Dealing with health insurance can sometimes feel like a bit of a chore. There’s all that paperwork to keep track of, forms to fill out, and then you have to wait to hear back about your claims. Well, things are starting to get better. A quiet but powerful change is happening in the sector, and it’s all thanks to digital health insurance UAE providers are shifting towards. For residents and expats alike, the way you can access health coverage, talk to doctors, and handle claims is being transformed.

The UAE is stepping into a world of tele-health insurance Dubai residents can easily access, instant approvals, video consultations with doctors, and managing everything from a simple app on your phone. This article is all about how the rise of digital health insurance in UAE is making a real difference in people’s lives.

Too Long; Didn’t Read (TL;DR)

Here are the key points we will cover in this article in a glance:

- The Big Change: Health insurance in the UAE is getting a major tech upgrade, moving from paper-based processes to digital systems and apps.

- Doctor on Demand: Many plans now include tele-health insurance Dubai subscribers can benefit from, letting you have video consultations with a doctor from your living room.

- Hassle-Free Claims: You can now submit online claim health insurance Dubai and track your medical claims online, which cuts down on paperwork and waiting times significantly.

- Easy Management: Everything from your policy card to your claim history can be stored and accessed on your smartphone through insurer apps.

- Saving Time and Money: Digital plans often mean faster service, less administrative hassle, and can help you avoid unnecessary hospital trips.

- A New Way to Choose: Platforms like Lookinsure make it simple to compare these modern, digital-friendly plans side-by-side.

Overview of Digital Health Insurance in UAE

It feels like everything in our lives has gone digital, and health insurance is no different. The entire industry is embracing technology to create a much more user-friendly experience. This shift is changing the relationship between people and their insurers, making it more of an ongoing conversation.

What is digital health insurance?

Think of it as a full package where every step is digitalized and hence become quicker and easier to get through. It means having a mobile app from your insurer that acts as your personal command center. You can store your digital insurance card, find a network doctor, and handle all your claims through it. It includes access to telemedicine coverage Dubai users can benefit from effortlessly.

Differences from traditional health insurance

Traditional insurance relied on physical documents and manual signatures. You’d have to pay upfront and then fill out a claim form. Digital health insurance UAE providers are introducing focuses on a cashless experience and allows you to submit an online claim health insurance Dubai through an app, often getting approval much faster.

Key players adopting digital platforms

This isn’t a limited trend. Major insurance providers in the country are actively investing in their own UAE online health insurance platforms. They are developing more sophisticated apps and customer portals because they see that this is what modern customers expect.

Tele-Health Insurance in Dubai

One of the most welcomed aspects of this digital shift has been the arrival of tele-health services. For a busy city like Dubai, the ability to see a doctor without rearranging your schedule is a game-changer in digital health insurance UAE plans offer.

Coverage for online consultations and virtual care

Digital insurance plans include an add-on for access to a tele-health app or platform. If you have a bad cold or need a repeat prescription, you can log in, book a slot, and have a video call with a licensed doctor. This kind of tele-health insurance Dubai service covers a wide range of non-emergency medical issues.

How tele-health reduces hospital visits

Many minor infections and follow-up consultations can be handled perfectly well through a virtual appointment. By using these services, you help decongest clinics and save yourself a lot of time and effort.

Advantages for chronic condition management

For people managing long-term conditions like diabetes or hypertension, this constant access is incredibly valuable. Regular check-ins are necessary, and tele-health makes these follow-ups much easier. Patients can have more frequent, shorter check-ins from home, which can lead to more effective treatment.

Online Claims and Policy Management

In addition talking to a doctor, the day-to-day management of digital health insurance UAE users need to manage has also seen a massive improvement. The piles of paperwork are being replaced by tele-health insurance Dubai and transparent digital processes.

Filing claims digitally

Filing an online claim health insurance Dubai is now simple. You can use your insurer’s mobile app to take photos of your receipt and doctor’s report, fill in a few details, and hit submit.

Tracking claims status online

This is one of the most satisfying parts of online claim health insurance Dubai users can get behind. Instead of calling customer service, you can log into your customer portal or app. There, you’ll find a clear tracker that shows you exactly where your claim is in the process, which completely removes the guesswork.

Benefits of app-based health insurance management

Having all your insurance information in one place on your phone is incredibly convenient. These app-based health insurance UAE tools act as a complete dashboard for your health cover. You can check your health insurance status with your Emirate ID, see your coverage limits, and use your digital card at clinics.

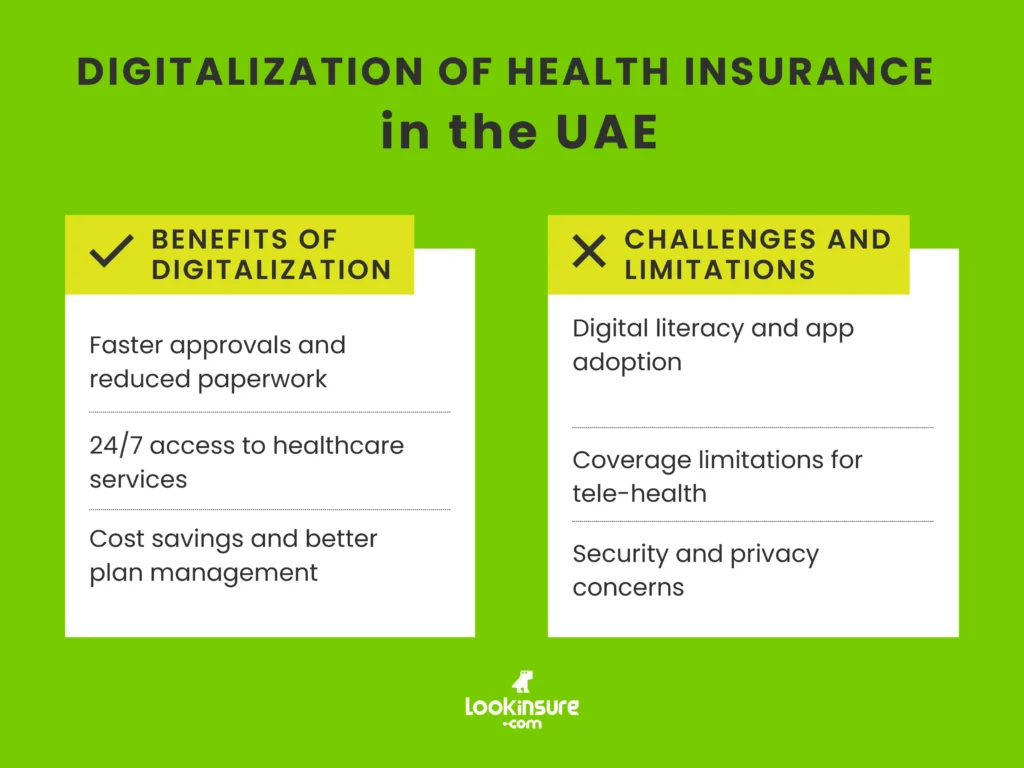

Benefits of Digitalization for Residents and Expats

This move towards digital and tele-health insurance Dubai services offers substantial real-world benefits for people living and working in the UAE, making healthcare more accessible and less stressful.

Faster approvals and reduced paperwork

The speed is a major win. Digital processing systems can handle claims much more quickly than manual ones. And there’s the joy of having less stuff to deal with, as everything is stored securely in your digital account.

24/7 access to healthcare services

Healthcare worries don’t always happen during office hours. With a digital plan, help is often available around the clock. Many telemedicine coverage Dubai services operate 24/7, providing a wonderful sense of security.

Cost savings and better plan management

Going digital can also be kinder to your wallet. Streamlined processes mean lower administrative costs for insurers, which can lead to more competitive premiums. For you, it means avoiding unnecessary hospital co-pays for minor issues.

Challenges and Limitations

While the digital shift is overwhelmingly positive, it’s fair to acknowledge a few of the growing pains that come with it.

Digital literacy and app adoption

Not everyone is comfortable with insurance portals or downloading apps, which can create a barrier for some. Insurers are working on simpler interfaces, but there is still a learning curve for many.

Coverage limitations for tele-health

It’s important to read the fine print. While tele-health insurance Dubai is fantastic, its coverage is not unlimited. It is for non-emergency use only and cannot handle serious conditions that require physical tests or emergency care.

Security and privacy concerns

Storing sensitive medical information on digital platforms raises questions about data privacy. Reputable insurers invest heavily in cybersecurity, but it remains a valid concern and a constant focus for the industry.

How Insurers Are Adapting

The insurance companies themselves are actively evolving their products and services to meet this new digital demand and stay competitive.

Offering telemedicine add-ons

For existing policies, many insurers now offer tele-health as a low-cost or even free add-on. They promote this benefit to improve customer satisfaction and help control claims costs.

Integrating AI and analytics for claims

Behind the scenes, insurers are starting to use Artificial Intelligence (AI) to process online claim health insurance Dubai clients submit. These systems can quickly scan documents and check for errors, speeding up approval for straightforward cases.

Partnerships with digital healthcare providers

Many insurance companies are forming smart partnerships with established tech and healthcare firms. They integrate with specialized digital medical insurance services to give their customers instant access to a proven digital infrastructure.

How to Choose a Digital Health Insurance Plan in UAE

With so many options, how do you pick the right digital-friendly plan? It’s about finding features that fit into your life.

Assessing tele-health and online claim options

When looking at a plan, ask specific questions. What tele-health app do they use? How many virtual consultations are included? Is their claims process fully digital? Reading reviews can give you a good idea of how smooth their UAE online health insurance platforms really are.

Comparing digital vs. traditional plans

Make a simple list to compare. On one side, list a basic, traditional plan. On the other, list a modern digital plan. Weigh the conveniences like tele-health and a functional app against the premium cost to see if the added value is worth it for you.

Using platforms like Lookinsure to compare features

Comparison websites are incredibly useful. A platform like Lookinsure allows you to see a range of plans from different providers all on one screen. You can filter for plans that highlight digital benefits, making it simpler to find the most digitally-advanced options.

Why Lookinsure Is Ideal for Digital Health Insurance

In a digitally-evolving market, you need a tool that can help you make sense of it all. Lookinsure is designed to be your digital health insurance UAE guide.

Compare digital-friendly health insurance plans

Lookinsure’s platform highlights the features that matter today. You can quickly see which plans offer robust digital medical insurance services, including their tele-health partners and app functionality.

Instant quotes and online purchase

The entire process is designed for speed. Once you find a plan, you can get an instant quote and often complete the entire purchase online, receiving your digital policy documents almost immediately.

Guidance for tele-health add-ons and online claims

The team at Lookinsure understands the nuances of these new plans. They can provide helpful guidance on which insurers offer the best tele-health insurance Dubai add-ons and which have the most user-friendly system for submitting an online claim health insurance Dubai.

Conclusion

Digitalisation is reshaping the health insurance landscape UAE clients have gotten used to in a very positive way. The integration of tele-health, seamless app-based health insurance UAE , and intuitive app-based management is giving residents and expats a level of convenience and control that was hard to imagine just a few years ago.

This shift towards digital health insurance UAE is more than a trend; it’s the new standard for accessible, efficient healthcare coverage. If you’re thinking about a new health insurance plan, it makes sense to prioritise these digital features. Using a comparison platform like Lookinsure is a very smart place to start.

Frequently Answered Questions

1. What is digital health insurance in UAE?

It’s health insurance that uses mobile apps and online portals as its main way of interacting with you. It lets you manage your policy, submit claims online, and often includes access to tele-health.

2. How does tele-health insurance work in Dubai?

Through your insurance provider, you get access to an app. You book a virtual appointment via video call with a licensed doctor who can provide a diagnosis and send an e-prescription to a pharmacy.

3. Can I submit claims online for my health insurance?

Yes, most modern insurers allow this. You log into their app or website, upload photos of your receipts and report, and submit a digital form.

4. Are digital plans cheaper than traditional health insurance?

They can be. More efficient processes can lead to lower premiums. You also save money by using tele-health for minor issues instead of paying for clinic visits.

5. Can expats rely solely on digital health insurance?

For comprehensive care, you still need a digital health insurance UAE that covers hospital treatment. However, for primary care and claims management, a digital plan can be your main tool.

6. Can I combine digital and traditional health insurance coverage?

Absolutely! Most digital health plans are comprehensive policies that have digital tools and tele-health services built into them or added on.