Citroen Car Insurance

Flexible installments to pay later with

And

Regulated by the Government of Dubai

Owning a Citroen in the UAE combines French elegance and practicality with the demands of modern driving. Whether it's for daily commutes or family journeys, ensuring your vehicle is properly protected is a key responsibility for every owner. Navigating the world of car insurance UAE can seem complex, but it is essential for your peace of mind and financial security.

The good news is that the process has been greatly simplified. Today, you can easily compare options and buy car insurance online from a range of providers. This guide will help you understand the specifics of Citroen car insurance, from the coverage you need to the factors that influence cost, empowering you to make a confident and informed decision.

Citroen Car Insurance in the UAE

Securing the right insurance for your Citroen is a crucial step in your ownership journey. The UAE mandates at least Third-Party Liability insurance for all vehicles, but for a car valued for its comfort and innovative technology, a comprehensive policy is often a wise investment. This is especially true for newer models where repair costs for specialized parts can be significant.

The market for Citroen auto insurance is competitive, offering owners a variety of choices. Factors such as your specific Citroen model, your driving history, and where you live in the UAE will all influence your premium. By understanding these elements and comparing quotes, you can find a policy that offers robust protection for your vehicle without stretching your budget.

Types of Citroen Car Insurance Plans in UAE

At Lookinsure, we pride ourselves on offering tailored insurance solutions for Citroen car insurance that cater to the diverse needs of Citroen owners. Understanding that each model, from the efficient Citroen C1 to the stylish Citroen DS3, requires specific coverage, we have crafted policies that provide the protection you need while driving. Our goal is to ensure peace of mind on the road with comprehensive options covering all aspects of vehicle ownership.

Our customized plans allow you to select from various coverage types that best suit your lifestyle and driving habits. Here’s a closer look at the different insurance solutions we offer for your Citroen vehicle.

Comprehensive Citroen Car Insurance

Our comprehensive Citroen car insurance protects you against losses from accidents, theft, and vehicle damage. This type of insurance ensures that your vehicle and belongings are safeguarded, giving you peace of mind while driving. With Lookinsure, you’ll benefit from hassle-free claims support and a policy that adapts to your needs as a Citroen owner.

Protecting your Citroën is now more affordable with flexible payment options. With Tamara car insurance, you can spread your payments over time with interest-free installments, making it easier to get the coverage you need without financial stress. Get started today and insure your car with ease!

Third-Party Citroen Auto Insurance

Our third-party Citroen auto insurance is an excellent choice for those looking for more budget-friendly options. This insurance covers damages caused to other vehicles and property in an accident where you are at fault. While it may be a more basic option, it meets legal requirements and can be a cost-effective way to ensure your safety while on the road.

Citroen Gap Insurance

If you’ve financed your Citroen vehicle, our Citroen gap insurance is a smart consideration. This type of coverage bridges the gap between what you owe on your vehicle and its actual market value in the event of a total loss. With Lookinsure’s gap insurance, you can know you won’t be left with financial burdens if the unexpected happens.

Add-ons for Citroen Cars

To enhance your insurance experience, we offer a range of add-ons specifically designed for Citroen cars. From Citroen breakdown cover to personal accident coverage and legal assistance, our add-ons provide extra protection tailored to your needs. Create a policy that reflects your driving habits and lifestyle while ensuring complete confidence in your Citroen insurance.

What Are Covered and Not Covered Under Citroen Insurance?

Your Citroen insurance policy is a contract that outlines exactly what scenarios are protected. Typically, you can choose between the mandatory Third-Party Liability (TPL) or more extensive comprehensive coverage.

What's Typically Covered (Comprehensive Policy):

- Damage to your Citroen from collisions, fire, or theft.

- Liability for injuries to other people or damage to their property.

- Repairs needed due to vandalism, falling objects, or natural disasters.

- Medical expenses for you and your passengers.

- Optional add-ons like roadside assistance and rental car coverage.

What's Typically Not Covered:

- Standard wear and tear or mechanical breakdowns.

- Damage that occurs while driving without a valid license.

- Intentional damage or damage under the influence of alcohol/drugs.

- Driving in off-road areas not permitted by your policy.

Citroen Car Insurance Price UAE

The insurance premium influences the vehicle’s age, value, and safety features. Below is a table outlining the approximate insurance costs for some popular Citroen models in the UAE. These figures provide a general guide, as individual premiums may vary based on specific circumstances.

Citroen Model | Approximate Annual Insurance Cost (AED) | Insurance Type |

Citroen C1 | 2,500 - 3,500 | Comprehensive/Third-Party |

Citroen C3 | 2,800 - 4,000 | Comprehensive/Third-Party |

Citroen Ami | 2,200 - 3,000 | Comprehensive/Third-Party |

Citroen Saxo | 2,600 - 3,800 | Comprehensive/Third-Party |

Citroen DS3 | 3,000 - 4,500 | Comprehensive |

Citroen Berlingo | 3,200 - 4,000 | Comprehensive |

Factors That Influence Your Citroen Insurance Premium

The cost of your Citroen motor insurance is calculated based on several key factors that insurers use to assess risk.

- Citroen Model and Year: The car's value, safety features, and repair costs directly impact the premium.

- Driver's Age and Experience: Younger and less experienced drivers often face higher costs.

- Claim History: A No-Claim Bonus (NCB) from years of safe driving can significantly reduce your premium.

- Coverage Level: A comprehensive policy is more expensive than a basic TPL one.

- Deductible Amount: Choosing a higher voluntary excess can lower your annual payment.

How to Save on Your Citroen Insurance

Finding affordable Citroen auto insurance is not really impossible. There are ways you can try in order to find cheaper options including:

- Compare Quotes Online: Use comparison websites to instantly review multiple Citroen car insurance offers and find the best rate.

- Protect Your No-Claim Bonus: Maintaining a claim-free record is the most effective way to earn long-term discounts.

- Increase Your Deductible: Opting for a higher voluntary deductible is a proven way to lower your premium.

- Install Security Features: Equipping your car with an alarm or tracking system can sometimes lead to a discount.

- Consider a TPL Policy: For older Citroen models, a Third-Party Liability policy is the most budget-friendly option, though it doesn't cover damage to your own car.

How to Buy Citroen Car Insurance Online with Lookinsure

Purchasing and renewing your Citroen auto insurance plan with Lookinsure is a straightforward process that saves you time and hassle. We empower you with the tools and resources you need to make informed decisions about your car insurance. Here’s a step-by-step guide on how to buy and renew your Citroen insurance:

Get a Quote

Visit our website and select the option to obtain a Citroen insurance quote. Enter your vehicle details, including the model, year, and personal information, to receive an estimated premium.

Choose Your Coverage

Review the different coverage options available for your Citroen model. Decide whether you need comprehensive, third-party, or add-on coverages. Take into consideration your budget and the level of protection you desire.

Customize Your Plan

Tailor your insurance plan according to your specific needs. To enhance your policy, you can add features such as Citroen breakdown cover or gap insurance.

Submit Your Application

Once you have finalized your coverage selection, fill out the application form with your details. Provide accurate information to avoid any issues with your policy.

Review Your Policy

After submitting your application, you will receive a draft of your insurance policy. Review all terms and conditions carefully to ensure they meet your expectations.

Make Your Payment

Once you are satisfied with your policy, you can pay securely online. Lookinsure offers various payment methods to suit your preferences.

Receive Your Policy Document

After payment confirmation, you’ll receive your official policy document via email. Keep this document for your records, as it serves as proof of your insurance.

Citroen Car Insurance Renewal Online

When your policy expires, we will send you a reminder to renew. You can either renew your existing coverage or adjust it based on any changes in your situation or vehicle. The renewal process follows the same steps as outlined above. All you need to do is:

- Go to Lookinsure's website

- Log in or sign up for an account

- Enter your policy number

- Modify it if you need

- Proceed to payment

Documents Required for Citroen Car Insurance

The required documents can vary slightly depending on the insurance provider and the specific coverage you choose, but typically include the following:

Essential Documents

- Completed Application Form

- Copy of Your Emirates ID

- Driving License

- Vehicle Registration Certificate (Mulkiya)

- Previous Insurance Policy (if applicable)

- No-Claims Certificate (if applicable)

- Proof of Purchase (if applicable)

This may include the invoice or receipt for your Citroen purchase, especially if the vehicle is new. - Vehicle Inspection Report (if required)

Additional Documents

- Bank Statements or Proof of Income: Some providers may require this to assess your risk profile.

- Finance Agreement: If the car is financed, providing documentation related to your finance agreement may be necessary.

Top Citroen Car Insurance Providers in the UAE

At Lookinsure, we collaborate with a range of leading insurance providers in the UAE to give you access to competitive rates and comprehensive coverage for your Citroen. Here are some of the top insurance affiliates we work with:

Renowned for its excellent customer service and customizable policies, AXA provides a variety of insurance plans tailored for Citroen owners, including comprehensive and third-party options. | |

With a strong presence in the UAE, Oman Insurance Company offers competitive coverage for Citroen vehicles, including benefits like roadside assistance and flexible payment options. | |

Emirates Insurance Company | Known for its comprehensive coverage solutions and dedicated customer service, Emirates Insurance is a great choice for Citroen owners looking for reliable insurance. |

Dubai Insurance offers a range of tailored insurance products, including specialized plans for various Citroen models, ensuring you get the protection you need. | |

ADNIC combines extensive market experience with customizable insurance solutions, making it a popular choice among Citroen owners in the UAE. | |

Union Insurance | Known for its innovative policies and customer-centric approach, Union Insurance provides various coverage options for Citroen vehicles, including discounts for safe driving records. |

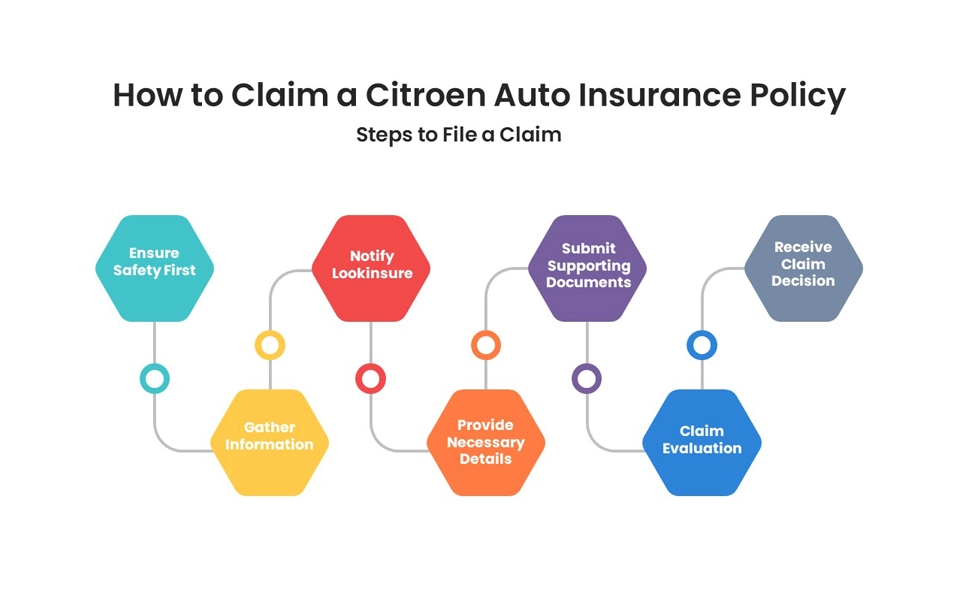

How to Make a Citroen Car Insurance Claim?

Filing a claim on your Citroen auto insurance policy can be a straightforward process, especially when you know the steps to take. At Lookinsure, we aim to ensure you can easily navigate the claims process, allowing you to focus on getting back on the road. Here's a step-by-step guide on how to claim your Citroen insurance policy:

Steps to File a Claim

- Ensure Safety First

If you are involved in an accident, prioritize safety. Move to a safe location, check for injuries, and call emergency services if anyone is injured. - Gather Information

Collect all pertinent information related to the incident, including:

- Other parties' names, contact information, and insurance details

- Vehicle registration numbers

- Photographs of the accident scene, vehicle damages, and any relevant road signs

- Notify Lookinsure

Contact Lookinsure as soon as possible to report the incident. You can reach us through:

- Our website

- Customer service hotline

- Mobile app (if available)

- Provide Necessary Details

When filing your claim, be prepared to share:

- Your policy number

- The date and time of the accident

- A brief description of what happened

- The information collected from other parties involved

- Submit Supporting Documents

Submit any documents required to support your claim. This may include photographs, police reports (if applicable), and insurance policy information. - Claim Evaluation

Once your claim is submitted, our claims team will review it. They may contact you for additional information or clarification regarding the incident. - Receive Claim Decision

After evaluating your claim, Lookinsure will notify you of the decision. If your claim is approved, details about the next steps, such as repair arrangements or compensation, will be provided.

Lookinsure offers tailored insurance solutions for Citroen vehicles in the UAE, providing comprehensive coverage options and a straightforward claims process. Whether you need comprehensive, third-party, or add-on coverage, Lookinsure protects your Citroen and ensures hassle-free driving. Get a quote for more information about Citroen auto insurance.