الحصول على تأمين الشاحنات في الإمارات أمر أساسي لا غنى عنه. السبب الأكثر وضوحًا هو الالتزام القانوني، حيث إن قيادة شاحنة بدون تأمين يعتبر مخالفًا للقانون ويعرضك للغرامات والعقوبات. لكن بجانب ذلك، فإن التأمين قرار مالي حكيم، لأن الشاحنات عادةً ما تكون استثمارات مرتفعة الثمن، كما أن إصلاحها مكلف جدًا. بالإضافة إلى ذلك، فإنها أكثر عرضة للأضرار مقارنة بالسيارات الأخرى. لذلك، من الضروري الحصول على تأمين يحمي شاحنتك ويوفر لك راحة البال.

ما الذي يجب مراعاته عند شراء تأمين الشاحنات أونلاين؟

عند الحصول على تأمين الشاحنات عبر الإنترنت، هناك عوامل متعددة يجب النظر إليها. أهمها أن تكون وثيقة التأمين متوافقة مع احتياجاتك وأولوياتك وحالة الشاحنة نفسها. معرفة هذه العوامل يساعدك على اتخاذ قرار أفضل ويضمن لك الاستفادة من ارخص تامين شاحنات مناسب مع الحفاظ على جودة التغطية التأمينية.

تأمين الشاحنات في الإمارات

تتعاون منصة لوکینشور مع أفضل شركات التأمين على السيارات في الإمارات لتقديم ارخص تامين شاحنات، ووثائق موثوقة للعملاء. الحل الأمثل هو الحصول على خطة تأمينية مخصصة تناسب طبيعة نشاطك التجاري.

الحصول على عروض أسعار خاصة لتأمين الشاحنات التجارية يحتاج إلى نهج شخصي أكثر. عند اختيار خطة تأمين لشاحنات عملك، عليك مراعاة عدة جوانب مثل احتياجاتك، عوامل المخاطر الخاصة بالشركة، المتطلبات، وأخيرًا الميزانية المتاحة.

هذا النوع من التأمين يوفر حماية واسعة بفضل التغطية المخصصة التي تساعدك على تجنب أكبر قدر ممكن من المخاطر. سواء كنت تملك شاحنة أو سيارة خاصة، فإن امتلاك التغطية المناسبة أمر ضروري لحمايتك على الطريق.

إذا كنت تبحث عن تأمين سيارات أو شاحنات في دبي، يمكنك مقارنة العروض بسهولة والعثور على البوليصة التي تناسبك. كل ما عليك فعله هو إدخال بياناتك لاكتشاف خيارات شاملة وبأسعار تنافسية.

العثور على التغطية التأمينية المناسبة أصبح أسهل عندما تتمكن من مقارنة عدة خطط في مكان واحد. عبر خدمة مقارنة تأمين السيارات في الإمارات، يمكنك مراجعة الوثائق المختلفة بسرعة واختيار الأنسب لاحتياجاتك. ابدأ المقارنة الآن للحصول على أكثر التأمينات ملاءمةً وبتكلفة معقولة.

أنواع خطط تأمين الشاحنات في الإمارات

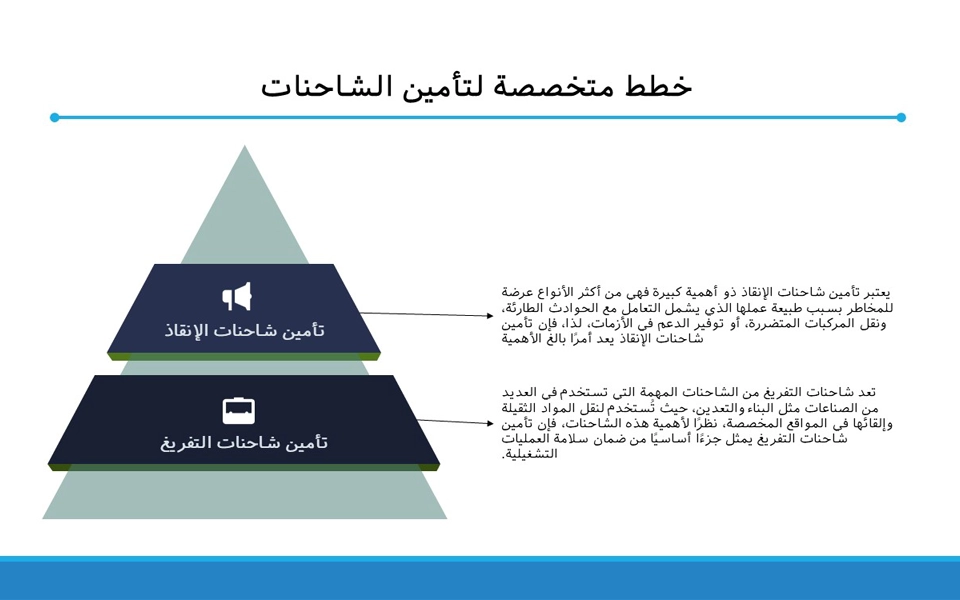

تشمل خطط تأمين الشاحنات المتخصصة وثائق مصممة لحماية أنواع محددة من المركبات التجارية، خصوصًا تلك المستخدمة في عمليات معينة. وتتميز هذه الخطط بأنها توفر حلولًا مخصصة وتغطية شاملة تأخذ في الاعتبار المخاطر والاحتياجات المختلفة للشاحنات التجارية. أبرز أنواع تأمين الشاحنات التجارية في الإمارات:

تأمين شاحنات السحب

يُعرف أيضًا بتأمين مشغلي السحب، وهو خطة تأمين شاحنات متخصصة تحمي شركات السحب من الخسائر أو الأضرار المحتملة.

يهدف هذا النوع من أسعار تأمين الشاحنات إلى توفير حماية للشركات التي تستخدم مركبات لاسترجاع السيارات المعطلة أو المتضررة أو حتى المخالفة لقوانين الوقوف، بما في ذلك شاحنات السحب أو شاحنات الأعطال. وبسبب أن شاحنات السحب تواجه مخاطر أكبر من معظم أنواع المركبات الأخرى، يصبح من الضروري أن تحصل الشركات على تأمين مناسب يغطي هذه المخاطر.

تأمين شاحنات التفريغ

يعد تأمين شاحنات التفريغ من أكثر خطط التأمين التجاري المتخصصة شيوعًا وضرورة. وهو مصمم لتوفير تغطية مخصصة للشاحنات المستخدمة في نقل وتفريغ المواد مثل الرمال أو مخلفات البناء.

نظرًا لكثرة استخدامها خاصة في مواقع الإنشاءات، تواجه هذه الشاحنات مخاطر وتهديدات أكبر مقارنة بغيرها من المركبات. لذلك، من المهم أن تستثمر الشركات في ارخص تامين شاحنات موثوق ومناسب يغطي المخاطر التي قد تهدد السائق، الممتلكات، والبضائع، والتي قد تسبب خسائر مالية كبيرة.

تغطيات لجميع أنواع الشاحنات

توفر لوکینشور مستويات مختلفة من تأمين الشاحنات لتناسب جميع الأنواع. وبما أن الشاحنات تختلف من حيث طبيعة التشغيل والاستخدام والإمكانيات، فقد تم تقسيمها إلى عدة فئات لتسهيل عملية التأمين واختيار الأنسب.

أنواع التأمين على الشاحنات

تأمين الشاحنات عالية المخاطر

الوصف: يوفر الحماية لشركات النقل التي تواجه مخاطر أكبر بسبب عادات القيادة، نوع الحمولة، أو طبيعة الموقع.

مخصص لـ: شركات النقل ذات سجل الحوادث المرتفع، الشركات الجديدة، أو التي تنقل مواد خطرة.

المزايا الرئيسية: تغطية مخصصة تتعامل مع المخاطر العالية بدلاً من الوثائق القياسية غير المناسبة في هذه الحالات.

تأمين شاحنات التفريغ

الوصف: تأمين متخصص لشاحنات التفريغ المستخدمة في التعدين، البناء، والأنشطة المشابهة.

مخصص لـ: أصحاب ومشغلي شاحنات التفريغ التي تنقل مواد البناء.

المزايا الرئيسية: يوفر تغطية مصممة خصيصًا للمخاطر المرتبطة باستخدام هذه الشاحنات الثقيلة.

تأمين الشاحنات نصف المقطورة الرخيص

الوصف: مصمم لحماية الشاحنات نصف المقطورة المستخدمة في نقل الحمولات الكبيرة لمسافات طويلة.

مخصص لـ: مشغلي الشاحنات نصف المقطورة الذين يبحثون عن ارخص تامين شاحنات مع تغطية أساسية.

المزايا الرئيسية: يقدم تغطية أساسية بتكاليف معقولة، ومناسب لمخاطر النقل لمسافات طويلة.

ما الذي يشمله وما لا يشمله تأمين الشاحنات؟

تهدف وثيقة تأمين الشاحنات التجارية أو الثقيلة إلى حماية مالكي الشاحنات من المخاطر المالية المرتبطة بالقيادة والتشغيل والصيانة. ويختلف نطاق التغطية باختلاف نوع الوثيقة، سواء كانت شاملة أو ضد الغير فقط (TPL). فيما يلي أهم التغطيات والاستثناءات:

ما يشمله التأمين

الأضرار التي تلحق بالشاحنة المؤمن عليها في الحوادث (مثل التصادم أو الانقلاب) ضمن الوثائق الشاملة.

الخسائر أو الأضرار الناتجة عن السرقة، الحريق، التخريب، أو الكوارث الطبيعية (مثل الفيضانات والعواصف) ضمن التغطية الشاملة.

المسؤولية تجاه الغير: الإصابات الجسدية أو الوفاة، والأضرار التي تلحق بممتلكات الآخرين بسبب الشاحنة المؤمن عليها.

تغطية الحوادث الشخصية للسائق (وأحيانًا الركاب) في حالة الإصابة أو الوفاة.

البضائع أثناء النقل (في حال إضافة تغطية Goods in Transit) – تعويض عن الأضرار أو الفقدان خلال عملية النقل.

الخدمات الطارئة مثل المساعدة على الطريق أو السحب في حال حدوث عطل أو حادث.

الإصلاحات لدى الوكيل أو ورش الإصلاح المعتمدة (حسب شروط الوثيقة).

ما لا يشمله التأمين

الأضرار الناتجة عن استخدام الشاحنة خارج الغرض المصرح به (مثل الاستخدام خارج الطرق إذا لم تكن مؤمّنة لذلك، أو استخدام مختلف عما هو مذكور في الوثيقة).

التحميل الزائد بما يتجاوز السعة المقررة.

التلفيات الناتجة عن التآكل الطبيعي أو الأعطال الميكانيكية والكهربائية غير الناتجة عن خطر مؤمَّن عليه.

الأضرار الناتجة عن إهمال السائق، القيادة المتهورة، أو القيادة تحت تأثير المواد المخدرة أو الكحول.

الأضرار الناتجة عن الحروب أو الإشعاعات النووية أو أحداث استثنائية مشابهة ما لم تُذكر صراحة في الوثيقة.

خسارة البضائع إذا لم يتم شراء تغطية Goods in Transit ضمن الوثيقة.

الأضرار أو الخسائر الناتجة عن تعديلات غير مرخصة أو استخدام قطع غيار غير معتمدة.

أسعار تأمين الشاحنات في الإمارات

تختلف أسعار تأمين الشاحنات التجارية أو الثقيلة في الإمارات حسب نوع الشاحنة، نوع التغطية، وعوامل المخاطر. وفيما يلي تقديرات تقريبية:

الشاحنات الخفيفة أو الفانات (حتى 3 أطنان) مع تأمين ضد الغير فقط (TPL): حوالي 1,550 درهم إماراتي سنويًا (الحد الأدنى حسب اللوائح).

الشاحنات الثقيلة (أكثر من 3 أطنان) مع تأمين ضد الغير فقط (TPL): حوالي 2,000 درهم إماراتي سنويًا (الحد الأدنى حسب جدول التعرفة).

الشاحنات التجارية مع التأمين الشامل: تتراوح الأسعار غالبًا بين 3,000 إلى 10,000+ درهم إماراتي سنويًا، حسب قيمة الشاحنة، عمرها، سجل القيادة، وطبيعة استخدامها.

من المهم أن تتذكر أن هذه مجرد تقديرات. قد تكون أسعار وثائق ارخص تامين شاحنات أقل أو أعلى حسب شركة التأمين والعوامل الخاصة بكل حالة. لذلك يُنصح دائمًا بمقارنة عدة عروض لتأمين الشاحنات عبر الإنترنت قبل اتخاذ القرار النهائي.

العوامل المؤثرة على أسعار تأمين الشاحنات

هناك عدة عوامل تحدد قيمة القسط التأميني الذي تدفعه مقابل وثائق تأمين الشاحنات التجارية أو الثقيلة في الإمارات. من أبرزها:

وزن وحجم وقيمة الشاحنة: كلما كانت الشاحنة أثقل أو أحدث، ارتفعت تكلفة التأمين. كما أن القيمة العالية تعني تكاليف أكبر للإصلاح أو الاستبدال.

نوع التغطية التأمينية: سواء تأمين شامل، ضد الغير (TPL)، أو إضافة تغطيات إضافية مثل البضائع أثناء النقل أو الحوادث الشخصية.

طبيعة الاستخدام والتعرض للمخاطر: مثل نقل لمسافات طويلة، العمل في مناطق خطرة أو مواقع إنشائية، أو التشغيل وسط زحام مروري كثيف.

ملف السائق: العمر، سجل القيادة، مدة الرخصة، وسوابق الحوادث أو المخالفات.

قيمة التحمل (Deductible): كلما ارتفعت نسبة التحمل التي تختارها، انخفضت الأقساط السنوية.

الموقع ومسار التشغيل: المناطق ذات معدلات حوادث أو سرقة عالية تزيد من التكلفة.

عدد الكيلومترات والاستخدام: كلما زاد الاستخدام والمسافات، زادت المخاطر.

ميزات السلامة والأمان: أنظمة الإنذار، أجهزة التتبع، الصيانة الدورية، تقلل من التكلفة.

حجم الأسطول: الشركات التي تؤمّن عدة شاحنات قد تستفيد من خصومات على مستوى الأسطول.

ارخص تامين شاحنات – كيف توفر أكثر؟

إذا كنت تبحث عن ارخص تامين شاحنات في الإمارات، إليك بعض الاستراتيجيات لتقليل التكلفة:

مكافأة عدم المطالبة (No-Claims Bonus): إذا كان لديك سجل خالٍ من المطالبات، قد تحصل على خصومات كبيرة من شركات التأمين.

المقارنة أونلاين: عبر منصات مثل لوکینشور يمكنك مقارنة الأسعار والعثور على عروض أرخص لنفس التغطية.

اختيار تحمل أعلى: إذا كنت قادرًا على دفع مبلغ أكبر عند وقوع حادث، ستقل قيمة القسط السنوي. مناسب للشاحنات قليلة الاستخدام.

الاعتماد على وثائق ضد الغير عند الحاجة: إذا كانت الشاحنة مستخدمة لمسافات قصيرة أو داخل مواقع عمل فقط، قد يكون التأمين ضد الغير خيارًا أرخص.

تقليل الإضافات: لا تضف مزايا إضافية إلا إذا كانت ضرورية مثل "قطع غيار جديدة فقط" أو "سيارة بديلة".

الحفاظ على سجل قيادة جيد: تدريب السائقين، الالتزام بالقوانين، واستخدام ورش معتمدة يساعد في تقليل التكلفة.

تجميع الوثائق: إذا كان لديك أكثر من شاحنة، فالتأمين الجماعي قد يخفض التكلفة لكل شاحنة.

كيفية شراء تأمين الشاحنات أونلاين عبر لوکینشور

بعد مقارنة عروض تأمين الشاحنات المختلفة، يمكنك إتمام الشراء بسهولة عبر لوکینشور باتباع الخطوات التالية:

زيارة موقع لوکینشور: انتقل إلى الموقع الرسمي واضغط على "احصل على عرض سعر فوري".

ملء البيانات المطلوبة: اختر الخيارات المناسبة وأدخل المعلومات الأساسية.

تسجيل الدخول: باستخدام UAE Pass أو بطاقة الهوية الإماراتية ورقم الهوية.

الإجابة عن الأسئلة: ستُسأل عن رخصة القيادة وسجل المطالبات السابق، أجب بدقة.

مراجعة ومقارنة العروض: ستعرض لك لوکینشور أفضل عروض التأمين من شركات مرخصة في الإمارات.

اختيار الوثيقة المناسبة: قارن بين الأسعار والمزايا واختر الأنسب لك.

إضافة المزايا الإضافية (اختياري): مثل التأمين على البضائع أو تغطية الحوادث الشخصية.

إتمام الدفع: عبر وسائل دفع آمنة مثل فيزا، ماستركارد، أبل باي أو غيرها.

استلام التأكيد: بعد الدفع، ستصلك رسالة تأكيد بوثيقة التأمين الخاصة بك.

تجديد تأمين الشاحنات أونلاين

يمكنك أيضًا تجديد وثيقة تأمين الشاحنات الخاصة بك عبر الإنترنت بكل سهولة. تتيح لك لوکینشور مراجعة شروط الوثيقة القديمة، مقارنة العروض الجديدة، وتحديث التغطيات أو الإضافات قبل التجديد، لضمان الاستفادة من أفضل أسعار تأمين الشاحنات المتاحة.

كيفية تقديم مطالبة تأمين الشاحنات

في حال وقوع حادث، يمكنك رفع مطالبة على وثيقة تأمين الشاحنات التجارية الخاصة بك عبر منصة لوکینشور من خلال الخطوات التالية:

إبلاغ الشرطة

أول خطوة أساسية هي إبلاغ الشرطة بالحادث. هذا الإجراء ضروري للحصول على تقرير رسمي من الشرطة، والذي يُستخدم لاحقًا كدليل أثناء عملية المطالبة.

إخطار شركة التأمين

بعد إبلاغ الشرطة، يجب أن تقوم بإخطار شركة التأمين بالحادث مباشرة.

ملء نموذج المطالبة

انتقل إلى موقع لوکینشور الإلكتروني وقم بملء نموذج المطالبة الخاص بالحادث.

إرفاق المستندات

قم بإرفاق المستندات المطلوبة، بما في ذلك تقرير الشرطة والصور والأدلة الأخرى.

تقديم النموذج

بعد مراجعة بياناتك والتأكد من إرفاق كل المستندات، قم بتقديم الطلب.

متابعة حالة المطالبة

يمكنك متابعة حالة مطالبتك مباشرة عبر موقع لوکینشور لمعرفة آخر التحديثات.

المستندات المطلوبة لتأمين الشاحنات

يتطلب الحصول على وثيقة تأمين الشاحنات في الإمارات توفير مجموعة من المستندات الرسمية، وتشمل:

رخصة تسجيل المركبة.

بطاقة الهوية الإماراتية.

جواز السفر والإقامة (للوافدين).

رخصة القيادة.

الرخصة التجارية (للمركبات التجارية).

إثبات ملكية الشاحنة.

كشوفات الحساب البنكي.

بالنسبة لتأمين البضائع، يجب تقديم تفاصيل عن نوع البضائع التي يتم نقلها.

نصائح عند اختيار وثيقة تأمين الشاحنات

عند التفكير في شراء وثيقة تأمين الشاحنات التجارية أو الثقيلة، هناك عدة عوامل ينبغي أخذها في الاعتبار:

تحديد طبيعة النشاط التجاري الذي تقوم به باستخدام الشاحنات.

اختيار التغطية المناسبة التي تتوافق مع نوع الشاحنة وقيمة البضائع المنقولة.

مقارنة عروض الشركات المختلفة للحصول على أسعار تأمين الشاحنات الأفضل.

الاستفادة من الخطط المخصصة التي تقدمها لوکینشور للشاحنات التجارية، والتي تساعدك على حماية ممتلكاتك وتجنب الخسائر المالية.