يزداد عدد الأشخاص الذين يستخدمون سيارات الأجرة كوسيلة تنقل في الإمارات عامًا بعد عام. على سبيل المثال في دبي، أظهر تقرير عام 2023 أن هناك ما يقارب 46 مليون رحلة بسيارة أجرة في دبي وحدها، كما قُدِّر عدد سيارات الأجرة في المدينة بحوالي 12,000 سيارة. وكما نرى، فإن سيارات الأجرة منتشرة وشائعة بين المواطنين والمقيمين في الإمارات، ويرجع ذلك إلى توافرها على مدار الساعة واعتماد الكثيرين عليها كوسيلة آمنة وموثوقة.

بصفتك مالك سيارة أجرة، يجب أن تعلم أن الحصول على تأمين سيارات الاجرة في الامارات هو متطلب قانوني لا غنى عنه. وأهم خطوة بالنسبة لك هي اختيار مزود تأمين موثوق وسهل التعامل. وهنا يأتي دور لوکینشور الذي يساعدك في رحلة البحث عن أفضل خطة تأمين مناسبة. لوکینشور يعتبر الخيار الأكثر موثوقية عند شراء تأمين سيارة أجرة أونلاين، حيث يوفر لك مجموعة واسعة من الخطط لأي طراز سيارة أجرة سواء كانت تويوتا كامري أو كيا أوبتيما، مع راحة البال والدعم الكامل.

عند التفكير في شراء تأمين لسيارة الأجرة ستلاحظ أن هذه السياسات قد تختلف قليلًا عن التأمين العادي، والسبب منطقي. سيارات الأجرة بطبيعتها تعمل لفترات أطول على الطريق، وبديهياً: كلما زاد الوقت الذي تقضيه على الطريق، زادت احتمالية الحوادث، وهو ما يؤثر بشكل مباشر على تكلفة تأمين سيارة الأجرة في الامارات. ولهذا السبب تختلف قيمة الأقساط والتغطيات مقارنة بالسيارات الخاصة. في الفقرات التالية ستتعرف على جميع التفاصيل المتعلقة بتأمين سيارات الأجرة، بدايةً من كم سعر تأمين سيارات الأجرة وحتى كيفية الحصول على عرض سعر فوري أونلاين بسهولة.

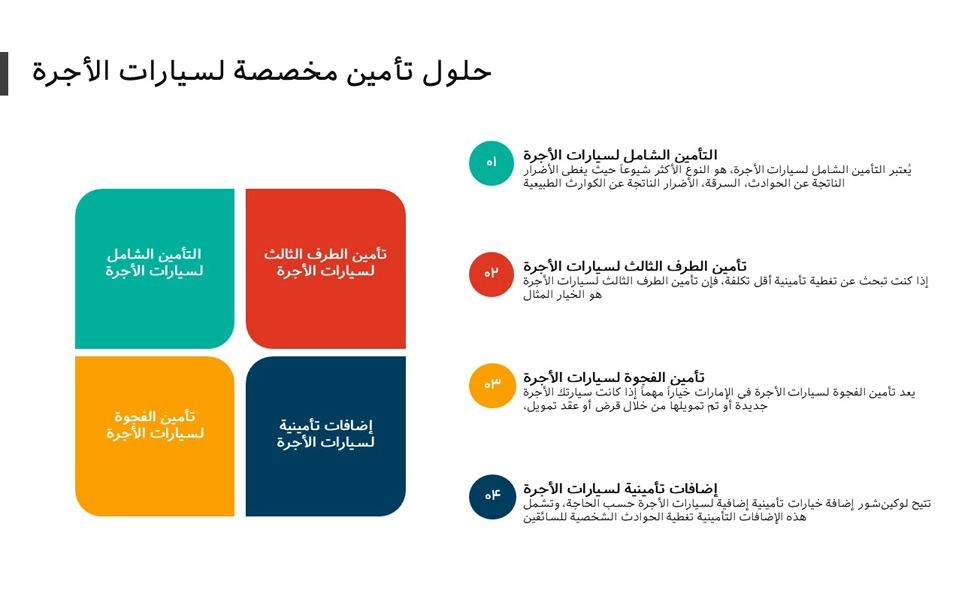

أنواع خطط تأمين سيارات الأجرة في الامارات

في القسم السابق، ذكرنا أن المرونة والأسعار المناسبة هما ميزتان أساسيتان مع لوکینشور. دعونا نوضح الآن نطاق التغطيات التي يوفرها لك في مجال تأمين سيارات الاجرة في الامارات.

التأمين الشامل لسيارات الأجرة

كما يوحي الاسم، يمنحك هذا النوع حماية واسعة رغم أن تكلفة تأمين سيارة الأجرة في الامارات قد تكون أعلى هنا. فهو مفيد في حالات متعددة قد تتعرض لها سيارتك الأجرة مثل الحوادث المرورية، السرقة، الحريق أو الكوارث الطبيعية. إذا كنت تبحث عن حماية كاملة لسيارتك أثناء العمل على الطرق، فهذا الخيار هو ما تقترحه لوکینشور. ورغم أن تكلفة هذا النوع قد تكون أعلى من غيره، إلا أن العديد من أصحاب سيارات الأجرة يعتبرونه استثمارًا آمنًا بدلًا من مواجهة خسائر كبيرة.

التأمين ضد الغير لسيارات الأجرة

يُفضّل الكثير من عملائنا خيار التأمين ضد الغير نظرًا لعمليته وسعره المناسب. هذا النوع يضمن لك التغطية الأساسية الإلزامية قانونيًا ويعتبر نوعا ما أقل في تكلفة تأمين سيارة الأجرة في الامارات. بمعنى آخر، يغطي مسؤولياتك تجاه الطرف الثالث سواء كان أشخاصًا أو ممتلكات في حال وقوع حادث. نوصي بهذا النوع لأصحاب التاكسي الذين يهتمون بالحصول على تغطية قانونية مع الحفاظ على انخفاض تكلفة أقساطهم. لذلك إذا كنت تسأل كم سعر تأمين سيارات الأجرة بأقل ميزانية، فغالبًا سيكون هذا هو الحل المناسب.

تأمين الفجوة

لفهم هذا النوع بشكل أوضح، لنأخذ مثالًا عمليًا: إذا قمت بشراء سيارة أجرة مثل تويوتا كامري بقيمة 100,000 درهم، ولا يزال عليك 70,000 درهم من القرض، وتعرضت السيارة لحادث نتج عنه خسارة كلية. في هذه الحالة، قد تدفع لك شركة التأمين العادية 50,000 درهم، بينما يبقى عليك من القرض 70,000 درهم، أي فجوة مقدارها 20,000 درهم.

بدون وجود تأمين الفجوة ستضطر إلى دفع هذا المبلغ من جيبك، لكن مع هذه التغطية لن تقلق بشأن هذه الخسارة.

الإضافات على تأمين سيارات الأجرة

إذا كنت تبحث عن حماية أكبر وراحة بال إضافية، فهناك العديد من الإضافات التي تجعل تأمينك أكثر تخصيصًا. وهذه واحدة من أبرز مزايا لوکینشور، حيث يقدم لك خيارات إضافية لتعزيز تغطيتك، مثل:

المساعدة على الطريق: دعم فوري إذا تعطلت سيارتك الأجرة أثناء العمل.

تغطية المواد الاستهلاكية: تغطي تكاليف الأجزاء المستهلكة عند إصلاح سيارتك.

حماية عدم المطالبة: تحافظ على امتيازاتك حتى بعد حادث بسيط.

تغطية المحرك: تعويض في حالة حدوث مشكلة ميكانيكية في المحرك.

تغطية الأعطال: دعم في حال توقفت السيارة بسبب عطل ميكانيكي أو كهربائي.

تغطية استبدال المفاتيح: في حال فقدت مفاتيح سيارتك الأجرة.

ما يشمله وما لا يشمله تأمين سيارات الأجرة

عند شراءتأمين سيارات الأجرة في الإمارات، من المهم أن تفهم بالضبط ما الذي يشمله التأمين وما هي الاستثناءات التي قد تواجهك. عادةً ما تكون وثائق سيارات الأجرة أشمل من التأمين العادي بسبب الاستخدام التجاري، لكنها في نفس الوقت تحتوي على حدود يجب معرفتها.

ما يشمله التأمين

المسؤولية تجاه الطرف الثالث عن الإصابات والأضرار بالممتلكات

تغطية مسؤولية الركاب

النفقات الطبية للسائق والركاب

أضرار سيارتك الأجرة نتيجة الحوادث

الحماية ضد الحريق والسرقة

الكوارث الطبيعية مثل الفيضانات والعواصف

التغطية ضد الحوادث الشخصية للسائق

ما لا يشمله التأمين

الأضرار أثناء القيادة بدون رخصة سارية

الحوادث تحت تأثير الكحول أو المخدرات

التلف الطبيعي الناتج عن الاستهلاك

الأعطال الميكانيكية أو الكهربائية

استخدام سيارة الأجرة خارج النطاق الجغرافي المتفق عليه

التعديلات غير المصرّح بها للمركبة

كم سعر تأمين سيارات الأجرة في الإمارات؟

عند التفكير في تكلفة تأمين سيارة الأجرة في الإمارات، ستجد أن هناك عوامل متعددة تحدد السعر النهائي. أهم هذه العوامل:

1. طراز السيارة

كل موديل له تسعيرة مختلفة. سواء كنت تبحث عن تأمين سيارات أجرة للاستخدام التجاري أو تأمين سيارات أجرة خاصة (Private Hire)، فإن الحصول على عروض أسعار تأمين يساعدك على مقارنة الأسعار بشكل أدق.

2. نوع التغطية

الخيار الشامل يكون أعلى سعرًا، بينما خيار الطرف الثالث أكثر توفيرًا. أيضًا، الإضافات الاختيارية على وثيقتك ستؤثر على السعر النهائي.

3. العوامل الشخصية

تشمل سجل القيادة، عدد سنوات الخبرة، وسجلك السابق في المطالبات، وجميعها تؤثر على تكلفة تأمين سيارات الأجرة في الإمارات.

| الموديل | خيار شامل | خيار طرف ثالث |

|---|---|---|

| تويوتا كامري | ابتداءً من 1,706.25 درهم/سنة | ابتداءً من 630 درهم/سنة |

| هيونداي سوناتا | ابتداءً من 1,680 درهم/سنة | ابتداءً من 630 درهم/سنة |

العوامل المؤثرة في تكلفة التأمين

بما أن سيارات الأجرة تقضي وقتًا أطول على الطرق وتحمل ركابًا باستمرار، يعتبرها مزودو التأمين أكثر عرضة للمخاطر. لذلك يتم حساب كم سعر تأمين سيارات الأجرة بناءً على:

عمر وخبرة السائق

سجل المطالبات السابقة

نوع التغطية المختارة (شامل أو طرف ثالث)

المدينة التي تعمل بها سيارة الأجرة

نوع السيارة وموديلها

كيف تحصل على تأمين سيارات الأجرة بسعر أرخص؟

يمكنك تقليل تكلفة تأمين سيارة الأجرة في الإمارات عبر بعض الاستراتيجيات:

الاستفادة من خصم عدم المطالبة (NCB) عند تجديد الوثيقة

المقارنة بين خطط التأمين عبر الإنترنت من خلال منصات مثل لوکینشور

اختيار نسبة تحمل أعلى لخفض القسط السنوي

الاكتفاء بخيار المسؤولية تجاه الغير (TPL) إذا كنت تبحث عن أرخص سعر

خطوات شراء تأمين سيارات الأجرة أونلاين عبر لوکینشور

زيارة موقع لوکینشور واختيار قسم تأمين سيارات الأجرة.

إدخال بيانات السيارة ونوع التغطية المطلوبة.

مقارنة عروض الأسعار واختيار الأنسب من حيث تكلفة تأمين سيارة الأجرة في الامارات.

الدفع أونلاين واستلام الوثيقة عبر البريد الإلكتروني.

تجديد تأمين سيارات الأجرة أونلاين

الدخول إلى حسابك على موقع لوکینشور.

مراجعة وثيقتك السابقة وتحديث البيانات إذا لزم الأمر.

اختيار الوثيقة المناسبة وإتمام الدفع عبر منصة آمنة.

استلام تأكيد التجديد بشكل فوري عبر البريد الإلكتروني.

أفضل شركات تأمين سيارات الأجرة في الإمارات

تعمل لوکینشور مع أبرز شركات تأمين سيارات الأجرة في الإمارات لتوفير أفضل الخيارات للراغبين في شراء التأمين أونلاين. إليك قائمة بأشهر الشركات:

| الشركة | نبذة عن الشركة |

|---|---|

| شركة أورينت للتأمين | تُعد من الشركات الرائدة في الإمارات، حيث تقدم حلول تأمين شاملة وتركز على رضا العملاء من خلال منتجات متنوعة تناسب مختلف الاحتياجات. |

| شركة الصقر للتأمين | تأسست عام 1979 وتتميز بالموثوقية والالتزام بالجودة، وتوفر حلول تأمينية مبتكرة بدعم فريق محترف لخدمة العملاء. |

| شركة سكون للتأمين | تعتمد على نهج رقمي لتبسيط تجربة التأمين، ما يجعل شراء وإدارة التأمين أسهل وأكثر كفاءة. |

| شركة سلامة للتأمين | رائدة في مجال التأمين التكافلي، حيث تمزج بين القيم التقليدية والمتطلبات العصرية لتقديم حلول تأمينية مميزة. |

المستندات المطلوبة لتأمين سيارات الأجرة

للحصول على تأمين سيارات الأجرة في الإمارات، ستحتاج إلى المستندات التالية:

رخصة القيادة

ملكية السيارة (Mulkiya) أو نسخة من بطاقة تسجيل سيارة الأجرة

بطاقة الهوية الإماراتية

(في بعض الحالات قد يُطلب شهادة خلو من السوابق من الشرطة)

كيف تقدم مطالبة تأمين سيارة أجرة؟

شراء التأمين يهدف في الأساس لحمايتك من دفع تكاليف الأضرار بشكل كامل سواء لسيارتك أو للغير. لذلك، تقديم المطالبة (Claim) يعد خطوة أساسية لضمان حقوقك.

عند تقديم مطالبة تأمين سيارات الأجرة في الإمارات، يجب الانتباه للتفاصيل الدقيقة، حيث أن أي خطأ صغير قد يؤدي إلى تأخير التعويض أو حتى إلغاء المطالبة.

الخطوات الأساسية لتقديم مطالبة:

إبلاغ شركة التأمين فور وقوع الحادث.

تقديم تقرير الشرطة إذا كان مطلوبًا.

إرفاق المستندات مثل رخصة القيادة وملكية السيارة.

متابعة الطلب عبر المنصة أو مركز خدمة العملاء.

الأسئلة الشائعة

لتقليل تكلفة تأمين سيارة الأجرة في الإمارات، يمكنك: مقارنة الأسعار عبر الإنترنت. الحفاظ على سجل قيادة نظيف للحصول على خصم عدم وجود مطالبات (NCB). اختيار نسبة تحمل (Deductible) أعلى. اختيار نوع التغطية الذي يناسب احتياجاتك وميزانيتك.