Driving beyond the UAE? Overseas Auto Insurance is mandatory protection for residents and expats. Standard UAE policies expire at the border – exposing you to fines up to AED 500, license penalties, and repair costs abroad. Whether you need short-term Auto Insurance for Overseas trips in GCC nations (like Oman or Saudi Arabia) or global coverage, this guide reveals: legal loopholes, costs from AED 100/month, and top-rated providers like AXA Dubai. Discover why skipping this risks car seizures and how to legally drive from Dubai to Europe.

Why Overseas Auto Insurance is Important?

Overseas car insurance, also called international car insurance cover is a policy similar to your current car insurance policy in the UAE. However, this insurance policy will provide you coverage even when you’re driving abroad and, in any country, other than the Emirates.

As you’re probably aware, standard car insurance policies (also known as domestic car insurance policies) come with limitations regarding where they apply. They’re usually only active in your country, and once you leave it, your car insurance policy does not support you anymore. Add your insurance information and learn more about Tokio Marine Insurance

An auto insurance for overseas plan is here to safeguard you and your vehicle abroad. By lifting insurance limitations, you can drive around different countries using overseas car insurance without anything to worry about.

Moreover, there are penalties for uninsured driving in many countries. In case of wondering about What is the Fine for Not Having Car Insurance, it is safe to say that in the UAE you will have to pay at least AED 500 as well as receive four black points on your license.

Your vehicle might also be seized for a week. In GCC countries, these penalties are similar to the UAE. However, as an international driver, you might face much worse penalties in case of driving without acceptable insurance.

Global Penalties for UAE Drivers without Overseas Auto Insurance

Driving without valid overseas auto insurance risks:

| Country | Fine | Additional Penalties |

|---|---|---|

| France | €3,750 | 3-year license suspension |

| USA (NY) | $1,500 | Vehicle impound + court summons |

| Australia | AUD 2,500 | 6 demerit points |

| *GCC residents: Fines mirror UAE’s AED 500 + black points but double for repeat offenses.* |

Legal Requirements for Driving In Foreign Countries

Just like any other legal process, applying for Car Insurance for Foreign Drivers has rules and regulations. When buying this type of coverage, you will have to provide certain requirements. Let’s take a look:

Driving License Requirements

When applying for overseas auto insurance, your driver’s license is necessary but probably not enough. Sometimes, you will need a driving permit to drive in certain countries. However, this depends on a country’s rules.

For Car insurance, an international driver’s license is necessary in certain countries. Therefore, it is crucial to know about your destination’s process methods.

| Country/Region | International Driving Permit (IDP) | UAE Driving License Validity | Additional Requirements |

| United States | Recommended (not mandatory in all states) | Valid for short-term visits (up to 1 year) | May require insurance and a vehicle rental agreement. |

| United Kingdom | Recommended | Valid for up to 12 months | Must carry passport and insurance documents. |

| Australia | Not required (depends on the state) | Valid for up to 6 months | IDP recommended; that local road rules must be followed. |

| European Union | Recommended in many countries | Valid for short-term visits | May need to show proof of insurance. |

Overseas Auto Insurance or Travel Insurance

In case you’re traveling to another country as a UAE resident, you will need travel or international insurance to drive around. Check out the rules of your country of destination before traveling. Travel insurance is mandatory in many countries to drive.

Required Documents for Imported Cars

Whether you are renting a vehicle in a foreign country, or you’re taking your own, there’s a lot of paperwork and documents regarding this matter. Make sure you have all the necessary documents with you.

Registration details and car insurance for driving abroad documents are necessary when gathering these documents. Make sure to check if your country of destination requires any special documents that you might not know about.

Modification Requirements

Just like the Emirates requires your car to have all the necessary gulf-special modifications, an overseas car insurance policy might come with certain requirements as well. It is important to check whether or not your car is ready to be driven in a certain country. If not, make the necessary modifications to be able to get international insurance. You can check the necessary modifications of the cars in insurance policies dedicated to different countries as well as a government’s website.

Overseas Insurance Coverage in GCC Countries

Overseas coverage for countries of the Gulf Cooperation Council, also known as the GCC cover is essential for UAE drivers when they want to travel to other member countries of the GCC and drive there.

The GCC includes Bahrain, Kuwait, Oman, Qatar, and the United Arab Emirates itself. The GCC coverage is necessary for driving in each of these countries (while residing in another one of them).

This policy provides coverage for you when driving internationally, and helps assure your safety. The GCC coverage is a form of overseas auto insurance that can also come in the form of temporary international auto insurance.

Types of Overseas Car Insurance Coverage

For overseas drivers, types of car insurance are similar to standard domestic policies. Let’s take a look:

Third-party Car Insurance

Third-party insurance coverage is a basic form of coverage that is also known for providing the lowest level of mandatory coverage in the UAE.

This policy only takes care of the damages to third-party liabilities due to an accident including property damage or self-injury.

This type of coverage does not take care of your property and vehicle, and no circumstances other than third-party liabilities are included under this category.

Comprehensive Car Insurance

The comprehensive car insurance policy lies on the other side of the spectrum. This type of coverage is known to provide the highest level of standard coverage.

Meaning, that third-party liabilities are covered as well as damage incurred to you or your vehicle due to accidents. When choosing comprehensive overseas auto insurance, many insurers also provide the driver with personal accident coverage.

Many of these policies also include coverage regarding the transit of your vehicle from your home country or previous country of residence (in case of immigration) to your destination.

Beyond Basic Coverage: Specialized Overseas Auto Insurance

UAE expats driving abroad often assume their domestic policy suffices, but overseas auto insurance requires specialized components like:

- Worldwide Physical Damage Coverage: Protects against collisions/theft internationally but excludes third-party liability (mandatory in most countries).

- Excess Liability Insurance: Covers costs exceeding local liability limits (e.g., €1M minimums in Europe) – critical for UAE drivers in litigious regions.

- Political Violence Add-ons: Covers riots or terrorism damage – excluded in standard UAE policies but vital for unstable destinations.

Dubai providers like AXA and ADNIC offer these as endorsements – compare costs via online insurance aggregators.

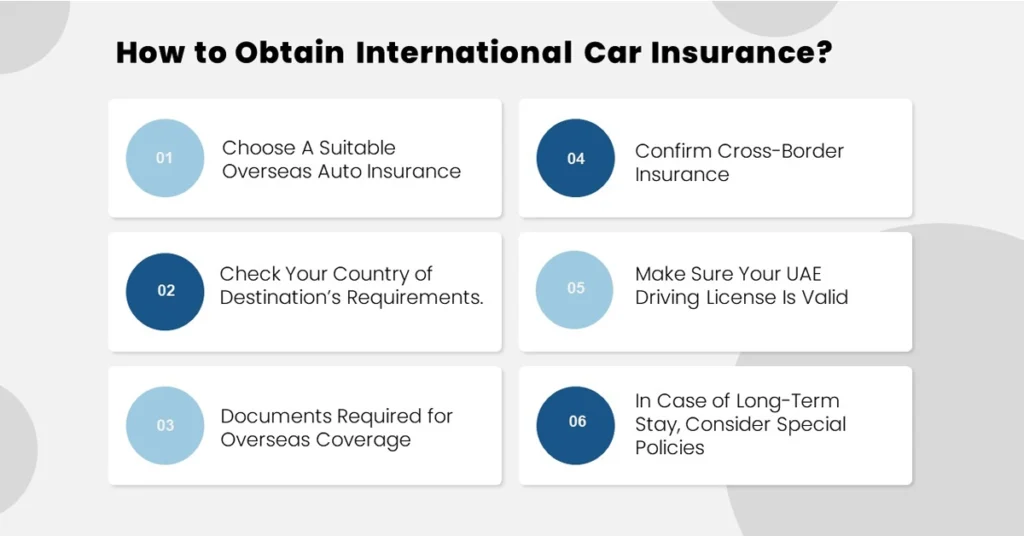

How to Obtain International Car Insurance?

When looking for a car insurance buying guide, learning how to obtain international car insurance international driver’s license is essential. Let’s take a look at all the necessary steps to get your international license:

Choose A Suitable Overseas Auto Insurance

At Lookinsure, we have all the best car insurance companies in Dubai and across the UAE. To start your insurance process, you will have to choose a suitable international insurance policy first.

Many insurance providers offer this type of coverage. This includes choosing the type of coverage that is also necessary for you including the two main types of coverage: third-party and comprehensive.

Check Your Country of Destination’s Requirements.

Necessary documents differ from place to place. Therefore, before starting the insurance process, make sure to check your destination’s requirements.

Documents Required for Overseas Coverage

- Your valid UAE driver’s license

- Copy of your vehicle registration

- Passport or your residence permit

- Travel itinerary

- Proof of no claims discount if applicable

Confirm Cross-Border Insurance

In case of traveling to countries in Europe, Asia, and Africa, make sure that your insurer provides coverage for those countries as well. Some overseas policies only include GCC countries.

Make Sure Your UAE Driving License Is Valid

Even if you’re peacefully driving around in the UAE, when applying for overseas auto insurance make sure to check the validity of your UAE driver’s license in the country you opt to go to.

In Case of Long-Term Stay, Consider Special Policies

Most countries require different sorts of coverage when you’re planning to spend a long time or live there. You might have to get their domestic insurance in that case. Therefore, if you think you’re going to stay for long, make sure to check your destination’s rules and regulations.

UAE-Specific Savings on Overseas Auto Insurance

Optimize costs with these Dubai-exclusive tips:

- Excess Adjustments: Increase standard excess to AED 600 for 15–20% premium reductions.

- Policy Bundling: Combine overseas + UAE comprehensive plans (e.g., Sukoon’s Expat Shield saves AED 400/year).

- GCC-Only Plans: For Oman/KSA trips, GCC-specific coverage costs 40% less than global policies.

Use comparison tools (PolicyBazaar.ae) to match rates.

Stress-Free Overseas Auto Insurance Claims

- Document: Photos, police reports, witness contacts.

- Notify Insurer: Call UAE helpline within 24hrs (e.g., ADNIC’s +971 600 533 322).

- Use Local Partners: AXA/Tokio Marine handle EU claims via in-network garages.

- Avoid Out-of-Pocket: Admitted insurers pay directly; non-admitted require reimbursement waits.

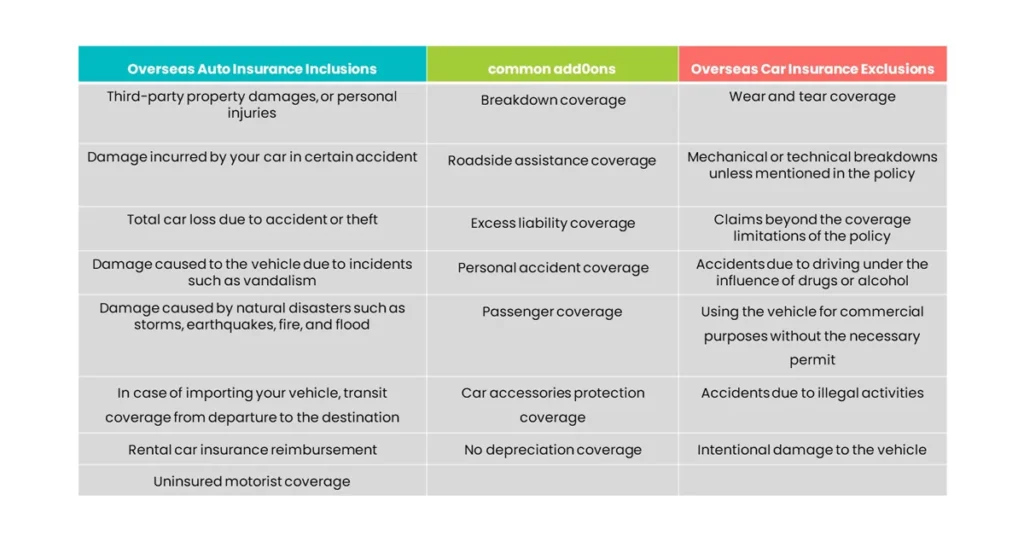

Overseas Auto Insurance Inclusions

After comparing Comprehensive vs Third Party Insurance for international drivers, it’s time to take a look at all the overseas insurance coverage inclusions.

These can vary from coverage to coverage, however, the following inclusions are mainly part of the general options in most international insurance policies:

- Third-party property damages, or personal injuries

- Damage incurred by your car in certain accident

- Total car loss due to accident or theft

- Damage caused to the vehicle due to incidents such as vandalism

- Damage caused by natural disasters such as storms, earthquakes, fire, and flood

- In case of importing your vehicle, transit coverage from departure to the destination

- Rental car insurance reimbursement

- Uninsured motorist coverage

Just like any other insurance policy, when getting this type of coverage, you can choose a few optional add-ons to your plan. When it comes to overseas car insurance, these are a few common add0ons you can choose:

- Breakdown coverage

- Roadside assistance coverage

- Excess liability coverage

- Personal accident coverage

- Passenger coverage

- Car accessories protection coverage

- No depreciation coverage

Overseas Car Insurance Exclusions

After looking through the international coverage inclusions, it is important to take a look at what the policy does not include:

- Wear and tear coverage

- Mechanical or technical breakdowns unless mentioned in the policy

- Claims beyond the coverage limitations of the policy

- Accidents due to driving under the influence of drugs or alcohol

- Using the vehicle for commercial purposes without the necessary permit

- Accidents due to illegal activities

- Intentional damage to the vehicle

Driving Your Own Car vs Renting Overseas — What’s Covered?

Depending on whether you’re taking your own vehicle or renting a car abroad, your overseas auto insurance coverage may vary:

| Aspect | Driving Your Own Car | Renting a Car Overseas |

|---|---|---|

| Insurance Required | Overseas auto insurance with GCC/international coverage | Car hire excess insurance or credit card insurance (if accepted) |

| Documents Needed | Registration, UAE license, IDP | Rental agreement, insurance confirmation, passport |

| Cross-border Coverage | Must confirm country-by-country validity | Usually limited to specific countries unless upgraded |

| Roadside Support | May require add-on | Often included or optional with rental provider |

| Cost | Higher if car is shipped/imported | May be bundled with rental fees |

Best Overseas Car Insurance Providers in UAE

When choosing a suitable insurance provider for overseas insurance, certain leading insurers in the UAE include:

- AXA Insurance

- Oman Insurance

- RSA Insurance

- Abu Dhabi National Insurance Company (ADNIC)

- Salama Insurance

- AL Sagr insurance

- Adamjee insurance

- Tokio marine insurance

- Noor takaful insurance

Pro Driving Tips for UAE Residents Abroad

Stay safe and compliant while driving overseas with these essential tips:

- Know the speed limits of the country you’re driving in — they may differ drastically from UAE standards.

- Keep emergency contact numbers saved, including police, ambulance, and roadside assistance.

- Check road signs and driving culture — in some countries, turning right on red or flashing headlights has different meanings.

- Carry your IDP and insurance papers at all times — some countries conduct random roadside checks.

- Avoid restricted zones such as toll areas or emission-controlled zones unless your vehicle qualifies.

- Plan for fuel types — ensure your car is compatible with fuel quality in your destination.

Compare Overseas Auto Insurance Options Online

At Lookinsure, we have gathered all the UAE’s best insurers in one place to help ease the process for you as lookinsure Mag. We are here to guide you through all the steps you may need to choose and purchase your insurance policy.

We’re also here to help you compare insurance quotes much simpler. Comparing insurance quotes is essential when choosing and finalizing a policy. This is because you will have to look through different providers and their policies which requires so much time and research.

With Lookinsure, you can stay on one website while comparing quotes. Also, by answering our few simple questions, we will be able to eliminate unnecessary options and recommend the most suitable policies available in the UAE.

Final Thoughts on Overseas Auto Insurance for UAE Residents and Expats

Getting Overseas Auto Insurance isn’t just a precaution — it’s a legal necessity in many countries. Whether you’re renting or driving your own car abroad, the right plan will protect your finances, your trip, and your peace of mind. Compare trusted insurers, read the fine print, and ensure your Auto Insurance for Overseas travel matches your exact needs.

Frequently Answered Questions

Do I need overseas auto insurance if I have a comprehensive policy in the UAE?

Most countries have car insurance as a mandatory requirement to allow you to drive there. The level of this coverage differs depending on the country. Comprehensive insurance in the UAE might not be enough to drive in foreign countries.

Can I purchase overseas auto insurance after I arrive in a foreign country?

Yes. You can purchase overseas auto insurance after you arrive at your destinated country. Make sure you check the process for this activity.

What happens if I get into an accident while driving abroad?

In this case, you should notify your insurer about the accident. They will help you with this process.

How much does overseas auto insurance typically cost?

The cost of your international insurance policy depends on the type of coverage you pick. However, this insurance for GCC countries is usually around AED 100 and AED 300 per month, and for European countries around AED 4500 and AED 7500 per month.

Should I choose overseas car hire excess insurance?

In case your insurance does not cover full access or your credit card does not provide rental insurance, you can get overseas car hire excess insurance.

Can I convert my UAE auto insurance plan to include coverage for international driving or auto insurance?

es, many UAE insurance providers offer options to extend or upgrade your existing auto insurance plan to include international coverage. It is recommended to contact your insurance provider directly to discuss available options, required documentation, and any additional premiums. Typically, you’ll need to provide details about your international travel plans, vehicle details, and the countries you intend to drive in. They may also offer specific international or global auto insurance policies that you can purchase as an extension or standalone coverage.