For years, sci-fi stories have imagined a future where cars drive themselves. That future is now. The advanced trial of driverless cars in the UAE is creating the foundation for a 2026 rollout. Dubai wants 25% of all transport trips to be self-driving by 2030. Such advances open up the conversation about driverless car insurance.

Who is responsible if this car causes an accident? Is it you, the car owner? Or is it the company that made the driverless technology? This is the new reality of how driverless cars are changing auto insurance. In this article we’ll explain how such a policy works and show how car insurance for driverless cars policies, prices, and claims will adapt to these new vehicles.

Understanding Driverless Cars

For decades, auto insurance focused on human drivers. Policies used driver age, history, and behavior to set prices. But now that the car makes driving decisions, we will witness how driverless cars are changing auto insurance.

What Are Driverless Cars?

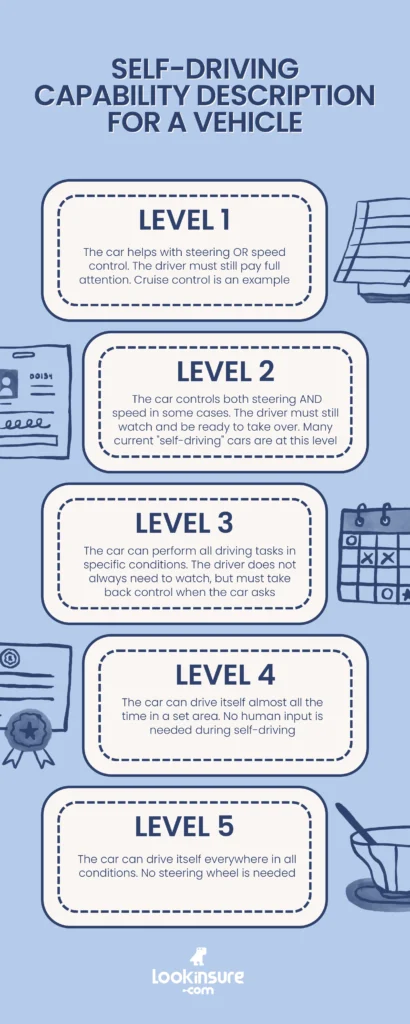

A driverless car can sense its environment and operate without human help. But you should know that not all automated cars are the same. Experts use levels from 1 to 5 to describe a car’s self-driving ability.

- Level 1 (Driver Assistance): The car helps with steering OR speed control. The driver must still pay full attention. Cruise control is an example.

- Level 2 (Partial Automation): The car controls both steering AND speed in some cases. The driver must still watch and be ready to take over. Many current “self-driving” cars are at this level.

- Level 3 (Conditional Automation): The car can perform all driving tasks in specific conditions. The driver does not always need to watch, but must take back control when the car asks.

- Level 4 (High Automation): The car can drive itself almost all the time in a set area. No human input is needed during self-driving.

- Level 5 (Full Automation): The car can drive itself everywhere in all conditions. No steering wheel is needed.

Growth of Driverless Cars in the UAE

The UAE is actively preparing for a future with driverless cars. As mentioned above, the Dubai Autonomous Transportation Strategy wants 25% of trips to be self-driving by 2030. This shows the country’s strong focus on new technology.

The government created special testing areas in Dubai Silicon Oasis and Masdar City in Abu Dhabi. These zones let companies test their driverless cars safely. The country is also building smart roads with sensors to help these vehicles work well. These steps make the UAE a leader in adopting this new technology.

Impact on Auto Insurance

There are many factors affecting how driverless cars are changing auto insurance, but risk is always the first factor to consider:

Reduced Risk or New Risks?

The main benefit of car insurance for driverless cars is safety. Most crashes happen because of human mistakes. Computers that do not get tired or distracted could prevent many accidents. Fewer crashes mean fewer insurance claims. This is one key way driverless cars are changing auto insurance for the better.

However, driverless cars also create new problems. Traditional insurance does not cover these new risks:

- Software Problems: A mistake in the car’s computer program could cause a crash.

- Hacking: A criminal could take control of the car through its internet connection.

- Expensive Repairs: The sensors and cameras on driverless cars are very expensive to fix after a crash.

So, while accidents may become less common, each claim could become more complex and costly. This is a major way driverless cars are changing auto insurance risk models.

Changing Insurance Premiums

In the long term, if the technology proves safer, the cost of car insurance for driverless cars should decrease. With fewer accidents caused by human error, insurers will pay fewer claims. This should lead to lower insurance premiums for everyone over time.

The factors that decide how driverless cars are changing auto insurance costs include:

- How safe and reliable the car’s technology is.

- How often does the car get software updates?

- How much responsibility does the car maker take for accidents?

Liability Shifts

This is the biggest change in how driverless cars are changing auto insurance. In a normal accident, the human driver is usually at fault. But who is at fault when there is no driver?

For fully self-driving cars (Level 4 and 5), responsibility shifts from the driver to the company that made the car or its software. If a crash happens because the car’s system failed, the manufacturer should be responsible. This change makes driverless car insurance very different from traditional insurance.

Car Insurance for Driverless Cars

There are currently no active plans for driverless car insurance, but let’s go over the hypotheticals of what car insurance plans are needed in light of how driverless cars are changing auto insurance.

Coverage Differences

Policies for driverless car insurance must cover new risks. Standard coverage for crashes and injuries will still exist. But new types of protection are now needed:

- Cyber Protection: Covers losses if a hacker controls your car or steals its data.

- Product Liability: Covers the manufacturer for faults in the car’s design or software that cause a crash.

- Sensor and Software Damage: Covers the expensive cameras and sensors that are vital for the car’s operation.

Some new policies split coverage based on control. They have different rules for when a human is driving versus when the car is driving itself. This is a clear example of how car insurance for driverless cars is different.

Insurance Providers Adapting

Insurance companies are already adapting to how driverless cars are changing auto insurance. Some car makers, like Tesla, offer their own car insurance for driverless cars with the vehicle.

The way to file a claim is also different. After an accident, insurers will look at the car’s own data. The car’s digital recorder shows what the sensors saw and what decisions the software made. This data helps decide who is at fault quickly and correctly.

Challenges and Opportunities for the Insurance Industry

The AI revolution in the UAE transportation industry will create new opportunities but also new challenges for the insurance industry. These will be the main considerations:

Challenges for Car Insurance for Driverless Cars

This new technology brings several problems for insurers:

- Data Access: Car makers control the vehicle’s data. It can be hard for insurers to get this information to price policies and handle claims.

- Predicting New Risks: It is difficult to guess how often software-driven cars will crash.

- Mixed Roads: For many years, roads will have both regular and driverless cars. This makes risk and liability very complicated.

Opportunities

Despite the problems, there are also good chances:

- New Kinds of Policies: Insurers can create new products, like insurance you pay for by the mile.

- Fewer Fake Claims: With clear data from the car, it is harder for people to make false accident claims.

- Working Together: Insurers can work with car makers to build safer vehicles and create better driverless car insurance.

Conclusion

The journey of driverless cars is just beginning, and it is already clear that they are reshaping the world of auto insurance. They bring the great promise of safer roads and fewer accidents, but they also introduce new complexities around liability, risk, and coverage.

- Driverless cars are changing auto insurance by moving legal responsibility from the driver to the car maker.

- New and specific car insurance for driverless cars is needed to cover new risks like hacking and software faults.

- The cost of driverless car insurance should fall over time as these cars prevent accidents caused by human error.

Frequently Asked Questions

1. How are driverless cars changing auto insurance?

Driverless cars are changing auto insurance by shifting blame from the driver to the manufacturer. This changes how risk is measured, how policies are designed, and how claims are handled after a crash.

2. What is car insurance for driverless cars?

Car insurance for driverless cars is a special policy made for self-driving vehicles. It includes standard protections but adds new ones for computer attacks, product faults, and damage to expensive sensors.

3. How does liability work for accidents involving autonomous vehicles?

Liability depends on who was driving. If the car is in full self-driving mode, the manufacturer is typically responsible for system failures. If the human driver was supposed to be watching the road, they could still be at fault.

4. Are insurance premiums cheaper for driverless cars?

At first, insurance premiums may not be cheaper due to high repair costs. However, in the long term, premiums for driverless car insurance should become more affordable as the technology prevents accidents.

5. Which insurance companies provide coverage for autonomous vehicles in the UAE?

The market for driverless car insurance is still new in the UAE. Major local insurers are expected to offer car insurance for driverless cars as these vehicles become more common on the roads.