If you are living in the UAE or planning to move here, here is something you need to know: health insurance in UAE is not optional anymore. Starting January 1, 2026, health insurance is mandatory for all visa types across every emirate in the country.

This means whether you are coming for work, bringing your family, or even visiting as a tourist, you must have valid health coverage. The good news? There are plenty of options available. From basic plans that cost as little as AED 320 per year to comprehensive worldwide coverage, there is something for every budget and need.

This guide explains everything about health insurance for UAE residents in 2026: what it is, who is responsible for it, how much it costs, and what happens if you do not have it when renewing your visa.

Too Long; Didn’t Read (TL;DR)

- Health insurance is now mandatory for all UAE residents across all seven emirates. You cannot get or renew a visa without it.

- Employers must provide insurance for their employees. Residents are responsible for insuring their dependents, like spouses and children.

- The cheapest option is the new federal basic plan at AED 320 per year. It covers inpatient care, emergencies, and basic outpatient services with some co-pays.

- Individual private plans range from AED 700 to AED 8,500 depending on age, coverage level, and network access.

- If you let your insurance lapse, your visa renewal will be blocked, and you may face fines of AED 500 per month.

Health Insurance for Residents: What Is It Exactly?

Health insurance for UAE residents is a policy that covers your medical costs when you need treatment. Instead of paying huge hospital bills out of your own pocket, the insurance company pays for you (or reimburses you) based on your plan.

Who Is a Resident?

A resident is anyone holding a valid UAE residence visa. This includes:

- Employees working in the private or public sector

- Spouses and children sponsored by a resident

- Domestic workers like maids and drivers

- Investors and Golden Visa holders

- Freelancers and self-employed people

If you have a UAE residence visa, you are a resident. And if you are a resident, you must have health insurance in UAE.

The Importance of Health Insurance for Residents

Why is health insurance so important? Three reasons:

- First, it is the law. From 2026, every emirate requires proof of insurance for visa issuance and renewal. No exceptions. Buying health insurance for expats is mandatory.

- Second, medical costs are high. A single emergency visit can cost thousands of dirhams. Health insurance protects you from bills that could wipe out your savings.

- Third, it gives you access to better care. With insurance, you can go to private hospitals, see specialists, and get treatment quickly. Without it, you might end up waiting longer at public facilities or paying full price for everything.

Who Is Responsible for Health Insurance in the UAE?

Here is how responsibility breaks down in 2026 :

| Who | Responsible For | Notes |

| Employers | Their employees | Must provide coverage at no cost to employees. Cannot deduct from salary |

| Individuals | Their dependents | Spouse, children, domestic workers must be insured by the visa sponsor |

| Freelancers/Self-employed | Themselves | Must buy their own individual plan |

| Investors/Golden Visa holders | Themselves | Can buy comprehensive or premium plans |

| Tourists/Visitors | Themselves | Must have travel insurance with AED 150,000 emergency cover |

For employees, your company handles everything. They choose a plan, pay for it, and provide you with an insurance card. You do not need to do anything except use it when needed.

For dependents, it is your job as the sponsor. You must buy health insurance for your spouse and children before you can renew their visas.

If you are freelancing or running your own business, you are responsible for your own coverage. The same goes for investors and Golden Visa holders.

Best Health Insurance for UAE Residents

When people ask about the best health insurance for UAE residents in the UAE in 2026, the answer depends on your situation. There is no single “Best” plan for everyone. The right plan for you depends on your budget, health needs, and which hospitals you want to use.

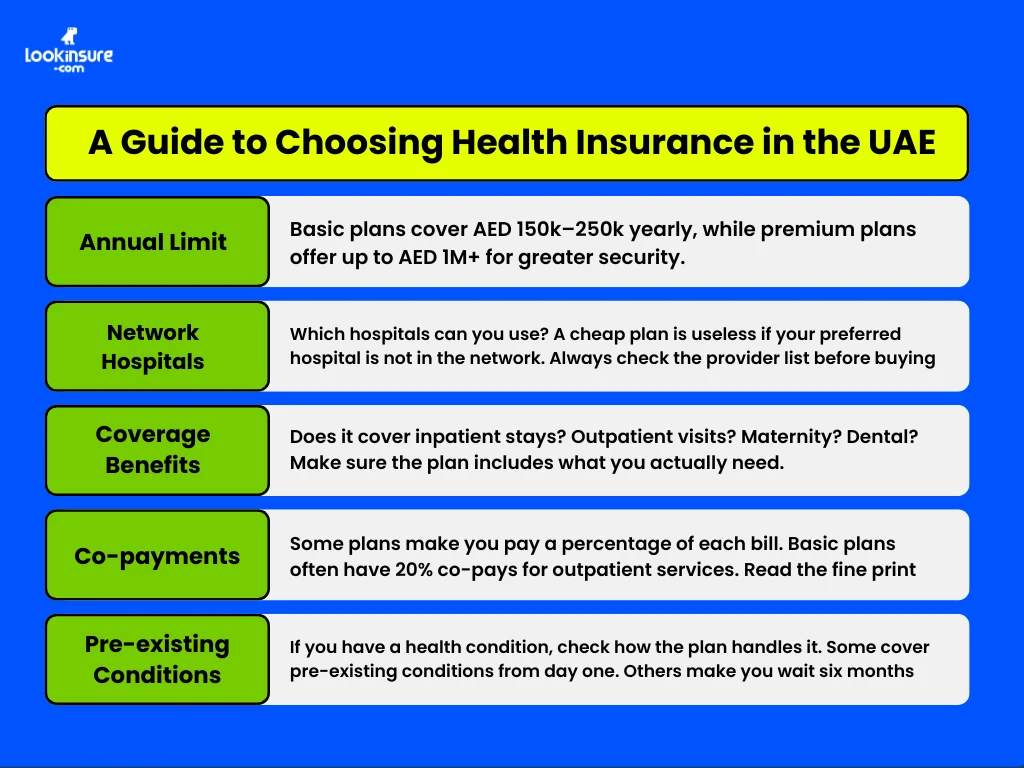

Here is what you should look for in a good health insurance plan:

- Annual Limit – How much will the insurer pay in a year? Basic plans offer AED 150,000 to AED 250,000. Premium plans go up to AED 1 million or more. If you want security, go higher to get the best health insurance price for UAE residents.

- Network Hospitals – Which hospitals can you use? A cheap plan is useless if your preferred hospital is not in the network. Always check the provider list before buying .

- Coverage Benefits – Does it cover inpatient stays? Outpatient visits? Maternity? Dental? Make sure the plan includes what you actually need.

- Co-payments – Some plans make you pay a percentage of each bill. Basic plans often have 20% co-pays for outpatient services. Read the fine print .

- Pre-existing Conditions – If you have a health condition, check how the plan handles it. Some cover pre-existing conditions from day one. Others make you wait six months .

Health Insurance Price for UAE Residents

Here are the actual prices for different types of plans in 2026:

| Plan Type | Annual Cost | Who It’s For | Key Features |

| Federal Basic Plan | AED 320 | Low-income employees in Northern Emirates | Covers inpatient, emergencies, basic outpatient. 20% co-pays |

| Abu Dhabi Flexible Plan | AED 750 | Families and individuals want good coverage | AED 150,000 annual limit, 20% co-pay |

| Dubai Basic EBP | AED 700 – 800 | Individuals needing minimum DHA-compliant coverage | Limited network, essential benefits |

| Standard Private Plan | AED 3,000 – 7,000 | Families and individuals wanting good coverage | Wider network, higher limits, better outpatient |

| Comprehensive Plan | AED 8,000 – 20,000+ | People who want premium hospitals and extras | Worldwide options, dental, optical, low co-pays |

| Premium International | AED 20,000+ | High-net-worth individuals, frequent travellers | Unlimited coverage, global access, VIP services |

For example, a healthy 35-year-old individual’s plans in Dubai range from AED 700 for basic EBP to AED 8,500 for premium worldwide coverage.

If you are on a tight budget, the federal basic plan (or free healthcare in UAE) at AED 320 is your best bet. Just remember it comes with limits; you can only use certain hospitals, and you will pay 20% to 25% of each bill up to certain caps .

Health Insurance for Visa Renewal in 2026

Starting in 2026, you cannot renew your UAE residence visa without valid health insurance.

This applies to every emirate including Dubai, Abu Dhabi, Sharjah, Ajman, Umm Al Quwain, Ras Al Khaimah, and Fujairah. The rules are now federal, meaning the whole country follows the same requirement.

When you apply for visa renewal through the ICP or GDRFA portals, you must upload proof of insurance. The system checks that your policy:

- Is from a UAE-licensed provider

- Meets the minimum coverage requirements

- Is valid for the full duration of your visa

What happens if you do not have insurance?

Simple. Your visa renewal gets rejected. You cannot complete the process until you provide valid insurance.

If your insurance lapses while you still have a valid visa? You could face fines of AED 500 per month for as long as you remain uninsured. In some cases, your visa may be blocked entirely until you fix the problem and pay the penalties.

For employees, your employer is responsible. If they fail to provide insurance, they face fines too, up to AED 500 per month per employee.

Conclusion

Health insurance in UAE is now simpler and more mandatory than ever. From 2026, every resident across all seven emirates must have valid coverage. No exceptions.

Options exist for every budget. If your employer provides coverage, you are already set. If you need to buy your own insurance, you can choose from basic plans starting at AED 320, mid-range plans for AED 3,000 to AED 7,000, or premium plans for those who want the best.

The key is to know what you are buying. Check the annual limit. Check the network hospitals. Check the co-pays. And make sure your policy is valid for your entire visa period.

Frequently Answered Questions

1. Does health insurance cover cancer treatment in UAE?

Yes. Both public and private health insurance in the UAE cover cancer treatment. Dubai law and Abu Dhabi regulations require insurers to include cancer care. Coverage includes diagnosis, chemotherapy, radiation, surgery, and hospital stays. Some advanced therapies may need pre-approval.

2. How much does health insurance cost in the UAE?

Costs vary widely based on your age, health, and desired coverage. The cheapest option is the federal basic plan at AED 320 per year. Standard individual plans range from AED 3,000 to AED 7,000. Comprehensive plans can cost AED 8,000 to AED 20,000 or more .

3. Is medical insurance required for a UAE residence visa?

Yes. Starting January 1, 2026, health insurance for UAE residents is mandatory for all visa types across all emirates. You cannot get or renew a residence visa without valid insurance from a UAE-licensed provider.

4. Do UAE residents get free healthcare?

Emirati citizens get free or heavily subsidized healthcare through government facilities. Expats do not. Residents must have private health insurance, either through their employer or purchased individually.

5. Which health insurance is best for expats in the UAE?

The best plan depends on your budget and needs. For minimum legal compliance, the AED 320 basic plan works. For good coverage at a reasonable price, look at standard private plans from AED 3,000 to AED 7,000 from insurers like Cigna, GIG Gulf, or Daman. For premium coverage with worldwide options, consider comprehensive plans from Sukoon Bupa or Allianz.