a more budget-friendly plan. For example, if you own a Renault Clio and are looking for a more basic Renault insurance plan, this coverage might be the right choice. It's also important to note that third-party coverage is mandatory by law. This type of coverage financially supports you in the event of damage to another individual or property. It's a practical and affordable plan to select.

Renault Gap Insurance

Adding Renault gap insurance to your plan is especially important if you're a new car owner. Renault gap insurance covers the difference between the value of your Renault vehicle and the amount you still owe. Covering the depreciation gap is essential, and Lookinsure ensures that this gap will be financially covered.

Add-ons for Renault Cars

Speaking of flexibility and tailored policies, Lookinsure also offers additional options you can add to your package for an enhanced experience. Here are some of the add-ons available which can also be added to your policy when buying a Renault car insurance renewal:

Add-On | Description |

Provides support in the event of a breakdown. Lookinsure will assist if you're stranded on the road. | |

Offers financial support in case of injury or death of the driver. | |

Accessory Coverage | Covers any accessories or additions installed in your Renault that may be damaged or stolen. |

Rental Car Coverage | Covers the cost of a rental car while your vehicle is being repaired due to an accident. |

Covers the repair or replacement of the windscreen without affecting your no-claims bonus. | |

Personal Effects Coverage | Protects personal belongings inside your car against theft or damage. |

What are Covered and Not Covered Under Renault Car Insurance?

Renault auto insurance in the UAE is designed to protect both drivers and their vehicles from common risks on the road. What’s included depends on whether you pick comprehensive or liability-only coverage.

What’s Covered

- Third-party liability for injury, death, or property damage.

- Damage to your Renault in accidents if you have comprehensive insurance.

- Theft, fire, and vandalism under comprehensive policies.

- Natural disasters such as floods or storms.

- Personal accident benefits for the driver and sometimes passengers.

- Roadside assistance or towing (if part of the policy or as an add-on).

What’s Not Covered

- Damage from reckless driving, driving under the influence, or racing.

- Mechanical or electrical breakdowns from normal wear and tear.

- Use of the Renault outside of declared purpose (e.g., commercial use if insured privately).

- Overloading or unsafe modifications not approved by the insurer.

- Losses caused by war, nuclear risks, or other excluded extreme events.

- Cargo or personal belongings inside the car unless specifically covered.

Renault Car Insurance Price in UAE

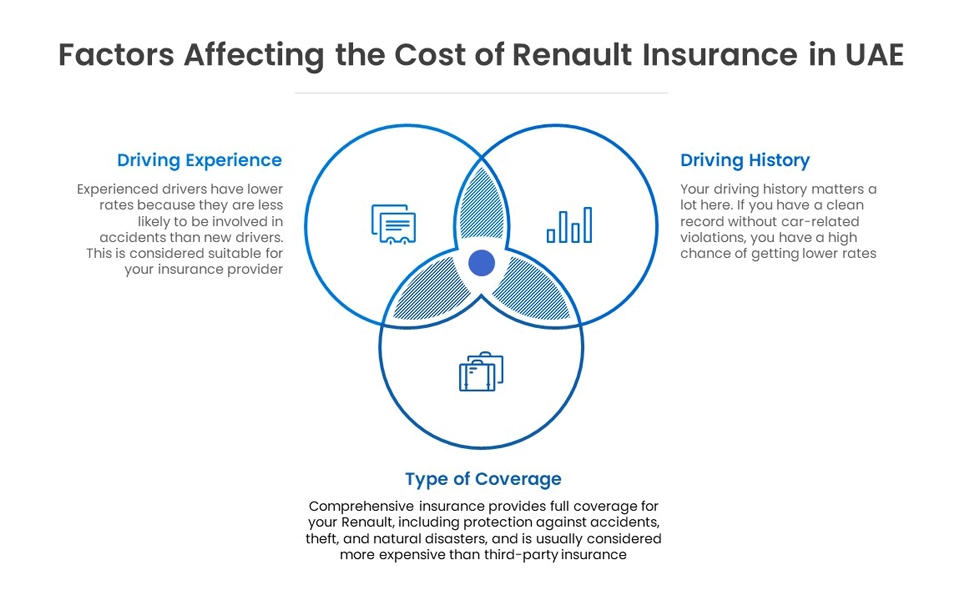

The cost of Renault insurance depends on several factors. One of the most significant factors is the model of your vehicle. For example, a Renault Kiger's insurance price differs from a Renault Triber's. Other factors that influence the cost include your driving experience, history, and the type of coverage you select (comprehensive or third-party). Here are the average insurance costs for popular Renault models in the United Arab Emirates:

Renault Model | Insurance Cost (Annual) |

Kwid | AED 1,200 to AED 1,800 |

Kiger | AED 1,500 to AED 2,200 |

Triber | AED 1,800 to AED 2,500 |

Duster | AED 2,000 to AED 2,800 |

Captur | AED 2,200 to AED 3,000 |

Zoe | AED 1,800 to AED 2,500 |

Clio | AED 1,500 to AED 2,500 |

Factors Affecting Renault Car Insurance Preimuims

Cheap Renault Car Insurance – How to Save More

if you want to save some money on your policy or Renault car insurance renewal here are some effective ways you can go about it:

- Maintain a no-claims record (NCB): Driving without accidents helps lower your premium over time.

- Compare quotes online: Platforms like Lookinsure make it simple to check multiple policies in minutes.

- Choose a higher deductible: If you are confident in your driving record, this lowers the yearly premium.

- Consider third-party liability policies: For older Renault cars or if you don’t mind covering your own minor damages, TPL is cheaper.

- Skip unnecessary add-ons: Only include extras that are genuinely useful to you.

- Keep your driving record clean: Fewer violations and accidents mean lower risk and lower costs.

How to Buy Renault Car Insurance Online with Lookinsure

Now, let's discuss the steps you must follow to buy your Renault car insurance plans with Lookinsure. The process is simple and user-friendly. The online process for purchasing or renewing your insurance plan is designed to be easy and convenient, saving you both time and effort.

- Get a Quote on Lookinsure

Visit Lookinsure's website and enter the details of your vehicle. Then, you can view the available options and receive a personalized quote based on your specific needs. - Compare Plans and Choose

Compare plans to find the one that best suits your needs. Then, select your ideal coverage type and any additional options. This ensures that you get the best deal for the required coverage. - Pay Securely

After choosing your coverage type, you can securely complete your payment on the website. Once your purchase is complete, you’ll receive your policy via email. The process is quick and convenient, allowing you to enjoy your day with peace of mind.

Renault Car Insurance Online Renewals

For Renault car insurance renewal, the steps are even easier. For example, if you have a Renault Kwid and you're looking for a renewal, simply log into your Lookinsure account, check the Renault Kwid insurance renewal price, and select the renewal option. That's it! You’re all set for another year of coverage.

Here's a list of the exact steps you should take when buying Renault car insurance renewal through our website:

- Visit the Lookinsure website and go to the renewals section.

- Enter your Renault’s details such as plate number, registration, and policy number.

- Upload required documents like your Emirates ID, driving license, and Mulkiya (vehicle registration).

- Compare available renewal offers from different insurers.

- Select the policy you prefer and review the coverage details.

- Make payment online using your preferred method.

- Receive your new policy instantly by email or download it directly from the site.

Documents Required for Renault Insurance

Whether you are buying a new policy or Renault car insurance renewal, you will be needing to submit these documents:

- Your Emirates ID

- A valid UAE driving license

- A copy of your vehicle registration

- A vehicle inspection report (typically required for used cars)

- Your bank account details (for payment)

These documents are essential for ensuring that your policy is processed correctly. Always have them ready before starting the insurance process.

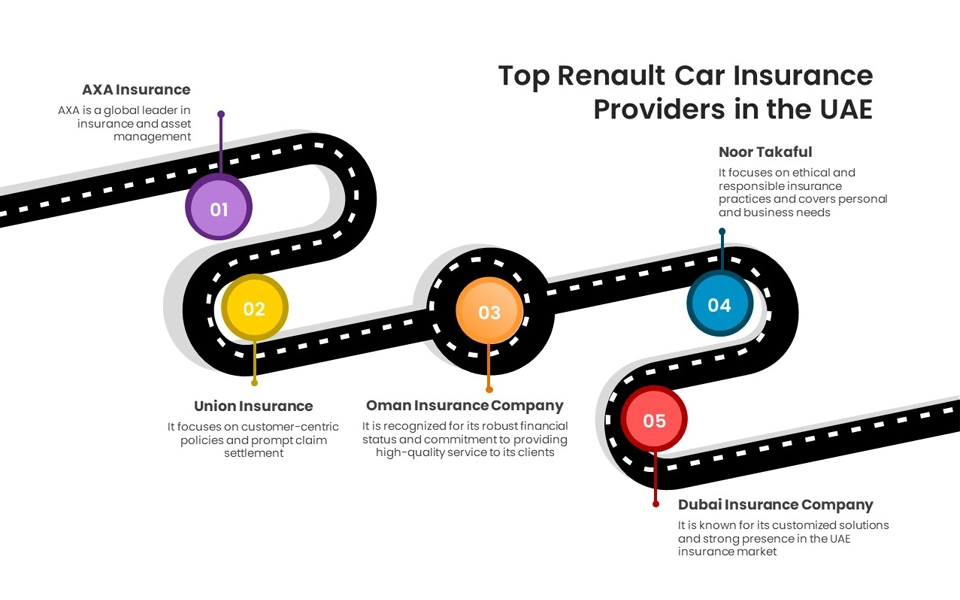

Best Renault Car Insurance Providers in the UAE

How to Make a Renault Car Insurance Claim?

The process of claiming your Renault auto insurance policy is straightforward. Here are the steps to follow:

- Report the Incident

Immediately inform your insurance provider after an accident occurs with your car. This ensures that your claim is processed as soon as possible. - Provide Documents

You must provide certain documents, including your car registration and accident proof, such as photos or videos. The more information you can provide, the quicker your claim will be processed. - Claim Approval

Wait for the experts to assess the damage to your car. Once the evaluation is complete, you will receive approval for your claim. After approval, your insurance provider will arrange the necessary repairs or settlement.

Finding and purchasing a suitable vehicle is a significant decision in a person’s life, but choosing the right insurance plan for that car is even more critical. Lookinsure is here to provide the best support you can expect from your insurance provider. With affordable and personalized Renault insurance plans, you can hit the road feeling protected and supported. Lookinsure ensures that you will feel safe driving your beautiful Renault car, knowing that you're covered in the event of an accident or other unfortunate circumstances.